2005 Estimated Dividend and Capital Gain distributions

advertisement

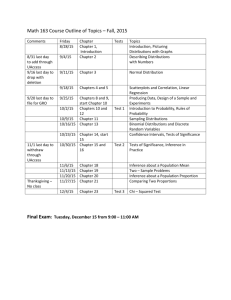

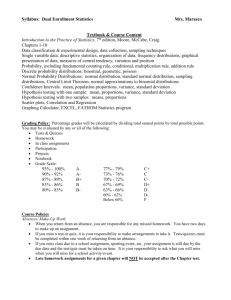

State Farm Mutual Funds® 2015 Estimated Dividend and Capital Gain distributions The following are the estimated distribution amounts per share for State Farm Mutual Funds®. These are estimates only and are subject to change. There is no guarantee that any Fund will pay dividends and/or capital gains. When distributions are paid, there is an effect on a fund’s net asset value (NAV) per share. The NAV is reduced by the amount of the distribution on the ex-dividend date. For example, if a mutual fund with a NAV of $10.00 per share were to pay a distribution of $1.00 per share, on the ex-dividend date the NAV would be $9.00 (reduced by $1.00). A fund’s NAV may also be impacted by market fluctuation on the ex-dividend date, so the actual change in a fund's NAV may be more or less than the distribution. Buying the dividend: There are times when it may not be in your best interest to purchase shares in a taxable account because the fund is about to declare a dividend. This may not only affect the price you pay for shares, but also generate income upon which you may have a tax liability. This is called buying the dividend. The following retail State Farm Mutual Funds are currently estimated to have no Capital Gains for 2015: International Equity Fund International Index Fund Money Market Fund Tax Advantaged Bond Fund Consult your tax or legal advisor for specific tax advice. State Farm Retail Mutual Funds Estimated Distributions – (Note: distributions may vary by share class) Equity Fund S&P 500 Index Fund Small/Mid Cap Equity Fund Small Cap Index Fund International Equity Fund International Index Fund Equity and Bond Fund Bond Fund Tax Advantaged Bond Fund LifePath® Retirement Fund6 LifePath 2020® Fund6 LifePath 2030® Fund6 LifePath 2040® Fund6 LifePath 2050® Fund6 Money Market Fund Estimated Income1 Per Share Estimated Capital Gain2 Per Share Total Estimated Distributions Per Share $0.01 – $0.11 $0.14 – $0.24 $0.01 – $0.05 $0.01 – $0.10 $0.01 – $0.07 $0.13 – $0.23 $0.02 – $0.12 N/A N/A N/A N/A N/A N/A N/A N/A $0.54 – $0.64 $0.01 – $0.07 $0.34 – $0.53 $0.69 – $0.89 $0.00 $0.00 $0.04 – $0.10 $0.011 – $0.065 $0.00 N/A N/A N/A N/A N/A N/A $0.55 – $0.65 $0.15 – $0.31 $0.35 – $0.58 $0.70 – $0.99 $0.01 – $0.07 $0.13 – $0.23 $0.06 – $0.22 $0.011 – $0.065 $0.00 N/A N/A N/A N/A N/A N/A Total Estimated Distributions as a Percent of 11/24/15 Legacy A Share NAV3 5.27% – 6.23% 0.94% – 1.93% 3.05% – 5.05% 4.40% – 6.22% 0.09% – 0.66% 1.14% – 2.02% 0.53% – 1.93% 0.10% – 0.58% N/A N/A N/A N/A N/A N/A N/A Projected Record Date4 Projected Ex-Dividend5 / Payable Date 12/22/2015 12/22/2015 12/22/2015 12/28/2015 12/24/2015 12/29/2015 12/24/2015 12/18/2015 12/18/2015 12/30/2015 12/30/2015 12/30/2015 12/30/2015 12/30/2015 12/18/2015 12/23/2015 12/23/2015 12/23/2015 12/29/2015 12/28/2015 12/30/2015 12/28/2015 12/21/2015 12/21/2015 12/31/2015 12/31/2015 12/31/2015 12/31/2015 12/31/2015 12/21/2015 State Farm Associates’ Funds Estimated Distributions – - Note: State Farm Associates’ Funds are only available to current State Farm associates and retirees. Estimated Estimated Total Estimated Total Estimated Income1 Per Capital Gain2 Per Distributions Per Distribution as a Share Share Share Percent of 11/24/15 NAV3 Growth Fund $0.77 – $0.87 $7.05 – $7.15 $7.82 – $8.02 10.59% – 10.86% Balanced Fund $0.79 – $0.89 $4.83 – $4.93 $5.62 – $5.82 8.43% – 8.73% Interim Fund N/A $0.00 $0.00 N/A Municipal Bond Fund N/A $0.00 $0.00 N/A Projected Record Date4 Projected Ex-Dividend5 / Payable Date 12/18/2015 12/18/2015 12/18/2015 12/18/2015 12/21/2015 12/21/2015 12/21/2015 12/21/2015 1 Income: Payments of dividends, interest, and/or short-term capital gains earned by the securities in the fund. 2 Capital Gain: A distribution to shareholders of profits realized from the sale of securities in a fund’s portfolio. Short-Term refers to securities held in a fund’s portfolio for 1 year or less; Long-Term refers to securities held in a fund’s portfolio for more than 1 year. 3 The distribution as a percent of NAV will vary based on the share class and the daily NAV. To calculate the percent, use the following formula: Total Estimated Distributions per Share Any day’s NAV for a chosen share class 4 Record Date: The date by which a shareholder must officially own shares in order to be entitled to a dividend. 5 Ex-Dividend Date: The first date that shares can be traded without the dividend included in the price. 6 LifePath Fund estimates will not be available, only actuals will be provided once distributions occur. To view the prior year’s actual distributions, go to www.statefarm.com, then click Finances > Mutual Funds > Investment Resources > Price, Performance and Distributions. Net Asset Value (NAV) is calculated by adding all of the assets of a Fund, subtracting the Fund’s liabilities, then dividing by the number of outstanding shares. LifePath Funds are target-date portfolios whose investment objectives are adjusted over time to be more conservative as the target date (date the investor plans to start withdrawing their funds) approaches. The principal value of the fund(s) is not guaranteed at any time, including at the target date. The stocks of small companies are more volatile than the stocks of larger, more established companies. Bonds are subject to interest rate risk and may decline in value due to an increase in interest rates Foreign investments involve greater risks than U.S. investments, including political and economic risks and the risk of currency fluctuations. Income may be subject to state and local taxes and (if applicable) the Alternative Minimum Tax. An investment in the Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. Before investing, consider the funds' investment objectives, risks, charges and expenses. Contact State Farm VP Management Corp (1-800-4474930) for a prospectus or summary prospectus containing this and other information. Read it carefully. Securities are not FDIC insured, are not bank guaranteed, and are subject to investment risk, including possible loss of principal. Neither State Farm nor its agents provide investment, tax, or legal advice. LifePath and LifePath followed by 2020, 2030, 2040 and 2050 are all registered trademarks of BlackRock Institutional Trust Company, N.A. Past performance is no guarantee of future results. AP2015/11/2092