Bank & Financial Institution Modeling

advertisement

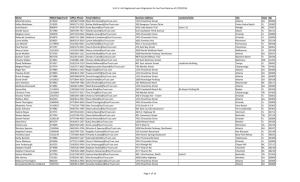

Bank & Financial Institution Modeling: Course Outline NOTE: This entire course is currently being revamped to include global coverage of banks and financial institutions; each module in the new course will be a case study based on an investment banking client presentation, hedge fund stock pitch, or private equity investment recommendation for a different bank. We also go into far more depth on topics like bank accounting, regulatory capital, Basel III, CRD IV, Dodd-Frank, stress testing for banks, and more. You will have access to both the existing and new courses once you sign up. The new course is a long way away from completion, but you’ll receive access to each new module as it is added. Currently, the first module, which gives a comprehensive introduction to all the topics and consists of 9 hours of training, is in place. The topics in Bank & Financial Institution Modeling teach you everything you need to know about accounting, regulatory capital, operating models, valuation, and merger models and LBO models for banks, insurance firms, and other companies that make money… with money. If you’re in a time crunch and needed answers yesterday, you can skip to whatever you need help with – but if you want to go through everything from top to bottom, you can do that too. In total, there are 71 lessons with accompanying Excel files as well as 5 quick reference guide PDFs on key topics. That amounts to over 26 hours of video altogether, which may seem like a lot. But don’t worry: everything is broken into bite-sized chunks so you can digest it easily. All the content is downloadable to your preferred device (works with QuickTime and most other media players and on all common devices including desktops, laptops, iPad, iPhone, and iPod). You also get full transcripts of all the videos. There are over 300,000 words in all, and all the transcripts are also downloadable. Use the transcripts to suit your preferred learning style or to quickly revise key concepts without having to find the exact location in the videos. Easily keep track of your progress: As you move through the lessons, you can check off what you’ve completed and what’s still on your “to-do” list. Fast answers to all your questions: Our expert support team is standing by to answer any questions you have about any of the content, 365 days a year. Quizzes and Certifications. After you have completed the course, you will be eligible to take our challenging Certification Quiz. Once you pass the Quiz, you’ll be issued a Certificate that you can add to your resume / CV and refer to in interviews. Included Lifetime Access: You also get lifetime access, so you can come back to the Course whenever you need it – whether that’s in 1 month, 1 year, or 10 years. www.BreakingIntoWallStreet.com What Others Are Saying About Our Modeling Courses... "Completing the FIG Modeling course was instrumental to transitioning into equity research, where I now cover the financial services sector." "Well researched, realistic and high quality content" www.BreakingIntoWallStreet.com "I interned at a BB bank this past summer in the Financial Institutions Group and the material that I have learned in the Bank & Financial Institution Modeling course is incredible.” "I work in the Treasury Department of a regional bank and the Banking course especially has been helpful.” www.BreakingIntoWallStreet.com Bank & Financial Institution Modeling Course Highlights In this course, you’ll learn accounting for banks and insurance companies, how to create operating models and detailed valuations, and how to build merger models and buyout models for banks. The bank modeling course is based on a case study of JP Morgan and SunTrust Banks, and we go through their SEC filings along with equity research from Morgan Stanley and RBC to build full models as you would at a real investment bank. You’ll start by learning how a bank operates differently from a normal company and how its 3 financial statements are different – and about credit loss accounting and regulatory capital. After that, we’ll create a detailed operating model for JP Morgan, starting with its loan portfolio and using its balance sheet and regulatory capital to drive everything else in the model. Then we’ll move into a detailed valuation based on public company comparables, precedent transactions, and a dividend discount model and residual income (excess returns) model – you’ll learn complex and simplified versions of both of these. Next, you’ll learn how to create a merger model for commercial banks and how it differs from a merger model for normal companies – everything from deposit divestitures to core deposit intangibles and other new items. We’ll conclude with a modified leveraged buyout (LBO) model for a bank that shows you how and why the traditional LBO framework doesn’t work, and what to do instead. On the insurance side, we’ll teach you accounting and revenue / expense recognition, go through an operating model for a brand-new P&C Insurance company, and then walk through valuation for both P&C and Life Insurance as well as key concepts such Embedded Value. Once you finish the course, you’ll be well-equipped to land offers in Financial Institution Groups (FIG) and to leap ahead of the competition once you start working. Resources: Completed JP Morgan / SunTrust Operating Model, Valuation & Merger Model Completed Bank Buyout Model JP Morgan 10-K Filing SunTrust 10-K Filing Completed P&C Insurance Operating Model Bank Balance Sheet