The marketing mix – product and price

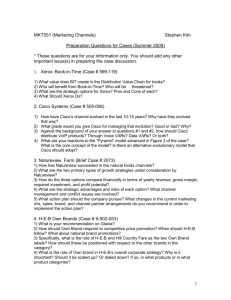

advertisement

16 The marketing mix – product and price Activity 16.1 (page 297): Toshiba drops HD DVD after promising start 1 Explain why the typical product life-cycle concept is of limited use in cases such as Toshiba’s HD DVD product. [8] Answers may include explanation of: Definition of the product life cycle: this is the concept that all products follow a similar pattern from development to growth, maturity and decline. The concept may be of limited use in cases such as Toshiba’s HD DVD product because: • The pace of technological development is difficult to predict and, therefore, the length of each phase of the life cycle is uncertain. • There was competition from a different technological format, Sony’s Blu-ray, meaning that it was quite likely that one format would fail. Marketing managers at Toshiba could not be certain whether Toshiba’s DVD format would be taken up by consumers. • The winning format in the end depended on the decision of the major filmproducing companies: a decision that Toshiba could influence, but not control. This external factor meant that once the companies unexpectedly decided to drop the Toshiba format, its market disappeared overnight. This was long before the format was expected to experience sales decline. • While there was a battle between Sony and Toshiba, many consumers were reluctant to adopt either format. Following Toshiba’s withdrawal of its HD format, sales of Blu-ray players exploded. 2 Sony has already made sure that its PlayStation games consoles have built-in Blu-ray players. Evaluate any two further extension strategies the company could introduce for their DVD-format product. [10] Extension strategy Commentary Product relaunch including new packaging/designs • Packaging is often used to brighten up products to revitalise • sales. However, in the case of Blu-ray players. the packaging is less likely to be a significant attraction to customers. Thus, although new packaging is a cheap extension strategy, it may be of limited value for electronic products. However, bringing out new designs or producing the product in new colours could boost sales before the product needs to be replaced. This strategy has been used successfully by Nintendo for the DS-Lite. (Continued) Chapter 16 © Cambridge University Press 2010 1 Launch in new markets • Blu-ray could be launched in new markets where Increased advertising • New forms of advertising and promotion can be Adding value • This would involve Sony adding new features to Blu-ray, adoption of newer technologies is much slower. For example, many electronic products are launched in Japan long before Western European markets. Sony may be able to carry out a similar strategy with regard to e.g. some African markets. developed to extend sales. For example, competitions are often used by firms to generate interest in already established products. This has been done by Kellogg’s to boost sales of cereals. using existing technologies: for example, a Blu-ray player that can connect to the internet and download movies onto disk. This has the benefit that it might encourage existing owners of Blu-ray players to replace their models. Thus, the sales potential may be high even if the market is saturated. Evaluation may consider: • cost of the strategy • impact on sales in short and long term. • Likelihood of new competitors entering the market with a more advanced product. Activity 16.2 (page 299) 1 Using the information in Figure 16.7, calculate the PED following the rise in price of Product B. [2] Price Quantity demanded $4 300 $5 200 percentage change in quantity = (200 − 300) ÷ 300 × 100 = − 33.3% percentage change in price = (5 – 4) ÷ 4 × 100 = 25% PED 2 = %ΔQd ÷ %ΔP = –33.3 ÷ 25 = –1.33 Comment on your result – explain what it means. [4] • • • Product B is price elastic in demand for the price change of $4 to $5. Demand is responsive to a change in price; the change in price leads to a more than proportionate change in demand. Revenue will fall as a consequence of the price change. Revenue falls from $1,200 to $1,000 per week. Chapter 16 © Cambridge University Press 2010 2 Activity 16.3 − answer provided on Student's CD-ROM. Activity 16.4 (page 300) A firm sells three products. The price elasticity of demand is estimated to be (including the negative signs): A –3, B –0.5, C –1 1 Explain what these results mean. [6] Definition of price elasticity of demand − this measures the responsiveness of quantity demanded to a change in price. • PED = %ΔQd ÷ %ΔP • The demand for product A is price elastic. Demand is sensitive to a change in price. • The demand for product B is price inelastic. Demand is not sensitive to a change in price. • The demand for product C has unit price elasticity. A change in price causes a proportionate change in quantity demanded. Other relevant comments regarding price elasticity in relation to the three products will be accepted. 