RBC Dominion Securities Inc.

Altaf Nanji, CFA (Analyst)

(416) 842-6462

altaf.nanji@rbccm.com

Edward Martinez (Associate)

(416) 842-5165

edward.martinez@rbccm.com

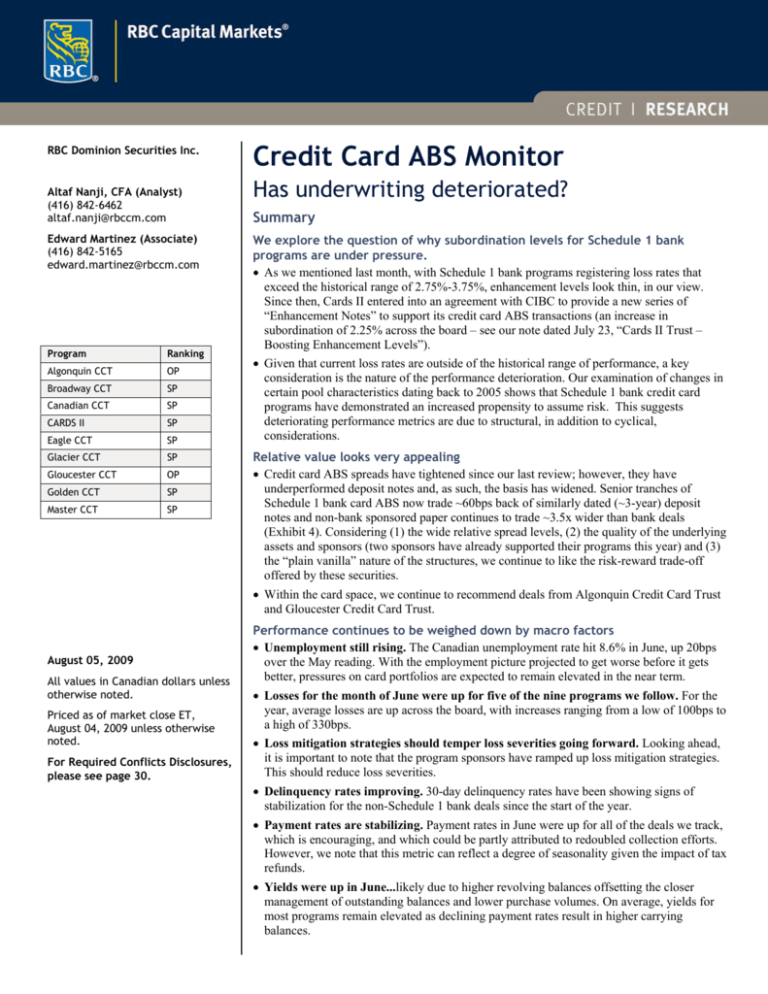

Program

Ranking

Algonquin CCT

OP

Broadway CCT

SP

Canadian CCT

SP

CARDS II

SP

Eagle CCT

SP

Glacier CCT

SP

Gloucester CCT

OP

Golden CCT

SP

Master CCT

SP

Credit Card ABS Monitor

Has underwriting deteriorated?

Summary

We explore the question of why subordination levels for Schedule 1 bank

programs are under pressure.

• As we mentioned last month, with Schedule 1 bank programs registering loss rates that

exceed the historical range of 2.75%-3.75%, enhancement levels look thin, in our view.

Since then, Cards II entered into an agreement with CIBC to provide a new series of

“Enhancement Notes” to support its credit card ABS transactions (an increase in

subordination of 2.25% across the board – see our note dated July 23, “Cards II Trust –

Boosting Enhancement Levels”).

• Given that current loss rates are outside of the historical range of performance, a key

consideration is the nature of the performance deterioration. Our examination of changes in

certain pool characteristics dating back to 2005 shows that Schedule 1 bank credit card

programs have demonstrated an increased propensity to assume risk. This suggests

deteriorating performance metrics are due to structural, in addition to cyclical,

considerations.

Relative value looks very appealing

• Credit card ABS spreads have tightened since our last review; however, they have

underperformed deposit notes and, as such, the basis has widened. Senior tranches of

Schedule 1 bank card ABS now trade ~60bps back of similarly dated (~3-year) deposit

notes and non-bank sponsored paper continues to trade ~3.5x wider than bank deals

(Exhibit 4). Considering (1) the wide relative spread levels, (2) the quality of the underlying

assets and sponsors (two sponsors have already supported their programs this year) and (3)

the “plain vanilla” nature of the structures, we continue to like the risk-reward trade-off

offered by these securities.

• Within the card space, we continue to recommend deals from Algonquin Credit Card Trust

and Gloucester Credit Card Trust.

August 05, 2009

All values in Canadian dollars unless

otherwise noted.

Priced as of market close ET,

August 04, 2009 unless otherwise

noted.

For Required Conflicts Disclosures,

please see page 30.

Performance continues to be weighed down by macro factors

• Unemployment still rising. The Canadian unemployment rate hit 8.6% in June, up 20bps

over the May reading. With the employment picture projected to get worse before it gets

better, pressures on card portfolios are expected to remain elevated in the near term.

• Losses for the month of June were up for five of the nine programs we follow. For the

year, average losses are up across the board, with increases ranging from a low of 100bps to

a high of 330bps.

• Loss mitigation strategies should temper loss severities going forward. Looking ahead,

it is important to note that the program sponsors have ramped up loss mitigation strategies.

This should reduce loss severities.

• Delinquency rates improving. 30-day delinquency rates have been showing signs of

stabilization for the non-Schedule 1 bank deals since the start of the year.

• Payment rates are stabilizing. Payment rates in June were up for all of the deals we track,

which is encouraging, and which could be partly attributed to redoubled collection efforts.

However, we note that this metric can reflect a degree of seasonality given the impact of tax

refunds.

• Yields were up in June...likely due to higher revolving balances offsetting the closer

management of outstanding balances and lower purchase volumes. On average, yields for

most programs remain elevated as declining payment rates result in higher carrying

balances.

ABS Monitor

August 05, 2009

Table of Contents

Why Are Schedule 1 Bank Subordination Levels Under Pressure?........................................... 3

Banks have demonstrated an increased appetite for risk................................................................... 3

Relative Value ................................................................................................................................. 5

Credit card ABS looking very appealing .......................................................................................... 5

Performance Commentary............................................................................................................. 7

Navigating the challenging macro backdrop..................................................................................... 7

Appendix.......................................................................................................................................... 9

Canadian Credit Card Trust (National Bank of Canada) ................................................................ 11

CARDS II Trust (CIBC) ................................................................................................................. 13

Golden Credit Card Trust (Royal Bank of Canada)........................................................................ 15

Master Credit Card Trust (Bank of Montreal) ................................................................................ 17

Algonquin Credit Card Trust (Capital One).................................................................................... 19

Broadway Credit Card Trust (Citibank).......................................................................................... 21

Eagle Credit Card Trust (PC Bank) ................................................................................................ 23

Glacier Credit Card Trust (Canadian Tire Bank) ............................................................................ 25

Gloucester Credit Card Trust (B of A / MBNA)............................................................................. 27

Global Credit Research Team ..................................................................................................... 29

Required Disclosures .................................................................................................................... 30

Disclaimer....................................................................................................................................... 31

2 Altaf Nanji, CFA

August 05, 2009

ABS Monitor

Why Are Schedule 1 Bank Subordination Levels Under Pressure?

Banks have demonstrated an increased appetite for risk

Given that current loss rates are outside the historical range of performance, a key

consideration is the nature of the performance deterioration. A structural change in the

characteristics of the pool could necessitate supplemental enhancement or a negative credit

rating action.

•

As we mentioned last month, with Schedule 1 bank programs registering loss rates that

exceed the historical range of 2.75%-3.75%, enhancement levels look thin, in our view. Since

then, Cards II entered into an agreement with CIBC to provide a new series of “Enhancement

Notes” to support its credit card ABS transactions (an increase in subordination of 2.25%

across the board – see our note dated July 23, “Cards II Trust – Boosting Enhancement

Levels”).

•

In our view, if the elevated loss rates are determined to be largely a function of the severity of

the economic downturn, current subordination levels may prove sufficient. However, if the

deterioration is judged to be more structural in nature (i.e., if the credit characteristics of the

underlying pools have eroded as the propensity to assume risk has increased), supplemental

enhancement (or negative credit rating action) could be required.

Our examination of changes in certain pool characteristics dating back to 2005 shows that

Schedule 1 bank credit card programs have demonstrated an increased propensity to

assume risk. This suggests deteriorating performance metrics are due to structural, in

addition to cyclical, considerations.

•

By segmenting each pool’s portfolio stratification of account balances and credit limits into

tertiles, we determined that the Schedule 1 banks have been relatively more aggressive in

growing their books of business over the last 3+ years, which is reflected in increased credit

limits and higher account balances.

