NOTES

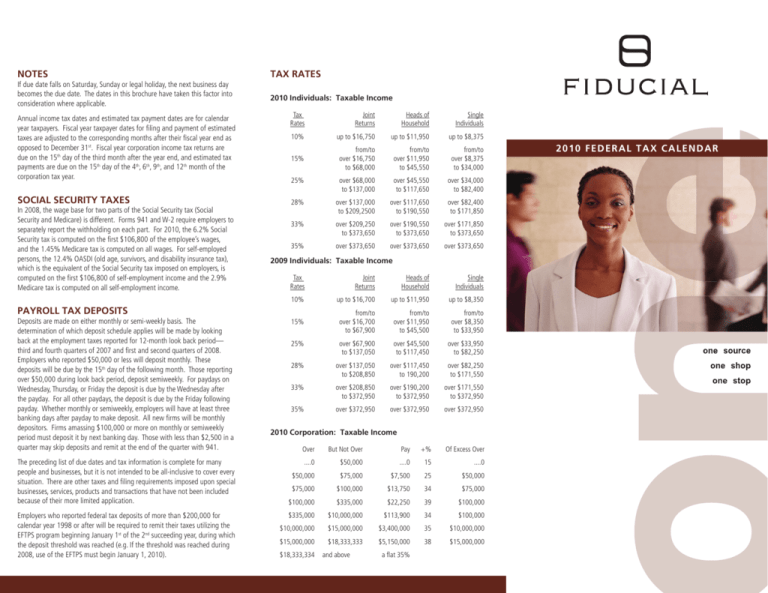

TAX RATES

If due date falls on Saturday, Sunday or legal holiday, the next business day

becomes the due date. The dates in this brochure have taken this factor into

consideration where applicable.

2010 Individuals: Taxable Income

Annual income tax dates and estimated tax payment dates are for calendar

year taxpayers. Fiscal year taxpayer dates for filing and payment of estimated

taxes are adjusted to the corresponding months after their fiscal year end as

opposed to December 31st. Fiscal year corporation income tax returns are

due on the 15th day of the third month after the year end, and estimated tax

payments are due on the 15th day of the 4th, 6th, 9th, and 12th month of the

corporation tax year.

SOCIAL SECURITY TAXES

In 2008, the wage base for two parts of the Social Security tax (Social

Security and Medicare) is different. Forms 941 and W-2 require employers to

separately report the withholding on each part. For 2010, the 6.2% Social

Security tax is computed on the first $106,800 of the employee’s wages,

and the 1.45% Medicare tax is computed on all wages. For self-employed

persons, the 12.4% OASDI (old age, survivors, and disability insurance tax),

which is the equivalent of the Social Security tax imposed on employers, is

computed on the first $106,800 of self-employment income and the 2.9%

Medicare tax is computed on all self-employment income.

Tax

Rates

Joint

Returns

Heads of

Household

Single

Individuals

10%

up to $16,750

up to $11,950

up to $8,375

15%

from/to

over $16,750

to $68,000

from/to

over $11,950

to $45,550

from/to

over $8,375

to $34,000

25%

over $68,000

to $137,000

over $45,550

to $117,650

over $34,000

to $82,400

28%

over $137,000

to $209,2500

over $117,650

to $190,550

over $82,400

to $171,850

33%

over $209,250

to $373,650

over $190,550

to $373,650

over $171,850

to $373,650

35%

over $373,650

over $373,650

over $373,650

2009 Individuals: Taxable Income

Tax

Rates

Joint

Returns

Heads of

Household

Single

Individuals

10%

up to $16,700

up to $11,950

up to $8,350

15%

from/to

over $16,700

to $67,900

from/to

over $11,950

to $45,500

from/to

over $8,350

to $33,950

25%

over $67,900

to $137,050

over $45,500

to $117,450

over $33,950

to $82,250

28%

over $137,050

to $208,850

over $117,450

to 190,200

over $82,250

to $171,550

33%

over $208,850

to $372,950

over $190,200

to $372,950

over $171,550

to $372,950

35%

over $372,950

over $372,950

over $372,950

PAYROLL TAX DEPOSITS

Deposits are made on either monthly or semi-weekly basis. The

determination of which deposit schedule applies will be made by looking

back at the employment taxes reported for 12-month look back period—

third and fourth quarters of 2007 and first and second quarters of 2008.