2 Explain what the effect on sales will be for each product if all prices rise by 10%. [6] • • • The demand for product A will fall by 30%. Sales revenue will fall. The demand for product B will fall by 5%. Sales revenue will increase. The demand for product C will fall by 10%. Sales revenue will not change. Other relevant comments regarding sales of the three products will be accepted. Activity 16.5 (page 301): Car prices to rise in China? 1 Explain why increasing costs usually lead manufacturers to raise prices to consumers. [4] • • • • Manufacturers typically have profit as a primary objective: profit = revenue – total costs If there is an increase in costs, then profit will fall if revenue does not increase. An increase in costs will erode the profit margin if there is no increase in price. A lower profit margin will reduce profit unless sales increase. As costs have increased by an average of $400 per car in 2009, this may reduce or even eliminate Volkswagen’s profit margin on each vehicle sold. Thus, VW will have to increase prices to maintain profitability. Chapter 16 © Cambridge University Press 2010 3 2 Why, in this case, are car manufacturers reluctant to raise prices? [4] The key reason suggested in the text is the increased competitive pressure in the market due to increasing production within China and increasing exports to China. Thus, it is important to remain price competitive to attract sales. If VW increases prices and competitors do not, then VW will lose market share. As China is a rapidly growing market, each manufacturer may be concerned to maintain and develop its share of the market. Consequently, there is pressure on the manufacturers to accept lower profit margins. They believe that demand for their cars is price elastic. 3 In such a competitive market, how might car manufacturers such as BMW or Mercedes still sell cars profitably? [8] The text clearly explains one method of maintaining profitability. It is suggested that manufacturers can generate profit through selling optional extras on top of the base price. Optional extras such as leather seats have much higher margins than the cars themselves. Thus, BMW and Mercedes may reduce the standard specification of models and offer desirable accessories as optional extras. Other strategies may include: • Developing brand image to reduce the sensitivity of demand to increases in price − however, developing the brand can require expensive marketing support to be effective. Thus, it may require significant cash outflows in the short run. • Differentiating cars from competitors’ − BMW would need to consider the design of products and functionality offered, e.g. offering optional extras such as DVD players and satellite navigation. • Using customer relationship marketing − BMW could focus on building a longterm relationship with the customer so that the customer is more likely to come back to repeat purchase. This might be achieved through improving after-sales customer service. CRM will help reduce price elasticity of demand and enable higher prices to be charged. However, this is an approach that will take time to have a positive impact. Activity 16.6 (page 305): Does the price fit? 1 Calculate the profit made by Hartwood last year. [3] = revenue − costs = 6 × 400, 000 = $2.4m total costs = fixed cost + total variable costs = 200,000 + (400,000 × 3) = $1.4m profit = 2.4m − 1.4m = $1m profit revenue Chapter 16 © Cambridge University Press 2010 4 2 What was the contribution per cap last year? [1] contribution per cap = price − variable cost =6−3 = $3 3 What price would be charged if full-cost pricing was used and 100% mark-up added to unit cost? [3] = total cost ÷ quantity = 1.4m ÷ 0.4m = $3.50 add 100% mark-up: price = 3.50 × 2 = $7 average total cost 4 Refer to your answer to 3. Advise the firm on what factors it should consider before fixing the price at this level. [4] Factors to consider might include: • The reaction of the two big sports firms − will they switch to other manufacturers? Can the sports firms pass on the price increase to the consumer? • Price elasticity of demand − this will affect the level of demand if the price is increased. If demand is price inelastic, then an increase in price will increase revenue. If demand is price elastic, then the increase in price will reduce demand significantly and revenues will fall. • The degree of competition − the more competitors there are, the more likely it is that demand will be price elastic. • Fixed costs and profit margin − a reduction in demand will reduce the capacity utilisation and, therefore, increase the average fixed cost per hat sold. • Likely reaction of competitors to the increase in price − if competitors increase their prices, then there will be less impact on the demand for Hartwood Hats. 5 If there were a 50% increase in variable costs and the contribution was lowered to $2, what profit would be made if sales remained unchanged? [4] A number of approaches can be taken to answer this