Existing client changes

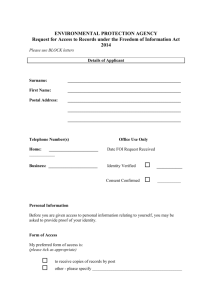

advertisement

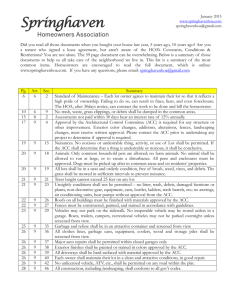

IR 793 Existing client changes December 2007 Please read the notes on the back before completing the form. Use an IR 795 to link or delink a client. Tax agent details Tax agent or agency name Tax agent or agency IRD number (8 digit numbers start in the second box. ) Contact person Contact numbers ( ) ( Ext. Daytime ) Fax Email address Client’s details Client’s name Client’s IRD number Changes required 1. Client’s name. Please send a copy of the certificate of incorporation for company name changes 2. Client’s business industry description Code 3. Client’s street address Street address Suburb or RD 4. Client’s postal address (if different from street address) Postcode Town or city Postcode Street address or PO Box number Suburb, box lobby or RD 5. Client’s contact numbers Town or city ( ) ( Business ) ( Mobile or after hours ) Fax 6. Client’s email address 7. Change of postal address Tick the agent column for tax types to be addressed to you. Agent Client Tax type AIL Approved issuer levy Agent Client Tax type IPS RWT on interest FAM Family assistance MAC Mäori authority credit Tick the client column for tax types to be addressed to your client. FBT Fringe benefit tax NRT Non-resident withholding tax Only indicate those tax types for which your client is liable and linked to your agency. GST Goods and services tax *Other tax types will automatically be updated with this tax type. See the notes to Question 7 on the back. GMD Gaming machine duty INC Income tax* IPE RWT on interest (exempt recipients) PAY PAYE tax deductions* REB Personal tax rebate RWT Resident withholding tax SLS Student loan (borrower) RESET form Notes Use this form to tell us about any changes needed to your client’s records. Make all additions to and deletions from your client list on a Client linking or delinking (IR 795) form. Question 1 – Name Enter your client’s name. Please send a copy of the certificate of incorporation for company name changes. Question 2 – Business industry description Enter any change to your client’s business industry description and code. If your client is an employer, a self-employed person or a close company, we supply the business industry description to the Accident Compensation Corporation (ACC). Inland Revenue is required by law to provide ACC with this information. To get an accurate business industry description and code, use the notes for guidance in the booklet Agent’s guide to ACC – business industry descriptions, codes and ACC levies (ACC414). You can get one by calling ACC on 0508 222 995 or from their website at www.acc.co.nz Questions 3 and 4 – Addresses Please enter any changes to your client’s postal and street addresses. Question 5 – Contact numbers Please enter any changes to your client’s telephone and fax numbers. Question 6 – Email address Please enter any change to your client’s email address. Question 7 – Addresses for your client’s mail Tick the “Agent” column for tax types to be addressed to you. Tick the “Client” column for tax types to be addressed to your client. “Agent” mail will be sent to your office. “Client” mail will be sent to your client’s street or postal address. Some other tax types are automatically updated with the same changes you request for the INC or PAY tax types. These are: Tax types linked to INC: DWT ICA QCT WPE WPN RWT on dividends Imputation credit account Qualifying company election tax Withholding payments elected Withholding payments non-elected Tax types linked to PAY: CSE SLE SSC Child support (employer) Student loan (employer) Specified superannuation contribution withholding tax Some other related tax types that are not automatically connected may also need to be changed, such as FBT. You need to indicate these at Question 7 so we can manually change them. For you to receive your client’s mail for the child support custodial parent (CPR) or paying parent (NCP) tax types, you must be nominated by your client. You cannot be linked for these tax types. Your client can nominate you by writing to us or using an Elect someone to make child support enquiries on your behalf (IR 146) form. www.ird.govt.nz Visit our website for services and information. Go to: Get it done online to file returns, register for services and access account information Work it out to calculate tax, entitlements, repayments and due dates and to convert overseas income to New Zealand currency Forms and guides You can also check out our newsletters and bulletins, and have your say on items for public consultation. INFOexpress INFOexpress is our automated phone service. You can order stationery (forms and guides) and request personal tax summaries using our natural language speech recognition system. This lets you use your voice instead of keying in numbers on the phone keypad. For all other services you’ll need to use a touch tone phone and key in numbers for options. Remember to have your IRD number with you when you call. It’s also helpful if you know the number or name of any forms or booklets you’re ordering. You can call INFOexpress between 6 am and 12 midnight, seven days a week.