•

As demonstrated in Exhibit 1, accounts with balances in the top-third of the portfolio

stratification have increased 19%, 15% and 14% for Cards II, Golden and Master,

respectively. In dollar terms, the growth in accounts with balances of $10K+ has averaged

15.5% for these three Schedule 1 bank programs. In contrast, accounts with balances in the

top-third of the portfolio stratification for the non-Schedule 1 programs have averaged 8.7%,

with Algonquin actually registering a decline.

Exhibit 1: Growth in top-tertile account balances of Schedule 1 bank pools exceeds that of non-Schedule 1 banks

70%

90%

+14%

+9%

80%

60%

70%

+12%

50%

60%

% of Pool

% of Pool

+19%

40%

+15%

30%

50%

+9%

40%

+14%

30%

20%

20%

10%

-1%

10%

0%

0%

CARDS II

Bottom-third ('05 vs. '09)

Golden

Mid-third ('05 vs. '09)

Master

Top-third ('05 vs. '09)

Algonquin

Broadw ay

Eagle*

Bottom-third ('05 vs. '08)

Mid-third ('05 vs. '08)

Glacier

Gloucester

Top-third ('05 vs. '08)

Source: RBC CAPITAL MARKETS, Trust Reports; * Eagle CCT data represents ’06 vs. ’08.

•

Looking at the shifts in the portfolio composition by authorized credit limit tells a similar

story. As can be seen in Exhibit 2, Schedule 1 bank programs have seen top-third credit limits

grow by an average of 16.5% (+22%, +18% and +10% for Cards II, Golden and Master,

respectively). In contrast, credit limits for non-Schedule 1 programs have increased an

average of 12.5%, with Algonquin and Eagle registering very low levels of growth (-1% and

+7%, respectively).

Altaf Nanji, CFA 3

ABS Monitor

August 05, 2009

Exhibit 2: Growth in top-tertile account balances of Schedule 1 bank pools exceeds that of non-Schedule 1 banks

100%

80%

+17%

+10%

90%

70%

80%

+22%

60%

% of Pool

70%

+19%

+18%

60%

50%

50%

40%

40%

+21%

+7%

30%

30%

20%

-1%

20%

10%

10%

0%

0%

CARDS II

Golden

Bottom-third ('05 vs. '09)

Master

Mid-third ('05 vs. '09)

Algonquin

Broadw ay

Bottom-third ('05 vs. '08)

Top-third ('05 vs. '09)

Eagle*

Glacier

Mid-third ('05 vs. '08)

Gloucester

Top-third ('05 vs. '08)

Source: RBC CAPITAL MARKETS, Trust Reports; * Eagle CCT data represents ’06 vs. ’08

•

The bottom line is that with subordination levels geared to underlying portfolios that were

more conservative in their composition, the Schedule 1 bank pools may have undergone a

structural shift in risk appetite that could necessitate supplemental support. Although Cards II

appears to be the worst offender, with loss rates pushing subordination levels for Master,

Canadian and Golden (Exhibit 3), a course of action similar to that taken for Cards II is not

out of the realm of possibilities.

•

Further, investors should keep in mind that Moody’s is of the view that if losses were to

continue to rise at a rapid pace (not out of the realm of possibilities given the outlook for

unemployment), any meaningful drop in yields or payment rates could put pressure on ratings,

especially for the lower-rated subordinate tranches.

Exhibit 3: Loss rates for Schedule 1 bank deals are approaching subordination levels…excess spread remains robust

30%

30%

Outperform

25.3%

25%

25%

21.7%

20.3%

17.0%

20%

15.9%

15.1%

15%

9.6%

10%

Enhancement

Enhancement

20%

19.9%

18.9%

15%

10%

10.8%

8.5%

8.5%

5%

6.9%

4.0%

4.4%

Golden

Master

5%

6.2%

5.7%

0%

6.0%

0%

Subordination

XS Spread

CARDS

Loss Rate

CCCT

Total

Source: RBC CAPITAL MARKETS, Trust Reports. Data as at 30-May-09.

4 Altaf Nanji, CFA

Algonquin

Broadw ay

Subordination

Eagle

XS Spread

Gloucester

Loss Rate

Glacier

Total

August 05, 2009

ABS Monitor

Relative Value

Credit card ABS looking very appealing

Credit card ABS spreads have tightened since our last review; however they have

underperformed deposit notes and, as such, the basis has widened. Senior tranches of

Schedule 1 bank card ABS now trade ~60bps back of similarly dated (~3-year) deposit notes

and non-bank sponsored paper continues to trade ~3.5x wider than bank deals (Exhibit 4).

Considering (1) the wide relative spread levels, (2) the quality of the underlying assets and

sponsors (two sponsors have already supported their programs this year) and (3) the “plain

vanilla” nature of the structures, we continue to like the risk-reward trade-off offered by

these securities.

•

Since the last Credit Card ABS Monitor, deposit notes in the area of 3-years to maturity have

tightened approximately 40bps. Over that time frame, Schedule 1 bank ABS tightened

approximately 15bps. The basis, which previously stood at ~35bps, has now widened to

approximately 60bps.

•

The relative value story is even more compelling when viewed versus bank sub-debt, as

Schedule 1 bank card paper now trades 0-10bps back.

Exhibit 4: Schedule 1 bank deals trade 25-40bps back of deposit notes – non-bank deals trade much wider

600

BCCT 5.449% 6/17/2013

500

ALGONQ 4.562%

6/15/2012

bps

400

GCC 5.421% 4/15/2013

300

200

100

MCCT 5.297% 8/21/2012

0

May/07

Aug/07

Nov/07

Feb/08

May/08

Aug/08

Nov/08

Feb/09

May/09

Avg. Deposit Note

Source: RBC CAPITAL MARKETS, ADI

Within the card space, we continue to recommend deals from Algonquin Credit Card Trust

and Gloucester Credit Card Trust.

•

As per our rich/cheap analysis (Exhibit 5) introduced last month, Schedule 1 bank deals still

trade tight to the peer group but offer a low credit enhancement ratio. In contrast, deals from

Algonquin and Gloucester trade wide and offer a high credit enhancement ratio. While there

are several factors at play contributing to a spread basis, in our view a 300bp+ differential (in

some cases) seems inconsistent with the underlying credit realities.

Altaf Nanji, CFA 5

ABS Monitor

August 05, 2009

GCCT 06-1 (Mar-11)

GCCT 04-1 (May-14)

MSTCCT 06-1 (Nov-09)

MSTCCT 06-2 (Nov-11)

MSTCCT 08-2 (Aug-12)

Average Spread

MSTCCT 08-1 (May-13)

ALGONQ 05-1 (Oct-10)

ALGONQ 07-1 (Jun-12)

ALGONQ 06-1 (Jul-11)

GCCT 08-1 (May-13)

Good Value

CCCT 05-1 (Apr-10)

CCCT 08-1 (Mar-13)

GLCRTC 05-1 (Nov-10)

GLCRTC 06-1 (Nov-11)

Expensive

CCCT 05-2 (Apr-12)

GLCRTC 06-2 (May-14)

GLCRTC 04-1 (Nov-09)

GOLCCT 05-1 (Jun-10)

EAGCCT 06-1 (Mar-11)

GOLCCT 06-1 (Feb-11)

100

GOLCCT 08-2 (Apr-13)

200

CARDS 05-4 (Oct-10)

CARDS 04-1 (Oct-09)

Spread (bps)

300

GLCRTC 08-1 (Feb-13)

Fair Value

400

GOLCCT 08-1 (Apr-11)

500

Average Enhancement Ratio

BCCTR 04-2 (Mar-14)

600

BCCTR 08-1 (Jun-11)

BCCTR 08-2 (Jun-13)

Exhibit 5: The ratio of enhancement to loss rates suggest non-Schedule 1 bank deals offer good value

Fair Value

4.43

4.32

4.10

3.55

3.43

2.96

2.71

2.59

2.57

2.52

2.29

2.20

1.69

1.42

1.00

0

Enhanc ement / Loss Rate (x)

Interpreting the chart: To present credit enhancement levels in context of the credit quality of the underlying pool, we display the total

enhancement (i.e., subordination and excess spread) as a multiple of the pool’s loss rate (the “credit enhancement ratio”). Accordingly,

deals in the lower left quadrant of the chart could be characterized as expensive (as they offer a low enhancement ratio but trade tight)

whereas deals in the upper right quadrant look to offer value (a high enhancement ratio and wide trading levels).

Source: RBC Capital Markets

6 Altaf Nanji, CFA

August 05, 2009

ABS Monitor

Performance Commentary

Navigating the challenging macro backdrop

The Canadian unemployment rate ticked up 20bps in June to 8.6%, providing another

reminder that pressures on card portfolios are likely to continue in the near-to-medium

term.

•

The outlook for pool performance remains soggy given the weak prospects for the economy.

RBC Economics continues to forecast Canadian unemployment peaking at a rate of 9.2% in

Q4/09 and Q1/10, then falling to 8.8% in Q4/10.

