NPV and Debt Assume

advertisement

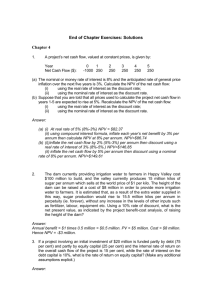

NPV and Debt Assume: Long-term debt at 4.25% = $2,000 A/P = $300 N/P = $400 100 shares selling for $25 each A 3-year project Pro forma income statement for a 3-year project (S = $2,000) Today 1 2 3 Sales (Costs) (Depreciation) EBIT (Interest) EBT (Tax) Net income $0.00 $0.00 $300.00 -$300.00 $0.00 -$300.00 $0.00 -$300.00 $5,000.00 $3,500.00 $540.00 $960.00 $85.00 $875.00 $297.50 $577.50 $5,000.00 $3,500.00 $432.00 $1,068.00 $85.00 $983.00 $334.22 $648.78 $5,000.00 $3,500.00 -$272.00 $1,772.00 $85.00 $1,687.00 $573.58 $1,113.42 Addition to RE Dividend -$300.00 $0.00 $375.38 $202.13 $421.71 $227.07 $723.72 $389.70 1 Pro forma income statement for a 3-year project (S = $2,000) Today 1 2 3 Cash Inventory A/R Current assets $100.00 $500.00 $400.00 $1,000.00 $1,015.38 $500.00 $400.00 $1,915.38 $1,869.09 $500.00 $400.00 $2,769.09 $0.00 $0.00 $0.00 $0.00 Gross fixed assets Depreciation Net fixed assets $3,000.00 $300.00 $2,700.00 $3,000.00 $840.00 $2,160.00 $3,000.00 $1,272.00 $1,728.00 $1,000.00 $1,000.00 $0.00 Total assets $3,700.00 $4,075.38 $4,497.09 $0.00 Today 1 2 3 $300.00 $400.00 $700.00 $300.00 $400.00 $700.00 $300.00 $400.00 $700.00 $0.00 $0.00 $0.00 Long-term debt $2,000.00 $2,000.00 $2,000.00 $0.00 Outstanding shares Retained earnings Owner's equity $1,300.00 ($300.00) $1,000.00 $1,300.00 $75.38 $1,375.38 $1,300.00 $497.08 $1,797.08 $0.00 ($0.00) ($0.00) Total L&E $3,700.00 $4,075.38 $4,497.08 ($0.00) A/P N/P Current liabilities 2 Cash flow projection for a 3-year project (S = $2,000) Today 1 2 3 -$300.00 $300.00 $0.00 $633.60 $540.00 $1,173.60 $704.88 $432.00 $1,136.88 $1,169.52 -$272.00 $897.52 Sales Costs Tax** OCF $0.00 $0.00 $0.00 $0.00 $5,000.00 $3,500.00 $326.40 $1,173.60 $5,000.00 $3,500.00 $363.12 $1,136.88 $5,000.00 $3,500.00 $602.48 $897.52 ATNOR DeprTS OCF $0.00 $0.00 $0.00 $990.00 $183.60 $1,173.60 $990.00 $146.88 $1,136.88 $990.00 -$92.48 $897.52 OCF Net Capital Spending Investment in CA net of A/P $0.00 -$3,000.00 -$700.00 $1,173.60 $0.00 -$915.38 $1,136.88 $0.00 -$853.71 $897.52 $2,000.00 $2,469.09 Unlevered Cash Flow -$3,700.00 $258.23 $283.17 $5,366.61 $0.00 $28.90 $28.90 $28.90 CF from assets -$3,700.00 $287.13 $312.07 $5,395.51 CF to creditors CF to shareholders -$2,400.00 -$1,300.00 $85.00 $202.13 $85.00 $227.07 $2,485.00 $2,910.51 CF to stakeholders -$3,700.00 $287.13 $312.07 $5,395.51 Unlevered Net Income Depreciation OCF Interest tax shield 3 Things to note: Notes payable carry very low interest, almost zero. For the purpose of this exercise we will assume to be equal to zero. The cost of long-term borrowing is 4.25%. The effective cost of borrowing, however, becomes: Effective cost of borrowing = Interest paid/All liabilities Effective cost of borrowing = $85/($2,000 + $400 + $300) = 3.15% At t= 0, Toy Inc requires $3,000 worth of plant and equipment and $1,000 worth of current assets. Since current assets are partially financed with accounts payable ($300), the total initial investment outlay that needs debt and equity financing is: Initial investment outlay = $3,000 + $1,000 - $300 = $3,700 OCF requires the estimation of unlevered net income. For example, in year 1, net income is equal to $577.5 as shown in the pro-forma income statement. One would have to estimate unlevered net income in the following way: UNI = EBIT(1-Tax%) - $960(1-0.34) = $633.6 The tax shield is equal to: Annual tax shield = Annual interest(Tax%) = $85(0.34) = $28.9 4 M&M NPV M&M states that: Total market value of project = PV(unlevered cash flow) + PV(debt tax shield) or Market value of equity + Market value of liabilities = PV(unlevered cash flow) + PV(debt tax shield) or Market value of