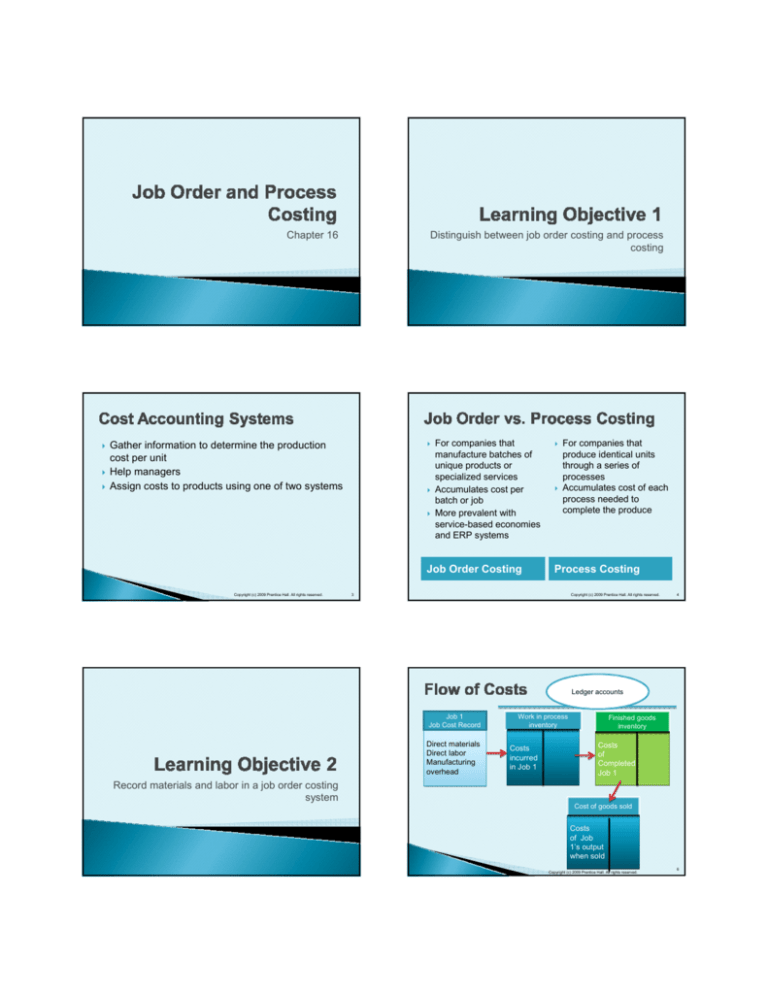

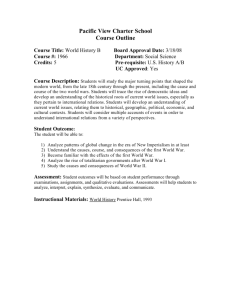

Chapter 16

Distinguish between job order costing and process

costing

Gather information to determine the production

cost per unit

Help managers

Assign costs to products using one of two systems

For companies that

manufacture batches of

unique products or

specialized services

Accumulates cost per

batch or job

More prevalent with

service-based economies

and ERP systems

Job Order Costing

Copyright (c) 2009 Prentice Hall. All rights reserved.

For companies that

produce identical units

through a series of

processes

Accumulates cost of each

process needed to

complete the produce

Process Costing

3

Copyright (c) 2009 Prentice Hall. All rights reserved.

