Business Models and their Elements - HEC

advertisement

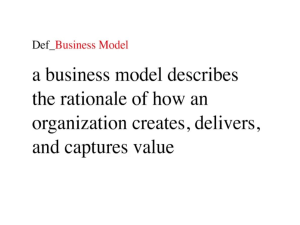

Business Models and their Elements Position Paper for the International Workshop on Business Models, Lausanne, Switzerland, 4-5 October 2002 Alexander Osterwalder & Yves Pigneur alexander.osterwalder@hec.unil.ch yves.pigneur@hec.unil.ch 1 WHAT IS A BUSINESS MODEL? In our view the term Business Model (BM) stands for a conceptual tool that contains a set of elements and their relationships and allows to express the business logic of a specific firm. Slywotzky (1995) calls this business design and understands it as the totality of how a company selects its customers, defines and differentiates its offerings, defines the tasks it will perform itself and those it will outsource, configures its resources, goes to market, creates utility for customers, and captures profit. It is the entire system for delivering utility to customers and earning a profit from that activity. This definition illustrates very nicely that most people speak about BMs when they really only mean parts of a it (Linder and Cantrell, 2001). When some authors speak of the "auction BM", the "advertising BM", the "subscription BM" and so on, they are wrong in the sense that these are merely instances of a specific (but dominant) element of a BM, in this case the pricing and the revenue model. But by using such a narrow view of BMs, most of the advantages of a more conceptual and global approach are lost. By using a theoretical and generic framework to describe BMs, one can easily capture, understand, share (Petrovic and Kittl, 2001), observe over time, and, maybe even measure and simulate BMs (Osterwalder and Pigneur, 2002;). They are a new unit of analysis and interesting tool for innovation (Stähler, 2001). A company's intrinsic Business Model (BM) must be understood as an instance of the more theoretical idea of the concept of BMs. 2 BUSINESS MODEL FRAMEWORK Slywotzky's description can be broken down in few simple pillars outlined by Markides (1999), which are the "what", the "who" and the "how" of a business, to which we would also add the "how much". In other words, these pillars allow to express what a company offers, who it targets with this, how this can be realised and how much can be earned by doing it. Such a schematic description of the company's business system can serve as a basis for discussion or as a plan for implementation. The Business Model Framework (BMF) outlined in this paper is a generic model with which companies can express the business logic of their firm or even the one of their competitors. The framework we subsequently present is composed of a set of objects that relate to each other and that can be classified among the four categories mentioned above. 2.1 WHAT? Product Innovation PRODUCT INNOVATION (PI) covers all aspects of what the firm offers its customers. This comprises not only the company's bundles of products and services but the manner in which it differentiates itself from its competitors. Product innovation is composed of the VALUE PROPOSITION (VP), which can be decomposed into its VALUE BLOCKS (VB). Each one of these blocks has a Description and the attributes Reasoning, Life Cycle, Value Level, Price Level and Categorization. Figure: Value Proposition Description: This attribute simply describes a bundle of products and services that together form a coherent value proposition Reasoning: This attribute captures the reasoning on why the firm thinks its VP could be valuable to the customer. Normally value is created either through use (e.g. driving a car), reduction of the customer's risk (e.g. car insurance) or by making his life easier through reduction of his efforts (e.g. home delivery of groceries). Life Cycle: This attribute captures at which one of the five stages of the value life cycle the VP creates value. This can be at the moment of the value creation (e.g. customization), its purchase (e.g. Amazon's one-click shopping), its consumption (e.g. listening to music), its renewal (e.g. software updates) or its transfer (e.g. disposal of old computers, selling of used books). Value Level: This attribute compares the VPs value level to the one of the competition's. The scale goes from me-too (e.g. commodities), over imitation (e.g. pocket pc) and innovation (e.g. Viagra in the 90's) to perfection (e.g. Swiss watches). Price Level: This attribute compares the VPs price to the one of the competition's. The scale goes from free (e.g. online newspapers) over economy (e.g. Southwest, EasyJet, RyanAir) and market (e.g. stocks) to high-end (e.g. Rolex). 