Special Decision Making

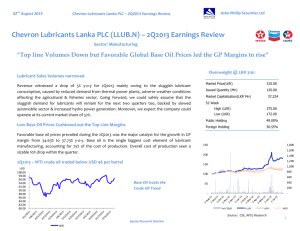

advertisement

CA BUSINESS SCHOOL POSTGRADUATE DIPLOMA IN BUSINESS AND FINANCE SEMESTER 1 : FINANCIAL PLANNING AND CONTROL Special Decision Making [best use of Management Accounting] M B G Wimalarathna [FCA, FCMA, MCIM, FMAAT, MCPM][MBA–PIM/USJ] Introduction Key management personnel of most manufacturing entities are taking useful short term specific decision by using data/information produced by the costing/management accounting system. Most of these decisions will be taken based on the relevant cost (relevant income). Relevant cost is the cost which specifically arise based on the decision of the management or any cost that will have to incur due to decision undertake by the management. Relevant cost will be either one of the following two or both. Incremental cost : element of cost which will increase due to management decision. It is certain that variable costs surrounds the decision will increase while possibility for fixed costs too. Opportunity cost : value of the benefit forgone from next best option due to selection of the best option in the given circumstance. Relevant Vs. Irrelevant Cost Following will be treated as non-relevant cost in the event of short term specific decision making. (should not be considered) Sunk cost : already incurred. Will not change based on the decision. Committed cost : already committed to pay in the future based on past decision. (moreover sunk cost) Notional cost : not a real cost. Instead it will indicate the cost of using resources in the business. (depreciation/amortization) Absorbed fixed overheads : fixed overheads which have already agreed to absorb based on pre determine rates. This should not be the actual incremental fixed costs identified in above. Relevant Cost of Materials It is important to ascertain the relevant cost of raw materials in the event of special decision making mostly in manufacturing entity. Replacement cost : when such raw materials can use for another production, it has to replace. Resale value :raw materials cannot use in other production but they can sell in the market if not use (scrap). No relevant cost :when no other possible use and/or no resale value of the raw materials, there is no cost of using such R/M. Relevant income :when entity expected to incur some cost at the event of removing raw materials in future, such value should be treated as relevant income in the production since such raw materials used now in the production. Qualitative Factors in Decision Making Availability of cash (at now and capability of getting when need arise) Key economic factors (macro) Legal constraints (BOI/TRC/CEA) Current market position and expected trend Pressure from the employees/unions Competition in the market (existing and prospective) Power of the suppliers/trust between each parties Reaction of the key customers/existing key suppliers Behaviour of the shareholders & other stakeholders Threat to the overall goodwill/image of the company Perception of the key management personnel Degree/level of impact with PEST factors Types of Short Term Decisions By considering above relevant costs and relevant income along with qualitative factors, key management attempt to take following short term decisions. Determining best sales mix when resources are limited Make or Buy decision Accept or Reject (orders) decision Shutdown or Continue decision Decision on working extra shift or not Types of Short Term Decisions (Contd.) Determining best sales mix with limiting factors An entity attempts to maximize its overall profit by determining most productive limiting factors and profitable sales mix. Limiting factor : any factor (resource) which is scares/limited at current and limit the activities of an entity accordingly. Key steps; 1. Identify the limiting factor 2. Determine the contribution per unit of each product 3. Determine the number of units required from limiting factor 4. Calculate the contribution per limiting factor 5. Rank the products based on results on above 4 (max ~ min) 6. Determine the sales/production mix in line with above 5 (Maximum units of production should be the demand from market) Types of Short Term Decisions Make or Buy decision Determining the best. Total relevant costs incurred in manufacturing in-house compare with available best price (to buy) in the market. (sometimes this could even consider with limiting factors) Following costs should consider as relevant when do in-house; 1. Incremental/relevant cost : VC + any incremental FC 2. Opportunity cost : value of contribution foregone that would have earned by deploying resources in other production which used to do in house now. Following qualitative factors also to be noted; a. Trustworthy/strong relationship of the supplier b. Quality of the products (confidence built among customers) c. Fluctuations of the prices d. Actions and reactions of the existing employees(union) e. Effect to the corporate image/goodwill Types of Short Term Decisions Accept or reject the orders An entity considers special order received from the external buyer (customer) for the product/service which is not entity is manufacture and sell frequently. For the evaluation purpose, this could be divided into; 1. Fulfil the order within existing capacity 2. Extra capacity need for the fulfilment of the order When revenue received from the order exceeds incremental/relevant costs of the order, entity will proceed with the order and vice versa. (need considers qualitative factors too) Relevant cost : VC + Op. Cost (any loss of the contribution enjoyed from other products at current) Note : in above 2, additional Fixed Costs will also be part of relevant cost. Types of Short Term Decisions Shutdown the product/line of business or continue decision Shutdown of a particular production line and/or a product or continue will be at a question. Decision will be taken based on the revenue recognized by an entity being operating such production line/producing product as opposed to relevant costs incurred in such an event. Relevant cost : VC + Op. Cost + additional FC Opportunity cost will be the loss of contribution that would have earned if resources utilized in this event deployed in another production line and/or producing another product. Types of Short Term Decisions Decision on working extra shift or not Decision as to whether do additional extra shift in order to fulfil the customers’ need or not. Decision will be taken based on the revenue recognized by an entity being engaging extra shift as opposed to relevant costs incurred in the event of engaged in extra shift. Relevant cost : VC + Op. Cost + additional FC Opportunity cost will be the loss of contribution that would have earned if resources utilized in this event deployed in the production of another product. Exercise: Variable Costs of manufacturing one unit of “X” & “Y” will be as follows. All figures are in LKR. DM DL (LKR 5 Per hour) VOHs X 20 10 20 Y 30 15 25 Selling price of one unit of X & Y are LKR 80 and LKR 100 respectively. Total labour hours are limited to 18,000. Expected sales of X & Y are 3,000 units and 5,000 units respectively. a. Determine the profit maximization sales mix b. Calculate the profit/loss if fixed cost is LKR 110,000 based on the above sales mix c. If additional labour is available, calculate the maximum rate per hour that company can afford to obtain such additional labour Exercise: Cost structure of manufacturing one unit of “Y” will be as follows; DM DL VOHs FOHs LKR 350 280 170 150 Total capacity is 1,000 units. External supplier has agreed to deliver the product Y at LKR 825 a. Determine whether make or buy product Y b. If company incurred an additional Fixed Costs of LKR 12,000 to produce Y, will the decision in above (a) be changed? c. If company can manufacture product Z using resources allocated to manufacture Y and if Z gives contribution of LKR 75 per unit, will the decision change? Additional Fixed Costs of LKR 35,000 will be incurred in producing Z and total quantity is 1,000 units. Details in above (b) will remains unchanged. Exercise: ABC & company is currently engaged in manufacturing product “A” at its factory. One unit of A will be sell at LKR 60 and variable costs of manufacturing one unit of A is LKR 40. Special order received from the customer for 1,000 units of A. customer agreed to pay LKR 45 per unit. As a result of the accepting new order, existing production will be lose by 200 units. a. Determine whether to accept or reject the order.