equity = - Market value of liabilities + PV(unlevered cash flow) + PV(debt tax shield) M&M NPV can be derived from above: NPV = Total market value of project – Initial cost NPV = PV(unlevered cash flow) + PV(debt tax shield) – Initial cost In this case, NPV is calculated by discounting unlevered cash flows using the unlevered cost of equity; and by discounting the annual tax shield at the effective cost of debt. PV(debt tax shield at 3.15%) = $81.51 M&M NPV = $258.23/(1.05) + $283.17/(1.05)2 + $5,366.61/(1.05)3 + $81.51 - $3,700 = $1,520.17 Further implications: Fair market value of equity = PV(unlevered cash flow) + PV(debt tax shield) - Total liabilities = $258.23/(1.05) + $283.17/(1.05)2 + $5,366.61/(1.05)3 + $81.51 -$2,700 = $2,520.17 5 Flow to equity NPV = PV(cash flow to shareholders) – Initial equity investment Note that PV(cash flow to shareholders) is estimated using the levered cost of equity Levered cost of equity = Unlevered cost of equity +Risk premium(financial leverage) Which financial leverage? Book value leverage = $2,700/$1,000 = 2.7 Market value leverage (current prices) = $2,700/$2,500 = 1.08 or Market value leverage (estimated fair value) = $2,700/ 2,520.17= 1.07 Hypothetical levered cost of equity = 6.32% Flow to equity NPV = $202.13/(1.0632) +$227.07/(1.0632)2+$2,910.15/(1.0632)3 - $1,300 = $1,512.7 WACC NPV NPV = PV(unlevered CF) – Initial cost Note: In this case, the present value of the project is found by discounting unlevered cash flow using the wacc. Wacc = (Levered cost of equity)(weight of equity) + (Effective cost of debt)(1-Tax%)(weight of debt) Assume weights are given by market prices: wacc = 6.32%(0.4808) + 3.15%(0.5192)(1-0.34) = 4.12% WACC NPV = $258.23/(1.0412) + $283.17/(1.0412)2 + $5,366.61/(1.0412)3 - $3,700 = $1,563.6 6 Perpetual project Toy Inc.: Sales projection with debt financing Today 1 2 3 Sales (Costs) (Depreciation) EBIT (Interest) EBT (Tax) Net income $0.00 $0.00 $300.00 -$300.00 $0.00 -$300.00 $0.00 -$300.00 $5,000.00 $3,500.00 $540.00 $960.00 $85.00 $875.00 $297.50 $577.50 $5,000.00 $3,500.00 $432.00 $1,068.00 $85.00 $983.00 $334.22 $648.78 $5,000.00 $3,500.00 $345.60 $1,154.40 $85.00 $1,069.40 $363.60 $705.80 Addition to RE Dividend -$300.00 $0.00 $375.38 $202.13 $421.71 $227.07 $458.77 $247.03 7 Toy Inc pro-forma balance sheet with $2,000 long-term debt, $300 A/P, and $400 N/P Today 1 2 3 Cash Inventory A/R Current assets $100.00 $500.00 $400.00 $1,000.00 $1,015.38 $500.00 $400.00 $1,915.38 $1,869.09 $500.00 $400.00 $2,769.09 $2,673.46 $500.00 $400.00 $3,573.46 Gross fixed assets Depreciation Net fixed assets $3,000.00 $300.00 $2,700.00 $3,000.00 $840.00 $2,160.00 $3,000.00 $1,272.00 $1,728.00 $3,000.00 $1,617.60 $1,382.40 Total assets $3,700.00 $4,075.38 $4,497.09 $4,955.86 Today 1 2 3 $300.00 $400.00 $700.00 $300.00 $400.00 $700.00 $300.00 $400.00 $700.00 $300.00 $400.00 $700.00 Long-term debt $2,000.00 $2,000.00 $2,000.00 $2,000.00 Outstanding shares Retained earnings Owner's equity $1,300.00 ($300.00) $1,000.00 $1,300.00 $75.38 $1,375.38 $1,300.00 $497.08 $1,797.08 $1,300.00 $955.85 $2,255.85 Total L&E $3,700.00 $4,075.38 $4,497.08 $4,955.85 A/P N/P Current liabilities 8 Toy Inc.: Cash flows with debt Today 1 2 3 -$300.00 $300.00 $0.00 $633.60 $540.00 $1,173.60 $704.88 $432.00 $1,136.88 $761.90 $345.60 $1,107.50 Sales Costs Tax** OCF $0.00 $0.00 $0.00 $0.00 $5,000.00 $3,500.00 $326.40 $1,173.60 $5,000.00 $3,500.00 $363.12 $1,136.88 $5,000.00 $3,500.00 $392.50 $1,107.50 ATNOR DeprTS OCF $0.00 $0.00 $0.00 $990.00 $183.60 $1,173.60 $990.00 $146.88 $1,136.88 $990.00 $117.50 $1,107.50 OCF Net Capital Spending Investment in CA net of A/P $0.00 -$3,000.00 -$700.00 $1,173.60 $0.00 -$915.38 $1,136.88 $0.00 -$853.71 $1,107.50 $0.00 -$804.37 Unlevered Cash Flow -$3,700.00 $258.23 $283.17 $303.13 $0.00 $28.90 $28.90 $28.90 CF from assets -$3,700.00 $287.13 $312.07 $332.03 CF to creditors CF to shareholders -$2,400.00 -$1,300.00 $85.00 $202.13 $85.00 $227.07 $85.00 $247.03 CF to stakeholders -$3,700.00 $287.13 $312.07 $332.03 Unlevered Net Income Depreciation OCF Interest tax shield 9 M&M NPV M&M states that: Total market value of project = PV(unlevered cash flow) + PV(debt tax shield) or Market value of equity + Market value of liabilities = PV(unlevered cash flow) + PV(debt tax shield) or Market value of equity = - Market value of liabilities + PV(unlevered cash flow) + PV(debt tax shield) M&M NPV can be derived from above: NPV = Total market value of project – Initial cost NPV = PV(unlevered cash flow) + PV(debt tax shield) – Initial cost In this case, NPV is calculated by discounting unlevered cash flows using the unlevered cost of equity; and by discounting the annual tax shield at the effective cost of debt. PV(UCF) = $258.23/(1.05) + $283.17/(1.05)2 + $303.13/(1.05)3 + $303.13(1.03)/(0.05-0.03)(1.05)3 PV(UCF) = $14,250.17 PV(debt tax shield) = $28.9/(0.0315) = $916.31 M&M NPV = $14,250.17 + $916 - $3,700 =$11.466.17 or if we want to include A/P as part of the initial cash outlay: M&M NPV = $14,250.17+ $916 - $4,000 = $11,166.17 Further implications: The market value of equity = - Market value of liabilities + PV(unlevered cash flow) + PV(debt tax shield) The fair market value of equity = -$2,700 + $14,250.17 + $916 = $12,466.17 Since the current price per share is $25, it follows that the firm is significantly undervalued ($2,500 vs $12,466.17) Note that: NPV = Market value of equity – Initial equity investment = $12,466.17 - $1,300 = $11,166.17 A/P lay in a grey area as they represent neither financial debt nor equity. 10 Flow to equity NPV NPV = PV(cash flow to shareholders) – Initial equity investment Note that PV(cash flow to shareholders) is estimated using the levered cost of equity Levered cost of equity = Unlevered cost of equity +Risk premium(financial leverage) Which financial leverage? Book value leverage = $2,700/$1,000 = 2.7 Market value leverage (current prices) = $2,700/$2,500 = 1.08 Market value leverage (estimated fair value) = $2,700/$12,073.89 = 0.224 We are at a loss to estimate even a simple metric such as financial leverage! Hypothetical levered cost of equity = 6.32% NPV=$202.13/(1.0632) +$227.07/(1.0632)2+$247.03/(1.0632)3 +$247.03(1.03)/(0.0632-0.03)(1.0632)3 - $1,300 NPV = $5,673.35 Why such a huge discrepancy? •Arbitrary leverage •Inconsistent assumptions about debt levels and leverage ratios •Lack of a reliable model to estimate discount rates •Arbitrary growth rate in cash flows Had we assumed 4.5% growth rate in CF to shareholders, the results would have been very close. 11 WACC NPV NPV = PV(unlevered CF) – Initial cost Note: In this case, the present value of the project is found by discounting unlevered cash flow using the wacc. Wacc = (Levered cost of equity)(weight of equity) + (Effective cost of debt)(1-Tax%)(weight of debt) Assume weights are given by market prices: wacc = 6.32%(0.4808) + 3.15%(0.5192)(1-0.34) = 4.12% NPV = $258.23/(1.0412) + $283.17/(1.0412)2 + $303.13/(1.0412)3 + $303.13(1.03)/(0.0412-0.03) (1.0412)3 - $3,700 NPV = $21,774.85 NPV: A summary NPV is a great tool for analysing and evaluating projects; in theory, that is. In practice, it has several formidable challenges: •Inability to project cash flows in the long-term •Lack of a reliable model for predicting risk and estimating required returns •Extreme sensitivity of NPV estimations to small changes in input variables For short-term projections, however, NPV does a decent job. 12