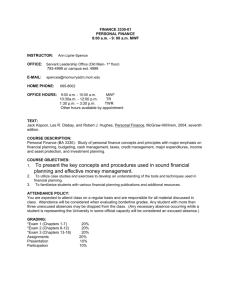

Intermediate Accounting I - Goldey

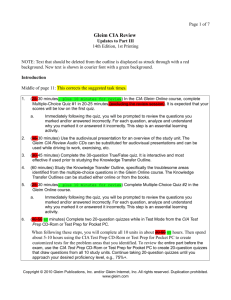

advertisement

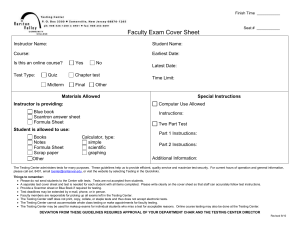

ACCT 306 Intermediate Accounting I Fall 2010 – 15 Week Class Instructor: Dr. Julie Burkey Office: 2D Office Hours: Phone number: 302-225-6221 E-mail address: burkeyj@gbc.edu MW 7:00 – 9:30 am 11:00 am – Noon Tues. 7:00 – 8:30 am 10:00 – Noon 2:30 – 5:30 pm Thur. 7:00 – 8:30 am Other times by appointment Tutoring Hours: M W REQUIRED TEXT: Noon – 1:30 pm Noon – 1:30 pm Warfield, Weygandt & Kieso, Intermediate Accounting Principles and nd Analysis (2 Ed.) (2008) Gleim & Collins, Financial Accounting Objective Questions and th Explanations, (14 Ed.) COURSE OBJECTIVE: 1. The student will learn to use the conceptual accounting framework and develop an understanding of the historical perspective of the accounting profession. 2. The student will exhibit expanded knowledge of the conceptual and procedural phases of the income statement and the statement of retained earnings. a. The student should be able to align all phases of the multiple-step income statement and retained earnings statements. b. The student should be able to discern the “irregular” elements of the multiplestep income statement. 3. The student will exhibit expanded knowledge of the classified balance sheet. a. The student will exhibit a working knowledge of the asset section of the classified balance sheet. b. The student will develop an understanding of the current liability section of the classified balance sheet. 4. The student will be able to utilized basic time value of money calculations. 1 Grade: Your grade will be based upon three exams and homework assignments. Your letter grade for the course will correspond to the appropriate College grading scale. The total points possible are as follows: The best 3 out of 4 exams Exam 1 (Chapters 1 – 4 and Appendix A) 100 Exam 2 (Chapters 5, 8, & 9 and Appendix A) 100 Exam 3 (Chapters 10, 11 & 16 and Appendix A) 100 Final (Comprehensive) 100 Minus low score -100 Exam points Online Homework Assignments Total points possible 300 60 360 Exam Policy: The lowest exam score will be dropped. If you are satisfied with your grade going into the final you will not have to take the final. However, if you want to try to raise your average you will have to take the final. The first three (non-comprehensive) exams will be composed of multiple choice questions and problems and will be administered in the classroom. Arrangements must be made with the instructor prior to exam time (this means before class starts) before any make-up exams will be allowed. Make-up exams are defined as missed exams not exams you have taken and want to take again. The student will receive a given percentage of the score received for any make-up exam administered as follows: First make-up exam Second make-up exam Third make-up exam 90% of score 75% of score 50% of score For example, a raw score of 80 is received on the first make-up exam, the student will receive an adjusted score of 72 (80 * 90%) in the gradebook. More likely than not make-up exams will be composed entirely of multiple choice questions (none of which will be found in the Gleim book) and must be taken in a timeframe established by the instructor. Comprehensive Final: The comprehensive final will consist of 53 multiple choice questions selected at random worth 2 points each. The administration of this final will be discussed at a later date. Extra Credit: Each exam will afford the student an opportunity to earn a minimum of 5 extra credit points. This allows everyone in the class an equal opportunity to earn extra credit. No additional