chevron lubricants lanka plc (llub)

advertisement

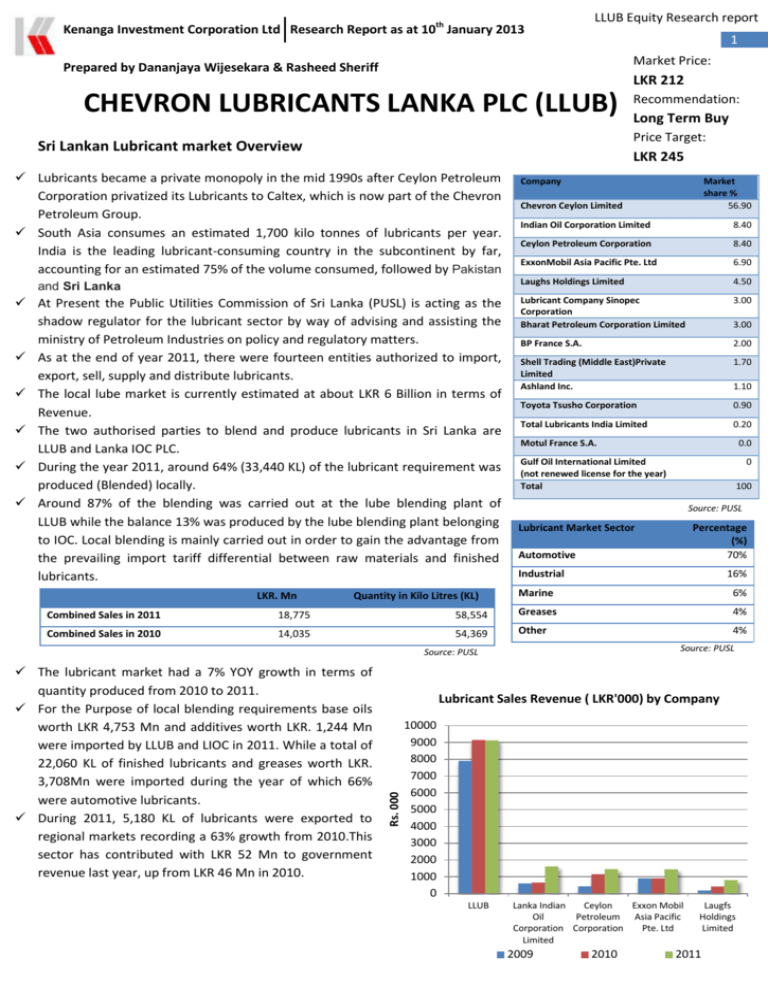

Kenanga Investment Corporation Ltd Research Report as at 10th January 2013 LLUB Equity Research report 1 Market Price: Prepared by Dananjaya Wijesekara & Rasheed Sheriff LKR 212 CHEVRON LUBRICANTS LANKA PLC (LLUB) Long Term Buy Price Target: Sri Lankan Lubricant market Overview LKR 245 Lubricants became a private monopoly in the mid 1990s after Ceylon Petroleum Corporation privatized its Lubricants to Caltex, which is now part of the Chevron Petroleum Group. South Asia consumes an estimated 1,700 kilo tonnes of lubricants per year. India is the leading lubricant-consuming country in the subcontinent by far, accounting for an estimated 75% of the volume consumed, followed by Pakistan and Sri Lanka At Present the Public Utilities Commission of Sri Lanka (PUSL) is acting as the shadow regulator for the lubricant sector by way of advising and assisting the ministry of Petroleum Industries on policy and regulatory matters. As at the end of year 2011, there were fourteen entities authorized to import, export, sell, supply and distribute lubricants. The local lube market is currently estimated at about LKR 6 Billion in terms of Revenue. The two authorised parties to blend and produce lubricants in Sri Lanka are LLUB and Lanka IOC PLC. During the year 2011, around 64% (33,440 KL) of the lubricant requirement was produced (Blended) locally. Around 87% of the blending was carried out at the lube blending plant of LLUB while the balance 13% was produced by the lube blending plant belonging to IOC. Local blending is mainly carried out in order to gain the advantage from the prevailing import tariff differential between raw materials and finished lubricants. LKR. Mn Recommendation: Quantity in Kilo Litres (KL) Company Chevron Ceylon Limited Indian Oil Corporation Limited 8.40 Ceylon Petroleum Corporation 8.40 ExxonMobil Asia Pacific Pte. Ltd 6.90 Laughs Holdings Limited 4.50 Lubricant Company Sinopec Corporation Bharat Petroleum Corporation Limited 3.00 BP France S.A. 2.00 Shell Trading (Middle East)Private Limited Ashland Inc. 1.70 Toyota Tsusho Corporation 0.90 Total Lubricants India Limited 0.20 3.00 1.10 Motul France S.A. 0.0 Gulf Oil International Limited (not renewed license for the year) Total 0 100 Source: PUSL Lubricant Market Sector Percentage (%) 70% Automotive Industrial 16% Marine 6% 4% Combined Sales in 2011 18,775 58,554 Greases Combined Sales in 2010 14,035 54,369 Other 4% Source: PUSL Source: PUSL Lubricant Sales Revenue ( LKR'000) by Company Rs. 000 The lubricant market had a 7% YOY growth in terms of quantity produced from 2010 to 2011. For the Purpose of local blending requirements base oils worth LKR 4,753 Mn and additives worth LKR. 1,244 Mn were imported by LLUB and LIOC in 2011. While a total of 22,060 KL of finished lubricants and greases worth LKR. 3,708Mn were imported during the year of which 66% were automotive lubricants. During 2011, 5,180 KL of lubricants were exported to regional markets recording a 63% growth from 2010.This sector has contributed with LKR 52 Mn to government revenue last year, up from LKR 46 Mn in 2010. Market share % 56.90 10000 9000 8000 7000 6000 5000 4000 3000 2000 1000 0 LLUB Lanka Indian Ceylon Exxon Mobil Oil Petroleum Asia Pacific Corporation Corporation Pte. Ltd Limited 2009 2010 Laugfs Holdings Limited 2011 LLUB Equity Research report 2 Company Overview LLUB Financials Chevron Lubricants Lanka PLC engages in blending, manufacturing, exporting Distributing, and marketing lubricant oils, greases, break fluids, and specialty products in Sri Lanka. The company offers its products for industrial, commercial, and consumer applications. Chevron Lubricants Lanka PLC markets its products under Chevron and Caltex brands. The company was incorporated