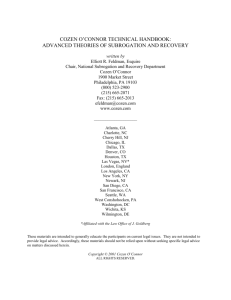

contents—summary

advertisement

CONTENTS—SUMMARY Table of Cases Table of Legislation, Treaties, and Conventions xvii lv I INTRODUCTION 1. Introduction 2. Discharge of Obligations 3 9 II SUBROGATION TO EXTINGUISHED RIGHTS 3. 4. 5. 6. 7. 8. 9. Introduction Enrichment At the Expense of the Claimant Grounds for Restitution Bars to Subrogation The Form of the Remedy Practical Points 19 33 47 87 135 199 255 III SUBROGATION TO SUBSISTING RIGHTS: INSURERS’ CLAIMS 10. Insurers’ Subrogation Rights 307 IV SUBROGATION TO SUBSISTING RIGHTS: SPECIAL INSOLVENCY REGIMES 11. The Third Parties (Rights against Insurers) Act 1930 12. Creditors of Trustees 395 423 Index 441 v Part I INTRODUCTION 1 INTRODUCTION A. What is Subrogation? B. How Does Subrogation Work? Subrogation to extinguished rights Subrogation to subsisting rights: insurers’ claims Subrogation to subsisting rights: special insolvency regimes 1.09 1.01 1.04 1.05 C. The Scope and Structure of the Book 1.11 1.07 A. What is Subrogation? ‘Subrogation’ literally means ‘substitution’; the word derives from the same Latin 1.01 root as the more familiar word ‘surrogate’.1 In English law the term ‘subrogation’ denotes a process by which one party is deemed to have been substituted for another, so that he can acquire and enforce the other’s rights against a third party for his own benefit. It is often said that a subrogated claimant ‘stands in the shoes’ of the party whose rights he is deemed to have acquired.2 Subrogation rights can be acquired by contract. They can also be awarded as a 1.02 remedy for unjust enrichment. Thus, in Banque Financière de la Cité v Parc (Battersea) Ltd, Lord Hoffmann explained that ‘subrogation may arise either from the express or implied agreement of the parties or by operation of law’.3 An example of contractual subrogation is where an insured gives his insurer a subrogation receipt, entitling the insurer to pursue the insured’s right of action against a third 1 Compact Edition of the Oxford English Dictionary (Oxford: OUP, 1987) vol II, 3126, sv ‘Subrogate’ and ‘Subrogation’, and 3177, sv ‘Surrogate’ and ‘Surrogation’. 2 eg Castellain v Preston (1883) 11 QBD 380 (CA) 403 (Bowen LJ); Nottingham Permanent Benefit BS v Thurstan [1903] AC 6, 10 (Lord Halsbury LC); Court Line Ltd v Canadian Transport Co Ltd (1939) 64 Lloyd’s List Rep 57 (CA) 61 (Scott LJ); Morris v Ford Motor Co Ltd [1973] QB 792 (CA) 808 (James LJ); Banque Financière de la Cité v Parc (Battersea) Ltd [1999] 1 AC 221, 226 (Lord Steyn); Co-operative Retail Services Ltd v Taylor Young Partnership (2000) 74 Con LR 12 (CA) [49] (Brooke LJ); Niru Battery Manufacturing Co v Milestone Trading Ltd (No 2) [2004] EWCA Civ 487, [2004] 1 All ER (Comm) 289 [29] (Clarke LJ). 3 [1999] 1 AC 221, 231. 3 Part 1: Introduction party: this constitutes ‘a contractual arrangement for the transfer of rights’.4 However in his Lordship’s view, the term ‘subrogation’ is also used:5 to describe an equitable remedy to reverse or prevent unjust enrichment which is not based upon any agreement or common intention of the party enriched and the party deprived. 1.03 Twenty years earlier, in Orakpo v Manson Investments Ltd, Lord Diplock expressed doubts about the latter proposition, because he considered that ‘there is no general doctrine of unjust enrichment in English law.’6 That is no longer a tenable view, following a series of House of Lords’ decisions to the contrary, starting with Lipkin Gorman (a firm) v Karpnale Ltd,7 and including the Banque Financière case, where Lord Steyn declared that unjust enrichment is ‘an independent source of rights and obligations’ which ‘ranks next to contract and tort as part of the law of obligations’.8 Hence Lord Hoffmann’s speech in the Banque Financière case can now be regarded as a definitive statement of English law.9 Indeed, it might be more accurate to describe his Lordship’s speech as a definitive restatement of the law, for according to the Court of Appeal in Cheltenham & Gloucester plc v Appleyard, it ‘does not establish any new principles’, and contains nothing ‘which conflicts with any of the established principles relating to subrogation.’10 B. How Does Subrogation Work? 1.04 Subrogation rights do not merely derive from several different sources. They also work in several different ways, depending on the relationship between the parties, and on the question whether the rights which a subrogated claimant is deemed to have acquired were previously extinguished by payment. Three different types of subrogation are discussed in this book. They arise in the following situations. ibid. An example of a subrogation receipt is given at para 10.179. ibid. 6 [1978] AC 95, 104. 7 [1991] 2 AC 584, prefigured by Fibrosa Spolka Akcyjna v Fairbairn Lawson Combe Barbour Ltd [1943] AC 32, 61–4 (Lord Wright). 8 [1999] 1 AC 221, 227. See too Woolwich Equitable Building Society v IRC (No 2) [1993] AC 70; Westdeutsche Landesbank Girozentrale v Islington LBC [1996] AC 669; Kleinwort Benson Ltd v Glasgow CC [1999] 1 AC 153; Kleinwort Benson Ltd v Lincoln CC [1999] 2 AC 349; Foskett v McKeown [2001] 1 AC 102; Deutsche Morgan Grenfell plc v IRC [2006] UKHL 49, [2006] 3 WLR 781. 