question. Calculating profit using contribution: profit = total contribution − fixed costs As the contribution is just $2, then the total contribution will be 400,000 × 2 = $800,000. Therefore: profit = 800,000 − 200,000 = $600,000 Calculating profit from revenue and costs: profit = revenue – total costs Unit variable cost will be $3 + 50% = 3 × 1.5 Chapter 16 © Cambridge University Press 2010 5 = $4.5 Total variable cost will be 4.5 × 400,000 = $1.8m OR Total variable costs will now be $1.2m + 50%, that is 1.2 × 1.5 = $1.8m A contribution of $2 means that the selling price is $6.50 Thus, profit = (400,000 × 6.50) − (200,000 + 1,800,000) = 2,600,000 − 2,000,000 = $600,000 Activity 16.7 (page 307): Prices rise – but for different reasons 1 Identify the different pricing methods used in Case 1 and Case 2. [2] Case 1 is an example of cost-based pricing. Note: Accept mark-up pricing, target-rate pricing or full-cost pricing. Case 2 is an example of competition-based pricing. 2 In Case 1, explain two potential benefits to Universal of the company not increasing its prices following the decision by Disney World to increase its entry fee. [6] Any reasonable answer applies. • Universal Orlando will gain a price advantage over Disney World of $4 for an adult ticket. This may lead to an increase in sales, as some customers will switch from Disney World to Universal Orlando. Thus, there will be an increase in sales revenue. • Increased sales will increase Universal’s market share. This will strengthen its position in the market. • An increase in sales will increase Universal’s capacity utilisation at its Orlando theme park. As there will be no increase in fixed costs as a result of the increase in customer numbers, profits will increase, assuming that direct costs are less than the ticket price. 3 Under what circumstances might you recommend to the managing director of Carib Cement that the company should not increase its prices, despite higher costs. Explain your answer. [6] • • • Where competitor prices would then be significantly lower − if competitor prices were lower than Carib Cement’s, Carib might lose customers to the competition and face falling revenue and market share. Where price elasticity of demand is highly price elastic − if demand is sensitive to a change in price, then sales at Carib Cement would fall significantly. Thus, even though the profit margin per sale would be higher, the overall profitability of the business would fall. Where the increase in costs is temporary − by leaving prices unchanged, Carib Cement would be enhancing its reputation in the market for its customer care and potentially customer loyalty would be improved. Chapter 16 © Cambridge University Press 2010 6 4 Explain what might happen to the price of ethanol in the USA when the 33 new plants start producing it. [4] • As the 33 new plants start producing ethanol, the supply curve will shift to the right, that is there is an increase in supply. Other things being equal, there will be a reduction in price. The increase in supply will drive down the equilibrium price as at the old price there will be excess supply. • This may be shown diagrammatically. Price $ S S1 P P1 D Q Q1 Quantity As supply increases from S to S1, then there is a fall in the equilibrium price from P to P1. Activity 16.8 (page 308): Levi claims Tesco cut-price jeans bad for brand image 1 Do you think Levi’s is right to try to limit the sale of its clothing products at ‘knock-down’ prices? Justify your answer [12] This can be looked at from the point of view of Levi’s and other key stakeholders. Levi’s should limit sale Levi’s should not limit sale • Levi’s has carefully developed a brand • Limiting sales to drive up prices • image of being a premium-priced brand. Developing the brand has been expensive; Levi’s investment in building its brand requires high prices to provide a suitable return on the investment. Tesco threatens that brand image by selling the product at low prices. This will place downward pressure on Levi’s prices and that will reduce its profit. Levi’s core responsibility is to its owners and it should be able to choose which companies it supplies in the pursuit of profit. Levi’s should be free to restrict supply to protect its profits. • is a form of exploitation of the consumer. It reduces consumer welfare as the consumer has to pay a higher price than would be set if there were fair competition. Tesco is simply responding to a legitimate demand for low-priced branded products from its customers. Levi’s is using price discrimination against its European customers. Its products are available at much lower prices in the USA. Its actions are unfair with regard to European consumers. (Continued) Chapter 16 © Cambridge University Press 2010 7 Levi’s should limit sale Levi’s should not limit sale • Tesco may have infringed Levi’s • The argument that ‘People want to • trademark rights and may, therefore, be acting illegally. If Levi’s has control over its brand, then consumers