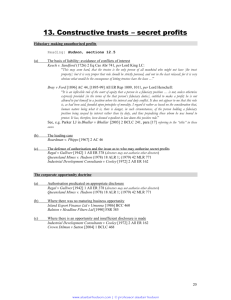

Regal (Hastings) Ltd

advertisement