INSTITUTE OF CHARTERED ACCOUNTANTS OF JAMAICA CODE

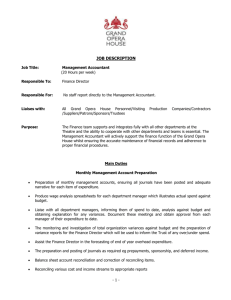

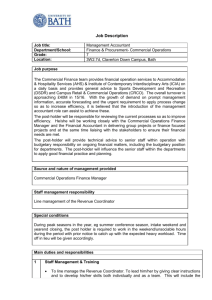

advertisement