can vote with their spending power if they are unhappy with Levi’s setting high prices. experience a premium brand like Levi’s in the right environment’ is dubious. Consumers are likely to appreciate the lower prices that Tesco offers, even if its facilities are not as good as those of fashion retailers. Evaluation may consider Evaluation may contrast the rights of Levi’s to pursue profit against the rights of the consumer and Tesco. Revision case study 1 (page 309): Dell to continue price cuts as PC sales slow down 1 What evidence is there in the case that the PED for Dell computers is greater than 1? [3] • • 2 As Michael Dell claims that his company has increased its revenue, this would suggest that the price elasticity of demand (PED) for Dell computers is greater than 1. A PED of more than 1 means that demand is price elastic. Therefore, when prices are cut, there is a more than proportionate increase in quantity demanded, and revenue rises. As the US market is ‘slowing’, the increase in sales revenue is not a result of the increase in the size of the overall market. Why might the issue of psychological pricing be important in setting prices for Dell computers? [4] It may be important in two distinct ways: • As computers are relatively expensive items, it may be important to set prices just below key price levels in order to make the price appear much lower than it really is. For example, Dell may set a price of $499 rather than $500 as this is likely to be a significant psychological barrier for the consumer. • Dell has a strong reputation for quality and is not perceived as being a cheap brand. Thus, although Dell wish to set competitive prices, they may wish to avoid very low prices as this may put off consumers. 3 Analyse the possible reasons for the price-cutting strategy used by Dell. [8] Any reasonable answer. Possible reasons for the price-cutting strategy used by Dell include: • Dell could be trying to increase revenue as demand appears to be price elastic. The strategy will improve its reputation for value. • This strategy could further increase Dell’s market share and thus enhance its influence in the market. • As one of the world’s largest computer makers, Dell will benefit from economies of scale. Dell’s price-cutting strategy is passing on these benefits to the consumer and will increase the pressure on smaller manufacturers to cut Chapter 16 © Cambridge University Press 2010 8 • 4 prices, despite facing higher costs. Thus, smaller manufacturers will see profit margins eroded and may even be unable to compete. Dell’s strategy is possibly aimed at destroying competition. The text refers to the profit warnings issued by Gateway, Apple and Hewlett-Packard. If competition is driven out of the market, then Dell will be able to enjoy greater profit in the long term. Evaluate the possible long-term impact of this price-cutting strategy on both Dell and computer consumers. [10] Impact on Dell • Higher sales will lead to greater economies of scale and enable Dell to be even more price competitive and/or enjoy higher profit margins. • Reduced competition, as some firms are forced out of the market, will enable Dell to set higher prices in the future as Dell will gain monopoly power in the market. Dell will enjoy increased levels of profit. • Dell may enhance its reputation for value, but may come to be perceived as a cheap brand. This may damage its longer-term ability to charge higher prices. • A price war may have negative effects on Dell’s profits. As other firms are forced to cut prices, Dell’s sales growth will decline or even be halted. Impact on consumers • If smaller computer manufacturers are forced out of the market, consumers will have less choice. In the long term, they may, therefore, have to pay higher prices. • It may lead to a price war as other manufacturers are forced to cut prices. This will benefit consumers, as all manufacturers accept much lower profit margins. • Smaller firms may have to become more innovative as they are unable to compete on price. Thus, the consumer could benefit from more differentiated products and the development of better features on computers. Evaluation may consider: The overall impact on consumers and Dell will depend on the structure of the computer industry and whether Dell’s strategy leads to increased dominance; the relative financial strength of different firms within the industry will be significant in determining the long-term outcome. Revision case study 2 (page 310): Pricing decision for new computer game 1 If Stella used full-cost pricing, using a mark-up of 50% on total unit costs, calculate the price that she would charge for Time Traveller. [4] average fixed cost = fixed cost ÷ quantity average fixed cost if annual output is 50,000 units is: 400,000 ÷ 50,000 = $8 Chapter 16 © Cambridge University Press 2010 9 = Average variable cost + average fixed cost =4+8 = $12 With a 50% mark-up the price will be 1.5 × 12 = $18 total unit cost 2 Recommend to Stella