•

Since bottoming at 5.8% in November 2007, the unemployment rate has increased by 280bps

and the average loss rate on the Canadian credit card pools has increased 230bps. Given the

tight relationship, another 60bp increase in the unemployment rate could translate into a

commensurate increase in pool loss rates.

Looking ahead, while increasing levels of unemployment should pressure loss rates further,

it is important to note that the program sponsors have ramped up loss mitigation strategies.

This should reduce loss severities.

•

Program sponsors have amplified their loss mitigation strategies as the economic backdrop

has soured. Efforts include cancelling inactive cards (which carry the risk of only being used

when a cardholder is in financial difficulty), cutting spending limits (for customers with faulty

payment histories), employing tighter underwriting standards for new accounts and

maintaining a heightened sensitivity to collections management.

•

We think the efforts outlined above should, in turn, mitigate the rate of increase in losses as

the employment situation deteriorates.

Credit deterioration looks set to continue

Losses for the month of June were up for five of the nine programs we follow. For the year,

average losses are up across the board, with increases ranging from a low of 100bps to a high

of 330bps.

•

For the month of June, losses were up for all programs except Broadway, Cards II, Eagle and

Golden (see Deal Summaries for individual program performance detail).

•

Average losses for all deals are up approximately 1.7% over year-end 2008 average losses. At

current levels, YTD 2009 average losses represent multi-year highs (Exhibit 6).

Exhibit 6: YTD 2009 average losses at multi-year highs

1999

2000

2001

2002

2003

2004

CapOne - Algonquin

-

-

-

-

-

-

Citi - Broadway

-

-

-

-

-

PC Bank - Eagle

-

-

M BNA - Gloucester

-

CanTire - Glacier

3.2%

6.0%

3.6%

2005

2006

2007

2008

4.9%

4.5%

4.5%

4.8%

6.8%

5.4%

4.8%

4.9%

6.7%

10.0%

3.5%

-

-

-

Y TD '09

3.1%

3.2%

4.1%

6.6%

3.9%

4.2%

4.4%

4.7%

4.4%

4.4%

4.0%

5.1%

7.5%

5.8%

4.7%

5.1%

5.8%

5.6%

6.1%

6.1%

5.7%

6.5%

RBC - Golden

-

1.3%

1.7%

1.7%

1.7%

1.6%

2.0%

2.3%

2.3%

2.5%

3.6%

BM O - M aster

-

1.9%

2.4%

2.2%

2.2%

2.1%

2.0%

1.9%

2.2%

2.6%

3.7%

3.1%

3.3%

3.5%

3.6%

3.6%

3.4%

3.3%

3.7%

6.1%

2.9%

3.3%

3.3%

3.5%

3.7%

3.7%

4.2%

5.3%

CIBC - CARDS

-

-

National - CCCT

-

-

-

Source: RBC Capital Markets, Trust Reports, DBRS

•

30-day delinquency rates have been showing signs of stabilization for the non-Schedule 1

bank deals since the start of the year (Exhibit 7), despite a blip for Algonquin. However, the

trend for Schedule 1 bank deals was mixed, with CCCT and Golden reporting increases in

delinquencies. With the macro environment souring and with unemployment spiking, the

improved delinquency trends are likely a result of seasonality and a heightened sensitivity to

receivables management, collections and underwriting.

Altaf Nanji, CFA 7

ABS Monitor

August 05, 2009

Exhibit 7: 30-day delinquency rates

Signs of stabilization in non-Schedule 1 deals, while Golden & CCCT disappoint

1.4%

2.8%

2.3%

1.2%

1.8%

1.0%

1.3%

0.8%

0.8%

Jan-09

Feb-09

Mar-09

CCCT

Apr-09

Cards I I

May-09

Golden

Jun-09

Jan-09

Master

Feb-09

Algonquin

Mar-09

Broadway

Apr-09

Eagle

May-09

Glacier

Jun-09

Gloucester

Source: RBC Capital Markets, Trust Reports

Payment rates in June were up for all the deals we track, which is encouraging, and which

could be partly attributed to redoubled collection efforts. However, we note that this metric

can reflect a degree of seasonality given the impact of tax refunds.

• In contrast to the May data (which were a real mixed bag), payment rates were up across the

board in June. While the June performance is encouraging, we note that seasonality may be a

key underlying driver of the sequential improvement.

• Looking at averages for the year, we note that payment rates are down for all deals with

Master CCT down the most, at -3.9% (though still a 50bp sequential improvement). That said,

Master CCT continues to report the fourth-highest payment rates of the group (Exhibit 8).

Exhibit 8: Average payment rates still low

1999

2000

2001

2002

2003

2004

2005

CapOne - Algonquin

-

-

-

-

-

-

-

2006

2007

2008

9.0%

9.8%

9.8%

Citi - Broadway

-

-

-

-

-

14.6%

PC Bank - Eagle

-

-

-

-

-

M BNA - Gloucester

-

12.8%

12.9%

13.7%

13.1%

CanTire - Glacier

22.3%

21.2%

23.1%

21.5%

22.6%

RBC - Golden

46.1%

42.4%

39.0%

38.9%

BM O - M aster

-

37.9%

38.7%

39.2%

CIBC - CARDS

40.0%

39.1%

39.4%

National - CCCT

29.9%

30.3%

27.5%

Y TD '09

9.2%

15.8%

17.5%

16.9%

17.0%

15.4%

-

-

43.8%

42.9%

42.9%

42.0%

13.9%

14.7%

15.0%

15.1%

14.2%

12.6%

23.4%

23.5%

27.8%

25.0%

25.8%

24.6%

38.4%

38.7%

39.4%

36.7%

37.2%

37.5%

35.5%

39.2%

40.6%

41.9%

41.6%

41.6%

39.1%

35.2%

42.0%

41.5%

43.0%

43.7%

42.7%

41.5%

39.4%

36.2%

26.2%

27.4%

26.5%

24.8%

24.2%

24.9%

28.9%

28.3%

Source: RBC Capital Markets, Trust Reports, DBRS

Yields were up for every deal bar Eagle CCT in June. On average, yields for most programs

remain elevated as declining payment rates result in higher carrying balances (Exhibit 9).

• Schedule 1 bank programs all registered higher yields in June, on average up 14bps for the

group (standout: Cards II +24bps) over May, while non-bank deals, on average, saw yields

rise 7bps sequentially (standout: Broadway +20bps).

•

8 Altaf Nanji, CFA

Increasing yields against a backdrop of higher payment rates, while somewhat of an anomaly,

will occur from time to time as revolving balances continue to grow in the current

environment.

August 05, 2009

ABS Monitor

Exhibit 9: Yields generally increase as payment rates decline

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

Y TD '09

CapOne - Algonquin

-

-

-

-

-

-

19.0%

19.4%

20.1%

20.6%

20.2%

Citi - Broadway

-

-

-

-

-

17.3%

17.5%

17.8%

17.8%

19.6%

20.6%

PC Bank - Eagle

-

-

-

-

-

-

-

17.7%

18.4%

20.6%

22.9%

M BNA - Gloucester

-

14.8%

15.7%

15.1%

17.6%

19.2%

20.3%

22.3%

19.7%

18.2%

17.2%

CanTire - Glacier

22.3%

20.6%

20.8%

17.6%

17.5%

16.8%

16.6%

18.6%

18.5%

19.9%

20.6%

13.6%

RBC - Golden

-

14.2%

13.6%

13.3%

13.2%

12.9%

13.1%

13.7%

13.6%

13.4%

BM O - M aster

-

15.2%

15.6%

16.8%

18.8%

18.8%

19.5%

20.4%

21.3%

21.5%

21.9%

CIBC - CARDS

-

-

16.7%

16.8%

16.9%

17.4%

17.1%

17.0%

17.1%

17.2%

17.8%

National - CCCT

-

19.2%

19.5%

19.3%

18.9%

18.9%

18.5%

18.6%

19.2%

19.7%

20.6%

Source: RBC Capital Markets, Trust Reports, DBRS

Altaf Nanji, CFA 9

ABS Monitor

August 05, 2009

Appendix

10 Altaf Nanji, CFA

August 05, 2009

ABS Monitor

Canadian Credit Card Trust (National Bank of Canada)

Exhibit 10: Deal Summary

Total

Series

Class

2005-1

A

Amount

Coupon

425,250,000

4.143

Maturity Subordination

26-Apr-10

Excess Spread Enhancement

5.50%

10.17%

15.67%

B

12,375,000

4.463

26-Apr-10

2.75%

10.17%

12.92%

C

12,375,000

4.813

26-Apr-10

0.00%

10.17%

10.17%

Amount

Coupon

330,750,000

4.513

Total

Series

Class

2005-2

A

Maturity Subordination

24-Apr-12

Excess Spread Enhancement

5.50%

9.79%

15.29%

B

9,625,000

4.863

24-Apr-12

2.75%

9.79%

12.54%

C

9,625,000

5.263

24-Apr-12

0.00%

9.79%

9.79%

Amount

Coupon

400,000,000

5.365

Total

Series

Class

2008-1

A

Maturity Subordination

25-M ar-13

Excess Spread Enhancement

5.50%

8.88%

14.38%

B

11,641,000

6.365

25-M ar-13

2.75%

8.88%

11.63%

C

11,641,000

7.914

25-M ar-13

0.00%

8.88%

8.88%

Excess Spread

2005-2

10.73%

10.99%

10.93%

11.14%

10.73%

10.56%

9.96%

10.33%

10.11%

10.09%

9.58%

9.79%

2008-1

9.15%

10.07%

10.01%

10.22%

9.81%

9.65%

9.04%

9.41%

9.19%

9.18%

8.66%

8.88%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Exhibit 11: 12-Month Pool Performance

