AMP High Growth

advertisement

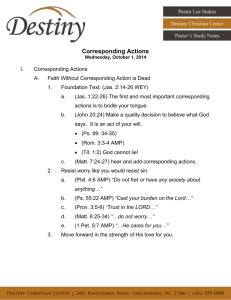

AMP High Growth Quarterly Investment Option Update 30 September 2015 Aim and Strategy Aim and strategy: To provide high returns over the medium to long term through a diversified portfolio investing mostly in shares with some property, fixed interest and alternative assets. Investment Option Performance To view the latest investment performances please visit www.amp.com.au Availability Asset Allocation Benchmark Range (%) APIR Australian Shares 38 26-50 AMP Flexible Lifetime Super AMP0342AU Global Shares 34 35-55 AMP Flexible Super - Retirement account AMP1325AU Growth Alternatives 3.5 0-15 Australian Property 3 0-15 Global Property 2.5 0-18 Global Infrastructure 5 0-12 Product name AMP Flexible Super - Super account AMP1455AU CUSTOM SUPER AMP0342AU Flexible Lifetime - Allocated Pension AMP0609AU Defensive Alternatives 2 0-5 Flexible Lifetime - Term Pension AMP0899AU Australian Bonds 6 0-12 METCASH SUPERANNUATION PLAN AMP0342AU Global Bonds 3 0-10 MultiFund Flexible Income Plan AMP0354AU Cash 3 0-15 SignatureSuper AMP0774AU SignatureSuper Allocated Pension AMP1133AU SuperLeader AMP1885AU Top Ten Australian Shares % Commonwealth Bank of Australia 8.16 Westpac Banking Corp 7.25 National Australia Bank Ltd 6.50 Australia & New Zealand Banking Group Ltd 6.26 Telstra Corp Ltd 5.76 BHP Billiton Ltd 5.16 Suggested investment 6 - 9 years timeframe Wesfarmers Ltd 3.59 Macquarie Group Ltd 2.29 Relative risk rating Medium - High Westfield Corp 2.18 Investment style Active QBE Insurance Group Ltd 2.15 Investment Option Overview Investment category AMP Life Limited 84 079 300 379 Diversified - Moderately Agressive Top Ten International Shares Exposure % Actual Allocation % Microsoft Corp 2.20 Australian Equities 39.10 Google Inc 1.60 International Shares 36.73 eBay Inc 1.54 Alternative Assets 10.54 Lowe's Cos Inc 1.52 Listed Property 7.31 Visa Inc 1.47 Australian Fixed Interest 4.40 IBM 1.46 Cash 1.92 Home Depot Inc/The 1.41 Direct Property 0.00 Intel Corp 1.20 International Fixed Interest 0.00 APPLE INC 1.18 Yum! Brands Inc 1.15 Portfolio Summary The Option delivered a negative return for the quarter; however, returns over one year remain positive. Unlisted real assets, fixed income and cash were positive contributors to performance. Australian shares were the largest detractor from performance. The Option remains overweight international shares and foreign currency. In the defensive portion of the portfolio cash is preferred to international bonds. Investment Option Commentary Performance this quarter was negative, with gains in unlisted real assets and Australian fixed income insufficient to offset sharp falls in Australian and global shares. Over the quarter global financial markets were driven by mounting concerns relating to growth in China and the potential for a crisis in other emerging markets. The outlook for the Australian economy weakened over the quarter as slowing Chinese economic growth contributed to continued falls in commodity prices. This further deterioration fuelled a selloff in Australian shares (down 6.6%) and increased the likelihood of further interest rate cuts by the Reserve Bank of Australia which boosted Australian fixed income (up 2.2%). The story was similar across other developed markets where shares declined (down 7.4%) and fixed income rallied (up 1.9%). The growing downward pressure on interest rates also helped real assets remain steady throughout the quarter. The Option’s overweight allocation to foreign currencies was a major contributor to performance with the Australian dollar falling considerably over the quarter (down 9% against the US dollar). No changes to portfolio positioning were made over the quarter and the Option continues to be overweight growth assets (expressed primarily through international shares) and foreign currency while being underweight defensive assets (expressed through international bonds). Outlook Equities While 2015 is likely to remain volatile, with the risk of further weakness, it’s also likely to see share markets end higher as the cyclical bull market in shares resumes into year end. Shares are cheap relative to bonds and monetary conditions are set to remain easy. Australian shares are likely to remain a relative laggard as commodity price weakness and the Chinese downturn continue to weigh on markets. Fixed income Low bond yields will likely mean soft medium-term returns from government bonds. An interest rate hike from the US Federal Reserve is likely within the next six months. In the current climate of volatility and increased share market pessimism, bonds may still prove valuable to investors during any lift in volatility that may likely be experienced over the short to medium term. Australian yields continue to trade at higher levels compared to those available in Japan and Europe, as such Australian fixed interest including corporate credit, may remain attractive to foreign entities. AMP Life Limited 84 079 300 379 Real assets In North America, the favourable economic and property fundamental backdrop we have been witnessing remains. From a macroeconomic perspective, the focus will be on US interest rates, our expectation is that the Fed will increase rates in September and takes a slow and steady approach to increasing rates rather than a rapid and disruptive pace. Contact Us Web: www.amp.com.au Email: askamp@amp.com.au Phone: 131 267 (Mon. to Fri. 8:30am to 6:00pm AEST) What you need to know This publication has been prepared by AMP Life Limited ABN 84 079 300 379, AFSL No. 233671 (AMP Life). The information contained in this publication has been derived from sources believe to accurate and reliable as at the date of this document. Information provided in this investment option update are views of the underlying Investment Manager only and not necessarily the views of the AMP Group. No representation is given in relation to the accuracy or completeness of any statement contained in it. Whilst care has been taken in the preparation of this publication, to the extent permitted by law, no liability is accepted for any loss or damage as a result of reliance on this information. AMP Life is part of the AMP Group. In providing the general advice, AMP Life and AMP Group receives fees and charges and their employees and directors receive salaries, bonuses and other benefits. The information in this document is of a general nature only and does not take into account your financial situation, objectives and needs. Before you make any investment decision based on the information contained in this document you should consider how it applies to your personal objectives, financial situation and needs, or speak to a financial planner. The investment option referred to in this publication is available through products issued by AMP Superannuation Limited ABN 31 008 414 104, AFSL No. 233060 (ASL) and/or AMP Life. Before deciding to invest or make a decision about the investment options, you should read the current Product Disclosure Statement for the relevant product, available from ASL, AMP Life or your financial planner. Any references to the “Fund”, strategies, asset allocations or exposures are references to the underlying managed fund that the investment option either directly or indirectly invests in (underlying fund). The investment option’s aim and strategy mirrors the objective and investment approach of the underlying fund. An investment in the investment option is not a direct investment in the underlying fund. Neither AMP Life, ASL, any other company in the AMP Group nor underlying fund manager guarantees the repayment of capital or the performance of any product or particular rate of return referred to in this document. Past performance is not a reliable indicator of future performance. AMP Life Limited 84 079 300 379