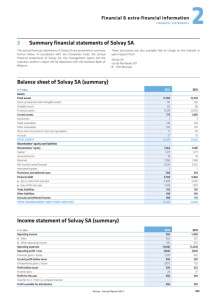

PDF - Bank al Etihad

advertisement