whether an even higher price than this should be charged in order to adopt a skimming strategy for this new product. Justify your recommendation. [6] The decision may take into account some of the following factors: • The life cycle of computer games is very short, so it is important to recoup development costs quickly before new competition enters the market. Thus, a high price should be set to take advantage of the product’s initial uniqueness in the market. • New competitors are entering the market virtually every month, so there is only a short window within which Horizon’s product will have a competitive advantage. Thus, a high price should be charged. • The software design for Time Traveller is superior to most of the competition. This quality will support a skimming strategy. • Competitor prices vary from $10 to $30 per game. • Price elasticity of demand will be important. This in turn will depend on factors such as the extent to which Time Traveller has a unique selling point. • A high price will reduce sales volume and, consequently, unit fixed costs will be greater. • A high price will result in lower sales growth and thus prevent Horizon Software taking a substantial market share. The lower take-up of the game may reduce consumer interest in later improved versions of the game. Evaluation may consider: Evaluation may focus on the likely sales of Time Traveller at a higher price and thus the importance of PED. Top tip 3 The latest market research suggests that 40,000 units might be sold each year at a price of $26 but that 50,000 units could be sold at a price of $20. Calculate the price elasticity of demand if this research is assumed to be accurate. Comment on your result. [7] When calculating price elasticity of demand between two given prices, your answer will differ according to whether you consider a price increase or a price decrease. Therefore, there are two possible answers to question 3 as it is not stated whether to calculate PED for an increase in price from $20 to $26 or a price decrease from $26 to $20. Assuming that a price change from $20 to $26 is to be considered, then: percentage change in quantity demanded = (40,000 − 50,000) ÷ 50,000 × 100 = −20% percentage change in price = (26 − 20) ÷ 20 × 100 = 30% PED = %ΔQd ÷ %ΔP = −20 ÷ 30 −0.67 Chapter 16 © Cambridge University Press 2010 10 • • • • 4 This result indicates that demand is price inelastic as price is increased from $20 to $26. Thus, revenue will be greater at $26 than $20 ($1.04m compared to $1m). However, if $26 is charged, then the lower sales volume will result in higher unit fixed costs − $10 compared to $8. The table below shows the estimate of profit at each price. Price Sales Unit contribution Fixed costs Total profit $20 50,000 16 400,000 400,000 $26 40,000 22 400,000 480,000 Once this product has been launched, evaluate the impact that knowledge of its life cycle could have on the price charged for it. [8] Knowledge of the product life cycle may be useful with planning marketing-mix decisions, including price. Pricing strategies may be changed at different points of the life cycle. In the case of Time Traveller, pricing may change as follows: Introduction − price skimming to take advantage of the superior software the product offers and the initial lack of direct competition. Growth − price may be kept high if there is still a lack of products imitating Time Traveller. However, low take-up of sales may lead to prices being reduced to encourage sales. Maturity − as growth of sales starts to slow and competitor products emerge, it may be necessary to reduce price. Pricing will have to be competitive to prevent a decline in sales. Decline − in this market, sales may start to decline rapidly unless extension strategies are used. Extension strategies will focus on improved versions of Time Traveller. When the product does move into decline, pricing is likely to be reduced further in order to sell off stock. No techniques can guarantee success. The product life cycle helps to establish the current position of a product, but it is not necessarily a very useful predictive tool. On its own, the product life cycle cannot tell a manager what pricing strategy will be effective. It merely provides a framework for considering the marketing mix. The computer-games market changes rapidly due to competitor decisions and technological change; these factors will be instrumental in determining appropriate pricing decisions for Horizon Software. Revision case study 3 (page 311): Chocolate wars lead to meltdown 1 Explain what is meant by the term ‘product life cycle’. [3] This is the theory that all products follow a similar life through introduction, growth, maturity and decline. Analysing a range of products by using the product life cycle can help firms make appropriate marketing decisions. Chapter 16 © Cambridge University Press 2010 11 2 What stage of its product life cycle does the Sun box of chocolates appear to be in? Explain your answer. [4] Sales for the Sun box of chocolates peaked in 2006 before falling in 2007. Although there was a recovery in 2008 and 2009, it appears that the product has reached maturity and saturation. The growth in sales between 2008 and 2009 may have been the result of an extension strategy. 