Agroindustry tomato chain in Brazil: present situation and

1

Agroindustry tomato chain in Brazil: present situation and prospects

Paulo C T Melo

1

; Nirlene J Vilela

2

; Leonardo C. Fonte

3

1

Universidade de São Paulo, Escola Superior de Agricultura “Luiz de Queiroz”, Departamento de Produção

Vegetal, Piracicaba, SP, Brasil, e-mail: pctmelo@esalq.usp.br

; nirlene@cnph.embrapa.br

, C. Postal 218, 70359-970 Brasília, DF;

3

2

Embrapa Hortaliças, e-mail:

Heinz Seed, Campinas, SP, Brasil, email:

Leonardo.daFonte@hjheinz.com

ABSTRACT

An overview of the Brazilian tomato agroindustry chain in the ‘00s is presented in this paper.

Brazil is the world's 5 th

largest producer of industrial tomatoes with an average production of

1,150,000 tons for the 2000-10 period. In 2010, tomato production set a new record of 1.8 mm tons with an average productivity of 85.4 ton/ha. Goiás State concentrated 78% of this volume or 1.4 mm tons. The Brazilian tomato production and processing sectors have experienced remarkable changes in the ‘00s. New factories were built, including Brasfrigo,

Goialli, Produtos Dez, and Fugini, while others closed down their operations, including

SoFruta, Cirio and Parmalat. Unilever moved their facilities to new sites and finally sold their tomato operations to Cargill. Heinz, the leading United States ketchup producer, absorbed

Quero, the second most important Brazilian brand. At the beginning of the 2000s, the production of tomato-based products in the Brazilian market reached approximately 350,000 tons or R$ 1.1 billion. At the end of the decade, these values had reached 530,000 tons or R$

2.1 billion, with about 350 brands, driven by consumption by the new Brazilian middle class.

Traditional cans and glass jars, common a few years ago, have been increasingly replaced by aseptic carton packs and stand up pouches. The valuation of the Brazilian Real is contributing to increased importation of tomato paste as well as of finished products. The many constraints and challenges that need to be overcome to optimize the technical and the economic efficiency of the Brazilian tomato processing chain are discussed.

Keywords: Solanum lycopersicum , tomato paste, processing tomato, yield, product quality, crop management

INTRODUCTION

The Brazilian production of industrial tomatoes for processing in 2010 was a record, estimated at 1,816,384 tons, with a mean productivity of 85.4 ton/ha. This was a significant

58% increase compared to the production of 1.15 mm tons in 2000 (Tables 1 and 2).

However, a combination of high production and high productivity, as observed in 2010, rarely occurs in this segment.

2

This production increase caused Brazil to be ranked as No. 5 among the 10 largest world producers of processed tomatoes. The data in Table 1 show that Brazil was ranked No.

7 and 8 for the 2005-2008 and 2009 crop seasons respectively, according to data collected by the WPTC (World Processing Tomato Council), located in Paris, France.

The state of Goiás is the most important regarding this record production, harvesting

1,466,184 tons on an area of 16,382 ha with a productivity of 89.5 ton/ha (Table 1). When the first tomato processing plant was opened in the state 25 years ago, industrial tomato production was estimated at only 80,000 tons from a planted area of 1,780 ha.

The mean productivity between 1985 and 2010 increased from 34 ton/ha to 85 ton/ha, a significant increase of 150%, with very vigorous growth after the mid-1990s (Table 1).

Melo & Vilela (2005) attributed this growth mainly to a greater concentration of production in the Goiás cerrado region and the increasing use of very productive hybrids. The gradual increase in productivity during the 1990s and 2000s is also due to the contract strategy of the processing companies, which started to finance the necessary inputs for tomato production in the cerrados of Goiás and Minas Gerais states.

GROWTH OF THE SECTOR

The tomato processing sector is currently experiencing significant growth due to the consolidation of Goiás state as the most important pole of agricultural processing in Brazil and South America. On the one hand, Britto and Castro (2010) credit the expansion of tomato production and processing in the Goiás cerrado region to the high technology used by growers and also favorable logistics, and on the other hand, to the policy of financial incentives offered by the state government.

