Fund Manager Report - JS Investments Limited

advertisement

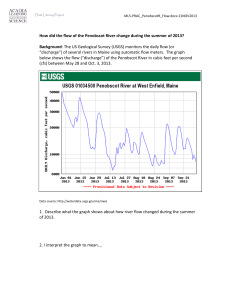

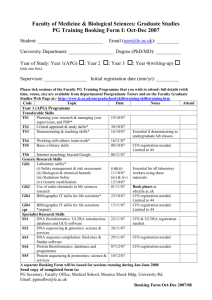

Fund Performance Reviews Unit Trust of Pakistan (UTP) UTP - Income Fund UTP - Islamic Fund UTP - Aggressive Asset Allocation Fund page 3 page 3 page 3 page 3 Economic Snapshots page 2 Economy..................In brief… Financial Markets - Review August 2005 Market Outlook page 4 page 4 Others.......... Glossary of Investment & Financial Terms page 2 SECP body to study capital market The Securities and Exchange Commission of Pakistan has formed a committee to conduct the feasibility of introduction of exchangetraded derivatives market in Pakistan. The committee has been given the mandate to identify the needs that led to the emergence of exchange-traded derivatives in the international (developed and emerging) marketplace and what benefits these markets gained as a result. The committee will study and recommend whether trading of exchange-traded derivatives is suitable for Pakistani capital markets in its present form. It will cover aspects, such as market infrastructure, systems, risks, investor interest and education, users of derivatives products and other related key matters. The likely benefits of the exchange-traded derivatives to the Pakistani capital markets, including suitability of exchange-traded derivatives as an alternative to badla financing, will also be covered in the study of the committee. The committee would devise and recommend a plan to enable successful introduction of exchangetraded derivatives in Pakistan. It is authorized to add other ancillary items associated with the key objectives mandated by the SECP and may also co-opt such members as it may deem fit. The committee would submit its report within 60 working days from the date of its first meeting. NAV Variation Fund UTP UTP - IF UTP - ISF UTP - AAAF Jul '05 7,098 513.25 586.75 51.32 Aug '05 7,406 517.00 621.25 56.38 MoM Change (%) +4.33 +0.73 +5.88 +9.86 BBF ASMF ACF AGF ACoF 13.72 16.38 14.83 32.34 10.33 14.17 17.19 15.61 33.83 10.88 +3.27 +4.95 +5.26 +4.74 +5.33 Issue: Sept '05 ABAMCO Investor CFS Replaces COT... The continuous funding system (CFS) took off at the Karachi Stock Exchange on Monday, August 22, 2005 with enthusiastic investor's response, as the KSE-100 index gained 279 points. According to analysts, the CFS rate on Monday stood at 16.9 per cent with the level of investment at Rs16.3 billion. KSE Chairman Yasin Lakhani told journalists that the new system would fulfil the immediate liquidity need of the market and would create stability and restore confidence. He also said that the CFS would eliminate shortcomings in the badla system. After months of negotiations between the government, bankers, the SECP and the bourses, an agreement on the introduction of the continuous funding system was agreed upon which replaces the controversial COT or badla system. That was made possible only when at the end of the last week, the stock market, drained of liquidity, saw a three-year low turnover and the prime minister himself had to step in to 'sort out' the issue after discussions with the parties concerned. The Continuous Funding System Regulations, 2005 have come into force from Monday, August 22, 2005. Some analysts thought that the CFS was a variant of the badla system, but majority of traders and market watchers pointed to some features of the system that were quite different from the 55-year old badla system. In the CFS system, a cap on investment under the CFS has been raised from Rs12 to Rs25 billion; the number of scrips eligible for the CFS is 14, which are twice those under the badla system; and the scrips included in the system would be reviewed every six months. A notice issued to the members by the KSE on August 22, 2005 stated: "Pursuant to the meeting of the board of directors and senior members with the prime minister and the adviser to the PM on finance, Continuous Funding System Regulations, 2005 have been approved by the SECP and the KSE board." The KSE also notified that scrips - PTCL, OGDC, NBP, FFC, D.G Khan Cement, PSO, Pakistan PTA, POL, PPL, SNGPL, BoP, MCB, Fauji Cement and Hubco - would be in the CFS system. The CFS facility would be available for a 30-day period against 10 days in the COT system, which