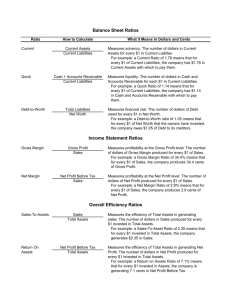

Analysis of the Operation and Financial Condition of the Enterprise

advertisement