Twelve of the current industrial tomato processing plants of the 23 in Brazil are located in Goiás municipalities . The remaining plants are located in the states of São Paulo

(seven), Minas Gerais (two) and Pernambuco (two) (Table 3).

Most companies are involved in the primary and secondary transformation segments

1

.

Considering the increase in the number of people eating out, especially in the large urban centres, the tomato processing industries have begun to invest in the Food Service segment

2

,

1

Refers to obtaining intermediary products later destined for processing, such as concentrated tomato paste at 28

- 30 ºBrix, cubes, crushed tomatoes, also known as semi-industrialized products; secondary processing involves

2 the production of finished products, such as sauces, extracts, purees and ketchup among others.

Unilever Food Solutions, multinational division for food eaten outside the home, announced the relaunching of its ketchup, mustard and Arisco mayonnaise product lines in May ( www.unileverfs.com.br

, 28/05/2011).

3 destined for the institutional market, such as restaurant and hotel chains, industrial kitchens, hospitals, the armed forces and fast-food chains.

In the last few years, due to the increase in people’s purchasing power and economic stability, the market competition for tomato-based products in Brazil has become ever fiercer.

Well-known brands, such as Elefante, Pomarola, Pomodoro, Salsaretti, Etti, Arisco, Tarantella and Predilecta, now dispute the market with a large number of brands belonging to companies which appeared after 2000.

A recent survey by the Supermercado Moderno (Modern Supermarket) magazine revealed the existence of around 350 brands of tomato-based products in the retail sector.

Such fierce competition has caused a restructuring of the sector, with various companies being put up for sale. In the opinion of specialists, the price of tomato-based products has fallen and tomato sauces, extracts and puree have become mere commodities, due to this market competition, making the business unviable for transnational companies, which have to operate with high profit margins. This seems to have been the main reason why the anglodutch company, Unilever, decided to give up its line of tomato-based products last year.

Acquisitions in the sector of tomato-based products intensified in the 1990s and continued after 2000

3

(MELO; VILELA, 2004). During the present decade, the bankruptcy of

Cirio Brasil Alimentos was declared, and its plants in the states of São Paulo and Goiás were closed down. In 1999, Cirio had already wound up its operations in the pioneering Peixe factory, located in the Agreste of Pernambuco, which had celebrated 100 years of existence that same year. Similarly, Unilever centralized its production of tomato-based products in its

Goiânia, GO, industrial plant, an old factory belonging to Arisco, and closed its manufacturing plants in Patos de Minas, MG, Juazeiro, BA and Rio Verde, GO. This has resulted in traditional brands, such as CICA and PEIXE being definitively discontinued in the

Brazilian market.

In Pernambuco in 2002, the ASA Indústria e Comércio Ltda. acquired Palmeiron, owner of the Palmeiron and Naturella brands, from Unilever. Both brands have a large penetration in the northeastern market. In Goiás, Unilever sold the Saúde brand and the Rio

Verde, GO, plant to Siol Alimentos in 2003 and 2005, respectively. In its turn, in 2006,

3

The first visible result of the transfer of share control of Brazilian firms to transnational groups was the radical restructuring of their first and second processing operations, with the closing of various industrial plants and the extension and modernization of others (Melo; Vilela, 2004).

4

Hypermarcas S/A

4

returned to the tomato product segment with the purchase of Etti, a traditional brand of tomato-based products and preserved vegetables, which had been owned by Parmalat since 1998. In this same year, Agristar do Brasil Ltda., which acts in the vegetable seed market, sold its unit for processing tomato pulp, located in Orizona, to

Conservas Oderich S/A, a centenary food industry from Rio Grande do Sul state, with plants in São Sebastião do Caí and Pelotas. In 2008, Dez Indústria e Comércio de Conservas

Alimentícias Ltda., with a factory in Morrinhos, GO, established a partnership with Predilecta

Alimentos, from São Paulo, with the objective of expanding its processing capacity.

In São Paulo state, Guari Fruits, with an industrial plant in the Guariroba district of

Taquaritinga, SP, initiated debt settlement proceedings in 2009. The following year, SóFruta

Indústria Alimentícia Ltda., with a factory in José Bonifácio, SP, was also declared bankrupt.