M onth

1-Jul-08

1-Aug-08

1-Sep-08

1-Oct-08

1-Nov -08

1-Dec-08

1-Jan-09

1-Feb-09

1-M ar-09

1-Apr-09

1-M ay-09

1-Jun-09

Yield Payment Rate

19.98%

32.88%

19.37%

27.21%

20.43%

30.99%

19.48%

31.21%

20.54%

26.38%

19.25%

31.17%

19.81%

28.79%

21.99%

28.36%

19.47%

27.81%

20.59%

27.14%

20.20%

28.56%

21.61%

29.29%

Loss Rate

3.81%

3.90%

3.74%

4.69%

5.13%

4.82%

4.07%

6.10%

5.09%

5.79%

5.22%

5.70%

30-59

0.86%

0.89%

0.94%

0.92%

1.03%

1.03%

1.19%

1.14%

1.15%

1.10%

1.08%

1.15%

Delinquencies

60-89

0.40%

0.41%

0.43%

0.42%

0.49%

0.49%

0.58%

0.58%

0.53%

0.47%

0.52%

0.52%

90+

0.66%

0.67%

0.70%

0.71%

0.72%

0.74%

0.84%

0.85%

0.86%

0.84%

0.83%

0.82%

2005-1

11.10%

11.37%

11.30%

11.51%

11.10%

10.94%

10.34%

10.70%

10.48%

10.47%

9.95%

10.17%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Altaf Nanji, CFA 11

ABS Monitor

August 05, 2009

Exhibit 12: Canadian CCT Performance Trends

Y ield

Pay me nt Rate

22%

32%

21%

%

%

20%

30%

28%

26%

19%

Apr-08

Jul-08

Oct-08

Jan-09

Apr-08

Apr-09

Jul-08

Oct-08

Jan-09

Apr-09

Delinque nc ie s

Lo ss Rate

7%

1.3%

1.1%

6%

%

%

0.9%

0.7%

5%

0.5%

4%

0.3%

Apr-08

3%

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-08

Oct-08

30-59

Jan-09

60-89

Apr-09

90+

Source: RBC Capital Markets Research

Sector Perform

We rank Canadian CCT at Sector Perform as positive attributes (i.e., healthy yields that are among the highest in the peer

group and payment rates that remain strong and have demonstrated stability) are offset by the fact that loss rates are

approaching senior-tranche subordination levels and spreads trade well through non-Schedule 1 bank programs.

12 Altaf Nanji, CFA

August 05, 2009

ABS Monitor

Cards II Trust (CIBC)

Exhibit 13: Deal Summary

Total

Series

Class

2004-1

A

Amount

Coupon

600,000,000

4.379

Maturity Subordination

15-Oct-09

5.00%

Excess Spread Enhancement

2.62%

7.62%

B

12,631,579

4.699

15-Oct-09

3.00%

2.62%

5.62%

C

18,947,369

4.699

15-Oct-09

0.00%

2.62%

2.62%

Amount

Coupon

Total

Maturity Subordination

Excess Spread Enhancement

Series

Class

2004-3

A

500,000,000

Floating

15-Oct-09

8.00%

6.23%

14.23%

B

21,739,131

Floating

15-Oct-09

4.00%

6.23%

10.23%

C

21,739,131

Floating

15-Oct-09

0.00%

6.23%

6.23%

Amount

Coupon

Total

Series

Class

Maturity Subordination

Excess Spread Enhancement

2005-1

A

500,000,000

Floating

22-M ar-10

10.25%

8.39%

B

21,739,131

Floating

22-M ar-10

6.25%

8.39%

14.64%

C

21,739,131

Floating

22-M ar-10

2.25%

8.39%

10.64%

18.64%

Total

Maturity Subordination

Excess Spread Enhancement

Series

Class

Amount

Coupon

2005-2

A

400,000,000

Floating

20-Sep-12

10.25%

8.39%

B

17,391,305

Floating

20-Sep-12

6.25%

8.39%

14.64%

C

17,391,305

Floating

20-Sep-12

2.25%

8.39%

10.64%

18.64%

Total

Maturity Subordination

Excess Spread Enhancement

Series

Class

Amount

Coupon

2005-3

A

200,000,000

Floating

23-Sep-10

10.25%

8.41%

B

8,695,653

Floating

23-Sep-10

6.25%

8.41%

14.66%

C

8,695,653

Floating

23-Sep-10

2.25%

8.41%

10.66%

18.66%

Total

Maturity Subordination

Excess Spread Enhancement

Series

Class

Amount

Coupon

2005-4

A

750,500,000

3.89%

15-Oct-10

7.25%

5.17%

12.42%

B

15,800,000

4.06%

15-Oct-10

5.25%

5.17%

10.42%

C

23,700,000

4.31%

15-Oct-10

2.25%

5.17%

7.42%

Amount

Coupon

Total

Maturity Subordination

Excess Spread Enhancement

Series

Class

2006-1

A

250,000,000

Floating

20-M ar-13

10.25%

8.39%

B

10,869,566

Floating

20-M ar-13

6.25%

8.39%

14.64%

C

10,869,566

Floating

20-M ar-13

2.25%

8.39%

10.64%

Amount

Coupon

18.64%

Total

Maturity Subordination

Excess Spread Enhancement

Series

Class

2006-2

A

100,000,000

Floating

20-Jun-13

10.25%

8.42%

B

4,347,827

Floating

20-Jun-13

6.25%

8.42%

14.67%

C

4,347,827

Floating

20-Jun-13

2.25%

8.42%

10.67%

18.67%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Altaf Nanji, CFA 13

ABS Monitor

August 05, 2009

Exhibit 14: 12-Month Pool Performance

M onth

1-Jul-08

1-Aug-08

1-Sep-08

1-Oct-08

1-Nov -08

1-Dec-08

1-Jan-09

1-Feb-09

1-M ar-09

1-Apr-09

1-M ay-09

1-Jun-09

Yield Payment Rate

16.95%

42.24%

16.89%

37.16%

17.16%

40.80%

17.22%

40.60%

17.09%

35.57%

17.02%

41.57%

17.29%

36.43%

17.96%

32.44%

17.82%

38.11%

18.17%

34.78%

16.88%

35.72%

18.90%

39.61%

Loss Rate

3.67%

3.83%

3.82%

3.89%

4.29%

4.64%

5.28%

5.27%

5.56%

6.27%

7.28%

6.85%

31-60

0.84%

1.01%

0.90%

0.93%

1.05%

1.14%

1.26%

1.16%

1.11%

1.12%

1.02%

0.95%

Delinquencies

61-90

0.47%

0.46%

0.53%

0.51%

0.54%

0.59%

0.67%

0.76%

0.70%

0.69%

0.68%

0.62%

90+

0.84%

0.87%

0.90%

0.99%

1.03%

1.07%

1.17%

1.28%

1.39%

1.42%

1.39%

1.34%

2004-1

6.76%

6.67%

6.78%

6.81%

6.64%

6.39%

6.01%

5.82%

5.83%

5.09%

3.67%

2.62%

2004-3

7.50%

7.51%

7.72%

7.76%

7.60%

7.37%

7.40%

7.89%

8.67%

8.30%

7.30%

6.23%

2005-1

7.81%

7.79%

7.92%

7.97%

7.89%

8.02%

8.23%

8.55%

8.98%

8.98%

8.48%

8.39%

Excess Spread

2005-2

2005-3

7.81%

7.83%

7.79%

7.81%

7.91%

7.94%

7.96%

7.99%

7.89%

7.91%

8.01%

8.04%

8.22%

8.25%

8.55%

8.57%

8.97%

9.00%

8.97%

9.00%

8.48%

8.50%

8.39%

8.41%

2005-4

7.28%

7.19%

7.30%

7.33%

7.16%

6.92%

6.53%

6.33%

6.33%

6.12%

5.36%

5.17%

2006-1

7.81%

7.79%

7.92%

7.97%

7.89%

8.02%

8.23%

8.55%

8.98%

8.98%

8.49%

8.39%

2006-2

7.84%

7.82%

7.95%

8.00%

7.92%

8.05%

8.26%

8.58%

9.01%

9.01%

8.52%

8.42%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Exhibit 15: Cards II Performance Trends

Pay me nt Rate

Y ie ld

19.0%

42%

18.5%

%

40%

18.0%

%

38%

17.5%

36%

17.0%

34%

32%

16.5%

Apr-08

Jul-08

Oct-08

Jan-09

Apr-08

Apr-09

Jul-08

Lo ss Rate

Jan-09

Apr-09

Delinque nc ies

1.5%

8%

1.3%

7%

%

Oct-08

%

6%

1.0%

0.8%

5%

0.5%

4%

0.3%

Apr-08

3%

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-08

Oct-08

31-60

Jan-09

61-90

Apr-09

90+

Source: RBC Capital Markets Research

Sector Perform

While the supplemental credit enhancement is well received, we continue to rank Cards II at Sector Perform as notes

continue to trade tight relative the credit enhancement offered. As such, we believe current trading levels represent fair value

and we maintain our Sector Perform ranking.

