Taxation of U.S. Expatriates

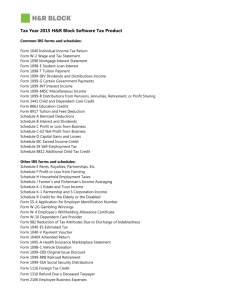

advertisement