Also in 2010, Predilecta Alimentos opened its third unit for producing tomato-based products in Guaira, SP.

The tomato processing complex in Goiás state expanded even more during 2010 with the beginning of operations at a new processing unit of the São Paulo company, Fugini

Alimentos, in Cristalina.

The tendency for acquisitions in the decade beginning in 2010 is following that of the

1990s and 2000s. The first big deal was announced in September 2010 with the sale of

Unilever’s tomato products line, a market leader, to Cargill Foods Brasil for R$ 600 mm. In the final agreement in March 2011, the Pomarola, Extrato Elefante, Extratomate, Pomodoro and Tarantella brands were included, but the tomato extracts and sauces of the Arisco brand have been directed to the food service market and will continue to be produced by Cargill, but sold by Unilever. Similarly, the Hellmann ketchup brand will continue under Unilever’s control and be manufactured in the Goiânia plant acquired by Cargill (CUNHA, 2011). With this transaction, Cargill is diversifying its portfolio and consolidating its expansion strategy in the retail market.

Another big negotiation in the segment was announced in March 2011, when Heinz, a traditional manufacturer of North American ketchup, acquired 80% of the capital of

Coniexpress S/A Indústrias Alimentícias (Quero Alimentos), located in Nerópolis, GO, and owner of the Quero brand. The deal was closed for R$ 1.2 billion, with Heinz having the option to buy the remaining 20% of Quero Alimentos. Up to now, the products with the

Heinz brand, especially ketchup, have been commercialized in the Brazilian market through

4

New industrial conglomerate belonging to the businessman, João Alves de Queiroz Filho, former owner of

ARISCO, sold in 2000 to Bestfoods, which was later acquired by Unilever in 2000.

5 distributors. With the Quero line, Heinz can, at the same time, increase product sales with the

Heinz label, with a Premium positioning, as well as be represented in the Class C population group, where Quero products are well established (CARDOSO, 2011).

The last deal in the market for tomato-based products was divulged in May 2011.

Bunge Brasil Food Division announced its entry into the market for tomato-based products in order to increase its presence in the retail sector. The market in Brazil’s northeast will be the first focus of the Bunge product line, to be sold under the Primor brand, which is presently used for its margarine sold in the northeast and has the highest recall by consumers.

According to Bunge’s press release, the tomato-based products with the Primor brand will be part of the Premium line, with higher prices than those of the current market leaders. In order to ensure the entry of Primor tomato products in the market, Bunge settled an out-sourcing contract with Siol Alimentos, which will be responsible for producing the tomato raw material and industrial processing, to be done at its Rio Verde, GO

5

factory.

STRUCTURAL CHANGES AND SECTOR EXPANSION

Since the beginning of the last decade, the Brazilian segment of tomato-based products has been growing significantly in both volume and market value, as can be easily observed by comparing the performance of the sector between 2000 and 2010.

In order to understand the recent changes in the market structure of tomato-based products in Brazil, the situation between the current reality and that at the beginning of the last decade should be compared. In 2000, the market was concentrated in only three firms, all foreign owned. The anglo-dutch firm, Unilever, was the absolute segment leader, with 50% market share, the Italian companies, Parmalat and Círio, had 19% and 8% share, respectively

(ARAÚJO, 2001). The remaining 23% were in the hands of small and medium-sized domestic companies, which sold their products in local or regional markets. In 2000, 350,000 tons of tomato-based products were sold and the production value reached around R$ 1.1 billion (ARAÚJO, 2001). Compare these numbers to 2010, when around 530,000 tons were sold with a value of R$ 2.1 billion, according to data from ACNielsen. Thus it can be seen that in only ten years, the market value of tomato-based products in Brazil practically doubled and volume growth was 51%. Recent data show that between 2007 and 2010, the Brazilian market of tomato-based products grew 16.2% in value, with sales of ready-to-use sauces

5

Information based on news posted on Bunge’s portal www.bunge.com.br

on May 13 th

, 2011.

6 increasing from R$ 769.7 mm in 2009 to R$ 863.2 mm in 2010. Volumes were 204 mm kilos in 2010, around 15% higher than in 2009, according to ACNielsen.

