Roy E - R-Net - Rollins College

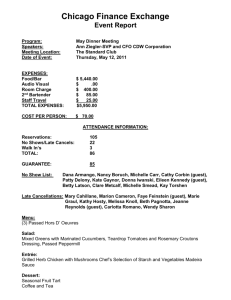

advertisement

Roy E. Crummer Graduate School of Business Rollins College Course Syllabus Spring 2012 ENT 602 - Entrepreneurial Finance Professor William A. Grimm Room 310 Crummer Rollins phone: 407-628-6345 E-mail: wgrimm@rollins.edu Office hours: by appointment (generally available) Course Prerequisite: FIN 501 – Financial Management Texts: (1) The Entrepreneurial Venture: Readings Selected, William A. Sahlman, et al. nd (2 Edition), Harvard Business School Press, 1999 (ISBN 0-87584-892-3) (2) Entrepreneurial Finance: A Casebook, Paul A. Gompers and William A. Sahlman, John Wiley & Sons, Inc., 2002 (ISBN 0-471-08066-7) Course Objectives: The objective of this course is to provide the student with an understanding of entrepreneurial finance so that the student will be able to: Understand the process of financing Determine valuation of the enterprise from different viewpoints Understand the importance of a business plan in financing a business Design and negotiate “deals” Understand the stages of financing from the initial start-up to a growing, profitable company Understand the sources of new venture finance ranging from friends and family to angel investors to venture capital firms to strategic partners Understand the exits for investors including an acquisition of the company or an initial public offering This course will tie real life successes and failures to the topics covered by the texts through the experiences of Professor Grimm, guest speakers and case studies. Reading Assignments: Assignments include readings and cases in the Gompers casebook and selected articles in the Sahlman textbook. All students are expected to read the assigned cases prior to the date assigned for each case. Conduct of Class: Classes will be a combination of team presentations of cases, interviews of guest speakers and discussion of questions assigned for each class. All students are expected to engage in these discussions. The assigned cases deal with the different issues in financing an entrepreneurial enterprise and, reflecting real life, will contain issues pertaining to phases of financing that may be covered in greater detail in later classes. 1 Grading: There will be a one-hour midterm exam and a one-hour final exam. The exams will consist of one or more essay questions and will be open text, computer and notes. The course grade will be determined as follows: Midterm Exam Final Exam Team presentation of 2 cases Individual case discussion papers Class participation (discussion of cases and new company) 20% 20% 20% 20% 20% Class Attendance: This course will provide the greatest learning experience to those students who prepare for and attend every class. The most valuable elements of this learning experience will be the class discussion and hearing from our guest speakers. You are expected to attend each class. If you cannot attend, please advise me by email prior to missing the class. You will be responsible for submitting assigned papers (see below) prior to the class even if you will miss the class. An attendance form will be circulated in some or all of the class sessions. Teams: The class will be divided into teams (4-5 members depending on the size of the class). The students will self-select the teams. The team member selections should be made in the breaks during the first class session. Each team will be responsible for presenting two of the assigned cases in the Gompers case book (see below). After the teams are formed, you will sit together as a team in the classroom for the remaining class sessions. Case questions and answers. Each student must read each assigned case and submit a 1-2 page paper answering 1-3 questions posed by Professor Grimm regarding the case. These questions will be posted 4-5 days prior to the class for which the case is assigned. You should post your paper to Blackboard under Content using the specific Assignment for that week. These papers will be assigned a pass/fail grade. Late papers will not be accepted unless excused in advance by Professor Grimm. Case Presentations by Team: Each team will select two of the assigned cases in the syllabus to present to the class on the date assigned for each case. The presentation will consist of a summary of the information in the case, a statement of the problems to be addressed, and the team’s recommended course of action with reasons for this course of action. The team should use the video projector to make this presentation. Each member of the team must take part in the presentation. The team should lead a class discussion of the case after making its recommendation. The entire process should take 45-50 minutes. The team must provide a printed copy of the team’s presentation to Professor Grimm prior to the beginning of the class session. Professor Grimm will take extensive notes during your presentation and will record your presentation for his later review. Start-up to Exit; Stages of a Company: We will form a new company during the first class session. Thereafter, we will discuss a stage of financing for a company in each class session from start-up to exit by discussing 5-7 specific questions assigned by Professor Grimm for each class session. Professor Grimm will call on students randomly to discuss each question. You should be prepared to discuss each question for every class. You will find it necessary to do research to find answers to the questions and may find experts who express conflicting answers to the questions. The questions are designed to require not more than 2 hours of research (for all of the assigned questions) each week. Guest Speakers: We will have a guest at the beginning of many of the classes. Each guest will have significant experience as an entrepreneur and have knowledge of different aspects of entrepreneurial finance. I will interview the guest for about 45 minutes, leaving 10-15 minutes for questions. MindMaps: Professor Grimm often uses MindMaps produced with MindManager 8 and posts them to Blackboard. You should download the free MindManager Viewer at http://www.mindjet.com/support/tutorials/viewer to view these MindMaps. 2 Class Sessions (subject to change) Class Session Number Reading Assignment in Gompers (chapters) 1 1 2 Reading Assignment in Sahlman (chapters) 1, 13 4, 8 5 5 6 21, 28 Terminology; overview of funding a new business (MindMaps posted on Blackboard) Beta Group Friends and family financing Tutor Time (A) 2 Stock compensation for key employees The Carlton Polish Company 10 Business plan for financing Honest Tea Sources of funding Midterm exam No class 7 Case in Gompers Formation and start-up 3 4 Stage of Financing Break 17, 19 12 8 Angel investors Xedia and Silicon Valley Bank (A, B-1 and B-2) Dealing with financial problems Parenting Magazine 9 19, 29 Strategic partnership E-Ink 10 15 Venture capital financing Edocs, Inc. (A) 23 Being acquired; preparing for an IPO Nantucket Nectars 11 30 Amazon.com 12 Initial public offering; being a publicly held company Final exam (or graded venture capital exercise) ** Note: We will have a guest speaker at the beginning of many of the classes. ** A graded venture capital term sheet negotiation by opposing teams may be substituted for the final exam. 3