Problem Set Answers 5

advertisement

Econ 122a (Intermediate Macroeconomics)

Due: Wednesday 4 November

Problem Set Answers 5

Professor: Nordhaus

Income/Wealth

Teaching assistant: Melanie Morten

A) Life cycle profit of YC2011

Earnings Profile

Consumption

Profile

Wealth

Profile

Age

20 (graduate)

Income/Wealth

60 (Retire)

80 (Die)

B) Life cycle profit of YC2011: with recession

Earnings Profile

Consumption

Profile

Wealth

Profile

Age

20 (graduate)

60 (Retire)

80 (Die)

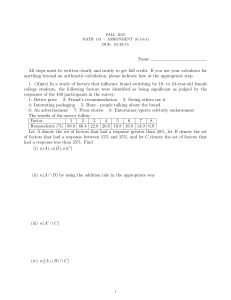

Question One: “A life cycle problem”. a) While at Yale, the MPC should be 1 as the

student has a low income, but cannot borrow against their future income as they would like

5-1

5-2

to smooth their consumption over their life cycle.

b) When there is a financial crisis income is lower that in would have been otherwise. The

impact of this is that consumption will be lower for every time period: both when the

individual is borrowing constrained, as their income (which they consume all of) is lower,

and then once they start to smooth their income, as they have lower remaining lifetime

income.

Question Two: “Mankiw Chap 17”. a) To find the interest rate use the intertemporal

budget constraint and substitute in the values for Jill:

c2 = (1 + r)(y1 − c1 ) + y2

100 = (1 + r)(0 − 100) + 210

r = 10

b) Jack consumes at the endowment level initially. This point is still feasible, so Jack

can be no worse off with the interest rate increase. However, consumption in period 2 has

become cheaper, so most likely (depending on the specific utility function) Jack will increase

consumption in period 2 and decrease consumption in period 1.

c) Jill is a borrower, so the increase in the interest rate must result in lower utility as her

previous bundle is no longer feasible. Jill is worse off as a result of the change.

Jack

100

Jill

u after

u before

u before

u after

100

Question Three: “A textbook investment question”. We will use the user cost of

capital formula from the readings, uc = (r + δ)pk calculated over one semester (half a

year) so the interest rate is 0.1/2 = 0.05: a) Textbook depreciates fully: δ = 1. uc =

(1 + 0.05) ∗ 60 = $63

b) Textbook depreciates 25% in one semester uc = (0.25 + 0.05) ∗ 180 = $54

c) The publisher is correct, the rental cost of a book has decreased over the period

5-3

Question Four: “An investment problem”. a) The problem of each person-firm is the

following:

max u(c0 ) + u(c1 )

c0 ,c1 ,k0

subject to

1/2

c0 + k1 = k0 11/2

1/2

c1 = k1 11/2

b) Using the linear utility function u(c) = c, and substituting in the constraints directly,

the problem becomes a maximization problem in only one variable, k1 :

max c0 + c1

c0 ,c1 ,k0

1/2

max(k0

k1

1/2

− k1 ) + k1

To solve this, take the first order conditions and then use the budget constraints:

−1/2

FOC : −1 + 1/2k1

=0

→ k1 = 1/4

c0 + k1 = 1period 1 budget constraint

→ c0 = 1 − 1/4 = 3/4

1/2

c1 = k1

= (1/4)1/2 = 1/16

{c0 , c1 , k1 } = {3/4, 1/2, 1/4}

c) When the government introduces the tax, the period 1 budget constraint changes: c1 =

1/2

(1 − 0.2)k1 . This will result in the following:

1/2

max(k0

k1

1/2

− k1 ) + (1 − 0.2)k1

−1/2

FOC : −1 + 2/5k1

=0

→ k1 = 4/25

c0 + k1 = 1period 1 budget constraint

→ c0 = 1 − 4/25 = 21/25

1/2

c1 = k1

= (4/25)1/2 = 2/5

{c0 , c1 , k1 } = {21/25, 2/5, 4/25}

The tax has caused the optimal amount of capital to decrease from 1/4 to 4/25. This means

that output reduced from (1/4)1/2 = 1/2 to (4/25)1/2 = 2/5

d) The capital tax is distortionary because it changes the behavior of the agent (the tax

appears in the first order condition for capital). An alternative mechanism to collect tax

would be to impose a fixed tax: if the government taxed the agent 0.2 ∗ 2/5 = 2/25 they

would collect the same tax revenue as in c), but output would be as in a) because the fixed

tax does not appear in the first order condition for capital, and hence does not affect the

capital accumulation decision.