Terms – Quick Reference Guide Projecting a Bank’s Financial Statements – Quick Reference Guide Credit Loss Accounting for Banks – Quick Reference Guide Capital Adequacy & Regulatory Capital – Quick Reference Guide Bank Valuation – Quick Reference Guide www.BreakingIntoWallStreet.com Module 1: Overview, Bank Accounting & Regulatory Capital In this module, you’ll learn why and how banks operate differently from normal companies, and why you can’t rely on traditional metrics or modeling when analyzing them. We’ll compare the financial statements of a bank to a normal company, and you’ll learn how the balance sheet drives everything for a bank; then you’ll learn about the provision for credit losses and loan loss reserves, which are critical to a bank’s finances. We conclude the module with an overview of regulatory capital, risk-weighted assets, and key metrics like Tier 1 Capital, Total Capital, and the Leverage Ratio. Resources: Bank Balance Sheet Terms – Quick Reference Guide Projecting a Bank’s Financial Statements – Quick Reference Guide Credit Loss Accounting for Banks – Quick Reference Guide Capital Adequacy & Regulatory Capital – Quick Reference Guide 1.1 Overview (Video Length: 18:08) In this lesson, you’ll get an overview of the entire course and learn the different types of financial institutions, how banks are different from normal companies, and how we’re going to approach the case study of JP Morgan. 1.2 Bank Balance Sheet (Video Length: 20:57) In this video, we’ll do a side-by-side comparison of JP Morgan’s balance sheet and the balance sheet of a “normal” company that sells products to consumers and you’ll learn the key line items and how everything ties together for a commercial bank. 1.3 Balance Sheet to Income Statement & Tier 1 Capital (Video Length: 29:44) This video will teach you how to move from a bank’s balance sheet to its income statement, and how the interest-earning assets and interest-bearing liabilities drive many of the income statement line items such as net interest income. You’ll also get an introduction to different types of capital, including Tier 1 Capital, and you'll see how banks can use securitization to alter their balance sheets. 1.4 Bank Income Statement & Cash Flow Statement (Video Length: 25:28) In this lesson, we’ll do a line-by-line comparison of JP Morgan’s income statement and cash flow statement vs. those of a “normal” company, and you’ll see how the line between operating, investing, and financing activities is blurry and subjective for a large commercial bank. 1.5 Provisions for Credit Losses & Loan Loss Reserves (Video Length: 29:43) www.BreakingIntoWallStreet.com Normal companies expect to maintain the value of their assets, but banks expect borrowers to default on their loans – and so they need to account for this in their statements. You’ll learn how to do that in this lesson, and we’ll walk through an example of how a bankruptcy and sale of collateral would affect the loan loss reserves, provision for credit losses, and all 3 statements. 1.6 Regulatory Requirements & Capital Adequacy (Video Length: 42:09) This lesson will give you a crash-course on bank regulation, including Basel I, Basel II, and Basel III, and teach you how to calculate risk-weighted assets, Tier 1, Tier 2, and Total Capital, and key metrics like the capital ratios and the Leverage Ratio. You’ll also learn why these are critical components of any model for a bank, and how they directly impact the operating model and valuation for JP Morgan. www.BreakingIntoWallStreet.com Module 2: Bank Operating Model In this module, you’ll construct a detailed operating model for JP Morgan, starting with its loan portfolio and loan loss reserves and moving onto its balance sheet, interest-earning assets and interest-bearing liabilities, and then its income statement and cash flow statement. Everything is linked to JPM’s real SEC filings and equity research from RBC and Morgan Stanley so that these projections are grounded in the real world. You’ll also learn about advanced topics like the circular calculation of stock repurchases and dividends based on regulatory capital requirements that other training courses do not cover at all. At the end, we’ll create a summary page that presents the key operating metrics for a bank and directly ties into the valuation in the next module. Resources: Completed JP Morgan Operating Model JP Morgan 10-K Filing JP Morgan Financial Statements JP Morgan – Equity Research from Morgan Stanley – July 2010 JP Morgan – Equity Research from RBC – July 2010 Projecting a Bank’s Financial Statements – Quick Reference Guide 2.1 Operating Model Overview & Loan Projections (Video Length: 21:25) In this lesson, you’ll learn how to build a complete operating model for JP Morgan and how to project their gross loan portfolio by loan type based on SEC filings and equity research. 2.2 Loan Charge-Offs & Recoveries (Video Length: 24:45) In this video, you’ll learn how to estimate net charge-offs by projecting gross charge-offs and recoveries by loan type; we’ll add everything together at the end to arrive at the net charge-offs number. 2.3 Gross Loans, Net of Charge-Offs & Key Metrics (Video Length: 22:21) We’ll link together the previous 2 videos in this lesson by teaching you how to calculate the provision for credit losses, gross loans prior to and net of charge-offs, as well as average loan balances and key metrics like the net charge-off ratio, the reserve ratio, and more. 2.4 Balance Sheet Projections (Video Length: 32:48) In this lesson, you’ll learn how to project a bank’s balance sheet based on its loans and deposits, and which items move independently of those key items vs. which ones are linked to the bank’s borrowing and lending capabilities. 