McCulloch v Maryland 1819 Gibbons v Ogden 1824

advertisement

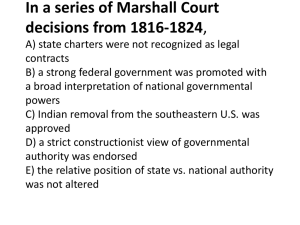

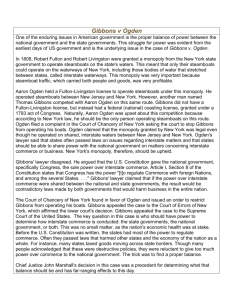

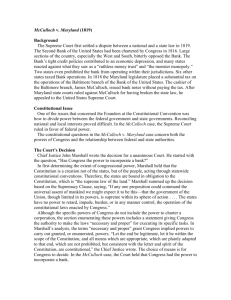

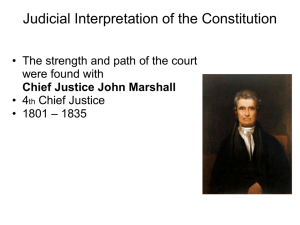

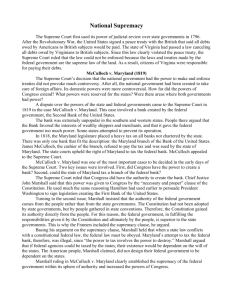

McCulloch v Maryland 1819 Gibbons v Ogden 1824 THESIS Despite resistance from States’ Rights advocates in the early American Republic, these two Marshall Court decisions were signature cases for establishing Federal Supremacy via Article VI and facilitating the growth of a more interdependent US national economy. Historical Context / Setting The Scene The Federalist appointed Marshall Court secured a significant legacy with its early establishment of Judicial Review, Broad Construction, and Pro-Commerce decisions …influencing the stability of not only the National Government, but the commerce among the PEOPLE and STATES as well. The Essential Question of the 1819 McCulloch v Maryland case …was whether the State of Maryland could impose taxes on functions of the Federal Government…specifically the B.U.S. and the paper it used to print its bank and security notes on. First Bank of the United States http://www.ushistory.org/tour/first-bank.htm Justice Marshall Federal Reserve Note 1918 www.coinweek.com Summary of McCulloch v. Maryland, 17 U.S. 316, 4 Wheat. 316, 4 L. Ed. 579 (1819). Issues Does Congress have the power under the Constitution to incorporate a bank, even though that power is not specifically enumerated within the Constitution? Does the State of Maryland have the power to tax an institution created by Congress pursuant to its powers under the Constitution? Holding and Rule (Marshall) Yes. Congress has power under the Constitution to incorporate a bank pursuant to the Necessary and Proper clause (Article I, section 8). No. The State of Maryland does not have the power to tax an institution created by Congress pursuant to its powers under the Constitution. Source: McCulloch v. Maryland – Case Brief Summary http://www.lawnix.com/cases/mcculloch-maryland.html …the Supreme Court ruled in McCulloch v. Maryland, back in 1819, that the Constitution exempts the Federal Government from state taxation. Setting forth his renowned dictum that "the power to tax involves the power to destroy," Chief Justice John Marshall declared that the states (and, by inference, local governments) "have no power, by taxation or otherwise, to retard, impede, burden or in any manner control the operations of the constitutional laws enacted by Congress." “THE SUPREME COURT: The Power to Tax”, TIME Magazine Monday, Mar. 17, 1958 http://content.time.com/time/magazine/article/0,9171,863135,00.html Justice Marshall Federal Reserve Note 1918 www.coinweek.com The Essential Question of the 1824 Gibbons v Ogden Case …was whether the State of New York could deny legal business transactions by a company operating with a Federal license on New York State and New Jersey State waters? aka “The Steamboat Case”…due in part to Robert Fulton’s interests Summary of Gibbons v. Ogden, 22 U.S. 1, 9 Wheat. 1, 6 L. Ed. 23 (1824). Issues: 1) May a state enact legislation that regulates a purely internal affair regarding trade or the police power, or is pursuant to a power to regulate interstate commerce concurrent with that of Congress, which confers a privilege inconsistent with federal law? 2) Do states have the power to regulate those phases of interstate commerce which, because of the need of national uniformity, demand that their regulation, be prescribed by a single authority? 3) Does a state have the power to grant an exclusive right to the use of state waterways inconsistent with federal law? Holding and Rule (Marshall) No. A state may not legislation inconsistent with federal law which regulates a purely internal affair regarding trade or the police power, or is pursuant to a power to regulate interstate commerce concurrent with that of Congress. No. States do not have the power to regulate those phases of interstate commerce which, because of the need of national uniformity, demand that their regulation, be prescribed by a single authority. No. A state does not have the power to grant an exclusive right to the use of state navigable waters inconsistent with federal law. Gibbons v Ogden -Case Brief Summary http://www.lawnix.com/cases/gibbons-ogden.html Gibbons was declared the winner … Ogden along with Fulton would lose their States’ Rights monopoly power … a clear victory for Federal Power over State Power also resulted The Jungle Store Animal Action Alert www.thejunglestoreblogspot.com Robert Fulton’s Steamboat Clermont www.cardcow.com Both of these Marshall Court decisions, combined with the Congressional 1820 Missouri Compromise to further strain relations between the Broad Construction “North” and leery Strict Construction “South”… it seemed the States’ Rights institution of chattel slavery was threatened The Missouri Compromise http://www.mrvanduyne.com/youngnation/change/misscomp.html Works Cited Gibbons v Ogden Case Brief Summary http://www.lawnix.com/cases/gibbons-ogden.html Justice Marshall Federal Reserve Note 1918 www.coinweek.com McCulloch v Maryland http://www.ushistory.org/tour/first-bank.htm McCulloch v Maryland Case Brief Summary http://www.lawnix.com/cases/mcculloch-maryland.html The Jungle Store Animal Action Alert www.thejunglestoreblogspot.com “THE SUPREME COURT: The Power to Tax”, TIME Magazine Monday, Mar. 17, 1958 http://content.time.com/time/magazine/article/0,9171,863135,00.html Oral Comp Questions /McCulloch v Maryland + Gibbons v. Ogden 1. How are these two cases similar with regard to expanding Federal authority under the Federalist Marshall Court? 2. How are these two cases similar with regard to promoting a more stable and dynamic economic system for the USA? 3. What are some subtle differences between the two cases lawyers would need to know if resolving disputes between competing governments in America today? (How would they be applied?) 4. Why were Southern political leaders more opposed to the legal implications of these two decisions than Northerners?