14 Altaf Nanji, CFA

August 05, 2009

ABS Monitor

Golden Credit Card Trust (Royal Bank of Canada)

Exhibit 16: Deal Summary

Series

Class

1999-3

Senior

Subordinated

Subordination

Total

Amount

Coupon

Maturity

/ OC

Excess Spread Enhancement

237,500,000

6.190%

15-Jul-09

5.0%

0.00%

5.00%

12,500,000

7.350%

15-Jul-09

0.0%

0.00%

0.00%

Amount

Coupon

Total

Series

Class

2005-1

Senior

Subordinated

Maturity Subordination

Excess Spread Enhancement

1,146,000,000

4.047%

15-Jun-10

4.5%

5.81%

10.31%

54,000,000

4.567%

15-Jun-10

0.0%

5.81%

5.81%

Amount

Coupon

Total

Series

Class

2006-1

Senior

Subordinated

Maturity Subordination

Excess Spread Enhancement

1,146,000,000

4.254%

15-Feb-11

4.5%

5.62%

10.12%

54,000,000

4.734%

15-Feb-11

0.0%

5.62%

5.62%

Amount

Coupon

Total

Series

Class

2008-1

Senior

Subordinated

Maturity Subordination

Excess Spread Enhancement

500,000,000

5.110%

15-Apr-11

4.5%

4.67%

9.17%

23,561,000

6.860%

15-Apr-11

0.0%

4.67%

4.67%

Amount

Coupon

Total

Series

Class

2008-2

Senior

Subordinated

Maturity Subordination

Excess Spread Enhancement

500,000,000

5.420%

15-Apr-13

4.5%

4.31%

8.81%

23,561,000

7.420%

15-Apr-13

0.0%

4.31%

4.31%

Total

Series

Class

2008-3

Senior

Subordinated

Amount

Coupon

Maturity Subordination

400,000,000

Floating

15-Jul-11

4.5%

Excess Spread Enhancement

4.92%

9.46%

19,020,526

6.300%

15-Jul-11

0.0%

4.92%

4.92%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Exhibit 17: 12-Month Pool Performance

M onth

1-Jul-08

1-Aug-08

1-Sep-08

1-Oct-08

1-Nov -08

1-Dec-08

1-Jan-09

1-Feb-09

1-M ar-09

1-Apr-09

1-M ay-09

1-Jun-09

Yield Payment Rate

13.65%

39.88%

12.82%

36.28%

13.81%

38.63%

13.87%

39.70%

12.81%

35.14%

14.18%

40.76%

13.11%

35.31%

12.41%

31.93%

15.19%

37.29%

13.47%

34.92%

13.44%

36.39%

13.96%

37.24%

Loss Rate

2.42%

2.11%

2.52%

2.95%

2.94%

2.70%

3.06%

2.73%

3.98%

3.68%

4.08%

4.00%

31-60

0.76%

0.82%

0.84%

0.87%

0.83%

0.92%

1.11%

1.10%

0.99%

0.98%

0.91%

1.02%

Delinquencies

61-90

0.44%

0.45%

0.47%

0.45%

0.51%

0.50%

0.58%

0.67%

0.64%

0.57%

0.61%

0.54%

91+

0.58%

0.64%

0.66%

0.69%

0.69%

0.74%

0.79%

0.87%

0.90%

0.93%

0.92%

0.90%

1999-3

4.67%

4.62%

4.82%

4.72%

4.44%

4.50%

4.45%

4.39%

3.61%

1.53%

-1.54%

0.00%

2005-1

6.78%

6.73%

6.93%

6.83%

6.55%

6.61%

6.32%

6.25%

6.16%

6.07%

5.96%

5.81%

Excess Spread

2006-1

2008-1

6.59%

5.61%

6.54%

5.55%

6.75%

5.76%

6.65%

5.65%

6.37%

5.37%

6.43%

5.44%

6.13%

5.15%

6.07%

5.10%

5.98%

5.03%

5.89%

4.94%

5.78%

4.83%

5.62%

4.67%

2008-2

5.22%

5.17%

5.37%

5.27%

4.99%

5.06%

4.78%

4.73%

4.66%

4.57%

4.46%

4.31%

2008-3

6.20%

5.67%

6.03%

5.89%

5.58%

5.58%

5.31%

5.29%

5.27%

5.18%

5.07%

4.92%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Altaf Nanji, CFA 15

ABS Monitor

August 05, 2009

Exhibit 18: Golden CCT Performance Trends

Y ield

Pay ment Rate

16%

42%

40%

15%

38%

%

%

14%

36%

34%

13%

32%

12%

30%

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Apr-08

Jul-08

Lo ss Rate

Oct-08

Jan-09

Apr-09

Delinque nc ies

1.2%

4.5%

4.0%

0.9%

3.5%

%

%

0.6%

3.0%

2.5%

0.3%

Apr-08

2.0%

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-08

Oct-08

31-60

Jan-09

61-90

Apr-09

91+

Source: RBC Capital Markets Research

Sector Perform

Our Sector Perform is based on spreads fully reflecting the solid underlying credit metrics and potential for better value in

other programs. Loss rates, while increasing, are among the lowest in the peer group and payment rates are among the highest

in the peer group. While pool performance has been relatively strong on an absolute basis, subordination levels are thin, in

our view, as loss rates are approaching senior-tranche subordination levels. With spreads trading well through non-Schedule

1 bank programs, we think non-Schedule 1 bank programs may offer better value.

16 Altaf Nanji, CFA

August 05, 2009

ABS Monitor

Master Credit Card Trust (Bank of Montreal)

Exhibit 19: Deal Summary

Series

Class

2006-1

Subordination

Total

/ OC

Excess Spread Enhancement

Amount

Coupon

Maturity

A

238,750,000

4.380%

21-Nov-09

4.5%

12.99%

17.49%

B

5,625,000

4.480%

21-Nov-09

2.25%

12.99%

15.24%

C

5,625,000

4.580%

21-Nov-09

0.0%

12.99%

12.99%

Amount

Coupon

Total

Series

Class

Maturity Subordination

Excess Spread Enhancement

2006-2

A

955,000,000

4.444%

21-Nov-11

4.5%

12.92%

17.42%

B

22,500,000

4.594%

21-Nov-11

2.25%

12.92%

15.17%

C

22,500,000

4.744%

21-Nov-11

0.0%

12.92%

12.92%

Total

Series

Class

Amount

Coupon

2008-1

A

525,000,000

5.240%

21-M ay-13

Maturity Subordination

4.5%

Excess Spread Enhancement

12.08%

16.58%

B

12,370,000

6.240%

21-M ay-13

2.25%

12.08%

14.33%

C

12,370,000

7.240%

21-M ay-13

0.0%

12.08%

12.08%

Amount

Coupon

Total

Series

Class

Maturity Subordination

Excess Spread Enhancement

2008-2

A

1,000,000,000

5.30%

21-Aug-12

4.5%

12.02%

16.52%

B

23,565,000

6.30%

21-Aug-12

2.25%

12.02%

14.27%

C

23,565,000

7.30%

21-Aug-12

0.0%

12.02%

12.02%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Exhibit 20: 12-Month Pool Performance