traders believed would give stability to the market. Where the borrower opts to pay back and clear his position within the 30 days, the financier can utilize the sum again in the market. Some of the major differences between the CFS and badla are that the CFS market will be available for the entire trading period against COT sessions, which takes place after the closure of the regular market. The CFS market will run parallel to the ready market and transactions will take place through the Karachi Automated Trading. And above all, the striking difference between the COT and CFS is that the financier shall keep the continuous funding system financed securities in a separate account maintained with the Central Depository Company of Pakistan Limited in order to ensure that these securities are not used for loaning against blank and short selling. 1 ABAMCO Investor Other Stories... Rs38bn withdrawn from NSS in FY05... Net withdrawals from National Saving Schemes (NSS) stood at Rs38.46 billion in the last fiscal year despite the fact that two tailor-made schemes generated more than Rs78 billion worth of fresh savings. Ten-year Bahbood (Welfare) Saving Certificates (BSCs) attracted fresh investment of Rs60.6 billion whereas Pensioners Benefit Accounts (PBAs) of the same maturity raised Rs17.7 billion during fiscal year 2005 ending in June. But despite that net withdrawals during the year totalled Rs38.46 billion as depicted by data released by the State Bank of Pakistan. The reason why withdrawals exceeded fresh investment was that oncepopular 10-year Defence Saving Certificates (DSCs) and five-year Regular Income Certificates (RICs) lost their charm in the last fiscal year due to dwindling returns. Three-year Special Saving Certificates (SSCs) became totally unwanted as investors made net withdrawals of Rs83.16 billion from this scheme; they also divested Rs8.7 billion worth of DSCs and Rs40.45 billion worth of RICs. Economic Indicators Indicator GDP Growth Industrial growth Agricultural growth Services sector growth Fiscal Deficit (% of GDP) Investment to GDP ratio Unemployment rate Per capita income (USD) Average bank lending rate SBP Discount Rate FX Reserves (USD bn) Total external debt (USD bn) Total internal debt (PKR bn) CPI Inflation Position 8.4% 13.4% 2.6% 5.2% 3.3% 18.1% 8.3% 652.00 9.0% 9.0% 12.24 35.83 2,149.80 9.9% Updated Aug 8 '05 Apr 12 '05 Aug 27 '05 Aug 13 '05 Aug 13, '05 Glossary of Investment & Financial Terms Debt security: another term for a bond. The rates of return on DSCs, RICs and SSCs stood at 8.15pc, 6.84pc and 6.95 per cent respectively in the last fiscal year - in each case lower than the annual average inflation of 9.28 per cent. But the rate of return on BSCs and PBAs was substantially higher at 10.08 per cent. Defined benefit plan: a tax-deferred company retirement plan, such as a pension, in which the benefit to participants is defined in advance, based on criteria such as salary history and years of service, and in which the employer bears the investment risk. That explains why people made a huge investment of more than Rs78 billion in BSCs and PBAs in the last fiscal year whereas they divested heavily the stocks of DSCs, RICs and SSCs. Deflation: a decline in prices, often caused by a reduction in the supply of money or credit. The opposite of inflation. FUTURE OUTLOOK: As the government has increased the rates of return on NSS for July-December 2005, chances are that the pace of withdrawals would slow down in case of DSCs, RICs and SSCs and BSCs and PBAs would attract still larger investments. Developing markets: also known as emerging markets, developing markets are generally defined as having a per-capita income below $9,265, and as countries in the process of developing existing or newly created market-based economies. Those who invest in NSS between July 1 and December 31 this year would earn 8.88pc and 8.6 per cent return on RICs and SSCs and 9.46pc return on DSCs. They will get even higher return i.e. 11.04 per cent on BSCs and PBAs. Director: a group of individuals elected by the shareholders of a mutual fund empowered to carry out certain tasks defined in the fund's charter, such as appointing senior management, issuing additional shares and declaring dividends. Also called board of trustees. The government