in 1992 and is based in Colombo, Sri Lanka. Caltex is the 5th most powerful brand in Sri Lanka, and its brand value is amongst the top 11 in Sri Lanka. LLUB has 120 Mn ordinary shares outstanding as at 10th January 2013. LLUB is considered a high dividend paying company However; KICL foresee a fall in the dividend payout rate due to its movement from current blending plant in Kollonnawa to Sapugaskanda at a cost of $ 15 Mn. This plant movement will be funded internally through its retained profits rather than looking at external financing. However from 2014 onwards KICL have predicted that the dividend payout rate will be sustained at 90% level (85% to 90%). Bloomberg Code LLUB.SL CSE Code LLUB.N0000 Share Price Rs. 212 Market Capitalization Rs. 2544 Mn All Time High Rs.233 All Time Low Rs. 35 52wk range Rs.160.00 - 231.00 Chairman Farrukh Saeed CEO/ MD Kishu Gomes Beta Values / ASI Beta Values/ MPI 0.43 0.28 Chevron Shareholding Structure as of Dec 2011 49% 51% Chevron Ceylon Limited Public Holding Source: LLUB Annual Report 2011 LLUB.N0000 Movement 350,000 250 300,000 200 250,000 150 150,000 100 Rs. 200,000 100,000 50 50,000 - 0 Volume Closing Price** Source: CSE LLUB Lubricant Sales Volume Performance Vs. Competition 70000 A fall in volume of 1,935 KL for LLUB, while Total Market volume increased by 4,184 KL in 2011 60000 56.90% 73.00% Volume (KL) 80.00% 70.00% 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% LLUB.Cm Share Volume LLUB recorded a LKR 2 Billion Profit after tax (PAT) in 2011 compared to 2010 in which it earned a PAT of LKR1.5 Billion. It’s a 33% PAT growth, with revenue growing at 17%. LLUB has further recorded a growth rate of 19.2% on its PAT, and a top line growth of 10.2% for 1-3Q 2011-2012. However, LLUB recorded a fall in top line by 2.8% QoQ for Q3 2012. And fall in bottom line by 13.5% QoQ for Q3 2012. As highlighted by CEO Mr. Kishu Gomes, this fall in both top line and bottom line is attributable to macro economic conditions faced by Sri Lanka such as an increase in duty on vehicle imports to minimise currency drain out of the country. Export Market LLUB exports 5% of its lubricants mainly to Maldives and Bangladesh. LLUB has seen a fall in growth in its Bangladesh sales whereas it has experienced the opposite in Maldives. LLUB entered Maldives in 2003 and has been identified as a key player in the lubricant market industry as one of the major exporters and currently enjoys a 10% market share with expectation of a 5% growth in the near future. It has also announced its commitment to the Damas Company in Maldives by signing an agreement spanning 5 years to distribute Chevron’s product range. With this new agreement Caltex will further penetrate into the Maldivian lubricant market by focusing on marine transportation and power generation, going one step further from supplying lubricants to the transport and fisheries sector. Sri Lankan economy recorded a steady export growth of 4% in the past 10 to 12 years but saw a decrease of 2% last year when compared to exports ,despite the prevailed general economic conditions, to Maldives which has grown from10 % to 12% in its lubricant exports. Reuters Code 50000 40000 30000 20000 10000 2009 2010 2011 0 2009 LLUB Market Share Ceylon Petroleum Corporation Market Share Source: PUSL Total Lubricant Production Ceylon Petroleum Corporation 2010 LLUB Prodcution Exxon Mobil Asia Pacific 2011 LIOC Production Source: PUSL LLUB Equity Research report 3 Company Financial Performance Total Top line Growth Revenue LLUB has 3 main revenue generating sources: Automotive, Industrial and Exports which contribute approximately 62%, 33%, and 5 % respectively to the total group revenue . The automotive sector -The transport and communication sector of Sri Automotive Exports Industrials 62% Lanka grew by 11% in 2011 in comparison to 11.9% growth in 2010. 