An interesting fact is that the three global food conglomerates, Unilever, Parmalat and

Cirio, which dominated the Brazilian segment of tomato-based products in 2000, are currently absent from the market for different reasons. Even though their brands are still active in the hands of other multinationals of the food segment, except for Cirio, the tomatobased products of medium-sized manufacturers, such as Predilecta, Quero, Fugini, Olé, and

Oderich, among others, have gained a significant share of the Brazilian market since 2000.

The big changes observed in the packaging sector of tomato-based products, which until the middle of the last decade were predominately sold in steel cans, glass jars and cups, are also worthy of note. The continuous increase in the costs of glass packaging and steel tins was one of the factors which drove the companies to look for cheaper and more practical packaging alternatives. The aseptic carton packs, whose use had been increasing in the milk and juice markets at the beginning of the years 2000, were now being used by the manufacturers of tomato-based products, especially for products with a greater added value, such as ready-to-use sauces and purees. Thus, in 2004, 35% of the volume of such products was sold in this type of packaging (EMBALAGEM MARCA, 2004).

In 2003, the stand up pouch was introduced into the domestic market of tomato-based products, a flexible packaging with a concertina base, which allows a vertical exhibition of the product on the shelf, and was already in use in Chile at that time. This new packaging category for tomato-based products was first adopted by the now extinct company, SoFruta

(EMBALAGEM MARCA, 2004). As happened in other South American markets, the use of stand up pouches or sachets, as they are popularly known, showed significant growth in the short term for Brazilian manufacturers of tomato-based products. Specialists of the segment attribute this growth to two main factors: consumer acceptance due to its practicality and a

30% cost reduction in packaging for manufacturers.

Another change in the tomato-based segment is related to the growth of companies’ own brands. The results of recently published market research by ACNielsen, involving the participation of 331 retail firms, has revealed that in the categories in which they are represented, companies’ own brands are responsible for 4.8% of the value sold by these retailers. This result, which refers to the first semester of 2010, is an increase of 21% compared to the same period of 2009. Among the most noticeable categories are the panettones and tomato-based products, with 38.6% and 32% of the volumes of each category, respectively. This study also showed that in the urban centers, 50% of the expenses with own

7 brand products are spent in the three principal supermarket groups (Pão de Açúcar, Carrefour and Wal-Mart), which together represent about 40% of the autoservice sector in Brazil.

IMPORTS AND EXPORTS

At present, tomato-based products are the seventh most important category of nonperishable food products on the Brazilian table and with a high frequency of purchase, according to AC Nielsen. Such growth in the consumption of tomato-based products in

Brazil, especially over the last few years, has resulted in a substantial increase in the import of concentrated tomato pulp and also of finished products. Table 4 shows that between 2006 and

2010, the import volumes of semi-processed and finished tomato-based products increased from 7,758 tons to 61,224 tons, respectively, a very significant increase of 789%. In fact, most of these imports are used to cover an annual deficit in tomato raw material, since in the period, 2006-2010, an average 1.2 mm tons of tomatoes were produced annually, insufficient for industrial needs. It should also be mentioned that historically, the domestic industry imports significant volumes of tomato paste, which are strategically used to reduce storage costs during the off-season period and also to complement eventual production deficits of concentrated tomato pulp due to crop problems. The 2008 and 2009 crops are good examples of crop failures resulting from climate problems and disease attack, causing a decrease of concentrated pulp stocks, which the companies usually keep for reprocessing during the long off-season period. As well as these factors, there is the favorable situation for imports due to the exchange rate policy adopted by the present and previous governments, based on a valuation of the Brazilian Real in relation to the dollar. In spite of this scenario, the result of the 2010 crop is a clear demonstration that companies are interested in expanding the domestic production of industrial tomatoes.

An analysis of the imports of tomato-based products in 2010, shows that the most important product was “tomatoes prepared/conserved (concentrated pulp)”, responsible for around 75% of the total import volume (Table 5). The highest concentrated pulp volumes came from Chile (28.9%), China (26.84%), USA (13.3%) and Italy (5.5%). These four countries together supplied Brazil with 74% of the volume of this product (Table 6).

