McCulloch V. Maryland, 1819

advertisement

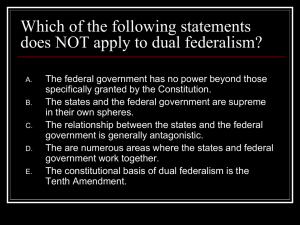

McCulloch v. Maryland (1819) Questions • 1. State the issue before the Supreme Court in this case. • 2. What facts are presented to the court? • 3. What was the decision by the court? What was the rationale for the decision? McCulloch V. Maryland, 1819 1. State the issue before the Supreme Court in this case. Does any state possess the constitutional right to tax an agency of the United States government? Another issue in this case was the right of Congress under the terms of the Constitution to establish a national bank ( Could Congress create a bank?). 2. What facts of the case were presented to the Court? The state of MD felt that the Constitution allowed states to tax agencies of the federal government because the only specific restrictions (Article 1, Section 10) on the states’ power to tax was related to imports and exports. The state also questioned the right of Congress to create a bank and to place branches in the various states without approval. McCulloch and the U.S. attorney felt no state could tax the national government or any agency of it. To do so would allow the state legislatures to become sovereign over the national government. They contended that Congress had the right to create the bank under the “implied powers” clause of the Constitution (Article I, Section 8, Clause 18) 3. What was the decision of the Court? What was the rational behind it? The court ruled unanimously in favor of McCulloch, saying that state legislatures had no right to tax the national government and that national laws passed by Congress are superior when in conflict with state statutes (Article VK). The Court also found that Congress had the constitutional right to create the National Bank as part of its “implied powers.” What was the effect of the decision? The ruling on the case established the principle that national law is superior to state law whenever the two come into conflict. Equally important, the ruling recognized a broad definition of the “implied powers,” strengthening the powers of Congress and the national government. “The Power to tax is the power to destroy” If Maryland or any other state could tax the national government then it could tax it out of existence. Is this true of the national government (can it tax the states)? “A tax on the states by the U.S. government is a tax levied on its constituency by their elected officials in the Congress, whereas a tax on the U.S. by a state legislature is a tax levied on people who are not all the constituents of the legislators of that state.” Opposing views: Congress includes representatives from all states, who are elected to represent the country as a whole; state legislators represent the people of a single state. Are members of Congress not also elected from the individual states and thus represent those constituents? Was the decision in this case an example of the Court’s use of “loose intrepretation” of he Constitution or an example of “strict interpretation” Explain. This case was an important step in establishing a “loose interpretation” of the elastic clause which has allowed Congress to justify powers previously believed to belong to the states.