5% 33% Considerable growth was posted by transport sector accounting to 1.3%. The Growth of the transport sub sector could be directly attributable to the increase in new motor registration by 46.3% in 2011. As automotive sector is LLUB’s largest revenue generating segment Sri Lanka’s Transport sector growth directly affects LLUB’s main stream of revenue. 6000000 A 157% increase of new vehicle registatrions from 2009 to The automotive Sector consists of the retail industry; the main factor that influences automotive revenue is the number of vehicle population in Sri Lanka. And KICL is expecting LKR 6865.75 Mn revenue from this sector in 2013. 16,000.00 14,000.00 5000000 3000000 2000000 Fall in new vehicle 1000000registration by 64,682 vehicles in 2009 Forecasted 10,000.00 Fall in import duty in 2010 increased SL vehicle population (+17% in 2010 8,000.00 0 Revenue Rs. Mn Vehicle Units 12,000.00 4000000 6,000.00 4,000.00 2,000.00 0.00 2007 2008 2009 2010 2011 2012 2013 2014 2015 Vehicle Population LLUB Sales Source: LLUB Annual Report 2011 & KICL Research Segementational Revenue of LLUB 16000 0.2 14000 0.15 The industrial sector will see a 10% growth considering the current economic development of the country. Reflecting the continued expansion of the domestic and external demand, the industry sector recorded a 10.3 % growth in 2011, the highest since 2002. And KICL is expecting LKR 3339.6 Mn revenue from this sector in 2013. The export sector consists of LLUB lubricant exports to Maldives and Bangladesh and revenue is forecasted to grow by 25% year each from this sector. However currency volatility and increased competition in the respective countries will play a huge part in revenue growth from this sector. From this sector KICL is expecting LKR 1725 Mn revenue in 2013. 0.1 8000 Percetange 10000 0.05 6000 4000 Overall Total Revenue of LLUB has increased from LKR 8,654 in 2007 to LKR 11,040 Mn in 2011 and forecasted total revenue of LKR 11930.35 Mn in 2013. LLUB increased the prices of all ranges of products in order to keep prices par with the increase in raw material prices in the world market. 0 2000 0 -0.05 Industrial Export Automative Revenue growth % Source: LLUB Annual Report 2011 & KICL Research Bangladesh (BDT) and Maladivian (MVR) against LKR movement 0.635 0.119 0.625 0.118 MVR 0.630 BDT Revenue Rs.Mn 12000 0.620 0.615 0.117 BDT MVR Source: Forex report & KICL Research Other Factors that have contributed to the growth in LLUB revenue are the change of product mix and product portfolio strategy, export growth, global synergies, enhanced operational efficiencies and the stable parity rate. Further the growing awareness witnessed in the recent years of vehicle emissions as a source of air pollution is driving environment regulation, which has forced commercial fleet across the region to modernize. This in turn has created a small but growing demand for higher performance engine oils. This enabled chevron to increase the revenue contribution from its premium brands. KICL believe that with rapid growth in sectors such as power and energy, agriculture, fisheries, ports and infrastructure will contribute to top line growth of LLUB. LLUB Equity Research report 4 12,000 10,000 LKR Million 100.00 8,000 80.00 6,000 60.00 4,000 40.00 2,000 20.00 0 The main driver of LLUB cost of sales are the base oil prices, where base oil is the main ingredient in lubricants, and has a strong correlation with crude oil prices with a lag of a few months. 0.00 Cost of Sales Average Yearly Cost of Crude Oil per Barrel Source: Oil Report& KICL Research 6000 Stable GP margin at 33.33% 5000 35.00% 30.00% Fall in base Oil Prices 4000 LKR Million LLUB Cost of Sales was LKR 6,368 Mn in 2007 and increased to LKR 7,565 Mn in 2011( a growth of 19%), with slight volatility in the years in-between attributable to the volatility experienced of the crude oil prices from US $ 72.34 per barrel in 2007 to US$ 94.89 in 2011. We forecast LLUB Cost of sales to further increase to LKR 9719 Mn in 2015. 