Employers who reported $50,000 or less will deposit monthly. These

deposits will be due by the 15th day of the following month. Those reporting

over $50,000 during look back period, deposit semiweekly. For paydays on

Wednesday, Thursday, or Friday the deposit is due by the Wednesday after

the payday. For all other paydays, the deposit is due by the Friday following

payday. Whether monthly or semiweekly, employers will have at least three

banking days after payday to make deposit. All new firms will be monthly

depositors. Firms amassing $100,000 or more on monthly or semiweekly

period must deposit it by next banking day. Those with less than $2,500 in a

quarter may skip deposits and remit at the end of the quarter with 941.

The preceding list of due dates and tax information is complete for many

people and businesses, but it is not intended to be all-inclusive to cover every

situation. There are other taxes and filing requirements imposed upon special

businesses, services, products and transactions that have not been included

because of their more limited application.

Employers who reported federal tax deposits of more than $200,000 for

calendar year 1998 or after will be required to remit their taxes utilizing the

EFTPS program beginning January 1st of the 2nd succeeding year, during which

the deposit threshold was reached (e.g. If the threshold was reached during

2008, use of the EFTPS must begin January 1, 2010).

2010 Corporation: Taxable Income

Over

But Not Over

Pay

+%

Of Excess Over

....0

$50,000

....0

15

....0

$50,000

$75,000

$7,500

25

$50,000

$75,000

$100,000

$13,750

34

$75,000

$100,000

$335,000

$22,250

39

$100,000

$335,000

$10,000,000

$113,900

34

$100,000

$10,000,000

$15,000,000

$3,400,000

35

$10,000,000

$15,000,000

$18,333,333

$5,150,000

38

$15,000,000

$18,333,334

and above

a flat 35%

2010 FEDERAL TAX CALENDAR

2010 FEDERAL TAX CALENDAR: JANUARY 1, 2010 TO DECEMBER 31, 2010

FEDERAL EXCISE TAX

JANUARY

Several types of excise tax are reported quarterly on Form 720. This form is

used to report Environmental Taxes (taxes on Ozone Depleting Chemicals),

Communications and Air Transportation Taxes, Fuel Taxes, Retail Tax on Truck

Bodies, Ship Passenger Tax, Luxury Tax on Automobiles, and other excise taxes.

In general, semimonthly deposits of these taxes are required. However, there

are exceptions that permit payment of the tax with the quarterly return if the

amount of tax due for the quarter is less than $2,500.

Except as otherwise provided in Form 720 instructions, file a return for each

quarter of the calendar year as follows:

Quarter Covered

All Excise Taxes Form 720

January, February, March

May 1

April, May, June

July 31

July, August, September

October 31

October, November, December

January 31

15 File fourth quarter individual estimate for 2009 or in lieu thereof, file

individual tax return on or before January 31 and pay full amount of tax.

FEBRUARY

1

Form 1099R must be sent to retirees.

File Form 940 (or 940-EZ) Federal Unemployment Tax for 2009 if timely

deposits not made File Form 941 for the fourth quarter 2009 if timely

deposits not made.

Last day to furnish employees with 2009 Form W-2.

Furnish Form 1099 to recipients of $10 or more of dividends, interest,

and original issue discount and other payment of $600 or more of rents,

royalties, and compensation to non-employees for 2009.

Furnish Form 8308 to transferor and transferee with respect to 2008

sale or exchange or a partnership interest.

10 File Form 941 for fourth quarter 2009 if not filed January 31, and timely

deposits have been made for entire quarter.

If any due date for filing falls on a Saturday, Sunday or legal holiday, file the

return on the next business day.

