Tax Filer Rules Cheat Sheet

advertisement

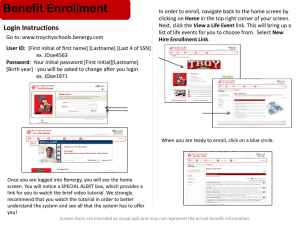

Tax Filer Rules Cheat Sheet RULE 1 STOP At The First Rule That Applies Individual Tax Payer not claimed as a tax dependent by someone else ELIGIBILITY DETERMINATION GROUP = Tax payer + all their claimed dependents + spouse if living with the tax payer 2 Individual is claimed as a dependent and is NOT a taxpayer If any of the following exceptions applies go to Rule #3 Individual is claimed as dependent by someone who is not their spouse or parent Individual is a child under 19 living with both parents and expects to be claimed by one parent as a tax dependent but the parents do not expect to file a joint return Individual is a child under 19 who is claimed as a tax dependent by a non-custodial parents 3 Individual is NOT a taxpayer and NOT claimed as a tax dependent If a dependent or the tax filer is pregnant include the number of unborn children in the EDG. Tax payer claiming the person + All claimed dependents + spouse if living with Tax payer If a dependent or the tax filer is pregnant include the number of unborn children in the EDG. EXAMPLE Joseph lives with his girlfriend Mary. Both are U.S. Citizens. Each says they file their own taxes, and claim no dependents Joseph’s EDG = Joseph + dependents (0) + spouse (0) Joseph’s EDG is a group of 1 The persons applying for health coverage are Robert and June who are the children of Rick. Rick files taxes and claims the 2 children (Robert and June) as his dependents. Robert’s EDG = Robert + Tax payer claiming the person (Rick) + all claimed dependents (June). Robert’s EDG is a group of 3 (Robert, Rick and June) June’s EDG = June + Tax payer claiming the person (Rick) + all claimed dependents (Robert). June’s EDG is a group of 3 (Robert, Rick and June) The person applying + Any of the following if living with the person The person’s spouse + The person’s (biological, adopted, step) children below age 19 (including unborn children) + IF a child under age 19, include the child’s [biological, adopted, step] parents and any [biological, adopted, step] siblings also under age 19 Betty is 59 and is raising her 6 year old grandson Ethan. Betty files taxes and claims Ethan as her dependent. She applies for health coverage for Ethan. Ethan’s EDG = Ethan (the person applying + a spouse (0) + children (0) + siblings/parents (0) Ethan’s EDG includes only him as there is no spouse, children, siblings or parents in the home for a group of one (1).