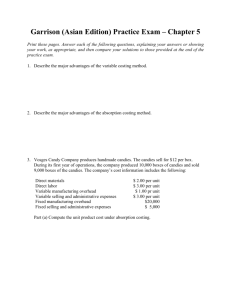

Chapter 5 Variable Costing

advertisement

Chapter 5 Variable Costing QUESTIONS 1. In full costing, fixed manufacturing overhead is treated as a product cost. In variable costing, fixed manufacturing overhead is treated as a period cost. 2. When production exceeds sales, part of fixed manufacturing overhead will remain in inventory. In variable costing, the entire amount of fixed manufacturing overhead will be expensed since it is treated as a period cost. Thus, income computed under full costing will exceed income computed under variable costing when production exceeds sales. 3. Variable costing facilitates C-V-P analysis since fixed and variable costs are separated and a contribution margin is calculated. Also, under variable costing, managers cannot artificially inflate profit by producing more units than they sell and burying fixed manufacturing overhead in inventory. 4. Companies using JIT generally have low levels of work in process and finished goods inventory. Thus, even when a company uses full costing, very little of fixed manufacturing overhead is in inventory at the end of a period. Rather, most of it is in cost of goods sold—an expense. 5. Under full costing, ending inventory includes direct material, direct labor, variable manufacturing overhead, and fixed manufacturing overhead. Under variable costing, ending inventory includes each of these items except fixed manufacturing overhead. Thus, the inventory balance under variable costing is always less than the balance under full costing (assuming the balance is not zero). 5-2 Jiambalvo Managerial Accounting EXERCISES E1. The income statement produced using variable costing provides a contribution margin. If we divide this by sales, we have the contribution margin ratio (the contribution margin per dollar of sales). Once we have this value, we can estimate the incremental effect on profit of an increase in sales. E2. Increasing production will increase profit since more fixed manufacturing overhead will be buried in ending inventory rather than expensed in cost of goods sold. For example, if the company produced and sold 40,000 items, the entire $20,000,000 of fixed manufacturing overhead would be in cost of goods sold. However, if the company produces 50,000 units, the fixed manufacturing overhead per unit will be $400. Then $16,000,000 will end up in cost of goods sold when the company sells only 40,000 units (i.e., $400 x 40,000) and $4,000,000 will be in ending inventory ($400 x 10,000). E3. Most Web sites make the point that variable costing aids planning and decision making. And, it prevents managers from artificially inflating profit by over-producing. Some Web sites seem to imply that variable costing is simply “wrong” because fixed overhead is a real cost and it is not included in inventory under variable costing. However, these same Web sites state or imply that variable costing is more useful for decision making. Frankly, it’s hard to see how the method can be more useful for decision making and still be “wrong.” E4. Variable cost per unit Fixed manufacturing overhead per unit ($600,000 ÷ 1,000 units) Full cost per unit Ending inventory under full costing: $900 x 100 units = $90,000 $300 600 $900 Chapter 5 Variable Costing 5-3 E5. Ending inventory under variable costing: $300 x 100 = $30,000 E6. Full cost per unit is $900 per exercise 4. Therefore, cost of goods sold under full costing is $900 x 900 units sold = $81,000. E7. Variable cost per unit is $300. Therefore variable cost of goods sold is $300 x 900 = $27,000. Under variable costing, the $600,000 of fixed manufacturing overhead is treated as a period expense. E8. Sales ($1,500 x 900 pairs) Less cost of goods sold ($900 x 900 pairs) Gross margin Less selling expense Less administrative expense Net income $1,350,000 810,000 540,000 200,000 100,000 $ 240,000 E9. Sales ($1,500 x 900 pairs) Less variable cost of goods sold ($300 x 900 pairs) Contribution margin Less fixed manufacturing overhead Less selling expense Less administrative expense Net income $1,350,000 270,000 1,080,000 600,000 200,000 100,000 $ 180,000 E10.The difference in net income between full and variable costing is $240,000 $180,000 = $60,000. This is equal to the amount of fixed manufacturing overhead in ending inventory under full costing ($600 x 100 pairs = $60,000). 