40.00% 25.00% 3000 20.00% 15.00% 2000 Percentage LLUB enjoys a 9% tariff benefit from blending their products locally, an advantage they share with their competitor Lanka IOC who currently has an 8.4% percent market share of the Sri Lankan Lubricant Market. 120.00 FORECASTED US $ Per Barrell Bottom Line Growth 10.00% 1000 5.00% 0 0.00% 2007 2008 2009 2010 2011 2012(E) 2013(E) 2014(E) 2015(E) Gross profit margins could come under pressure if base oil prices rise which could Gross Profit Gross profit margins on revenue lower LLUB’s gross profit margin in the future. Source: LLUB Annual Report 2011 & KICL Research However base oil prices and crude oil prices have a strong correlation, with a lag of only a few months. Chevron’s global sourcing capabilities give rise to LLUB to benefit from pricing opportunities that arise as a result of this lag. However according to KICL forecast we believe that Crude oil prices will be stable around US $ 90 levels from 2013 to 2015, which will stabilise LLUB’s gross profit margins at 33.33% during the period from 2013 to 2015. Since any changes in crude oil prices that affect LLUB cost of sales will be partially passed on as price increases to its customers. LLUB recorded a Gross profit of LKR 3,475 Mn in 2011 an increase of 14% compared to LKR 3,045 Mn recorded in 2010.However gross profit margin has fallen from 32.15% in 2010 to 31.48% in 2011,an approximate fall of 4.14% fall in gross profit margin when compared with 2009. This is mainly due to the rise in crude oil prices from US $ 61.95 in 2009 to US $ 94.89 in 2011. 6000 0.3 The company has managed ito maintain its SG&A at low levels, resulting in its EBIT margins remaining healthy. 0.25 5000 19.98% 0.2 15.44% 0.15 4000 LKR MN With regard to LLUB Earnings before interest and taxation (EBIT), the company has done well to manage its EBIT margins despite the increase in its distribution networks. The company recorded an EBIT margin of 24.68% in 2011 compared to 23.94% in 2010. 5.90% 0.1 4.31% 3000 -3.60% -8.58% 2000 1000 6.02% 5.86% 0.05 0 -0.05 -0.1 -0.15 0 2007 2008 2009 2010 2011 2012(E) 2013(E) 2014(E) 2015(E) Operating Profit(EBIT) Distribution and Administration Cost Growth YoY % Gross Profit EBIT Margins Source: LLUB Annual Report 2011 & KICL Research LLUB Equity Research report 5 Overall EBIT grew by 24.68% YoY to LKR 2,725 Mn in 2011. KICL forecast an EBIT of LKR 3,830 Mn in 2015. KICL further foresee an EBIT margin of 26.27% in 2015.Positive Volume growth 33% 35% coupled with price increases are expected to drive EBIT margins. LLUB’s healthy cash position paid off with a finance income of LKR 52.5Mn in 2007 to a high of LKR 99 Mn in 2009 and thereby a sudden fall to LKR 43 Mn in 2011, attributable to a fall in interest income from LKR 79 Mn in 2010 to LKR 35 Mn in 2011. The company achieved a net profit of LKR 2,001 Mn in 2011, which was the highest net profit recorded during LLUB’s presence in the SL lubricant market. This is partially attributable to the reduction in the corporate tax from 35% in 2010 to 28% in 2011. 30% 26% 25% 20% 20% 12% 15% 10% 5% 0% 2007 In line with our forecasts we foresee net profits of LLUB to increase to LKR 2,408Mn in 2012, LKR 2,553Mn in 2013, LKR 2, 703Mn in 2014 and LKR 2,862 Mn in 2015. 2015 (E) Gross profit margins on revenue Net Profit Margins Source: LLUB Annual Report 2011 & KICL Research LLUB net profit margins increased from 12.46 % in 2007 to 18.13% in 2011. We foresee net profit margins of LLUB to be stable around the level of 19% for the year 2012 and going into 2015. Fall in Dividend payment and rise in Retention rate due to the movement of the Lubricant Blending Plant. 