The second most important product imported in volume was “whole tomatoes or pieces, prepared or conserved”, responsible for 16.5% of imports, mostly originating from

Italy (12%) and China (3.8%). Considering all types of tomato-based products imported by

Brazil, it can be seen that most came from China (30%) and from Chile (30%), Italy (17.3%) and the U.S.A (13.5%). These four countries together supplied Brazil with about 90% of the

8 total import volumes. It should be mentioned that at the beginning of 2000 China was not a country which exported tomato-based products to Brazil (MELO; VILELA, 2004).

Regarding the export of concentrated pulp and other tomato-based products, Brazil has been losing competitiveness since the middle of the last decade. The volume exported for the period 2000-2004 reached 24,308.6 thousand tons, falling to only 9,198 thousand tons between 2006 and 2010, a reduction of approximately 164% (Table 4, Figure 2). The increase in exports at the beginning of the last decade (Figure 2) may be explained by the impacts caused by devaluation of the Brazilian Real in January 1999. On the other hand, the significant fall in imports of tomato-based products can be attributed to devaluation between

2000 and 2004, when companies had to substitute a large part of their imports with domestic production (MELO; VILELA, 2004).

After 2006, the foreign trade situation for industrial tomatoes changed again due to the monetary policy of a floating exchange rate with a substantial valuation of the Brazilian Real against the dollar and Brazilian tomato products have been losing their competiveness ever since. Comparing 2006 with 2010, it can be seen from Table 7 that there was a 15.8% decrease in the volume of semi-processed and finished tomato-based products exported by

Brazil.

The data from MDICE/SECEX indicate that in 2010, 86.1% of the total volume

(7,650 t) of Brazilian tomato-based products were destined for MERCOSUL countries, especially Uruguay (80.5%), and Paraguay (5.6%).

CHALLENGES AND PERSPECTIVES

Despite the conquests observed in the industrial tomato processing chain during the last decade, it is necessary to open a new chapter, involving the implementation of actions to overcome bottlenecks threatening the sustainability of expansion in this segment. On the one hand, the biggest challenge for the productive sector is to continue improving cultural management, seeking even greater increases in productivity and quality, cost reductions and increases in rentability per ton of tomato raw material delivered to the processors.

One obvious question, which needs to be asked, is if the current installed processing capacity of the industries is sufficient to attend the continual domestic growth in demand for tomato products and still produce a surplus for export. It is known that the 2010 crop could have been even larger if the losses of around 132 mm tons of tomato raw material, which were not processed due to lack of processing capacity, had been considered (MELO; FONTE,

2001).

9

An even greater challenge is to reach this objective with sustainability and a perception of environmental preservation and rational water use in irrigation. Similarly, the question of the rational use of agrochemicals must be a permanent worry in production, especially if there is an increase in the export of tomato pulp and finished products. Another threat, for which there is already a solution, but which depends on governmental actions, is the need to increase the electricity supply.

At the moment, there is already a disequilibrium between the electricity supply and demand, making it difficult to plan any growth in tomato production and processing in the

Goiás cerrado region, and thus, guarantee sustainability. Increasing the energy supply is one of the big challenges facing the new Federal Government, which has made a commitment to continue the virtuous circle of growth in the Brazilian economy.

The projections for the current year’s crop indicate an estimated reduction of 15% in planted area. It is unclear if this decrease is due to readjustments in cultivated area due to the high productivities obtained in the previous crop cycle or if it is related to the availability of surplus paste produced in 2010. Also, the increase in imports due to the highly favorable exchange rate may also be a factor, since importing tomato paste is very attractive, principally for those companies acting only in the secondary processing stage.

REFERENCES

ARAÚJO L. 2001. Atomatados: um mercado disputado por gigantes. Brasil Alimentos 9: 21-

22.

BRITTO L.; CASTRO SD. 2010. Expansão da produção de tomate industrial no Brasil e em

Goiás. Conjuntura Econômica Goiana 16: 43-52.

CARDOSO J. Visando expandir-se na América Latina, Heinz fica com 80% da Quero.