has set inflation target at eight per cent for the current fiscal year - and data released on Monday showed that July inflation was around 9pc. So, if inflation during the first half of this fiscal year i.e. between July-December 2005 remains anywhere between eight and nine per cent, the rates of return on DSCs, RICs and SSCs would be just too little. Discount rate: the interest rate charged by the State Bank of Pakistan for loans to member banks. However, the rates of return on BSCs and PBAs, investment in which is allowed only by senior citizens of 60 years or more, widows and pensioners, would be above inflation. And that should not only encourage the targeted class of investors to invest more in the two instruments but also enable the government to once again rely on NSS as a source of borrowing. Diversification: an investment strategy designed to reduce exposure to risk by combining a variety of investments, such as local and international stocks, bonds and cash, which are unlikely to all move in the same direction. Holding mutual funds with different objectives can help investors achieve diversification through the broad range of investments held in fund portfolios. Acting MD KSE appointed... Dividend: a distribution of investment income to shareholders. The amount of a mutual fund dividend is authorized by the fund's or its management company's board of directors. Muhammad Yacoob Memon was appointed as Acting Managing Director of the Karachi Stock Exchange from August 26, 2005 by the Board of Directors of KSE at a meeting held on Monday. A press release issued by the bourse on Thursday said that the acting MD had been vested with all powers, functions and privileges available to the managing director under the Articles of Association and Rules & Regulations of the Exchange. The board was also said to have accepted the request of Managing Director Moin M. Fudda for leave preparatory to his 3 years term ending on September 19, 2005. "The board extended its heartiest congratulations to Mr Fudda on award of Sitara-e-Imtiaz by President Pervez Musharraf and recorded its appreciation for the services rendered by him during last 3 years", the KSE press release stated. Distribution: the payment of a dividend or capital gain realized by a mutual fund. Also, the payment of funds from a retirement or pension plan. Earnings: the single most important factor in determining a stock's price, earnings represent a company's revenues minus cost of sales, operating expenses and taxes. Earnings per share are the portion of a company's profit allocated to each outstanding ordinary share. Equity: a security representing shares of ownership in a corporation, unlike a bond, which represents a loan to the issuer. Equity-income fund: a mutual fund that invests in a mixture of dividend-paying stocks and bonds to provide shareholders with current income and, as a secondary goal, growth of capital. These are commonly known as Balanced Funds. Unit Trust of Pakistan (UTP) being a prime example. 2 ABAMCO Investor Unit Trust of Pakistan Performance Review UTP-Islamic Fund Performance Review During August 2005, the NAV per unit of UTP appreciated by 4.34% as against the 8.61% rise in the KSE-100. The market recovered during the month with healthy volumes from its earlier whipsaw trend with the introduction of the CFS facility that helped improve the share financing capacity of the market as a whole. During the month, we sold shares that hit our target price and switched to alternatives with more upside. Likewise, as we aim to position our equity portfolio to capture the general market performance trend, we will look forward for opportunities in growth sectors at reasonable prices. The fund increased in value by 5.88% versus the 8.61% rise in the KSE100 during the month of August 2005. The reason the market is moving up is largely being cited as the pattern underneath the market has improved, and that's courtesy of the increased level of liquidity made available to the market. Similarly, there have been very few earnings disappointments on the corporate front. Volume is higher on the upside than it is on the downside and while the pullbacks are brief, these are being used as opportunities to buy dips. Overall, the market's internal dynamics suggest that a cyclical bull move is