Insurance and insurance activities

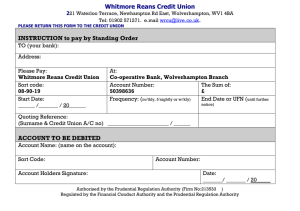

advertisement