extra credit will be made available. Online Homework Assignments: Three online homework assignments will be given throughout the semester for a grade. Each will be worth 20 points. These graded assignments will be available on Blackboard under “Assignments” at least one week before each of the first three exams. Each homework assignment must be submitted before taking the corresponding exam. Ungraded Homework: The only way to learn accounting is by practicing problems and exercises. Problems and exercises will be assigned in the textbook throughout the course. These will not be collected or graded. Solutions for all textbook problems and exercises will be posted on Blackboard under “Course Documents.” 2 Office Hours: Office hours are to discuss your questions. Office hours are not to repeat lectures that you have missed. When you miss class, it is your responsibility to get the notes from another student. Tutorials: Tutorials will be held in the instructor’s office. If you are planning to attend you must made an appointment prior to Noon of the day you are planning to attend. If no one has made an appointment, the tutorial session will be cancelled. You can make an appointment either in person (there will be a sign-up sheet on the bulletin board outside my office door) or via email. All courses taught at Goldey-Beacom College are governed by the GBC Academic Honor Code. This syllabus is subject to change at the instructor's discretion. 3 Tentative Schedule Date Chap. 8/24 1 Major Topics Textbook Homework History of Accounting Standards Gleim Modules th th 14 or 15 Edition 1.1 House of GAAP 8/26 2 Conceptual Framework 8/31 3 Types of Accounts Regular Business Transactions Adjusting Entries Financial Statements Closing Entries 9/2 3 9/7 9/9 9/14 4 4 App. A Classified Balance Sheet Classified Balance Sheet Time Value of Money 9/16 9/21 9/23 App. A Time Value of Money Exam 1 Basic Income Statement Basic Earnings per Share Discontinued Operations Extraordinary Items Changes in Accounting Principles Prior Period Adjustments Retained Earnings Cash and Cash Equivalents Restricted vs. Unrestricted Cash Bank Overdrafts Recognition of Accounts Receivable Valuation of Accounts Receivable Disposition of Accounts Receivable Time Value of Money Long-Term Notes Receivable Long-Term Notes Receivable Inventory Systems Cost Flow Assumptions: Average Costing FIFO LIFO 5 9/28 5 9/30 10/5 5 8 10/7 8 10/12 8 10/14 9 1.2, 1.3, 1.4 2.1, 2.2, 2.3 E3-19, P3-1 (Journalize regular Sept. entries only) E3-6, E3-10 Prepare closing entries using the Adjusted Trial Balance in E3-10 P4-2 E4-5, E4-11 EA-2, EA-3, EA-4, EA-5, EA8 EA-9, EA-10, EA-12 5.1 None 3.1, 3.2, 3.3, 3.4 E5-6 E5-7 E5-5, E5-8, P5-7 E5-15 E8-2 5.3, 5.4, 5.5, 5.6 E8-5, E8-6 E8-7, P8-3 E8-12, E8-15, E8-17 E8-18 E8-19 (skip part d) E9-1, E9-5 E9-9, P9-4 4 6.1, 6.2, 6.3, 6.4, 6.5 (LCM only) Date Chap. 10/19 9 10/21 10/26 10/28 9 10 Major Topics Textbook Homework Cost Flow Assumptions: Dollar-Value LIFO Lower of Cost or Market Exam 2 Acquisition of PPE Gleim Modules th th 14 or 15 Edition E9-21, P9-8 E9-23, E9-24 E10-2, E10-4, E10-5, E10-8 7.1, 7.3, 7.4, 7.5, 7.7, 8.1, 8.2 Sale of PPE for cash 11/2 10 11/4 11/9 10 11/11 11 11/16 16 11/18 16 11/23 11/25 11/23 to 12/2 by 11:59 pm Depreciation Methods E10-12, E10-14, E10-15, E10-16, P10-17 Changes in Estimations TBA Exchange of NonMonetary Assets Subsequent Expenditures Intangible Assets Research and Development E10-21, E10-22, P10-8, P10-9 None Payroll Deductions Compensated Absences Stock Options Postretirement Benefits Exam 3 No Class - Thanksgiving Online Final E16-3, E16-4 E16-1 E16-5, E16-6 5 9.1, 9.2, 9.3, 9.4, 9.5 (Skip questions with calculations and entries)