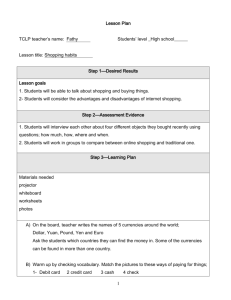

Online Grocery Shopping:

advertisement