Disponível em www.valoronline.com.br

. Acesso em: 3 de março de 2011

CUNHA L. Cargill compra divisão de atomatados da Unilever. Disponível em www.valoronline.com.br

. Acesso em: 18 de maio de 2011

EMBALAGEM MARCA. Os benefícios da diversidade. Revista Embalagem Marca, n.55, p.16-20, março 2004. Disponível em www.embalagemmarca.com.br

. Acesso em: 23 de maio de 2011

MELO PCT; VILELA NJ. 2005. Desafios e perspectivas para a cadeia brasileira do tomate para processamento industrial. Horticultura Brasileira 23(1): 154-157.

MELO PCT; FONTE LC. 2011. Brazil processing tomato season 2010: results and future perspectives. Tomato News 3: 15-19.

10

MELO PCT; VILELA NJ. 2004. Desempenho da cadeia agroindustrial brasileira do tomate na década de 90. Horticultura Brasileira 22(1): 154-160.

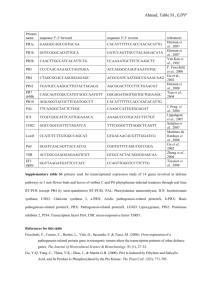

Table 1 . Cultivated area and production of industrial tomatoes by region in Brazil, 1985-2010, according to industry estimates

Northeast (PE/BA) São Paulo

Year

Area

(ha)

Production

(m ton)

Area

(ha)

Production

(m ton)

1985 6,500 215,000 10,350 350,000

Cerrado

(GO/MG)*

Area

(ha) nd

Production

(m ton)

Area

(ha) nd 16,850

1990 12,422 338,000 8,260 297,400 6,400 300,000 27,082

Brazil

Production

(m ton)

Productivity ton/ha

565,000 33.5

935,400 34.5

1995 9,750 350,000 5,490 280,000 5,030 300,000 20,270 930,000 45.9

2000 1,370 65,000 2,040 141,000 11,450

2005 nd nd 266,000 11,760

787,500 14,860

948,000 15,970

993,500 66.9

1,214,000 76.0

2010 470 15,000 4,406 335,200 16,382 1,466,184 21,258 1,816,384 85.4

*The first tomato processing factory started operating in 1986, with a capacity to process 1,200 ton/day

Source: tomato processing industries.

Table 2 . Production (1000 m tons) of tomatoes for industrial processing in 10 leading countries from 2005 to

2010

Country

U.S.A

China

Italy

Spain

BRAZIL

Iran

Turkey

Portugal

Chile

Tunisia

2005 2006 2007 2008 2009 2010

9,296 9,642 11,474 11,185 12,629 11,980

3,200 4,300 4,600 6,405 8,655 6,210

5,300 4,400 4,619 4,900 5,747 5,080

2,850 1,580 1,750 1,730 2,700 2,350

1,246 1,160 1,292 1,200 1,150 1,816

2,124 1,800 2,100 2,060 2,400 1,400

1,626 1,450 1,650 2,700 1,800 1,280

1,000 900 1,040 998 1,242 1,280

756 630 670 510 619 864

735 463 580 800 750 850

Source: WPTC, April 2011.

11

Source: MDICE/SECEX

Figure 2 . Brazil: exports (1,000 US$; m ton) and imports (1,000 US$; m ton) of tomato-based products between 2000 and 2010

Table 3 . Major tomato processing industries, their respective brands and factory locations.

ABC Ind. de Alimentos Ltda.

Alimentos Wilson Ltda.

Natu, Da Gente

D’Ajuda, Calcutá

Turvânia, GO

Regente Feijó, SP

ASA Indústria e Comércio Ltda.

Best Pulp Brasil Ltda.

Brasfrigo S/A (Grupo BMG)

Cargill Foods Brasil

CISAL Ind. Sul Americana de Alimentos Ltda.

Conservas Oderich S/A

Dez Ind. e Com. de Conservas Alimentícias Ltda.

Etti/Hypermarcas S/A

Fugini Alimentos Ltda.

Goialli Alimentos S/A

Goiás Verde Alimentos

HEINZ/Coniexpress

Predilecta Alimentos

Indústria de Polpas e Conservas Val Ltda.

Ind. e Com. Produtos Alimentícios Cêpera Ltda.

Karambi Alimentos Ltda.