2.5 Interest-Earning Assets & Interest-Bearing Liabilities (Video Length: 22:50) www.BreakingIntoWallStreet.com We’ll begin moving from the balance sheet to the income statement in this lesson by projecting JP Morgan’s interest-earning assets and interest-bearing liabilities – and you’ll learn how to project the interest rate spread and the net interest income based on these items. 2.6 Income Statement Projections (Video Length: 39:00) In this video, you’ll learn how to project JP Morgan’s non-lending businesses such as investment banking and asset management; you’ll also see which income statement line items are tied to the balance sheet and which move independently of assets and liabilities. We’ll conclude by linking in the provision for credit losses, projecting non-interest expenses, and calculating net income, net income to common, and EPS. 2.7 Cash Flow Statement Projections (Video Length: 30:17) In this lesson, you’ll learn how to project JP Morgan’s cash flow statement by linking in the appropriate items from the income statement and balance sheet and making assumptions for the rest; you’ll also see why certain items such as stock repurchases and dividends cannot be projected until we know the regulatory capital of the bank. 2.8 Linking the Statements (Video Length: 15:17) You will learn why a bank’s 3 financial statements link together differently from a normal company’s in this lesson, and see how to balance the balance sheet with the federal funds sold and federal funds purchased line items. 2.9 Capital Adequacy Calculations (Video Length: 27:00) In this lesson, we’ll project JP Morgan’s risk-weighted assets, Tier 1 Common Capital, Tier 1 Capital, Tier 2 Capital, Total Capital, and Tier 1 Leverage based on the derivation in their SEC filings. You’ll also learn how the definitions for many of these items are far messier in the real world than they are in theory. 2.10 Dividends Issued & Shares Repurchased (Video Length: 31:43) Once we know JP Morgan’s capital levels, we can back into the amount of dividends they can issue and the share repurchases they can make each year – and that’s what you’ll learn how to do in this lesson. You’ll see why this calculation is inherently circular and how to link these numbers to the rest of our model. 2.11 Operating Model Summary (Video Length: 25:50) When an MD is breathing down your neck to understand what a company is doing, you can’t give him a 50-page Excel printout – you need a summary, which is what you’ll learn to create here. www.BreakingIntoWallStreet.com You will calculate key metrics such as ROE, ROA, and Tangible Book Value here that will lead us directly into the valuation of JP Morgan. Module 3: Bank Valuation In this module, you will create a full-fledged valuation model for JP Morgan based on public company comparables, precedent transactions, and dividend discount and residual income models. We’ll begin with an overview of how relative and intrinsic valuation is different for banks, and then learn how to select comps and transactions and which metrics and multiples to use for banks. Next, we’ll go into the dividend discount model and you’ll learn different approaches for calculating the present value of equity, including a complex model based on JP Morgan’s real data and a simplified one you can use in interviews. Finally, we’ll conclude with a residual income (excess returns) model and you’ll learn the intuition behind the model as well as how to build a complex model for JP Morgan and a simplified version you can use for interviews. Resources: Completed JP Morgan Operating Model & Valuation Bank Valuation – Quick Reference Guide 3.1 Valuation Overview (Video Length: 16:02) In this lesson, you’ll learn why traditional valuation multiples and methodologies such as the DCF do not apply to banks – and the strategies that we’ll be using in their place to complete a full valuation of JP Morgan. 3.2 Public Company Comparables (Video Length: 25:30) This video will show you how to select comparable public companies for JP Morgan based on a list of the largest banks in the US, and we’ll go through several examples of how to pull the relevant operating metrics from filings and equity research and how to calculate valuation multiples for Bank of America, Citigroup, and Wells Fargo. 3.3 Precedent Transactions (Video Length: 11:53) We’ll shift our focus to precedent transactions in this lesson, and you’ll learn how to find M&A transactions based on research by PricewaterhouseCoopers and how to narrow down an appropriate list based on industry and size criteria; you’ll also see why financial crisis M&A deals such as JPM / Bear Stearns and BoA / Merrill Lynch are problematic to use. 3.4 Dividend Discount Model – Overview and Assumptions (Video Length: 24:52) www.BreakingIntoWallStreet.com In this lesson, you’ll learn the intuition behind a multi-stage dividend discount model and how we use dividends as a proxy for free cash flow for a bank. You’ll also learn how to set up the key assumptions and how we use risk-weighted assets and return on tangible common equity to drive the model. 