3 Outline the options available to the marketing manager for the Sun box of chocolates product. [4] • • • 4 The marketing manager could use extension strategies, such as new packaging or new flavours of chocolates. Supported by an increased marketing effort, this could keep the product in the mature phase of the cycle and prevent decline setting in. Divestment could be adopted. The price could be reduced to sell remaining stock and the product could be withdrawn from production. However, this is Jupiter’s only chocolate box on sale. Would it need to be replaced with another new product to maintain Jupiter’s presence in this high-value market? The price could be reduced to make the product more competitive and accept a lower profit margin. The business has decided to try to extend the life of this product. Evaluate three extension strategies that it could use in your country for this product. [12] Extension strategy Commentary New packaging, new sizes • New packaging for Sun is potentially a cheap extension • New flavours strategy to employ. As the product is over ten years old, the packaging may appear dated and a new design can be used to revitalise sales. This is a relatively cheap method of regaining consumer interest. It involves no fundamental change to the product. Launching the product in new box sizes may encourage new users and more frequent use. • Market research could be employed to identify which are the most and least popular choices within the selection box. The firm can then remove unpopular products from the selection to be replaced with new flavours of chocolate. As there will be cost differences between the chocolates, Jupiter must ensure that it keeps control of costs so that the box does not become too expensive. This exercise has recently been used by Nestlé in relation to their Quality Street brand. Developing new flavours to meet consumer demand may be expensive as it requires careful market research and will incur development costs. Reposition the product • For example, it may be possible to develop a product which is lower in fat and sugar. Thus, the product could be marketed as a healthier alternative to competitors. Healthy eating is a growing market in many countries due to concerns about obesity. However, it may be difficult to market Sun as a healthier alternative due to the fact that it is chocolate. It is primarily an indulgence product and reducing its fat content may actually reduce its appeal if flavour is compromised. (Continued) Chapter 16 © Cambridge University Press 2010 12 Extension strategy Commentary New users • Find new markets for the product. For example, market Sun as being suitable for a range of different occasions. Rebrand and relaunch • Jupiter could focus on the core features that make Sun • different from the competition and model the new brand image on them. Identify if Sun has a unique selling point and then focus promotion and other elements of the marketing mix on supporting the new brand image. This strategy is widely used in business, e.g. Kellogg’s relaunch of the Nutri-Grain bar. Rebranding will be potentially expensive and requires significant primary market research In all of these strategies, market research plays a vital role. The extension strategy adopted may depend on an assessment of the resources available to Jupiter. 5 Outline two problems this business could face as a consequence of launching very few new products. [6] • • • Profit − with few new product launches, there will be long-term profit problems. As existing products enter the decline phase of their life cycle, there will be no new products coming through to take their place. An example of this problem is provided by Mercury, which is suffering a decline in sales. Consequently, there will be a decline in Jupiter’s profit. Cash flow − with old stocks of Mercury being returned by retailers, there will be cash-flow problems for Jupiter as it will have incurred production costs for the product. There will be no products in the growth phase of the life cycle to generate new cash inflows. Image − Jupiter’s image will be negatively affected as its product portfolio will become increasingly dominated by ageing products. Competitors will be bringing out products which match changing consumer tastes, whereas Jupiter’s products may appear old-fashioned. This will affect sales of existing products, such as Sun, Venus and even Orion. Essentially, Jupiter will have an unbalanced product portfolio with too many products at the mature-and-decline phase of the product life cycle and no new products in the growth phase. 