2.2 WHO? Customer Management CUSTOMER MANAGEMENT (CM) covers all customer related aspects. This includes the definition of target customers, the means to reach and communicate with him, as well as the relational strategy the firm aims to establish with the customer. 2.2.1 Target Customer A firm generally creates value for a specific TARGE CUSTOMER (TC) segment. We distinguish between more traditional marketing segmenting (e.g. middle-class working mother) and the relatively recent concept of communities of interest (Hagel and Armstrong, 1997). Figure: Target Customer 2.2.2 Channels CHANNELS (CH) refer to the way a firm “goes to market” and how it actually “reaches” its customers (Hamel, 2000). ICT has had an important impact on channels by increasing the range of them and making new ways of reaching the customer possible. The process of eliminating middlemen (disintermediation)(Benjamin and Wigand, 1995), shortening channels (direct selling), introducing new mediation (cybermediaries)(Sarkar et al., 1995) or cross-channel selling have made channel management increasingly complex and indispensable. The expansion of the range of channels has also multiplied the potential conflicts between channels (Anderson et al., 1998). A channel can be decomposed in its elements that we call LINK (LI). Each one of these Links has a Description and the attributes Reasoning and Customer Buying Cycle. Figure: (Distribution) Channel Description: This attribute simply describes the function and nature of the Link. Reasoning: This attribute captures the reasoning on why the firm thinks this part of the channel is necessary to get in touch with the customer. Life Cycle: This attribute captures to which one of the four stages of the customer buying cycle the L belongs to. This can be the awareness phase (e.g. getting the customers attention through advertising), the evaluation phase where the customer compares his needs to the company's offer (e.g. limited software trial), the purchase (e.g. online or offline transaction) or the after-sales phase (e.g. troubleshooting and maintenance). 2.2.3 Customer Relationship When "getting in touch" with the customer the firm automatically establishes a certain CUSTOMER RELATIONSHIP (CR). This can be a first time relationship (e.g. customer acquisition), an existing relationship (e.g. customer retention, add-on selling), or a one time relationship (e.g. transaction). ICT has an important role to play in managing CR because it provides the tools for the relationship MECHANISMs of which a CR is composed of. Personalization (e.g. Amazon's book recommendations)(Piller et al., 2000), trust (e.g. the TRUSTe label, eBay's escrow service or SGS's certification and verification)(Friedman, 2000; Dimitrakos, 2001) or security (e.g. encryption). Figure: Customer Relationship 2.3 HOW? Infrastructure Management INFRASTRUCTURE MANAGEMENT (IM) covers all elements related to the configuration of activities and resources between the firm and its partners in order to create value and reach the customer. 2.3.1 Capabilities and Resources A firm has to ensure that it disposes of the necessary CAPABILITIES (CA) to deliver its value proposition (e.g. home delivery of small quantities for online retailers)(Bagchi and Tulskie, 2000; Wallin, 2000). CA are based on a range of RESOURCES (RE) that can be owned by the firm or a partner organization. Figure: Capabilities and Resources 2.3.2 Value Configuration This value proposition of a firm is the outcome of a VALUE CONFIGURATION (VC) of in-house and outsourced activities and processes (see also Gordijn et al., 2001). This configuration can take the form of a value chain (Porter et al., 1985), a value shop or a value network (Stabell et al., 1998). Its ACTIVITIES (AC) have a Description and the attributes Reasoning and Categorization. Description: This attribute simply describes the function and nature of the AC. Reasoning: This attribute captures the reasoning on why the firm thinks this part of the VC is necessary to create value. Figure: Value Configuration 2.3.3 Partnership PARTNERSHIPS (PA) help firms leverage their core competencies. By concentrating on what they do best and partnering for most other activities a company can lower its costs and strengthen its market position. PAs can take different forms, such as integrated relationships (e.g. Collaborative Planning, Forecasting and Replenishment (CPFR) at WalMart), buy-side online platforms (e.g. Nestlé, Danone and Henkel's CPGmarket.com) or service contracting (e.g. Seafax's industry-wide credit reporting for the seafood industry). Partnerships are based on a range of AGREEMENTs (AG). Figure: Partnership 2.4 HOW MUCH? Financial Aspects The FINANCIAL ASPECTS are the culmination of a business model. The neatest VP and the finest CR are only worth being maintained if they guarantee a long-term financial success to the company. This simply means that the revenue model and the costs have to be in balance in order to make a profit possible. 