3.5 Dividend Discount Model – Cost of Equity (Video Length: 11:08) You’ll learn how the cost of equity calculation is different for banks in this lesson, and why we don’t have to worry about un-levering and re-levering Beta; you’ll also see how we can use equity research as a benchmark for what cost of equity should be. 3.6 Dividend Discount Model – Calculating Dividends Issued and Present Value (Video Length: 20:05) In this lesson, we’ll go through the most important part of a dividend discount model – the circular calculation required to estimate dividends issued based on a minimum Tier 1 Common ratio. You’ll also learn several methods you can use to calculate the terminal value and how to tie everything together to calculate the present value of equity for JP Morgan. 3.7 Dividend Discount Model – Sensitivity Tables (Video Length: 16:09) This video will show you how to arrive at JP Morgan’s implied per-share price and the key variables to use in sensitivity tables that allow you to analyze its valuation under different assumptions. 3.8 Simplified Dividend Discount Model (Video Length: 25:13) In this lesson, we’ll take a step back and look at a more simplified dividend discount model that eliminates some of the complexity introduced when we analyze a large bank like JP Morgan. You’ll also learn how to construct a model based on ROA rather than ROE and how everything changes as a result. 3.9 Residual Income Model – Overview (Video Length: 25:59) You’ll learn the intuition behind a residual income (excess returns) model in this lesson, and how it’s very similar to how you would assess the value of a house. You will also learn how to modify the dividend discount model to support a multi-stage residual income analysis instead. 3.10 Residual Income Model – Calculating Excess Returns (Video Length: 20:52) In this video, we’ll finish up the residual income model by calculating excess returns based on ROE and Cost of Equity – you’ll also learn how to calculate the present value of equity in a residual income model, including the terminal value calculation and why “terminal value” is often unnecessary for this type of model. 3.11 Simplified Residual Income Model (Video Length: 20:07) www.BreakingIntoWallStreet.com We’ll step back from the traditional, complex residual income model here and instead focus on a model you might use when preparing for interviews – and you’ll learn how a few quick modifications to the simplified dividend discount model lead to a simplified residual income model. 3.12 Valuation Summary (Video Length: 22:02) We’ll conclude the valuation in this lesson by creating the traditional “football field” graph and comparing all the valuation methodologies, including advantages and disadvantages of each one and why you might use or not use various methods to value a bank. Module 4: Bank Merger Model You’ll create a detailed merger model for two commercial banks in this lesson as we look at JP Morgan’s hypothetical acquisition of SunTrust Banks – a regional bank based in the Southeastern part of the US. We’ll begin by creating an operating model for SunTrust and then jump into the key assumptions and setup for a bank merger model – and you’ll learn how it is fundamentally different from a merger model for two normal companies. You’ll then learn how to factor in bank-specific acquisition effects, such as the creation of core deposit intangibles and deposit divestitures, and also how to account for the impact of cost synergies and restructuring on the combined company’s financial statements. Next, we’ll allocate the purchase price and make pro-forma adjustments to the combined company’s balance sheet, federal funds requirements, and regulatory capital and you’ll learn how to adjust dividends to meet the target capital requirements as well as how to create a combined income statement. Finally, we’ll conclude by providing commentary on the JP Morgan / SunTrust deal via a relative contribution analysis, an internal rate of return (IRR) calculation, sensitivity tables, and a transaction summary page. Resources: Completed JP Morgan / SunTrust Operating Model, Valuation & Merger Model JP Morgan 10-K Filing SunTrust 10-K Filing SunTrust Equity Research – Credit Suisse 4.1 Bank Merger Model – Overview and Key Differences (Video Length: 20:10) In this lesson, you'll learn why the bank merger model is important, what it can tell us about bank M&A deals, the key differences between bank merger models and merger models for normal companies, and how we'll approach the JP Morgan / SunTrust M&A case study. 4.2 Changes to Operating Model (Video Length: 11:23) www.BreakingIntoWallStreet.com In this video, we'll show you how the model has changed compared to the JPM operating model and valuation in order to support the merger model we are constructing. You'll also learn some of the key assumptions required to project SunTrust's financial statements. 4.3 SunTrust – Balance Sheet Projections (Video Length: 28:34) You'll learn how to project SunTrust's balance sheet and determine the proper growth rates for loans, deposits, and related items based on historical performance and equity research projections in this lesson. 4.4 SunTrust – Interest-Earning Assets & Interest-Bearing Liabilities (Video Length: 17:34) In this video, you'll learn how to pull in line items from SunTrust's balance sheet to forecast its interestearning assets and interest-bearing liabilities, and how to properly project the interest rate spread to determine its net interest income. You'll also learn one important factor we must take into account when making projections for the seller in a bank merger model. 4.5 SunTrust – Income Statement Projections (Video Length: 25:36) This lesson will teach you how to project SunTrust's income statement and calculate its Net Income and Net Income to Common – and how the projections differ from JP Morgan’s financial statements in the operating model module. 