Real Estate Finance - the School of Economics and Finance

advertisement

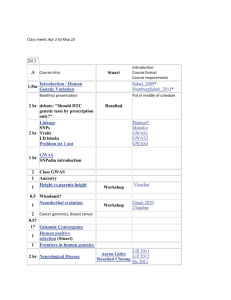

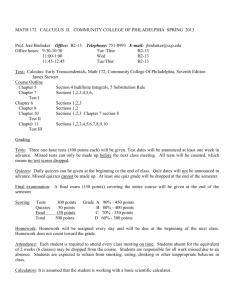

Real Estate Finance Dr. K. S. Tse, University of Hong Kong, Spring 2002 E-mail: ktse@econ.hku.hk Course Objectives: Real Estate represents a large fraction of the world's wealth, and its efficient utilization and the markets in which it is traded involve many interesting and complex economic and policy issues. The objective of this course is to develop an analytical framework by which students can make sound real estate investment decisions. The main emphases of the course are on theory, concept building, financial modelling, and practical application. In particular, class discussions will cover the following areas in real estate: • • • • Real estate markets and investments, appraisals, and development Institutional aspects of real estate finance Optimal financing strategies Pricing of Mortgage-Backed Securities Materials and data pertaining to local real estate market will be used throughout the course whenever possible. Text and Reading Materials: There is no required text book for this course. Reading materials for all topics will be handed out in class as well as put on reserve at the HKU library. Students are responsible for all materials. • References: Real Estate Finance and Investments, Bruggeman and Fisher, 9th Edition, Irwin. Required Tool: A standard financial calculator such as TI BA35 and HP 12C. Grading Policy: The course grade will be based on tutorial discussions on local real estate market, an in-class and a take-home mid-term test, and the year-end exam. The point distribution is as follows: Cases Analysis (Tutorial) Two Tests (1 in Class and 1 take home) Year-End Final Exam 20% 20% 60% Problems sets will be assigned, but they will not be collected and therefore not graded. The purpose of the assignments is to assist you in reviewing the materials and preparing for the exams. Details about the requirements for the case reports will be given shortly after the semester starts. Date Jan 22 Jan 24 Jan 29 Jan 31 Feb 05 Feb 07 Feb 12 Feb 14 Feb 19 Feb 21 Feb 26 Feb 28 Mar 05 Mar 07 Mar 12 Mar 14 Mar 19 Mar 21 Mar 26 Mar 28 Apr 02 Apr 04 Apr 09 Apr 11 Apr 16 Apr 18 Apr 23 Apr 25 Apr 30 May 02 Reading Assignments Topic Tue Thur Tue Thur Tue Thur Tue Thur Tue Thur Tue Thur Tue Thur Tue Thur Tue Thur Tue Thur Tue Thur Tue Thur Tue Thur Tue Thur Tue Thur Introduction Residential Property Market in Hong Kong Financing Residential Properties Financing Residential Properties Financing Residential Properties Mortgage-Related Backed Securities Lecture notes Lecture notes Lecture notes University Holiday University Holiday Mortgage-Related Backed Securities Mortgage-Related Backed Securities Mortgage-Related Backed Securities Mortgage Market Real Estate Auctions in Hong Kong Real Estate Auctions in Hong Kong Lecture notes Reading Week Reading Week Real Estate Auctions in Hong Kong Quiz Pre-Sale Transactions Pre-Sale Transactions Default Risk in Real Estate Transaction Default Risk in Real Estate Transaction Valuation of Income Properties Valuation of Income Properties Valuation of Income Properties Land Valuation Land Valuation Land Valuation Valuation of Redevelopment of Income Properties Valuation of Redevelopment of Income Properties Lecture notes Lecture notes Lecture notes Lecture notes RM1, RM2 Lecture notes Reading Materials RM1: Jeffrey Fisher, George Lentz, and K.S. Tse, “Valuation of the Effects of Asbestos on Commercial Real Estate.” RM2: George Lentz and K.S. Tse, “An Option Pricing Approach to the Valuation of Real Estate.” Tse 2