70.00 60.00 100% 50.00 80% 40.00 Rs. Rs. Mn 120% 60% 30.00 40% 20.00 20% 10.00 0% 0.00 1 2 3 4 Retention ration 5 6 7 8 Dividend payout 9 EPS Source: LLUB Annual Report 2011 & KICL Research 2007 (LKR ' Mn) Fall in dividend payout rate 2008 2009 2010 (LKR ' Mn) (LKR ' Mn) (LKR ' Mn) (LKR ' Mn) DPS 2011 2012(E) Book value per share 2013(E) 2014(E) 2015(E) (LKR ' Mn) (LKR ' Mn) (LKR ' Mn) (LKR ' Mn) Turnover Rs. 8654.30 8900.30 8691.00 9,471.00 11,040.00 12265.96 13,004.09 13,765.85 14,578.06 Net Profit Rs. 1078.30 948.00 1495.00 1501.00 2001.61 2408.49 2553.42 2703.00 2862.48 YoY % - -12.08% 57.70% 0.40% 34.25% 19.52% 6.02% 5.86% 5.90% EPS Rs. YoY % PER – at LKR 212 /= (X) PEG (X) DPS Dividend yield at LKR 212/= ROE Rs. % Book value per share Rs. PBV (X) 8.99 7.9 12.46 12.51 16.79 20.07 21.28 22.53 23.85 - -12.08% 57.70% 0.40% 34.25% 19.52% 6.02% 5.86% 5.90% 26.84 12.46 16.95 12.71 10.56 9.96 9.41 8.89 -2.22 0.22 42.23 0.38 0.52 1.66 1.61 1.51 6.25 5.25 12.00 12.25 9.00 10.04 18.09 20.27 21.47 33.92 40.38 17.67 17.31 23.56 21.13 11.72 10.46 9.87 0.00 0.44 0.68 0.67 0.63 0.55 0.54 0.54 0.54 15.28 17.93 18.39 18.65 26.32 36.36 39.55 41.80 44.19 8.05 5.83 5.36 5.07 4.80 % Profitability ratios Gross Margin % 26.41% 23.53% 35.62% 32.15% 31.48% 33.33% 33.33% 33.33% 33.33% EBIT Margins % 18.55% 15.56% 25.83% 23.94% 24.81% 26.27% 26.27% 26.27% 26.27% EBT Margins % Net Profit Margins % 19.16% 12.46% 16.66% 10.65% 26.97% 17.20% 24.64% 15.85% 25.20% 18.25% 27.27% 19.64% 27.27% 19.64% 27.27% 19.64% 27.27% 19.64% Source: LLUB Annual Report 2011 & KICL Research LLUB Equity Research report 6 Chevron Lubricants Lanka Financial Performance for the Year 2012 Quarter 1 – Quarter 3. LLUB Quarterly Financial Performance 2012 3QFY12 Revenue Cost of Sales Gross profit - Distribution costs - Administrative expenses Other income Operating profit Finance income Finance costs Profit before Income tax Income tax expense Profit for the period Total comprehensive income for the period Basic earnings per share 2,995,884.00 -2,066,055.00 929,829.00 -129,225.00 -127,625.00 2,528.00 675,508.00 46,647.00 -230.00 721,925.00 -199,938.00 521,987.00 521,987.00 4.35 3QFY11 Change % 3,084,346.00 -2,066,357.00 1,017,989.00 -100,798.00 -97,600.00 104.00 819,695.00 15,547.00 -291.00 834,951.00 -231,509.00 603,442.00 603,442.00 5.03 1-3QFY12 -2.87 -0.01 -8.66 28.20 30.76 2,330.77 -17.59 200.04 -20.96 -13.54 -13.64 -13.50 -13.50 -13.52 1-3QFY11 8,892,260.00 -5,982,627.00 2,909,633.00 -302,706.00 -357,415.00 6,676.00 2,256,188.00 134,360.00 -17,261.00 2,373,287.00 -657,025.00 1,716,262.00 1,716,262.00 14.30 Change % 8,065,848.00 -5,500,742.00 2,565,106.00 -305,216.00 -292,858.00 12,837.00 1,979,869.00 22,595.00 -11,004.00 1,991,460.00 -552,283.00 1,439,177.00 1,439,177.00 11.99 10.25 8.76 13.43 -0.82 22.04 -47.99 13.96 494.64 56.86 19.17 18.97 19.25 19.25 19.27 Source: LLUB Quarterly Report 2012 & KICL Research Top line reduced by 2.87 % Vehicle purchases are comparatively lower than other economies due to high taxation policies introduced by the government. Limited access to fuel station has also had an impact on revenue. This has directly affected their top line. However we foresee that LLUB will increase its revenue stream in the last quarter in 2012 due to increase in tourism and also seasonal effects where people tend to travel more during the last quarter of the year which will have a positive impact on the top line. Revenue Performance Millions LLUB revenue fell by 2.87% from 3QFY11 (LKR.3, 184 Mn) to 3QFY12 (LKR 2, 995 Mn). The reduction in the top line was primarily due to high competition faced in the lubricant market as well as due to macro economic factors that affected the market. 