4.6 Linking the Statements & Regulatory Capital (Video Length: 26:34) In this video, you'll learn how to calculate SunTrust's Tier 1 Capital, Tier 1 Common Capital, and other regulatory capital ratios – and how to use these requirements and its Net Income to determine the maximum allowable dividends that can be issued each year. 4.7 Transaction Assumptions and Sources & Uses (Video Length: 16:34) You'll learn how to set up the transaction assumptions for the JP Morgan / SunTrust acquisition here, and how to determine the financing structure and the implied exchange ratios. 4.8 Core Deposit Intangibles (Video Length: 22:17) In this lesson, you'll learn what Core Deposits and Core Deposit Intangibles mean and why they get created in a bank M&A deal. You'll also learn how to estimate the Core Deposit Intangible balance and how to take into account the after-tax impact of amortization and writing off existing intangibles. 4.9 Cost Synergies (Video Length: 12:44) This video will teach you how to estimate the cost synergies in a bank merger model, and how to recognize the cost savings and associated restructuring expense over time. 4.10 Deposit Divestitures (Video Length: 17:27) www.BreakingIntoWallStreet.com In this lesson, you'll learn why banks are often required to divest deposits in M&A deals due to federal regulations; you'll also learn how to estimate the lost Net Income and the Net Income benefit from a deposit divestiture, and how it affects the pro forma balance sheet. 4.11 Calculating the Restructuring Funding Expense (Video Length: 8:51) You'll learn how to estimate the cash and non-cash portion of the restructuring expense each year, and how to estimate the after-tax impact of funding this restructuring expense in this lesson. 4.12 Purchase Price Allocation (Video Length: 12:06) In this video, you'll learn how purchase price allocation differs in bank merger models; you'll also understand how to factor in items like Core Deposit Intangibles, the Restructuring Reserve, and Deferred Tax Liabilities. 4.13 Pro-Forma Combined Balance Sheet (Video Length: 40:05) In this lesson, we'll combine the balance sheets of the buyer and seller and make all the required transaction adjustments – we will also project the combined balance sheet and balance it properly while taking into account the transaction adjustments. 4.14 Federal Funds Sold and Federal Funds Purchased Differential (Video Length: 10:28) You will balance the combined balance sheet in this lesson by adjusting the federal funds sold and federal funds purchased line items to reflect additional or reduced funding; you'll also learn how to estimate the after-tax income statement impact of this federal funds differential. 4.15 Pro-Forma Combined Regulatory Capital (Video Length: 25:14) In this lesson, you'll learn how to combine Tier 1 Capital and Tier 1 Common for JP Morgan and SunTrust, and how the acquisition effects and deposit divestitures change the numbers. You will also learn why we need to analyze this separately and how it affects the combined company's dividend and stock repurchase levels. 4.16 Pro-Forma Combined Dividends (Video Length: 15:23) We'll adjust the combined company's dividend levels in this lesson to correspond to the new levels of regulatory capital and the new target Tier 1 Common ratio in this lesson – and you'll learn how to account for the cost of funding these additional dividend issuances. 4.17 Combining the Income Statements (Video Length: 21:57) You'll learn how to combine the income statements of the buyer and seller in this lesson, as well as how to adjust for the tax rate differential, acquisition effects, and additional shares issued – and how the key accretion / dilution metrics differ from what you see for normal companies. 4.18 Relative Contribution Analysis (Video Length: 16:50) www.BreakingIntoWallStreet.com In this lesson, you'll learn what the purpose of a contribution analysis is, how to set it up and calculate the implied exchange ratios and per share purchase prices for two banks, and what the results tell us about JP Morgan's offer price for SunTrust Banks. 4.19 Calculating the Internal Rate of Return (IRR) (Video Length: 20:01) You will understand why the IRR of an acquisition often matters more than accretion / dilution to a large bank, and you'll practice calculating JP Morgan's return on SunTrust Banks in this video. You will also learn the 3 different ways that the acquisition of another bank can generate a return on investment for an acquirer. 4.20 Sensitivity Tables (Video Length: 27:03) In this lesson, you'll create sensitivity tables for this hypothetical JP Morgan / SunTrust deal and learn which variables impact the EPS and BVPS accretion / dilution the most, as well as which variables we should NOT analyze. 