Month

1-Jul-08

1-Aug-08

1-Sep-08

1-Oct-08

1-Nov -08

1-Dec-08

1-Jan-09

1-Feb-09

1-Mar-09

1-Apr-09

1-May-09

1-Jun-09

Yield Payment Rate

21.99%

42.37%

21.49%

37.61%

21.78%

40.02%

21.61%

40.56%

21.69%

33.98%

22.80%

40.17%

21.42%

35.59%

21.96%

31.00%

22.55%

36.76%

22.02%

35.03%

21.66%

34.96%

21.83%

37.86%

Loss Rate

2.66%

2.88%

2.88%

2.61%

2.67%

2.76%

2.98%

3.51%

3.67%

3.73%

4.09%

4.44%

30-59

1.02%

1.15%

1.13%

0.99%

1.11%

1.20%

1.24%

1.22%

1.14%

1.18%

1.18%

1.13%

Delinquencies

60-89

0.45%

0.46%

0.51%

0.47%

0.48%

0.52%

0.61%

0.68%

0.64%

0.62%

0.62%

0.62%

90+

0.71%

0.73%

0.76%

0.80%

0.85%

0.90%

0.98%

1.06%

1.15%

1.18%

1.18%

1.20%

Excess Spread

2006-1

14.93%

14.21%

14.50%

14.60%

14.62%

15.64%

14.04%

14.05%

14.48%

13.89%

13.17%

12.99%

2006-2

14.86%

14.14%

14.43%

14.54%

14.56%

15.74%

13.98%

13.99%

14.42%

13.82%

13.11%

12.92%

2008-1

14.01%

13.29%

13.58%

13.69%

13.71%

14.73%

13.13%

13.14%

13.57%

12.98%

12.26%

12.08%

2008-2

13.96%

13.24%

13.52%

13.63%

13.65%

14.67%

13.07%

13.08%

13.51%

12.92%

12.20%

12.02%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Altaf Nanji, CFA 17

ABS Monitor

August 05, 2009

Exhibit 21: Master CCT Performance Trends

Y ield

Pay ment Rate

23%

45%

40%

22%

%

%

21%

35%

20%

30%

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Apr-08

Jul-08

Lo ss Rate

Oct-08

Jan-09

Apr-09

Delinque nc ie s

4.5%

1.3%

4.0%

1.0%

%

3.5%

%

0.7%

3.0%

2.5%

0.4%

2.0%

Apr-08

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-08

Oct-08

30-59

Jan-09

60-89

Apr-09

90+

Source: RBC Capital Markets Research

Sector Perform

We maintain our Sector Perform ranking following the same logic as for Golden. Our ranking is a function of spreads fully

reflecting the solid underlying credit metrics. Loss rates, while increasing, are among the lowest in the peer group and

payment rates are among the highest in the peer group. While pool performance has been relatively strong on an absolute

basis, subordination levels are thin, in our view, as loss rates are approaching senior-tranche subordination levels. With

spreads trading well through non-Schedule 1 bank programs, we think non-Schedule 1 bank programs may offer better value.

18 Altaf Nanji, CFA

August 05, 2009

ABS Monitor

Algonquin Credit Card Trust (Capital One)

Exhibit 22: Deal Summary

Total

Series

2005-1

Class

A

Amount

Coupon

397,500,000

3.890

Maturity Subordination

Excess Spread Enhancement

15-Oct-10

20.5%

5.25%

25.75%

B

50,000,000

4.449

15-Oct-10

10.5%

5.25%

15.75%

C

52,500,000

4.779

15-Oct-10

0.0%

5.25%

5.25%

Amount

Coupon

397,500,000

4.889

Total

Series

2006-1

Class

A

Maturity Subordination

Excess Spread Enhancement

15-Jul-11

20.5%

4.40%

24.90%

B

50,000,000

5.158

15-Jul-11

10.5%

4.40%

14.90%

C

52,500,000

5.459

15-Jul-11

0.0%

4.40%

4.40%

Amount

Coupon

397,500,000

4.562

Total

Series

2007-1

Class

A

Maturity Subordination

Excess Spread Enhancement

15-Jun-12

20.5%

4.73%

25.23%

B

50,000,000

4.792

15-Jun-12

10.5%

4.73%

15.23%

C

52,500,000

5.092

15-Jun-12

0.0%

4.73%

4.73%

Excess Spread

2006-1

8.49%

8.60%

8.50%

8.21%

8.28%

7.98%

7.53%

7.20%

6.58%

5.89%

4.72%

4.40%

2007-1

8.81%

8.93%

8.82%

8.55%

8.62%

8.32%

7.86%

7.54%

6.92%

6.24%

5.05%

4.73%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Exhibit 23: 12-Month Pool Performance

M onth

1-Jul-08

1-Aug-08

1-Sep-08

1-Oct-08

1-Nov -08

1-Dec-08

1-Jan-09

1-Feb-09

1-M ar-09

1-Apr-09

1-M ay-09

1-Jun-09

Yield Payment Rate

19.96%

10.50%

19.77%

9.19%

20.27%

9.72%

21.06%

9.95%

21.87%

9.87%

20.46%

9.26%

19.73%

8.63%

21.98%

7.97%

19.79%

9.83%

20.31%

9.31%

19.27%

8.92%

20.09%

10.42%

Loss Rate

4.20%

4.50%

4.80%

4.82%

5.11%

5.28%

5.42%

5.77%

6.30%

7.53%

7.35%

8.48%

30-59

1.65%

1.76%

1.80%

1.78%

1.85%

1.91%

1.91%

2.02%

1.85%

1.98%

2.52%

2.16%

Delinquencies

60-89

0.87%

0.92%

0.93%

0.98%

0.96%

1.02%

1.09%

1.11%

1.08%

1.07%

1.16%

1.37%

90+

1.67%

1.73%

1.75%

1.81%

1.81%

1.88%

2.03%

2.18%

2.21%

2.26%

2.31%

2.32%

2005-1

9.31%

9.44%

9.36%

9.08%

9.14%

8.82%

8.36%

8.07%

7.45%

6.78%

5.57%

5.25%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Altaf Nanji, CFA 19

ABS Monitor

August 05, 2009

Exhibit 24: Algonquin CCT Performance Trends

Y ie ld

Pay me nt Rate

11%

22%

21%

10%

%

%

9%

20%

19%

8%

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Apr-08

Jul-08

Lo ss Rate

3.0%

8%

2.5%

%

1.5%

5%

1.0%

4%

0.5%

Apr-08

3%

Jul-08

Oct-08

Apr-09

2.0%

6%

Apr-08

Jan-09

Delinque nc ies

9%

7%

%

Oct-08

Jan-09

Apr-09

Jul-08

Oct-08

30-59

Jan-09

60-89

Apr-09

90+

Source: RBC Capital Markets Research

Outperform

With (1) spreads trading ~300bps back of Schedule 1 bank programs, (2) substantial subordination levels (20.5%) providing

ample overall credit enhancement at the senior level, (3) the program exhibiting stable underwriting trends, and (4) yields

demonstrating some resilience, we think Algonquin offers a good risk reward trade-off for investors. As such, we rank

Algonquin CCT at Outperform. While payment rates are low, they have held relatively steady (which is key). On the

downside, we note that liquidity may not match that of Schedule 1 bank deals.

20 Altaf Nanji, CFA

August 05, 2009

ABS Monitor

Broadway Credit Card Trust (Citibank)

Exhibit 25: Deal Summary

Total

Series

Class

2004-2

A

Amount

Coupon

350,000,000

4.804

Maturity Subordination

Excess Spread Enhancement

17-M ar-14

18.50%

3.12%

21.62%

B

31,818,182

5.434

17-M ar-14

10.50%

3.12%

13.62%

C

15,909,091

5.884

17-M ar-14

6.50%

3.12%

9.62%

Amount

Coupon

Total

Series

Class

Maturity Subordination

Excess Spread Enhancement

2008-1

A

525,000,000

5.234

17-Jun-11

15.50%

2.75%

18.25%

B

29,167,000

6.084

17-Jun-11

10.50%

2.75%

13.25%

C

29,167,000

7.143

17-Jun-11

5.50%

2.75%

8.25%

Amount

Coupon

Total

Series

Class

Maturity Subordination

Excess Spread Enhancement

2008-2

A

250,000,000

5.449

17-Jun-13

15.50%

2.52%

18.02%

B

13,889,000

6.439

17-Jun-13

10.50%

2.52%

13.02%

C

13,889,000

7.659

17-Jun-13

5.50%

2.52%

8.02%

Total

Series

Class

Amount

Coupon

2008-3

A

500,000,000

Floating

18-Oct-10

Maturity Subordination

18.50%

Excess Spread Enhancement

4.88%

23.38%

B

34,091,000

Floating

18-Oct-10

12.50%

4.88%

17.38%

C

34,091,000

Floating

18-Oct-10

6.50%

4.88%

11.38%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Exhibit 26: 12-Month Pool Performance