9 His Lordship’s finding that non-contractual subrogation is a remedy for unjust enrichment has been followed in: Birmingham Midshires Mortgage Services Ltd v Sabherwal (1999) 80 P & CR 256 (CA) 264 (Robert Walker LJ); Khan v Permayer [2001] BPIR 95 [36] (Morritt LJ); Cheltenham & Gloucester plc v Appleyard [2004] EWCA Civ 291 [32] (Neuberger LJ); Niru Battery Manufacturing Co v Milestone Trading Ltd (No 2) [2004] EWCA Civ 487, [2004] 1 All ER (Comm) 289 [27] and [56] (Clarke LJ); Primlake Ltd (in liq) v Matthews Associates [2006] EWHC 1227 (Ch) [339]–[340] (Lawrence Collins J). 10 [2004] EWCA Civ 291 [31] (Neuberger LJ). 4 5 4 Chapter 1: Introduction Subrogation to extinguished rights The first situation arises when a defendant owes an obligation to a creditor, for 1.05 example because he is contractually bound to pay him money, or has committed a tort against him, or has been unjustly enriched at his expense. A claimant then pays the creditor in respect of the defendant’s obligation; or else another party— perhaps the defendant himself—pays the creditor using the claimant’s money. As a result of this payment, the defendant’s obligation is discharged, and the creditor’s corresponding rights are extinguished. In these circumstances, the claimant may then have a direct claim against the defendant, either because the defendant has previously agreed to indemnify him for his expenditure, or else because the defendant is unjustly enriched at his expense. The claimant may also have a subrogation claim—ie he may be entitled to supplement his direct claim by asserting the right to be treated, by a legal fiction, as though the creditor’s rights were not extinguished by the payment, but were transferred to the claimant so that he could enforce them for his own benefit. By this means the claimant is given new rights which replicate the creditor’s extinguished rights. An example of this kind of subrogation arises in the law of guarantee.11 When a 1.06 surety pays a creditor in respect of a guaranteed debt, his payment discharges the creditor’s personal right of action against the principal debtor, and also any securities which the principal debtor has given the creditor to secure repayment of the debt. Many contracts of guarantee provide that in these circumstances the principal debtor will indemnify the surety. The surety also has concurrent claims in the law of unjust enrichment. These arise because the principal debtor is enriched by the discharge of the debt and accompanying securities, in circumstances which make it unjust for him to keep this benefit. The law of unjust enrichment gives the surety a direct personal claim against the principal debtor for reimbursement, and the additional right to be treated as though he has acquired the creditor’s securities for his own benefit. Subrogation to subsisting rights: insurers’ claims The second situation discussed in this book resembles the first situation, but 1.07 differs from it in one important respect. As before, a defendant owes a creditor an obligation, and as before, the claimant pays the creditor in respect of the defendant’s obligation. In this situation, however, the defendant’s obligation is not discharged, and the creditor’s corresponding rights subsist. Hence the defendant cannot have benefited from the payment, because the creditor still has a right of 11 Discussed further in paras 6.03 ff. 5 Part 1: Introduction action against him. Hence the law of unjust enrichment will not supply the claimant with a direct restitutionary claim against the defendant—and it is unlikely that the claimant will have a contractual right to repayment by the defendant either. Nevertheless, the claimant may be entitled to acquire the creditor’s subsisting rights against the defendant via subrogation. He may have agreed with the creditor that he should have this right. Alternatively, the law of unjust enrichment may give him a subrogation right in order to prevent the double enrichment of the creditor that would follow, were the creditor to sue the defendant after having received the claimant’s payment, and also to prevent the enrichment of the defendant that would alternatively follow, were the creditor to forbear from suing him and thereby exonerate him from liability. 1.08 The most important example of this type of subrogation arises in the law of indemnity insurance.12 When an indemnity insurer pays its insured in respect of an insured loss which has been caused by a defendant’s tort, the insurer’s payment does not discharge the defendant from liability.13 Hence the defendant derives no benefit from the insurer’s payment and no question can arise of the insurer suing him directly. However, indemnity insurance policies usually contain subrogation clauses which entitle the insurer to acquire the insured’s subsisting rights of action after payment under the policy. The insurer is also given a subrogation right by law, as a prophylactic device to prevent the insured from recovering more than a full indemnity, and to prevent the defendant from shifting the burden of paying for the insured loss onto the insurer.14 Subrogation to subsisting rights: special insolvency regimes 1.09 The third situation is very different from the other two. Here, a claimant has a right against a third party—in tort or contract, for example—and the third party has a right to be indemnified by a defendant, in the event that he is obliged to pay the claimant. In the normal run of things, the third party pays the claimant, and 12 Discussed in ch 10. A further example arises in the law of bills of exchange. Under the Bills of Exchange Act 1882, s 59(2), the acceptor of a bill is not discharged from liability when the holder is paid by the drawer or indorser; and s 52(4) provides that when the bill is paid the holder must deliver it up to the party paying it who can then enforce the bill as the new holder; this party also has the right to be subrogated to the original holder’s securities over the acceptor’s property: Duncan, Fox & Co v North & South Wales Bank (1880) 6 App Cas 1. 