Provider-Based Status, Under Arrangements, Enrollment and

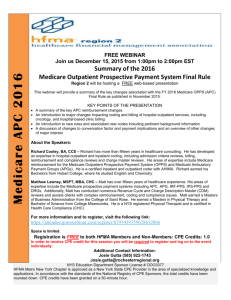

advertisement