6 Evaluate the factors that the business should consider before deciding to withdraw the Mercury bar from the market. [10] • • Contribution − although Mercury sales are declining, it may still be making a positive contribution to the fixed costs of Jupiter. If this is so, then in the short term it may be worthwhile continuing production as fixed costs will still have to be paid even if production of Mercury is stopped. Capacity utilisation − withdrawing the Mercury bar will reduce capacity utilisation, unless there is another product to replace its sales. Much will, therefore, depend on by how much sales of Orion are increasing and whether the firm has current spare capacity. Chapter 16 © Cambridge University Press 2010 13 • • • Reputation in market − Mercury has been very popular with older customers. Firms will sometimes benefit from continuing production of products in the decline phase in order to satisfy existing customers of the product. New product development − if Mercury is consuming resources in terms of marketing expenditure, then these resources may best be diverted to developing replacement products, e.g. low-fat chocolates. Cost of reviving sales − can the sales of Mercury be revived through using extension strategies? What would be the cost of implementing a successful extension strategy? Answering these questions will require market research. Jupiter may prefer to withdraw Mercury and invest money in developing an alternative product. Evaluation may consider: Evaluation may focus on the potential costs and time limitations of developing new products, the overall objectives of Jupiter and its attitude toward risk. Revision case study 4 (page 311): Body Shop held back by product errors 1 What evidence is there that Body Shop did not undertake sufficient market research before making product changes? [4] • • • 2 The chief executive has admitted that the changes made to packaging of a new haircare range were unpopular. Further, customers were unhappy that Body Shop had discontinued some product lines. Body Shop ‘tried to do too many things, too fast’. This also implies that there was insufficient market research. Falling profits are also an indication of customer dissatisfaction in response to the changes made and this suggests a lack of market research. Explain briefly how The Body Shop could use the 4Cs approach to increase sales in the future. [8] The 4Cs are: • Customer solution – what the firm needs to provide to meet the customer’s needs and wants. • Cost to customer – the total cost of the product, including extended guarantees, delivery charges and financing costs. • Communication with customer – providing up-to-date and easily accessible two-way communication links with customers to both promote the product and gain back important consumer market research information. • Convenience to customer – providing easily accessible pre-sales information and demonstrations and convenient locations for buying the product. By considering any one of the 4Cs, The Body Shop could increase future sales. For example, the customer solution focuses on the needs of the consumer. Through market research, The Body Shop would be able to identify how products need to be developed to better meet the needs of consumers. The case refers to making sure that new products were closer to the ‘brand’s ethical traditions that customers Chapter 16 © Cambridge University Press 2010 14 identified with’. The 4Cs approach places the customer at the centre of the business and thus seeks to ensure that customer needs are met. 3 Why might it be important for the future sales success and profitability of Body Shop for it to keep closer to the brand’s traditions and exercise ‘better control of costs’? [8] • • • • • Brand image is essential to The Body Shop and the firm’s ethical behaviour is its USP. Thus, it must remain close to the brand’s traditions. If its ethical stance is brought into question, then customers will be suspicious of the brand and are likely to look for alternative products. Thus, sales growth will be negatively affected. The ethical traditions of the business reduce the sensitivity of demand to price. The Body Shop’s opposition to animal testing and sustainable sourcing of ingredients differentiate its products from other mainstream producers. Thus, it is able to charge a higher price and enjoy improved profit margins. Corporate social responsibility is increasingly important to attracting customers. Controlling costs is important to ensure that products can be sold at prices that the customer is satisfied provides value for money. Even though Body Shop products are viewed by many as being ‘ethical’, this does not mean that price becomes unimportant. If the company introduces products on which margins are lower than those they are replacing, then unless there is a significant increase in sales, profits will be lower. The Body Shop’s recent poor control of stocks will have affected profits. Essay 1 a Explain why price decisions are an important part of the marketing mix. [10] Answers may include comment on the following issues: Definition of the