5-4 Jiambalvo Managerial Accounting PROBLEMS P1. a. Fixed manufacturing overhead Divided by units produced Fixed manufacturing overhead per unit Variable manufacturing costs Full cost per unit Sales ($200 x 10,000 units) Less cost of goods sold: ($160 x 10,000) ($150 x 10,000) ($150 x 2,000 + $175 x $8,000) Gross margin Less selling and administrative expense Net income 2006 $ 600,000 10,000 60 100 $ 160 2007 $ 600,000 12,000 50 100 $ 150 2008 $ 600,000 8,000 75 100 $ 175 $2,000,000 $2,000,000 $2,000,000 1,600,000 1,500,000 400,000 200,000 $ 200,000 500,000 200,000 $ 300,000 1,700,000 300,000 200,000 $ 100,000 $ 600,000 Ending inventory -0($150 x 2,000) $ 300,000 -0- b. Even though sales is the same in each period, profit fluctuates. That results because different quantities are produced each period which affects the fixed manufacturing overhead in cost of goods sold versus ending inventory. Chapter 5 Variable Costing 5-5 c. Fixed manufacturing overhead Variable manufacturing costs per unit Sales ($200 x 10,000 units) Less variable cost of goods sold: ($100 x 10,000) Contribution margin Less fixed costs: Manufacturing Selling and administrative Net income 2006 $ 600,000 100 2007 $ 600,000 100 2008 $ 600,000 100 $2,000,000 $2,000,000 $2,000,000 1,000,000 1,000,000 1,000,000 1,000,000 1,000,000 1,000,000 600,000 200,000 $ 200,000 600,000 200,000 $ 200,000 600,000 200,000 $ 200,000 $ 600,000 Ending inventory -0($100 x 2,000) $ 200,000 -0- d. Profit does not fluctuate each period because fixed manufacturing overhead is treated as a period cost and expensed each year even if more units are produced than sold. Note that income is the same under variable and full costing in 2006 since the quantity produced is equal to the quantity sold. Income under full costing is higher than variable costing income in 2007 since the quantity produced is greater than the quantity sold. Income under full costing is less than income under variable costing in 2008 since the quantity produced is less than the quantity sold. 5-6 Jiambalvo Managerial Accounting P2. a. Fixed manufacturing overhead Divided by units produced Fixed manufacturing overhead per unit Variable manufacturing costs per unit Full cost per unit Sales ($2,000 x 20,000 units) ($2,000 x 18,000) ($2,000 x 16,000) Less cost of goods sold: ($1,800.00 x 20,000) ($1,800.00 x 18,000) ($1,800.00 x 2,000 + 2,228.57 x 14,000) Gross margin Less selling and administrative expense Net income 2006 $ 20,000,000.00 20,000.00 1,000.00 800.00 $ 1,800.00 2007 $ 20,000,000.00 20,000.00 1,000.00 800.00 $ 1,800.00 2008 $ 20,000,000.00 14,000.00 1,428.57 800.00 $ 2,228.57 $ 40,000,000.00 $ 36,000,000.00 $ 32,000,000.00 36,000,000.00 32,400,000.00 $ 4,000,000.00 300,000.00 3,700,000.00 3,600,000.00 300,000.00 $ 3,300,000.00 34,799,980.00 (2,799,980.00) 300,000.00 $ (3,099,980.00) $ 3,900,020.00 Ending inventory -0($1,800 x 2,000) $ 3,600,000.00 -0- b. Fixed manufacturing overhead Variable manufacturing costs per unit Sales ($2,000 x 20,000 units) ($2,000 x 18,000) ($2,000 x 16,000) Less variable cost of goods sold: ($800 x 20,000 units) ($800 x 18,000) ($800 x 16,000) Contribution margin Less fixed costs: Manufacturing Selling and administrative Net income 2006 $ 20,000,000.00 $ 800.00 2007 $ 20,000,000.00 $ 800.00 2008 $ 20,000,000.00 $ 800.00 $ 40,000,000.00 $ 36,000,000.00 $ 32,000,000.00 16,000,000.00 14,400,000.00 12,800,000.00 24,000,000.00 21,600,000.00 20,000,000.00 300,000.00 $ 3,700,000.00 20,000,000.00 300,000.00 $ 1,300,000.00 19,200,000.00 20,000,000.00 300,000.00 $ (1,100,000.00) Ending inventory -0($800 x 2,000) $ 1,600,000.00 -0- $ 3,900,000.00 Chapter 5 Variable Costing 5-7 Note that the $20 difference in net income for the three years between full and variable costing is due to rounding. c. Under full costing, management could manipulate profit in 2007 by overproducing (producing more units than really needed in 2007). This results in fixed manufacturing overhead being buried in ending inventory. Note that the difference in profit in 2007 between full and variable costing is equal to the difference in ending inventory under full and variable costing. This approach to manipulating earnings could not be repeated year after year—eventually the inventory build-up would be quite obvious. P3. a. Fixed manufacturing overhead Divided by units produced Fixed manufacturing overhead per unit Variable manufacturing costs per unit Full cost per unit 2006 $ 2,000,000.00 10,000.00 200.00 2,200.00 $ 2,400.00 2007 $ 2,000,000.00 6,000.00 333.33 2,200.00 $ 2,533.33 $ 24,000,000.00 $ 24,000,000.00 Sales ($3,000 x 8,000 units) Less cost of goods sold: ($2,400 x 8,000) ($2,400 x 2,000 + $2,533.33 x 6,000) Gross margin Less selling and administrative expense Net income 4,800,000.00 1,000,000.00 $ 3,800,000.00 Ending inventory ($2,400 x 2,000) $ 4,800,000.00 19,200,000.00 19,999,980.00 4,000,020.00 1,000,000.00 $ 3,000,020.00 $ 6,800,020.00 -0- b. Company performance is really not worse in 2007—note that the company had the same cost structure and the same level of sales. The difference is due to greater production in 2006 which lowered unit cost and buried fixed manufacturing overhead in inventory. 