likely to carry into the next quarter of FY2006. As the cap on financing was raised to PKR 25bn under CFS from the previous PkR 12bn, we increased our exposure in fixed income market from this end, while keeping the weightage in other debt instruments unchanged from the previous month's level. Our asset allocation as of August 31, 2005 was 57% equities, 23% cash and 20% debt. During the month, we reduced the portfolio allocation in Closed end funds, Power, Textiles and Chemical sectors, while at the same time increased weightage in Oil and Gas upstream and downstream sectors, where we believe strong international oil prices will continue to drive FY06 earnings growth. Other than that, we also added more Fertilizer and Cement picks in the portfolio. On a month-on-month basis, we reduced our exposure in equities to 70% from 83% on July 29th. UTP : Change in Equities by Sector, August 31, 2005 UTP-ISF : Change in Equities by Sector, August 31, 2005 20% 20% 29-Jul-05 29-Jul-05 31-Aug-05 % of NAV 15% 10% 5% 10% We would like to reiterate that the positive sentiments combined with inflows of liquidity could carry the upturn further with normal setbacks along the way. In this regard, experience also shows that it's always appealing to take a positive view of things; however, the question that remains is whether a bullish view is actually warranted. Don't miss out the inflation factor! Therefore, we think that this is a time when we should neither overemphasize the positives nor ignore the negatives. Chemical Refineries Power Gen & Dist Tech & Comm Fertilizer Textile Cement Mutual Funds Oil & Gas Marktg Oil & Gas Explr UTP-Income Fund Performance Review Aug '05 saw erratic COT volumes until COT was replaced with CFS (Aug 22, 200%) with an upward cap of PKR 25 billion. This pushed avg. rates to increase from a low of 10.50% to average 15.50% at month end. We have increased our overall exposure to COT and spread transactions after assessing the overall risk framework, which has resulted in giving a higher single digit return. Outlook - Given the announcements from the institutions, we believe that spread transactions will increase given the dividend components and increased market volumes after the introduction of CFS. We expect a double digit return for Sept '05. Average COT Rate & Badla Volume 18% 130 16% 125 14% 120 12% 10% 115 8% 110 6% 105 Share Vol. in Mn. The fund's NAV appreciated by 9.86%, while it outperformed the KSE100 by 125 bps during the month. The fund increased sector holdings of Banking and Telecom, whereas it initiated investments in Oil and Gas marketing, Refineries and Power sectors to name a few besides select growth picks in other sectors. On a month-on-basis, we increased exposure in equities to 91% from 28% on July 29th. 0% COT Rate UTP-Aggressive Asset Allocation Fund Performance Review Pharmaceutical Tech & Comm Auto Assem Insurance Engineering Fertilizer Oil & Gas Marktg Power Gen & Dist Paper & Board Cement Textile Mutual Funds Oil & Gas Explr 0% 31-Aug-05 5% Comm. Banks % of NAV 15% 4% 100 2% 95 0% 1 4 5 6 Volume 7 8 11 12 13 14 15 18 19 20 21 22 25 26 27 28 29 COT Rate 3 ABAMCO Investor Financial Markets Review - August 2005 KSE 100 Index Across August 2005 8000 7800 7600 Index Equity Market: While remaining considerably volatile during the first three weeks of August, the stock market witnessed a strong positive rally with the introduction of CFS in the last week of the month. The KSE-100 Index gained a significant 618 points (8.61%) during August, which came on the back of improved liquidity situation in the market and strong corporate results, especially by the banking sector. Along with the banking sector, which remained the top pick of investors, the Oil & Gas sector also performed well with consistently rising oil & gas prices. Volumes remained cramped until the introduction of CFS, and reached a record low of a mere 36.2mn on August 17, 2005. However, the volumes revived substantially with the introduction of CFS leading the average daily volumes for August to rise by 57% over the previous month to 224mn. PTC, OGDC and NBP stood as the volume leaders with average daily turnover of 55mn, 36mn and 18mn shares respectively, constituting almost 49% of the total volumes at the KSE. 7400 7200 7000 6800 01/08/2005 08/08/2005 15/08/2005 31-Jul-05 9.75 30-Jun-05 9.42 9.50 9.32 9.12 9.25 8.95 8.98 9.19 9.10 9.00 8.76 8.75 8.50 8.86 8.20 8.07 8.25 8.00 11.50% 11.25% 11.00% 10.75% 10.50% 10.25% 10.00% 9.75% 9.50% 9.25% 9.00% 8.75% 8.50% 8.25% 8.00% 7.75% 7.50% 7.25% 7.00% 6.75% 6.50% 6.25% 6.00% Close PKR Yield Curve Yield 9.00 Outlook - With YoY inflation again rising, international oil prices rallying upwards above US$ 67 a barrel on supply concerns, we forecast inflation to be 9.00% for FY'06, with a further increase of 100bps in SBP discount rate quite likely in September '05. 