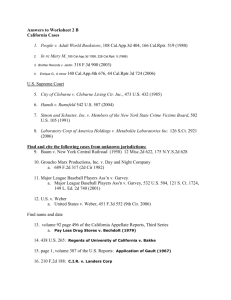

California - ALFA International

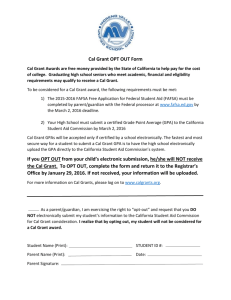

advertisement