M onth

1-Jul-08

1-Aug-08

1-Sep-08

1-Oct-08

1-Nov -08

1-Dec-08

1-Jan-09

1-Feb-09

1-Mar-09

1-Apr-09

1-M ay-09

1-Jun-09

Yield Payment Rate

18.88%

18.17%

20.81%

16.87%

20.61%

16.54%

19.98%

18.45%

20.34%

15.79%

20.98%

15.85%

19.51%

16.36%

21.77%

14.27%

21.14%

15.41%

19.02%

15.51%

20.79%

14.92%

21.35%

15.94%

Loss Rate

5.55%

6.94%

6.84%

6.82%

7.86%

8.61%

7.90%

10.56%

10.16%

9.69%

10.98%

10.77%

30-59

1.43%

1.59%

1.84%

1.68%

1.68%

1.72%

1.74%

1.88%

2.09%

2.04%

1.87%

1.89%

Delinquencies

60-89

0.83%

0.89%

0.94%

1.05%

1.00%

1.05%

1.09%

1.13%

1.21%

1.27%

1.29%

1.24%

90+

1.58%

1.64%

1.71%

1.82%

1.97%

2.03%

2.16%

2.26%

2.37%

2.45%

2.49%

2.60%

2004-2

6.19%

6.80%

7.09%

6.98%

6.43%

5.87%

5.47%

4.99%

4.55%

3.61%

3.31%

3.12%

Excess Spread

2008-1

2008-2

7.63%

7.41%

7.04%

6.83%

6.82%

6.60%

6.43%

6.20%

5.92%

5.69%

5.51%

5.29%

5.07%

4.84%

4.55%

4.32%

3.98%

3.73%

3.09%

2.85%

2.63%

2.61%

2.75%

2.52%

2008-3

7.08%

5.90%

5.80%

5.58%

5.77%

5.77%

5.14%

4.90%

4.88%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Altaf Nanji, CFA 21

ABS Monitor

August 05, 2009

Exhibit 27: Broadway CCT Performance Trends

Pay ment Rate

Y ie ld

%

22%

19%

21%

18%

20%

%

17%

19%

16%

18%

15%

17%

14%

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Apr-08

Jul-08

Lo ss Rate

3.0%

10%

2.5%

%

1.5%

7%

1.0%

6%

0.5%

Apr-08

5%

Jul-08

Oct-08

Apr-09

2.0%

8%

Apr-08

Jan-09

Delinque nc ie s

11%

9%

%

Oct-08

Jan-09

Apr-09

Jul-08

O ct-08

30-59

Jan-09

60-89

Apr-09

90+

Source: RBC Capital Markets Research

Sector Perform

Broadway seems to be reporting credit metrics at the weak end of the performance spectrum, so we maintain our Sector

Perform rating. Specifically, we note: (1) loss rates are among the highest in the peer group; (2) delinquencies are exhibiting

less positive trends relative to peer programs; and (3) payment rates appear to be declining sharply. Nevertheless, (1) spreads

trade well back of Schedule 1 bank peers, adequately compensating for the incremental risk; (2) enhancement levels seem to

appropriately reflect loss patterns; and (3) we note that Citi, the trust sponsor, has demonstrated support for the program

recently.

22 Altaf Nanji, CFA

August 05, 2009

ABS Monitor

Eagle Credit Card Trust (PC Bank)

Exhibit 28: Deal Summary

Total

Series

2006-1

Class

Amount

Coupon

Maturity Subordination

A

465,000,000

4.441

17-M ar-11

B

17,500,000

4.701

17-M ar-11

C

17,500,000

4.981

17-M ar-11

Excess Spread

Enhancement

7.0%

11.90%

18.90%

3.5%

11.90%

15.40%

0.0%

11.90%

11.90%

90+

0.87%

0.91%

0.92%

Excess Spread

2006-1

9.85%

10.34%

10.84%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Exhibit 29: 12-Month Pool Performance

M onth

1-Jul-08

1-Aug-08

1-Sep-08

Yield Payment Rate

20.94%

45.81%

21.23%

41.56%

22.63%

50.07%

1-Oct-08

21.21%

1-Nov -08

1-Dec-08

Delinquencies

60-89

0.47%

0.53%

0.55%

Loss Rate

3.87%

3.88%

3.14%

30-59

0.81%

0.86%

0.92%

43.59%

3.90%

0.87%

0.58%

1.08%

10.67%

22.57%

39.09%

4.66%

0.88%

0.55%

1.20%

10.84%

22.97%

43.43%

5.53%

1.00%

0.54%

1.18%

10.71%

1-Jan-09

21.19%

42.41%

5.71%

1.13%

0.69%

1.32%

10.23%

1-Feb-09

23.39%

37.20%

6.34%

1.23%

0.71%

1.37%

10.09%

1-Mar-09

1-Apr-09

1-M ay-09

1-Jun-09

22.75%

23.79%

23.30%

22.96%

43.41%

40.73%

41.18%

47.10%

6.67%

6.90%

7.45%

6.24%

1.08%

0.99%

0.91%

1.04%

0.72%

0.66%

0.62%

0.59%

1.39%

1.42%

1.30%

1.29%

9.76%

10.17%

9.75%

11.90%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Altaf Nanji, CFA 23

ABS Monitor

August 05, 2009

Exhibit 30: Eagle CCT Performance Trends

Pay ment Rate

Y ie ld

24%

52%

23%

49%

22%

%

%

21%

46%

43%

20%

40%

19%

18%

37%

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Apr-08

Jul-08

Lo ss Rate

Oct-08

Jan-09

Apr-09

Delinque nc ie s

8%

1.5%

7%

1.1%

%

6%

%

0.7%

5%

4%

0.3%

Apr-08

3%

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-08

O ct-08

30-59

Jan-09

60-89

Apr-09

90+

Source: RBC Capital Markets Research

Sector Perform

Our Sector Perform rating on Eagle is a function of: (1) healthy payment rates that are among the highest in the peer group;

and (2) strong yields that have exhibited resilience despite the weak macro backdrop. However, we note that loss rates are

increasing quickly and, in our view, the enhancement ratio would seem to suggest current spread levels offer fair value.

24 Altaf Nanji, CFA

August 05, 2009

ABS Monitor

Glacier Credit Card Trust (Canadian Tire Bank)

Exhibit 31: Deal Summary

Series

Class

2004-1

Senior

Subordinated

Subordination

Total

Amount

Coupon

Maturity

/ OC

Excess Spread Enhancement

590,625,000

4.274%

20-Nov-09

11.0%

9.04%

20.04%

34,375,000

4.674%

20-Nov-09

5.5%

9.04%

14.54%

Amount

Coupon

344,925,000

4.187%

19-Nov-10

11.0%

9.12%

20.12%

20,075,000

4.507%

19-Nov-10

5.5%

9.12%

14.62%

Amount

Coupon

300,000,000

4.271%

18-Nov-11

11.0%

9.04%

20.04%

17,460,000

4.571%

18-Nov-11

5.5%

9.04%

14.54%

Total

Series

Class

2005-1

Senior

Subordinated

Maturity Subordination

Excess Spread Enhancement

Total

Series

Class

2006-1

Senior

Subordinated

Maturity Subordination

Excess Spread Enhancement

Total

Series

Class

2006-2

Senior

Subordinated

Amount

Coupon

238,650,000

4.405%

20-M ay-14

Maturity Subordination

11.0%

Excess Spread Enhancement

8.90%

19.90%

13,890,000

4.765%

20-M ay-14

5.5%

8.90%

14.40%

Amount

Coupon

600,000,000

5.027%

20-Feb-13

11.0%

8.24%

19.24%

34,930,000

6.027%

20-Feb-13

5.5%

8.24%

13.74%

Total

Series

Class

2008-1

Senior

Subordinated

Maturity Subordination

Excess Spread Enhancement

Source: RBC Capital Markets Research, Company reports, Bloomberg

Exhibit 32: 12-Month Pool Performance

M onth

1-Jul-08

1-Aug-08

1-Sep-08

1-Oct-08

1-Nov -08

1-Dec-08

1-Jan-09

1-Feb-09

1-M ar-09

1-Apr-09

1-May-09

1-Jun-09

Yield Payment Rate

19.63%

28.21%

19.87%

25.15%

20.28%

26.88%

19.88%

27.22%

20.48%

23.73%

21.07%

27.24%

20.24%

25.25%

20.40%

21.84%

19.34%

25.61%

21.69%

23.27%

20.62%

24.50%

21.30%

27.00%

Loss Rate

6.40%

6.23%

6.32%

6.22%

8.85%

6.38%

6.50%

7.23%

7.42%

7.71%

7.62%

8.52%

31-60

1.28%

1.41%

1.37%

1.25%

1.30%

1.39%

1.66%

1.74%

1.58%

1.46%

1.47%

1.45%

Delinquencies

61-90

0.78%

0.78%

0.80%

0.75%

0.70%

0.74%

0.86%

0.97%

0.96%

0.93%

0.90%

0.87%

91+

1.55%

1.58%

1.58%

1.56%

1.44%

1.43%

1.51%

1.61%

1.73%

1.79%

1.82%

1.77%

2004-1

9.03%

9.19%

9.36%

9.60%

8.92%

9.19%

9.05%

9.54%

8.61%

8.80%

8.72%

9.04%

2005-1

9.12%

9.28%

9.45%

9.69%

9.01%

9.28%

9.14%

9.63%

8.70%

8.89%

8.80%

9.12%

Excess Spread

2006-1

9.04%

9.19%

9.37%

9.61%

8.93%

9.20%

9.05%

9.54%

8.61%

8.80%

8.72%

9.04%

2006-2

8.90%

9.06%

9.23%

9.47%

8.79%

9.06%

8.91%

9.40%

8.48%

8.67%

8.58%

8.90%

2008-1

8.28%

8.44%

8.58%

8.80%

8.11%

8.40%

8.27%

8.76%

7.83%

8.01%

7.92%

8.24%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Altaf Nanji, CFA 25

ABS Monitor

August 05, 2009

Exhibit 33: Glacier CCT Performance Trends

Y ie ld

Pay ment Rate

30%

22%

28%

21%

%

%

26%

24%

20%

22%

19%

20%

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Apr-08

Jul-08

Lo ss Rate

Oct-08

Jan-09

Apr-09

De linque nc ies

9%

2.0%

1.5%

8%

%

%

1.0%

7%

0.5%

Apr-08

6%

Apr-08

Jul-08

O ct-08

Jan-09

Apr-09

Jul-08

O ct-08

31-60

Jan-09

61-90

Apr-09

91+

Source: RBC Capital Markets Research

Sector Perform

We maintain our Sector Perform rating on Glacier to reflect that: (1) yields are holding steady; (2) payment rates remain

healthy in the mid-20% range; and (3) losses are not showing signs of inordinate deterioration. Enhancement levels seem

appropriate considering pool performance, and spreads seem to properly reflect underlying credit metrics.

