(DTaP): A Case Study - Institute of Medicine

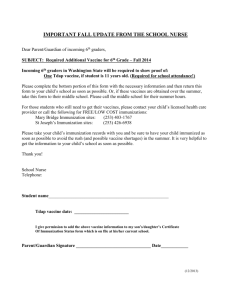

advertisement