5-8 Jiambalvo Managerial Accounting c. Fixed manufacturing overhead Variable manufacturing costs per unit 2006 $ 2,000,000.00 $ 2,200.00 2007 $ 2,000,000.00 $ 2,200.00 $ 24,000,000.00 $ 24,000,000.00 Sales ($3,000 x 8,000 units) Less cost of goods sold: ($2,200 x 8,000 units) Contribution margin Less fixed costs: Manufacturing Selling and administrative Net income 17,600,000.00 6,400,000.00 17,600,000.00 6,400,000.00 2,000,000.00 1,000,000.00 $ 3,400,000.00 2,000,000.00 1,000,000.00 $ 3,400,000.00 Ending inventory ($2,200 x 2,000) $ 4,400,000.00 $ 6,800,000.00 -0- Note that the difference in income between full and variable costing over the two years is due to rounding. d. Variable costing presents a more realistic view of firm performance in that income is the same in both years which is consistent with the firm having the same cost structure and level of sales in both years. P4. Income computed under full costing is $4,000 higher than income computed under variable costing. Under variable costing, the entire amount of fixed manufacturing overhead ($24,000) was treated as a period cost. Under full costing, $4,000 remains in ending inventory. Fixed manufacturing overhead Divided by units produced Fixed manufacturing overhead per unit $24,000 1,200 $ 20 Amount of fixed manufacturing overhead in ending inventory: $20 x 200 units = $4,000 Chapter 5 Variable Costing 5-9 P5. a. Contribution margin ÷ sales = contribution margin ratio $8,100,000 ÷ $18,000,000 = .45. (Incremental sales x contribution margin ratio) – incremental salaries = incremental profit ($1,600,000 x .45) - $120,000 = $600,000. b. The chief accountant is treating income per dollar of sales as the contribution margin ratio. Income only varies in proportion to sales if all costs are variable which is clearly not the case for Wilner Glass Company. P6. a. Variable Costing 2004 Sales $ 10,000,000 Less variable cost of goods sold 4,000,000 Contribution margin 6,000,000 Less: Fixed production costs 6,000,000 Fixed selling and administrative costs 2,000,000 Net income $ (2,000,000) 2005 $ 12,500,000 5,000,000 7,500,000 2006 $ 15,000,000 6,000,000 9,000,000 6,000,000 2,000,000 $ (500,000) 6,000,000 2,000,000 $ 1,000,000 b. Under full costing, it appears that Ed did a good job since the company hit the break-even point in its first year and then earned a profit of $500,000 in its second year. However, variable costing provides a better picture of the firms profitability under Ed’s guidance. Note that under variable costing, the company had a $500,000 loss in its second year. Ed was able to show a profit under full costing by producing more than needed for current period sales and burying a substantial amount of fixed manufacturing cost in ending inventory. That’s why Zac could not show a profit under full costing in 2004. He had to cut production in 2004 to avoid building up excess inventory. This increased per unit cost. Income statements prepared under variable costing indicate that Zac’s performance was quite good. Sales have increased and so has profit. 5-10 Jiambalvo Managerial Accounting c. The company should not get out of the tractor business. As indicated in the variable costing income statement, the company is generating a substantial profit. If the company can continue performing at this level, it will be quite successful. P7. a. Fixed manufacturing overhead ÷ Units produced = fixed overhead per unit $500,000 ÷ 100,000 = $5 $5 x 80,000 units sold = $400,000. b. With variable costing, the entire amount of fixed manufacturing overhead ($500,000) will be expensed. c. The amount of fixed manufacturing overhead in ending inventory under full costing is $100,000: $5 x 20,000 units = $100,000. This accounts for the difference between income under full versus variable costing. Chapter 5 Variable Costing P8. a. Fixed manufacturing overhead Divided by units produced Fixed manufacturing overhead per unit Variable manufacturing costs per unit ($60 + $20 + $5) Full cost per unit 2006 $ 2,000,000.00 200,000.00 10.00 $ 85.00 95.00 Sales ($120 x 170,000 units) Less cost of goods sold: ($95.00 x 170,000) Gross margin Less selling expense ($1,000,000.00 + .10 x $20,400,000) Less administrative expense Net income $ 20,400,000.00 3,040,000.00 800,000.00 $ 410,000.00 Ending inventory ($95 x 30,000) $ 2,850,000.00 16,150,000.00 4,250,000.00 5-11 5-12 Jiambalvo Managerial Accounting b. 2006 $ 20,400,000.00 Sales ($120 x 170,000 units) Less variable cost of goods sold: ($85.00 x 170,000) Less variable selling expense ($.10 x $20,400,000) Contribution margin Less fixed costs: Manufacturing Selling expense Administrative expense Net income 2,000,000.00 1,000,000.00 800,000.00 $ 110,000.00 Ending inventory ($85 x 30,000) $ 2,550,000.00 14,450,000.00 2,040,000.00 3,910,000.00 c. The amount of fixed manufacturing inventory that is included in ending inventory under full costing is $300,000 ($10 x 30,000 units). This accounts for the difference in income under full versus variable costing.