4.21 Summary Page (Video Length: 16:17) In this video, we'll go through an M&A Transaction Summary page that presents the key operational, valuation, and transactional data and you'll learn how to present a bank M&A deal to Partners and MDs so that they can understand it at a glance. Module 5: Bank LBO Model You will learn how to create a “bank LBO model” – really just a buyout model – in this module, and why the traditional LBO framework does not apply to commercial banks. Once we explain an alternative approach to private equity buyouts of depository institutions, we’ll go through the key assumptions and model drivers when contemplating the acquisition of a fictional bank. Then, you’ll learn how to allocate the purchase price, create a Sources & Uses schedule, adjust the balance sheet and regulatory capital, and project the income statement in a bank buyout. We’ll conclude by calculating the internal rate of return (IRR) and creating sensitivity tables so that you can see how key variables such as the Return on Equity improvement, purchase price, and exit multiple expansion impact the feasibility of the deal. Resources: Completed Bank Buyout Model 5.1 Why Traditional LBO Models Don’t Work for Banks and What to Do Instead (Video Length: 20:19) In this introductory lesson, you'll learn why the standard leveraged buyout framework does not apply to commercial banks, why buyouts of depository institutions are so rare, and how a private equity firm can realize high returns when acquiring a bank – without using leverage in the traditional sense. www.BreakingIntoWallStreet.com 5.2 Assumptions & Setup (Video Length: 12:54) You will learn how to set up a bank buyout model in this lesson – including how to determine the purchase price and exit multiple, how to pick the key model drivers such as gross loan growth, ROE improvement, and the Tier 1 Common Ratio, and how the assumptions differ from what you see in an LBO of a normal company. 5.3 Sources & Uses and Purchase Price Allocation (Video Length: 5:13) In this lesson, you'll learn how to create a Sources & Uses schedule for a bank buyout, and how to allocate the purchase price and determine the new goodwill and intangible asset numbers based on the bank's pre-transaction balance sheet. 5.4 Pro-Forma Balance Sheet (Video Length: 12:15) You'll learn how to adjust a bank's balance sheet and how to properly reflect the premium that a PE firm pays to take a bank private in this lesson. You will also understand how to adjust a bank's balance sheet going forward based on the transaction and operating assumptions. 5.5 Pro-Forma Regulatory Capital (Video Length: 9:25) In this video, you'll learn how a commercial bank's regulatory capital ratios change in a buyout, and how to calculate the new Tier 1 Common and Tier 1 Capital levels once all acquisition effects have been taken into account. 5.6 Income Statement Projections (Video Length: 13:36) In this lesson, you'll learn how to project a bank's income statement in a buyout scenario and how to factor in the ROE improvement the private equity firm achieves, as well as how to project dividends and how to link everything to the projected balance sheet. 5.7 Calculating the Internal Rate of Return (IRR) (Video Length: 11:20) You will learn how to calculate the internal rate of return (IRR) to the private equity firm in a bank buyout and how different methods of calculating the exit P/BV multiple, the ROE improvement, and dividends impact the 5-year returns; you'll also learn why bank buyouts can work even when you do not use leverage. 5.8 Sensitivity Tables (Video Length: 16:54) In this lesson, you'll learn how to analyze the variables that have the greatest impact on IRR in the bank buyout model, and why we see counterintuitive behavior with model drivers such as the per share purchase premium; you will also learn how our results compare to the expectations of FIG bankers as laid out in a report on PE activity in the financial services sector. www.BreakingIntoWallStreet.com Module 6: Insurance Overview You’ll get a crash-course in all things insurance in this set of lessons. We begin by explaining the business model of insurance companies and then walk through accounting, the financial statements, and valuation. We start off by showing you how premiums work, from Gross Written Premiums down to Ceded and Assumed Premiums and Net Written Premiums and Net Earned Premiums. On the expense side, we then walk you through key concepts such as the Loss & LAE Ratio, the Loss Reserve, and Deferred Acquisition Costs. After that, we’ll delve into the financial statements of 2 real insurance companies – MetLife (Life) and Travelers Companies (P&C) – and you’ll learn how to construct a 3-statement operating model for a brand-new insurance company. Finally, you’ll learn about valuation for both P&C and Life Insurance companies and you’ll see how to apply comps, valuation multiples, and intrinsic valuation. We’ll also cover how methodologies such as the dividend discount model work differently, and how to use insurance-specific methodologies such as Embedded Value. Resources: Completed P&C Insurance Operating Model Insurance Key Terms (from Travelers Companies’ Filings) Travelers Companies – 10-K Filing, Financial Statements, and Equity Research MetLife – 10-K Filing, Financial Statements, and Equity Research 6.1 Insurance Financial Modeling: Overview (Video Length: 29:02) In this lesson, you'll learn how insurance companies differ from both commercial banks and normal companies – and what they have in common. You'll also understand how they make money and the key differences when modeling and valuing insurance companies. 6.2 Insurance Overview – Premiums and Revenue Recognition (Video Length: 47:59) You’ll learn how to derive Net Earned Premiums (NEP), Ceded Premiums, Assumed Premiums, and Reinsurance terms for the income statement in this lesson. You'll also understand how to move from Direct Written Premiums (DWP) down to Net Earned Premiums (NEP) and how revenue recognition and the Unearned Premium Reserve work. 6.3 Insurance Overview – Losses, Expenses, and Key Metrics (Video Length: 53:28) In this video, you'll learn about the key expenses for insurance companies and how Losses & LAE Incurred vs. Paid, the Loss & LAE Reserve, and Deferred Acquisition Costs work. You will also learn key insurance metrics and ratios, such as the Loss Ratio, the Expense Ratio, and the Combined Ratio. 