4

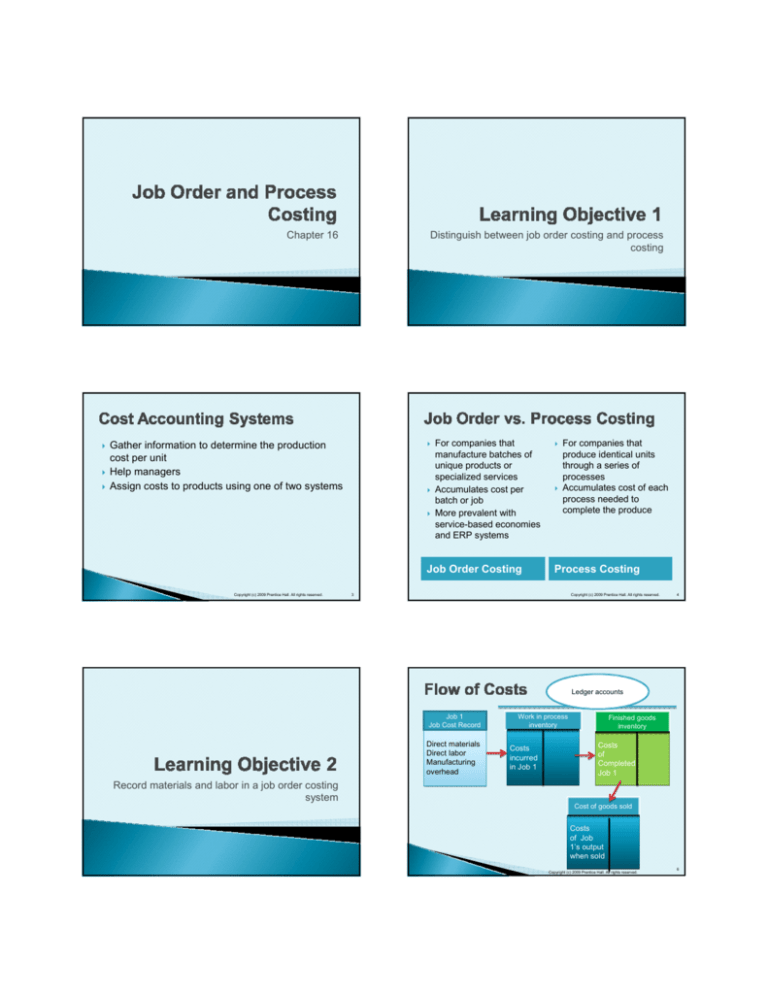

Ledger accounts

Job 1

Job Cost Record

Direct materials

Direct labor

Manufacturing

overhead

Work in process

inventory

Costs

incurred

in Job 1

Finished goods

inventory

Costs

of

Completed

Job 1

Record materials and labor in a job order costing

system

Cost of goods sold

Costs

of Job

1’s output

when sold

Copyright (c) 2009 Prentice Hall. All rights reserved.

6

GENERAL JOURNAL

DATE

GENERAL JOURNAL

REF

DESCRIPTION

DEBIT

CREDIT

DATE

Materials inventory

Accounts payable

Date

Manufacturing overhead

Materials inventory

Indirect materials

Units

Used

Cost Total

Purchases

Units

Cost

Item No. ________

Balance

Total

CREDIT

Subsidiary Materials Ledger Card

Description _________________________

Received

DEBIT

Direct materials

Subsidiary Materials Ledger Card

Item No. ________

REF

DESCRIPTION

Work in process inventory

Units

Cost

Date

Total

Copyright (c) 2009 Prentice Hall. All rights reserved.

Units

Description _________________________

Received

Used

Cost

Units Cost Total

Requisitioned

Total

7

Balance

Units

Cost

Total

Copyright (c) 2009 Prentice Hall. All rights reserved.

8

Accounting for Materials

Used to authorize the use of materials on a job

Serves as a source document for recording

material usage

MATERIALS REQU ISITION NO. _____

Date: _______

Item no. Item

Quantity

Materials inventory

Work in process

Material

Direct

Purchases Materials

Indirect

Materials

Job No. _____

Unit cost Amount

Direct

Materials

Manufacturing overhead

Indirect

materials

Copyright (c) 2009 Prentice Hall. All rights reserved.

9

Copyright (c) 2009 Prentice Hall. All rights reserved.

10

Accounting for Labor

Manufacturing wages

Job C ost Record

Job No.

Customer Name and Address

Job Description

Date Promised

Direct Materials

Date

Requisition No.