10.00 9.00 8.00 7.00 Sharp duty increases on vehicles, and price increases to recover cost escalations 6.00 5.00 4.00 -2.87% QoQ 3.00 2.00 1.00 0.00 3QFY11 3QFY12 Gross profit reduced by 8.66% due to high cost of sales 10.25% QoQ 1-3QFY11 1-3QFY12 Source: LLUB Quarter 3 report & KICL Research Even though LLUB’s top line has decreased by 2.87% the cost of sales remain at almost same levels (Q32012).LLUB was unable to reduce their heavy cost of sales due to high fixed cost and running cost in order to maintain their blending plant situated at Kolonnawa (Which is producing 50000 MT capacity).Further LLUB has increased inventory by 20% (as at Sep 30th 2012) compared to last year. This is a clear indicator that their stocks are not moving as swiftly as during periods when they were operating as a monopoly. Due to high cost of sales LLUB was unable to maintain profit margins. By looking at past trends LLUB has always been able to pass on the increase in cost of the inputs to their customers in terms of higher prices. But in 3QFY2012 LLUB might have not been able to pass these above mentioned costs due to high competition in the Sri Lankan market which created high amount of stagnant inventory. LLUB Equity Research report 7 High Distribution and Administrative expenses LLUB was unable to reduce the cost structure along with drop in revenue due to high cost of sales. The operational cost is high due to higher volume handling cost as well as high distribution cost which were unable to pass on to the customers which resulted in low revenue in 3QFY2012. Despite the economic situation in the country LLUB was unable to increase operating profit margins in 3QFY2012 compared to 3QFY2011 period. But considering the 1-3QFY2012 LLUB has managed to increase profit margins by 13.96%.Contribution from the 3QFY2012 to the 2012 operating margin accounted only for 30% compared to 41% contribution in the previous year during the same quarter. This clearly indicates that LLUB has a challenge in retaining their customers and to maintain market share. Millions Operating Profit has reduced by 17.6% compared to 2.87% reduction in revenue. 6.00 -19% 5.00 -2% 4.00 -19% 5% 3.00 -23% 2.00 17% 1.00 - Q1 2012 Revenue Q2 2012 Gross Profit Q3 2012 Net Profit Source: LLUB Quarter 3 report & KICL Research Finance income grew by 200%. LLUB was able to increase finance income by a considerable percentage due to upward movement of the current interest rates in Sri Lanka during the 3rd quarter of 2012 Considering the current movement in Sri Lanka interest rates we can expect an upward trend of the interest rates in the short term which will have a positive impact on LLUB’s finance income. Profit for the period and net profit margins has reduced. LLUB Share Price Movement : Quartely 197.00 200.00 190.00 180.00 Rs. Due to negative impact created in the market share and macro economic factors, LLUB was unable to achieve expected profit target in 3QFY2012. Considering the cumulative performance in 2012, LLUB has managed to increase their net profit by 19.25% which is a positive outlook for the company’s performance in 2012. 185.00 182.00 183.50 170.00 172.00 160.00 165.50 150.00 140.00 Q1 Q2 Highest Price 2012 Q3 Highest Pric 2011 Source: LLUB Quarter 3 report & KICL Research LLUB Equity Research report 8 LLUB: Risk Management Loss of market share due to the competition In the recent past LLUB has lost their conventional distributional channel which was refuelling stations which was one of significant channels that gave LLUB the ability to increase their volumes. However, currently LLUB is trying to increase their distribution network through their own automobile service stations which will give an opportunity to other competitors to increase Regional Outlets Sales Outlets their market share by looking at locations where LLUB has not entered yet such as some parts of the North and East provinces. Meanwhile