16 Individuals. If you claimed exemptions from income tax withholding last

year on the Form W-4 you gave your employer, you must file a new Form

W-4 with your employer to continue your exemption for another year.

Use the latest due date for the type of tax reported. File only one return for

each quarter.

MARCH

Complete details are available in the instructions for Form 720 and Form 6627

(covering Ozone Depleting Chemicals). Both the instructions and the forms are

avail from the IRS at one of their offices or via the Internet at www.irs.gov.

Magnetic media reporting. If you are required to file 250 or more Forms W-2,

you must file them on magnetic media diskette or electronic filing unless the IRS

granted you a waiver.

You may request a waiver on Form 8508, Request for Waiver Form Filing

Information Returns on Magnetic Media. Submit Form 8508 to the IRS at least

45 days before the due date of the return. Get Form 8508 for filing information.

Note: If you file on magnetic media, do not file the same returns on paper.

Magnetic media reporting specifications for Forms W-2 and W-3 are in SSA’s

Employer Services Online. This item can be downloaded by going to website

www.ssa.gov. You can also get these specifications by contacting any Social

Security Employer Service Liaison officer. Call 1-800-SSA-6270 for the phone

number of the officer in your area.

1

File 2009 Form 1096 accompanied by copies of Form 1099.

File reconciliation on Form W-3 accompanied by ‘A’ copies of Form W-2.

File Form 8027 Employees Annual Tip Income Return.

File Form 1098 for $600 or more mortgage interest received.

File Form W-2G (Gambling Winnings)

15 File 2009 calendar year corporation tax return or file Form 7004 for

a 6-month extension and pay tax due (If not paying, still disclose the

amount due).

31 Electronic filing of Forms 1098, 1099, 8027 and W-2 G

APRIL

15 File individual tax return or file form 4868 for a six-month filing

extension and pay tax due for 2009 (If not paying, still disclose the

amount due).

Pay first installment of Individual Estimated Taxes for 2009.

File partnership return for 2009.

File 2009 calendar year estate income tax return and pay first

installment for 2010.

File 2009 calendar year trust income tax return and pay entire tax.

Last day for individuals to make IRA contribution for 2009.

Deposit first installment of calendar year corporation’s 2010 estimated

income tax.

Payment of gift tax and filing of gift tax returns for taxable gifts made

during 2009.

MAY

10 File first quarter 2010 Form 941 if not filed April 30 and timely deposits

have been made for entire quarter.

17 File 2009 information return of tax-exempt organizations.

JUNE

15 Individuals and calendar year corporations pay second installment of

2010 estimated tax.

Individuals living and working (or on Military duty) outside the U.S. file

Form 1040.

AUGUST

2

File Form 941 for second quarter of 2010 Deposit second quarter Federal Unemployment Taxes if more than $500.

File calendar year 2009 Forms 5500, 5500-EZ, for employee benefit plans.

10 File second quarter 2010 Form 941 if not filed July 31, and timely

deposits have been made in full for entire quarter.

SEPTEMBER

15 Individuals and calendar year corporations pay third installment of 2009

estimated tax.

File 2009 calendar year corporation tax return if not filed March 15

and an automatic six-month extension was requested, and pay any tax,

interest and penalties due.

OCTOBER

15 File 2009 trust, estate and partnership returns if not filed April 15, and a

six month extension was filed.

File individual tax returns if you have an automatic six-month extension.

NOVEMBER

1

File Form 941 for the third quarter of 2010.

Deposit third quarter Federal Unemployment Taxes if more than $500.

Last date to give employees notice of employer match for a SIMPLE plan.

10 File third quarter 2010 Form 941 if not filed October 31, and timely

deposits have been made in full for entire quarter.

DECEMBER

15 Calendar year corporations pay fourth installment of 2010 estimated tax.

31 Last date to establish Keogh or 401K Pension Plan for 2010.

30 File Form 941 first quarter 2010.

Deposit first quarter Federal Unemployment taxes if more than $500.

WWW.FIDUCIAL.COM

© 2010 Fiducial. All Rights Reserved.