6.4 Insurance Overview – Financial Statements (Video Length: 30:58) www.BreakingIntoWallStreet.com You'll learn how an insurance company's financial statements differ from those of a normal company in this lesson, and how Life Insurance and P&C Insurance statements differ via an analysis of Travelers Companies' and MetLife's statements. 6.5 Insurance Overview – Operating Model Part 1: Premiums and Commissions (Video Length: 21:57) In this lesson, we'll project the gross and net premiums as well as the commissions and DAC asset for a brand-new insurance company – and you'll learn how to make the key assumptions that drive the rest of the operating model. 6.6 Insurance Overview – Operating Model Part 2: Losses and Expenses (Video Length: 13:20) You'll learn how to project the Loss & LAE Ratio based on inflation and policy rate growth, as well as how to project the cash losses paid out and the loss reserves in this lesson. You'll also learn how to simplify the loss projections over the normal loss triangle you create. 6.7 Insurance Overview – Operating Model Part 3: Income Statement (Video Length: 7:46) In this video, we'll project the insurance company's income statement and you'll learn how to link together the premiums, underwriting expenses, and investment and interest income / expense and calculate everything down to the net income line item. 6.8 Insurance Overview – Operating Model Part 4: Balance Sheet and Cash Flow Statement (Video Length: 15:19) You'll learn how to link together the "grossed up" balance sheet and cash flow statement for the insurance company in this lesson, and you'll see how the completed statements affect the income statement and previous supporting schedules. 6.9 Insurance Overview – Operating Model Part 5: Statutory Accounting and Key Ratios (Video Length: 28:21) In this lesson, you'll learn the motivation for statutory accounting and how it differs from GAAP / IFRS accounting; you will also learn how to calculate key metrics and ratios for insurance companies and what those numbers tell you about their performance and valuation. 6.10 Insurance Overview – Valuation and Key Multiples (Video Length: 28:38) You'll learn the key relative and intrinsic valuation methodologies for insurance companies in this lesson, including valuation multiples and concepts such as embedded value and the dividend discount model; you'll also learn how valuation differs for P&C vs. Life Insurance companies. 6.11 Insurance Overview – P&C Insurance Relative and Intrinsic Valuation (Length: 36:53) In this video, we'll walk through several examples of how to value P&C Insurance companies - public comps and the appropriate multiples, the dividend discount model using solvency ratios, and the Net Asset Value (NAV) model. www.BreakingIntoWallStreet.com 6.12 Insurance Overview – Embedded Value for Life Insurance (Video Length: 29:07) You'll learn what Embedded Value is, why it applies to Life Insurance companies, and how to calculate it over a 20-year policy term as well as for a new insurance company with shorter policy terms in this lesson; you'll also learn why EV and NAV converge on the same value for a single year of policies. 6.13 Insurance Overview – P&C vs. Life Insurance (Video Length: 20:06) In this final overview lesson, we'll walk through how P&C and Life Insurance companies differ – from their business models to their accounting and financial statements to their valuation metrics and multiples. We’ll also review the key concepts taught in the previous 12 overview lessons of the module. Instructor Interaction and Your Questions… Answered You don’t just get tons of videos, transcripts, Excel files, and quick reference guides with this course. You also get to ask questions on anything you don’t understand – whether it’s an entire course, just one lesson, or just one sentence of one question. We have a team (you can read more about everyone here) who is on call to answer questions 365 days per year – and you can access all previous questions and answers from the thousands who have already signed up for the course. You’re looking at accessing not only years of wisdom and questions and answers all in one spot, but also the ability to get new answers on anything you need – even if it’s Christmas or New Year’s Day. Some of our lessons have dozens (or more) of questions and answers, and more are being added every day: I no longer even offer 1-on-1 consulting, and the last time I did offer it, the price was over $300 per hour. And even when you had hired me for a session, you couldn’t ask questions 24/7 and receive responses on any topic you could think of – our time was limited to the session itself. This support function and the superb community of Breaking Into Wall Street mean that you get an even better deal – it’s like getting a detailed guide, hiring a seasoned coach to answer your questions, and getting to access the experience of thousands of previous and current students. www.BreakingIntoWallStreet.com What Are Your Alternatives? And What’s Your Investment In This Course? There are only two other companies offering courses for bank and/or insurance modeling: Wall Street Prep Advanced Bank Modeling: $399 Wall Street Training Bank Financial Modeling + Insurance Financial Modeling: $1500 I’ve personally been through both courses above. They certainly cover some good material, but they also have a few shortcomings: Wall Street Training includes nothing on valuation, merger models, or LBO models – that’s