the local government has opened up doors to foreign and local lubricant providers which will have a direct impact on LLUB’s market share due to low switching costs. Customers can always switch to another lubricant product without any cost. Unlicensed operators Even though there are only 14 legal players in the market there are number of other sellers who sell lubricant products without obtaining a license. This is a common issue faced by the industry as a whole. Still there is no effective regulatory framework in order to stop these illegal operations. Operational activities are outsourced LLUB has outsourced most of their important operational activities such as warehousing, distribution as well as drum fabrication in order to reduce administrative hassle as well as to obtain cost effective methods from economies of scale obtained by outsourced party. However, there is always risk element attached with outsourced activities. Improper service by one outsourced party will have a huge impact on the whole production process which will result in a negative impact on LLUB’s performance in the long term. Smooth production processes are always expected in order to face the strong competition. Therefore LLUB should maintain their strong and healthy relationship with outsourced parties and also their contingent plans should be accurate and up to date in order to facilitate any emergency. Exchange Rate Risk Most of the raw materials for the production are imported and any exchange rate movements will directly impact to the cost of production. Any depreciation of rupee would lead to increase cost of production which will ultimately result reduction in bottom line. Therefore LLUB might require moving into hedging instrument in order to mitigate exchange rate fluctuation risks. LLUB Equity Research report 9 LLUB: Future Direction Currently LLUB owns 65% to 60% of the market share and still remains as market leader in the lubricant industry. There are significant opportunities in the industrial business segment due to high expected foreign investments as well as future industrial expansion projects done by government. 5000000 Fall in Automotive revenue due to loss of marketshare 8000 7000 6000 4000000 5000 Rs. Mn With the expected increase in vehicle population, potential industrial growth as well as expected export growth, KICL assume that revenue will grow by 7% YOY up to 2015. 6000000 Vehicle Units KICL assume that LLUB is focusing more on their profit margins rather than focusing on market share due to high competition created in the local market. KICL believe LLUB will maintain their market position in the near term due to high level of satisfaction of the customers and quality of the products. 4000 3000000 3000 2000000 2000 1000000 1000 0 0 Vehicle Population Automotive Revenue Source: KICL Research & ministry of Finance Furthermore, with the economic crisis faced in developed countries KICL expect crude oil prices to dip in the world market which will directly impact to LLUB’s main raw material which is base oil. Due to high correlation with base oil and crude oil KICL expect a positive impact on LLUB cost structure in the near future. However, KICL don’t expect any dramatic change on LLUB administrative and distribution activities in near future. As a good dividend payer KICL does not expect any drastic change in the dividend policy in near future. Due to the movement of the manufacturing plant KICL expect reduction in the dividend payout ratio in order to facilitate investment requirements. KICL expect LLUB will maintain 90% levels retention ratio after 2014. Valuation KICL valuation is based on the Dividend Discount Model (DDM). We considered DDM model due to the high dividend payout ratio of LLUB. KICL expect that LLUB will continue to maintain the current dividend payout