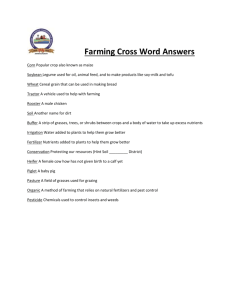

factory farming

advertisement