Annual Report 2011

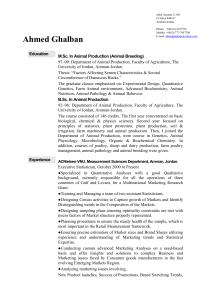

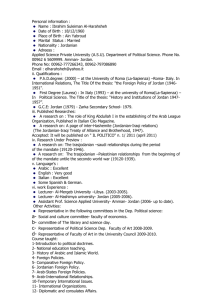

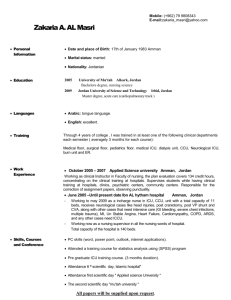

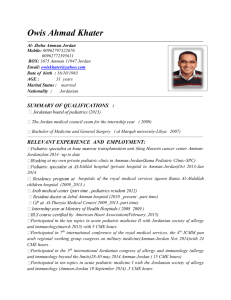

advertisement