13 This is the most common case. Note, though, that the insurer’s payment can sometimes discharge the defendant’s obligation to the insured if it derives from the law of contract, rather than the law of tort: see paras 2.12–2.17. 14 The question obviously arises, why insurers should wish to contract for subrogation rights when they are legally entitled to such rights in any case. The answer is that some subrogation clauses merely restate the insurer’s common law rights for the sake of certainty, but that most subrogation clauses expand the insurer’s rights in various ways: see paras 10.166 ff for discussion. 6 Chapter 1: Introduction then recovers an indemnity from the defendant. However this process can be disrupted if the third party becomes insolvent, and the claimant is obliged to prove in the insolvency as an unsecured creditor. In these circumstances, the claimant may recover little or nothing, even though the third party’s estate is swollen by the amount of the indemnity. The law sometimes views this outcome as inappropriate. In effect, the law sometimes says that allowing the third party’s other creditors to share in the indemnity payment would unjustly enrich them at the claimant’s expense. To prevent this outcome, the law therefore transfers the third party’s indemnity right to the claimant, and allows him to enforce this right against the defendant for his own exclusive benefit. One example of this kind of subrogation is the claim given by the Third Parties 1.10 (Rights against Insurers) Act 1930 to a third party with a claim against an insolvent insured, to enforce the insured’s rights against his insurer under a liability policy.15 Another example is the equitable claim given to the creditor of a trustee, to recover the amount of the trustee’s debt out of the trust estate by enforcing the trustee’s indemnity right for his own benefit.16 C. The Scope and Structure of the Book The three different types of subrogation identified here work in different ways, 1.11 and are awarded to claimants for different reasons. Hence they are discussed in separate parts of the book. In the following account, subrogation to extinguished rights is considered in part 2; insurers’ claims to be subrogated to their insureds’ subsisting rights are discussed in part 3; and the special insolvency rules which entitle claimants to acquire an insolvent party’s subsisting indemnity rights are examined in part 4. The third type of subrogation is readily distinguished from the first two because 1.12 the relationship between the parties is obviously different. The essential difference between the first type of subrogation and the second is that the first gives the claimant new rights which replicate the creditor’s rights after these have been extinguished by payment, while the second transfers rights from the creditor to the claimant which have not been extinguished even though the creditor has been paid. In order to tell them apart one therefore needs to know whether the creditor’s rights have been extinguished. There are practical reasons why a claimant might need to be sure of this: for example, different pleading rules govern the two types of claim and a claimant runs the risk that his claim will be struck out if he 15 16 Discussed in ch 11. Discussed in ch 12. 7 Part 1: Introduction pleads it on the mistaken assumption that it is one type of claim when in fact it is the other.17 To avoid this, the claimant therefore needs to know the rules governing the discharge of obligations by payment, and for this reason an account of these rules is given in the next chapter by way of preliminary to the main discussion. 1.13 This is a book about the law of subrogation in England and Wales. However this law shares many common principles with the law of other Commonwealth jurisdictions. Hence authorities from other Commonwealth countries are also discussed, eg cases from Australia, Canada, New Zealand, and Scotland. The law is stated as it stands on 1 January 2007. 17 For discussion of these pleading rules, see paras 9.02–9.10. For a recent case in which a claim was nearly shipwrecked because the claimant insurer misidentified the type of subrogation to which it was entitled, see Caledonia North Sea Ltd v London Bridge Engineering Ltd [2000] Lloyd’s Rep IR 249 (Court of Session (Outer House)); reversed 2000 SLT 1123 (Court of Session (Inner House)); affirmed sub nom Caledonia North Sea Ltd v BT plc [2002] UKHL 4, [2002] 1 Lloyd’s Rep 553. This was a Scottish case but English law can present claimants with identical difficulties. 8