2.4.1 Revenue Model A sound business model is one in which a firm can translate its VP into a range of REVENUE STREAMS (RS) from its customers. A RS can have a set of different PRICING (PR) mechanisms. The new pricing mechanisms enabled by ICT should be used in order to maximize revenues. Particularly the Internet has had an important impact on pricing and has created a whole new range of pricing mechanisms (e.g. auctions, pay-peruse, yield management)(Klein and Loebbecke, 2000). Figure: Revenue Model 2.4.2 Cost structure The COST STRUCTURE (CS) measures all the costs the firm has to incur to create, market and deliver the VP. It sets a price tag on all the resources, assets, activities and partner network relationships and exchanges that cost the company money. These costs are booked in the firms ACCOUNTS. Figure: Cost Structure 3 CONCLUSION The generic BM framework provided in this paper allows a company to seize the logic of its business. It can capture the different elements of its BM in a more formal way. By doing this it will better understand its business, will be able to share this understanding among stakeholders, can easily observe its BM over time, can better define a range of indicators to follow and can create a portfolio of scenario BMs it might want to pursue in the future. 4 BIBLIOGRAPHY Anderson, E., Day, G.S., Rangan, V.K. (1998) Strategic Channel Design, Journal of Product Innovation Management, Volume 15, Issue 5, September 1998, pp. 472-473. Bagchi, S., Tulskie, B. (2000) e-business Models: Integrating Learning from Strategy Development Experiences and Empirical Research, 20th Annual International Conference of the Strategic Management Society, Vancouver, October 15-18. Benjamin, R.I., Wigand, R.T. (1995). Electronic Commerce: Effects on Electronic Markets, Journal of Computer-Mediated Communication 1 (3). Dimtrakos, T. (2001) System Models, e-Risk and e-Trust, Towards the E-Society, IFIP Conference on E-Commerce, EBusiness and E-Government, Dordrecht: Kluwer Academic Publishers Group. Friedman, B., Kahn, P., Howe, D. (2000) Trust Online, Comm. ACM, 43 (12) pp. 34-40. Gordijn, J., J. Akkermans, J. van Vliet (2001). Designing and Evaluating E-Business Models, IEEE Intelligent Systems, July/August 2001, Vol. 16, No. 4, pp. 11-17 Hagel, J., Armstrong, A. (1997) Net Gain - Expanding Markets through Virtual Communities, Boston: Harvard Business School Press. Hamel, G., (2000). Leading the revolution, Boston: Harvard Business School Press. Klein, S., Loebbecke, C. (2000) The transformation of pricing models on the web: examples from the airline industry, 13th International Bled Electronic Commerce Conference, Bled, June 19-21 Linder, J.C, Cantrell, S. (2001) Changing Business Models: Surveying the Landscape, Working Paper, Institute for Strategic Change, Accenture. Markides, X. (1999) Boston: Harvard Business School Press Osterwalder, A., Pigneur, Y. (2002) An e-Business Model Ontology for Modeling e-Business, Proceedings of the Bled Electronic Commerce Conference, June 17 -19 Peterovic, O., Kittl, C., Teksten, R.D. (2001) Developing Business Models for eBusiness, International Conference on Electronic Commerce 2001, Vienna, October 31. – November 4. Piller, F.T, Reichwald, R., Möslein, K. (2000). Information as a Critical Success Factor for Mass Customization or: why even a customized shoe not always fits, ASAC-IFSAM 2000 Conference, Montreal, July 8-11. Porter, M., Millar, V. (1985) How Information Gives You Competitive Advantage. Harvard Business Review, 63 (4): pp. 149-160. Sarkar, M., Butler, B., Steinfield, C. (1995). Intermediaries and cybermediaries: a continuing role for mediating players in the electronic marketplace, Journal of Computer-Mediated Communication 1 (3). Slywotzky, X. (1995) Value Migration, Boston: Harvard Business School Press Stabell, C.B., Fjeldstad, O.D. (1998). Configuring value for competitive advantage: on chains, shops, and networks, Strategic Management Journal, 19: pp. 413-437. Stähler, P. (2001) Geschäftsmodelle in der digitalen Ökonomie: Merkmale, Strategien und Auswirkungen, Dissertation, University of St.Gallen HSG Wallin, J. (2000) Operationalizing Competencies, 5th Annual International Conference on Competence-Based Management, Helsinki, June 10-14 5 Figures Figure 1: Business Model Framework Figures 2-10: Business Model Components