LF de Castro

Palmeiron, Naturella

Best Pulp

Jurema, Tomatino

Pomarola, Elefante, Pomodoro, Tarantella

Minha Quinta

Oderich

Predilecta*

Etti, Salsaretti, PuroPurê

Fugini

Goialli

Goiás Verde, Bonare, Tomadoro

Quero, Heinz

Predilecta

Val

Cepêra, Mamma d’Oro

Belo Jardim, PE

Janaúba, MG

Luziânia, GO

Goiânia, GO

Morrinhos, GO

Orizona, GO

Morrinhos, GO

Araçatuba, SP

Cristalina, GO

Goianésia, GO

Luziânia, GO

Nerópolis, GO

Matão e Guaira, SP

Vista Alegre do Alto, SP

Monte Alto, SP

Bonamassa, Bonadelli Vianópolis, GO

Stella d’Oro Alimentos Ltda.

Tambaú Indústria Alimentícia Ltda.

Stella D’Oro

Tambaú

Itápolis, SP

Custódia, PE

* Operating since 2008 in partnership with Indústria e Comércio de Conservas Alimentícias Predilecta Ltda.

** Formed a partnership with Bunge Brasil Alimentos in May 2011 to produce the Primor line of tomato-based products.

12

Table 4 . Brazil: foreign trade of industrial tomatoes, 2000-2010

Year

Exports Imports

Value (mil US$) Volume (m ton)

2001 17,340 31,083 9,388 19,631

2002 14,274 28,151 9,279 18,477

2003 11,673 21,988 7,678 12,993

2005 9,753 12,395 6,945 12,304

2009 9,204 7,674 29,998 27,539

Source: MDICE/SECEX, 2011

Table 5 . Brazil: imports by type of tomato-based product in 2006 and 2010

Product Type

Prepared/preserved (concentrated pulps)

Ketchup and other sauces

Other ketchup and other sauces

Whole or pieces, prepared or preserved

Juices

Value

(1000 US$)

Volume

(m ton)

Value

(1000 US$)

Volume

(m ton)

AV AH

1,864.3 2,904.5 41,462.0 46,027.1 75.18 1,484.7

1,947.0 3,505.5 8,440.9 10,151.0 16.58 189.6

1,229.0 1,012.2 6,730.6 3,930.4 6.42 288.3

153.8 218.0 745.5 752.5 1.23 245.2

7,757.9 689.2

* AV= Vertical Analysis = Percentage participation of each product type in total volume;

AH= Horizontal Analysis = Percentage Variations of each type in relation to 2006.

Source: MDICE/SECEX, 2011

13

Table 6 . Principal suppliers of tomato-based products to Brazil, 2010

Country

Value

(US$ FOB)

Volume

(kg)

Participation

(%)

New Zealand

Cape Verde

Korea, South

Democratic Republic of Congo

6,301

3,443

690

2,948

600

249

0.00

0.00

0.00

United Kingdom

Total

54

57, 898, 646

Source: MDICE/SECEX, 2011

Table 7 . Brazil: exports by tomato-based type in 2006 and 2010

36

61, 337, 725

0.00

100.00

Product Type

Prepared/preserved (concentrated pulps) and sauces

Whole or pieces, prepared or preserved

Juices

Juices, unfermented

TOTAL

Value

(1000 US$)

666.9

Volume

(m ton)

863.1

Value

(1000 US$)

297.2

Volume

(m ton)

212.2

AV AH

5,250.5 5,595.1 7,283.6 5,473.8 71.56 -2.2

1,787.5 1,538.6 1,733.8 1,080.3 14.12 -29.8

952.9 967.8 816.6 883.3 11.55 -8.7

2.77 -75.4

8,758.1 9,081.9 10,131.2 7,649.5 100.00 -15.8

* AV= Vertical Analysis = Percentage participation of each product type in total volume;

AH= Horizontal Analysis = Percentage Variations of each type in relation to 2006.

Source: MDICE/SECEX, 2011

Note: This article was submitted for publication in the Proceedings of the Tomato Workshop to be held in conjunction with the 51 st Brazilian Olericulture Congress, Viçosa, Minas Gerais, 25-29, July

2011.