ratio because it is a one of the reasons why investors are attracted to this stock. KICL has improved our forecast for year 2012(E), revenue to be LKR 12,265 Mn and to improve further to LKR 13,004Mn in 2013(E). KICL has anticipated that crude oil prices will remain at the same level or even dip in the world economy resulting in a favourable outcome for the lubricant market which will ultimately impact LLUB’s bottom line. In our valuation model we have assumed that the company will have 5% long term growth considering LLUB retention ratio and return on equity. We have used 12.89% as cost of equity in order to discount the dividends. We have calculated 12.89% of cost of equity considering risk free rate, beta and market risk premium. Risk free rate Beta Market risk premium -10.74% (5 year Treasury bond rate) -0.43 (based on ASPI and LLUB stock prices) - 5% Based on forecasted values net profit of LKR 2408.49 Mn for FY12E amounts to a PE of 10.56 X at the current price of LKR 212.Based on 2013E and 2014E expected earning we expect a PE of 9.96X and PE 9.41 X respectively. The sector PE stands at 10.3X.Based on sector market capitalization almost 22% of the total sector market capitalization is contributed by LLUB which is the best contributor to the sector. This is a clear indicator that LLUB’s performance has had a direct impact to the Manufacturing sector index performance. Based on KICL forecasted figures LLUB’s stock has a target value of LKR 245/=.Based on valuation KICL have concluded that LLUB counter is undervalued. Considering the macro economic factors as well as qualitative and quantitative factors KICL is likely to provide Long term buy recommendation. LLUB Equity Research report 10 Annexure 01 Shareholder Information 20 Largest Shareholders as at 30th September 2012 Name of Shareholder Number of Shares % Chevron Ceylon Limited HSBC International Nominees Ltd-BPSS Lux -Aberdeen Global Asia Smaller Comp HSBC International Nominees Ltd-BPSS Lux -Aberdeen Global- EME HSBC International Nominees Ltd-BP2S London -Aberdeen Asia Smaller Comp Caceis Bank Luxembourg S/A Barca Global Master Fund LP Employees Provident Fund Cargo Boat Development Company Limited Renuka Hotels Limited National Savings Bank Bank of Ceylon No 1 Account Crescent Launderers & Dry Cleaners (Pvt) Ltd HSBC INTL NOM LTD-BP2S LUXEMBOURG-ABERDEEN GLOBAL FRONT Danske Invest- Global emerging markets small cap Mellon Bank N.A.- Florida Retirement system Danske Bank A/S DFCC Bank- Account No 1 AVIVA NDB Insurance PLC A/C No 07 Northern Trust CO S/A National Westminister Bank PLC as trustee of Jupiter India Mr. Udabage Bartleet Finance Plc 61,200,000 10,629,700 51.00 8.86 4,563,700 3,580,800 3,414,600 3,310,800 2,000,000 1,400,000 1,155,135 1,144,800 1,000,000 953,597 874,000 770,000 650,000 609,400 594,800 500,000 3.80 2.98 2.85 2.76 1.67 1.17 0.96 0.95 0.83 0.79 0.73 0.64 0.54 0.51 0.50 0.42 476,500 400,000 99,227,538 0.40 0.33 82.69 Source: LLUB Annual Report 2011 DISCLAIMER: This document is a research report prepared by Kenanga Investment Corp Ltd based on the information contained in the document the report has been compiled from sources that we believe to be reliable: however we do not hold ourselves responsible for its completeness or accuracy. All opinions and estimates included in this report constitute of our judgment to this date and are subject to change without notice. Information contained in this document is not and should not be construed as an offer, or a solicitation of an offer, to buy or sell any security or other financial instruments. Kenanga Investment Corporation Ltd, or its affiliates and/ or its directors, officers and employees shall not be in any way be responsible or liable for loss or damage which any person or party may sustain or incur by relying on the content of this document.