29/08/2005 Low High Weeks Money Market: Headline inflation or CPI rose in Aug '05 to 8.99% YoY (Jul '05 8.74% YoY) mainly due to increase in transport and fuel costs passed on to consumers by the government. However, Core inflation (non-food & non-oil) has come down slightly to 8.86% (Jul '05 8.91%). SBP increased the cut-off yields marginally to 7.91%, 8.13% and 8.79% (7.69%, 7.98% & 8.69%) for 3, 6 & 12 M tenors respectively. Almost negligible activity was seen in the benchmark 10Year bond and yields remained subdued at levels of 9.15 - 9.25%. 22/08/2005 8.38 8.42 3-years 4-years 8.58 8.58 8.61 8.58 6-years 7-years 8-years 9-years 8.48 8.27 7.75 Inflation July '04 - Jul '05 7.89 7.50 7.25 7.53 Core 7.00 CPI Jul-04 Aug-04 Sep-04 Oct-04 Nov-04 Dec-04 Jan-05 Feb-05 Mar-05 Apr-05 May-05 Jun-05 Jul-05 Foreign Exchange Market: With oil prices rising, the pressure on rupee in the currency markets slightly increased during August. Nevertheless, the pressure was somewhat offset by regular inflows of exports proceeds. The currency traded within a range of 59.62-60.15, with an average of 59.68/USD as against an average of 59.63/USD during July. The rupee is expected to undergo slight depreciation as rising oil prices continue to create an imbalance between import and export exchanges. 90-days 180-days 365-days 5-years 10-years Future Outlook: With the market reacting positively to the introduction of CFS and corporations showing healthy results, the stage has been set for the market to rally on a consistent uptrend. Going forward, the volumes are expected to remain high - at least until the CFS limits are exhausted. As the fundamentals remain strong and many undervalued stocks reach levels close to their fair values, some selling pressure and profit-taking might be seen. Significant positive moves in the market can, therefore, be followed by immediate corrections. The sound banking results, rising oil & gas prices, and increasing local demand for urea and autos, and world demand for textile products, will tend to bode well for the sector stocks. In addition, news relating to the privatization of NIT is expected to positively impact the banking sector, while further privatization related rallies in the stock market may be lead by market leaders such as OGDC, PPL and PSO. Credits: Editor: Imtiaz Noor Mohammad (imtiaz.noor@abamco.com) Market Reviews: Ammar Ali (ammar.ali@abamco.com) Fund Management Reports: Syed Hussain Haider (hussain.haider@abamco.com) & Nabil Daudur Rahman (nabil.rahman@abamco.com). For circulation queries, please contact the editor. Head Office: 7th Floor, The Forum, Block 9, Khayaban e Jami, Clifton Fax: 536 1727 Lahore Office Ground Floor, 307, Upper Mall Tel: 8415114 Islamabad Office: Shop 6-7, 1st Floor, Razia Sharif Plaza, Blue Area Fax: 580 2096 Contact: Tel: 111-222-626 Website: www.abamco.com E-mail: info@abamco.com Disclaimer: This newsletter is for informational purposes only. The correctness of information in this newsletter cannot be guaranteed, however, the publishers have made their best attempt to keep the information provided here as correct as possible. ABAMCO Limited cannot be held responsible for any losses or gains arising upon actions, opinions and views created by this newsletter. All investments in mutual funds are subject to market risks. The NAV based prices of units and any dividends /returns thereon are dependent on forces and factors affecting the capital markets. These may go up or down based on market conditions. Past performance is not necessarily indicative of future results. Please read the "Risk" & "Disclaimer" clauses of the respective funds' offering document and consult your investment /legal adviser for understanding the investment policies and risks involved. 4