marketing mix: the so-called 4Ps of product, price, promotion and place. Each of these elements is important in contributing to the achievement of marketing objectives. • • • • Price is the amount paid by consumers for a product. Price is important in determining the demand for a product. There is an inverse relationship between quantity demanded and price. Therefore, price has a fundamental impact on the level of demand. Different pricing strategies and when they might be appropriate: – For a firm wishing to increase market share a penetration-pricing strategy may be most appropriate. – For a new product with a unique selling point, a price-skimming strategy will be appropriate. – In a market in which there is significant competition, prices will need to be set competitively. However, if price is set too low, then consumers may lose confidence in the product. – If there are groups of customers with different demand characteristics and markets can be separated, then price discrimination will be appropriate, e.g. when setting train fares. Price discrimination helps increase revenue. Ultimately, price determines whether it is possible to cover costs. It determines the degree of value added, by the business, to bought-in components. Chapter 16 © Cambridge University Press 2010 15 • • b Pricing decisions can support the other elements of the marketing mix to ensure that a consistent marketing message is given to consumers. For example, Chanel No. 5 is marketed at a premium price; promotional activity is through magazines read by high-income earners; distribution is through exclusive retail outlets and packaging is expensive. Price can help establish the psychological image and identity of a product. Get the pricing decision wrong and much hard work in market research and product development can be put at risk. For all these reasons, pricing decisions are some of the most significant issues that marketing managers are faced with. Using worked examples, evaluate the importance of price elasticity of demand to a firm’s price decisions. [15] Answers may include a definition of the price elasticity of demand (PED) and worked examples to show how price changes affect revenue, given differing values of PED. Definition of price elasticity of demand: this measures the responsiveness of quantity demanded to a change in price. • PED = %ΔQd ÷ %ΔP • It is vital for a firm to know how demand will respond to a change in price, as this will affect revenue and profitability. For example, consider the two demand curves illustrated below: Price Firm B Price Firm A P1 P D Q1 Q Quantity • • • P1 P D Q1 Q Quantity Firm A can raise price substantially and yet demand falls only slightly. In contrast, if firm B increases price, there will be a sharp drop in sales. If a firm wishes to increase its total revenue by altering price, then it must know what value PED has. Worked examples are given below. Price-elastic demand: • If price is increased, then total revenue will fall because there will be a more than proportionate decline in quantity demanded. • If price is reduced, then total revenue will increase because there will be a more than proportionate increase in quantity demanded. Chapter 16 © Cambridge University Press 2010 16 Price ($) Quantity Revenue ($) 40 25 1,000 20 70 1,400 As price is reduced from $40 to $20, quantity demanded increases from 25 units to 70 units. PED = 180 ÷ −50 = −3.6 Price-inelastic demand: • A price rise will lead to an increase in revenue. • A price fall will lead to a decrease in revenue. Price ($) Quantity Revenue ($) 100 50 5,000 70 60 4,200 As price is reduced from $100 to $70, quantity demanded increases from 50 units to 60 units. PED = 20 ÷ −30 = −0.67 However, just because demand is price elastic does not necessarily mean that the firm will increase profit by reducing price. For example, consider a car retailer that pays $9,000 to its manufacturing supplier per car. Assume that it currently charges $10,000 to customers and that it sells 100 cars per month. The marketing manager is considering cutting price by 5% as he believes that PED is –1.4. The table below shows the outcome of such a decision, if the marketing manager is proven right. Price ($) Quantity Revenue ($) Costs Gross Profit 10,000 100 1,000,000 900,000 100,000 9,500 107 1,016,500 963,000 53,500 Further, when considering pricing, a firm needs to consider other factors such as: • The reaction of competitors − if competitors respond to a price reduction by decreasing their prices, then there may be no increase in sales. The number of competitors may be significant in determining the response of competitors to a price change. • Marketing objectives − if a firm wishes to build market share, then cutting price may be necessary even if demand is price inelastic. • Brand image − although cutting price may lead to an increase in revenue, it may undermine the brand image and thus have a negative long-term impact. Chapter 16 © Cambridge University Press 2010 17