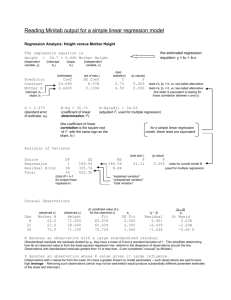

Bivariate Regression

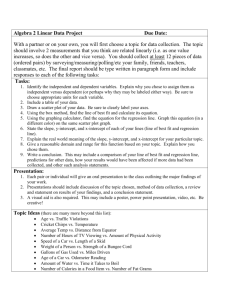

advertisement