over 50% of interview questions right there. And while the insurance course is good, there’s nothing on Life Insurance companies, which are much different from P&C Insurance companies. Wall Street Prep includes nothing on Dividend Discount Models or public comps / precedent transactions, merger models, or LBO models and does not include the loan portfolio and loan loss reserves in the bank operating model projections. And there’s nothing on insurance companies. There’s no Certification Quiz in either course, so you can’t test your knowledge or prove to employers what you learned. With the Breaking Into Wall Street version: You get more material – overview, accounting, regulatory capital, operating model, and full valuation all based on a case study of JP Morgan and SunTrust Banks. Plus, you get insurance lessons that teach you all the fundamentals, how to create an operating model for a new insurance company, and how to value it. Everything has been designed for online, interactive learning, from the ground up – these are not re-hashed classroom training seminars. Everything is downloadable, in multiple formats, so you can take your training with you wherever you are. It comes with our famous 100% No Hassle 12-Month Money Back Guarantee. And you get to take our challenging Certification Quiz – if you score above 90%, you’ll receive a Certificate that you can use to prove to employers what you learned in the course. All for an investment of just $347 (rather than $399 or $1,500 for the other, less complete courses). ...So you pay significantly LESS for MORE content, lessons, and more in-depth material. www.BreakingIntoWallStreet.com I actually thought about raising the price because this is extremely specialized content – good luck finding these lessons in standard finance books or via Google searches (I tried many times and failed – that’s why most of the material comes directly from FIG bankers instead!). And $347 is still a big discount to the other courses above – this is specialized information that makes you far more valuable than if you simply knew basic accounting and valuation for other industries. But More Importantly… What’s the Return On Investment in This Course? As Warren Buffett says, “Price is what you pay. Value is what you get.” The price is $347, but what’s the value of your investment? Let’s run the numbers… The pay for entry-level investment banking jobs varies from year to year, but it's safe to say that even entry-level Analysts would make at least $100,000+ USD right out of university. At the MBA level, that climbs to $200,000 USD. And as you progress, your total compensation only gets higher and higher. By investing $347 in this highly-specialized Course, you’re doing several things, all at the same time: Gaining extremely specialized knowledge in a field where there’s always high demand for people who know what they’re doing. Differentiating yourself from other candidates – even the very best ones with the top academic pedigrees and high grades. Proving beyond doubt to potential employers that you’re someone who is prepared to go “above and beyond” to be the best and get results…which is exactly the type of person finance firms love to hire. You’re setting yourself up for a job that pays a minimum of $100,000 – that's more than 250x return on investment. (Good luck getting that in the stock market!) Even if we’re super-conservative and assume that you only have a 10% chance of landing the job after going through this Course, that’s still a 28x ROI for you. Plenty of other training firms would charge you thousands of dollars for this same content, but why bother when you get a much higher ROI from your investment with us? Plus, You Get A No-Hassle Money-Back Guarantee Just like every one of the BIWS products and courses, this comes with our unconditional 12-month money back guarantee. www.BreakingIntoWallStreet.com That’s right – take a full 12 months to evaluate everything inside the Course, and if you’re not 100% satisfied, simply contact us via the “Contact” link displayed on every page of the site and ask for your money back. You’ll receive a prompt and courteous refund. There are no strings attached, no special terms or conditions, and no fine print. Here’s What Happens Within Minutes Of You Signing Up Once you sign up, you’ll immediately have access to the 71 instructional videos, all the Excel files and quick reference guides, and the complete curriculum. And you’ll have access to our team to ask whatever questions you have. With that comes lifetime access, free upgrades, new content as we add it, and expert support. Click Here to Sign Up Now for The BIWS Bank & Financial Institution Modeling Course Best Regards, Brian DeChesare Mergers & Inquisitions Breaking Into Wall Street Pssst! Here’s An “Even Better” Offer What’s even better value than this industry-specific financial modeling course? The Industry-Specific Financial Modeling Course Bundle. With the bundle, you get the following three components, at a deep discount to the regular price: Oil & Gas Modeling Course Bank & Financial Institution Modeling Course Real Estate & REIT Modeling Course (Including all bonuses, expert support, immediate access and a 12-Month Money-Back Guarantee on everything…) all for just $697 (savings of $344). Knowledge and skill in these three specialized disciplines will truly set you apart from the pack, and I promise you – they will never be offered at a lower price than this. Click Here to Sign Up Now for The Industry-Specific Financial Modeling Course Bundle www.BreakingIntoWallStreet.com