26 Altaf Nanji, CFA

August 05, 2009

ABS Monitor

Gloucester Credit Card Trust (B of A / MBNA)

Exhibit 34: Deal Summary

Subordination

Total

Amount

Coupon

Maturity

/ OC

Excess Spread Enhancement

A

253,500,000

5.376%

15-M ay-14

16.0%

7.65%

23.65%

B

46,500,000

6.486%

15-M ay-14

0.05%

7.65%

7.70%

Amount

Coupon

Series

Class

2004-1

Total

Series

Class

Maturity Subordination

Excess Spread Enhancement

2006-1

A

422,500,000

4.445%

15-M ar-11

16.0%

7.96%

23.96%

B

77,500,000

4.994%

15-M ar-11

0.5%

7.96%

8.46%

Amount

Coupon

Total

Series

Class

Maturity Subordination

Excess Spread Enhancement

2006-2

A

300,000,000

Floating

15-Nov-13

14.5%

8.16%

22.70%

B

49,000,000

4.909%

15-Nov-13

0.5%

8.16%

8.66%

Amount

Coupon

Total

Series

Class

Maturity Subordination

Excess Spread Enhancement

2007-1

A

516,000,000

Floating

15-Jun-10

14.5%

8.04%

22.54%

B

84,000,000

5.377%

15-Jun-10

0.5%

8.04%

8.54%

Amount

Coupon

Total

Series

Class

Maturity Subordination

Excess Spread Enhancement

2008-1

A

400,000,000

5.340%

15-M ay-13

12.0%

3.79%

15.79%

B

52,000,000

7.330%

15-M ay-13

0.5%

3.79%

4.29%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Exhibit 35: 12-Month Pool Performance

M onth

1-Jun-08

1-Jul-08

1-Aug-08

1-Sep-08

1-Oct-08

1-Nov -08

1-Dec-08

1-Jan-09

1-Feb-09

1-M ar-09

1-Apr-09

1-M ay-09

1-Jun-09

Yield Payment Rate

17.57%

14.65%

17.95%

14.68%

17.01%

13.51%

18.34%

14.38%

18.03%

14.35%

16.69%

12.89%

16.97%

13.12%

16.96%

13.08%

16.86%

11.86%

18.46%

13.27%

16.95%

12.46%

16.79%

12.02%

17.47%

12.89%

Loss Rate

3.67%

4.12%

4.01%

3.92%

3.82%

3.78%

4.62%

3.90%

5.17%

4.65%

5.41%

5.56%

5.96%

30-59

1.00%

1.04%

1.11%

1.13%

1.07%

1.16%

1.21%

1.22%

1.36%

1.39%

1.35%

1.37%

1.37%

Delinquencies

60-89

0.54%

0.51%

0.52%

0.53%

0.55%

0.60%

0.61%

0.64%

0.68%

0.77%

0.73%

0.75%

0.74%

90+

1.19%

1.13%

1.09%

1.09%

1.06%

1.10%

1.14%

1.25%

1.27%

1.32%

1.43%

1.47%

1.51%

2004-1

8.00%

7.56%

7.55%

7.71%

7.78%

8.00%

7.69%

8.64%

7.92%

8.71%

8.38%

8.34%

7.65%

2006-1

8.31%

7.90%

7.89%

8.04%

8.09%

8.31%

8.00%

8.25%

8.24%

9.03%

8.68%

8.65%

7.96%

Excess Spread

2006-2

8.45%

8.03%

8.02%

8.17%

8.23%

8.46%

8.16%

8.41%

8.41%

9.21%

8.87%

8.84%

8.16%

2007-1

8.33%

7.92%

7.91%

8.06%

8.11%

8.34%

8.03%

8.29%

8.29%

9.10%

8.76%

8.73%

8.04%

2008-1

5.87%

5.99%

6.10%

6.03%

6.14%

6.06%

5.39%

5.08%

4.62%

5.12%

4.56%

4.50%

3.79%

Source: RBC Capital Markets Research, Company reports, Bloomberg

Altaf Nanji, CFA 27

ABS Monitor

August 05, 2009

Exhibit 36: Gloucester CCT Performance Trends

Pay me nt Rate

Y ie ld

16%

20%

15%

19%

%

%

18%

14%

13%

17%

12%

16%

11%

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Apr-08

Jul-08

Lo ss Rate

Oct-08

Jan-09

Apr-09

Delinquenc ies

6%

1.7%

1.5%

1.3%

5%

%

%

1.1%

0.9%

4%

0.7%

0.5%

Apr-08

3%

Apr-08

Jul-08

O ct-08

Jan-09

Apr-09

Jul-08

Oct-08

30-59

Jan-09

60-89

Apr-09

90+

Source: RBC Capital Markets Research

Outperform

Our Outperform rating is based on: (1) attractive spread (300bps+ back of Schedule 1 bank programs); (2) strong

subordination levels for investors in the senior tranches; and (3) yields that are holding steady in the challenging operating

environment. On the downside, we note that (1) Payment Rates are low (although the deterioration has been in line with

peers); and (2) liquidity may not match that of Schedule 1 bank deals.

28 Altaf Nanji, CFA

August 05, 2009

ABS Monitor

Global Credit Research Team

Royal Bank of Canada Europe Limited

London

Roger Appleyard, Head Global Credit Research

Hank Calenti, CFA, Analyst

Miriam Hehir, Analyst

Alastair Whitfield, Associate

+44 20 7653 4101

+44 20 7653 4386

+44 20 7653 4175

+44-20-7653-4834

roger.appleyard@rbccm.com

hank.calenti@rbccm.com

miriam.hehir@rbccm.com

alastair.whitfield@rbccm.com

RBC Dominion Securities Inc.

Toronto

Jonathan Allen, CFA, Director, Credit Research (Canada)

Matthew Kolodzie, CFA, P.Eng., Analyst

Altaf Nanji, CFA, Analyst

Jie Liu, Associate Analyst

Edward Martinez, Associate

(416) 842-3806

(416) 842-6152

(416) 842-6462

(416) 842-6140

(416) 842-5165

jonathan.allen@rbccm.com

matthew.kolodzie@rbccm.com

altaf.nanji@rbccm.com

jie.liu@rbccm.com

edward.martinez@rbccm.com

(212) 618-3253

(212) 428-6461

(212) 618-3250

(212) 618-3304

phillip.armstrong@rbccm.com

christina.boni@rbccm.com

adam.leight@rbccm.com

sarah.orielly@rbccm.com

High Yield Research

RBC Capital Markets Corporation

New York

Phillip Armstrong, Analyst

Christina Boni, Analyst

Adam Leight, Analyst

Sarah O'Rielly, Associate

Altaf Nanji, CFA 29

ABS Monitor

August 05, 2009

Required Disclosures

Conflicts Disclosures

This product constitutes a compendium report (covers six or more subject companies). As such,

RBC Capital Markets chooses to provide specific disclosures for the subject companies by

reference. To access current disclosures for the subject companies, clients should refer to

http://www7.rbccm.com/GLDisclosure/PublicWeb/DisclosureLookup.aspx?EntityID=1 or send a

request to RBC CM Research Publishing, P.O. Box 50, 200 Bay Street, Royal Bank Plaza, 29th

Floor, South Tower, Toronto, Ontario M5J 2W7.

The analyst(s) responsible for preparing this research report received compensation that is based

upon various factors, including total revenues of the member companies of RBC Capital Markets

and its affiliates, a portion of which are or have been generated by investment banking activities of

the member companies of RBC Capital Markets and its affiliates.

Distribution of Ratings

For the purpose of ratings distributions, regulatory rules require member firms to assign ratings to

one of three rating categories - Buy, Hold/Neutral, or Sell - regardless of a firm's own rating

categories. Although RBC Capital Markets' ratings of Top Pick/Outperform, Sector Perform and

Underperform most closely correspond to Buy, Hold/Neutral and Sell, respectively, the meanings

are not the same because our ratings are determined on a relative basis (as described above).

Conflicts Policy