Amount

Date Started

Direct Labor

Time

Ticket

No.

Amount

Incurred

Date Completed

Overhead Costs Applied

Date

Rate

Direct

Labor

Indirect

Labor

Amount

Work in process

Direct

Materials

Direct

Labor

Manufacturing overhead

Totals

Overall Cost Summary

Materials

Labor

Overhead

Total Job Cost

Copyright (c) 2009 Prentice Hall. All rights reserved.

Actual

Overhead

Costs

11

Copyright (c) 2009 Prentice Hall. All rights reserved.

12

LABOR TIME RECORD

J. Khan

Employee ___________

J9738

Job _______

GENERAL JOURNAL

DATE

REF

DESCRIPTION

DEBIT

CREDIT

Time:

800

Started: ___________

Stopped: __________

1500

7 hours

Elapsed: __________

Manufacturing wages

Wages payable

Employee: _J K ___________

Copyright (c) 2009 Prentice Hall. All rights reserved.

13

No. ______

K13

Rate: ____________

$11.25

Cost of Labor

$78.75

Charged to Job $___________

Supervisor: M. Morley

Copyright (c) 2009 Prentice Hall. All rights reserved.

14

GENERAL JOURNAL

DATE

REF

DESCRIPTION

DEBIT

CREDIT

Work in process inventory

Manufacturing overhead

Manufacturing wages

Record overhead in a job order costing system

Copyright (c) 2009 Prentice Hall. All rights reserved.

15

GENERAL JOURNAL

DATE

REF

DESCRIPTION

DEBIT

CREDIT

Manufacturing overhead

Accumulated depreciation

Manufacturing overhead

Actual overhead costs are debited to the

Manufacturing overhead account

Overhead costs are essential to production

Must be assigned to specific jobs to determine full

cost

A predetermined overhead rate is used

Cash

Manufacturing overhead

Property taxes payable

Copyright (c) 2009 Prentice Hall. All rights reserved.

17

Copyright (c) 2009 Prentice Hall. All rights reserved.

18

Allocated

manufacturing

overhead cost

Total estimated manufacturing overhead costs

Total estimated quantity of the manufacturing

overhead allocation base

Predetermined

overhead application

rate

Copyright (c) 2009 Prentice Hall. All rights reserved.

19

Actual quantity of

allocation base used

on the job

Copyright (c) 2009 Prentice Hall. All rights reserved.

20

Accounting for Manufacturing

Overhead

Manufacturing overhead

GENERAL JOURNAL

DATE

REF

DESCRIPTION

DEBIT

Actual

Overhead

Costs

CREDIT

Work in process

Manufacturing overhead

Copyright (c) 2009 Prentice Hall. All rights reserved.

Overhead

Allocated

21

Work in process

Direct

Materials

Direct

Labor

Overhead

Allocated

Copyright (c) 2009 Prentice Hall. All rights reserved.

22

GENERAL JOURNAL

DATE

DESCRIPTION

REF

DEBIT

CREDIT

Finished goods

Work in process

Record completion and sales of finished goods

and the adjustment for under- or overallocated

overhead

Accounts receivable

Sales revenue

Cost of goods sold

Finished goods

Copyright (c) 2009 Prentice Hall. All rights reserved.

24

Accounting for Finished Goods

GENERAL JOURNAL

Work inpProcess

•Direct

Materials

Finished goods

Cost of Goods

Manufactured

DATE

Cost of Goods

Cost of

Manufactured Goods Sold

(a)

DESCRIPTION

REF

DEBIT

CREDIT

Advertising expense

Cash

•Direct Labor

•Manufacturing

Overhead

(b)

Manufacturing wages

Cash

Cost of goods sold

Cost of

Goods

Sold

(c)

Materials inventory

Accounts payable

Copyright (c) 2009 Prentice Hall. All rights reserved.

25

Copyright (c) 2009 Prentice Hall. All rights reserved.

GENERAL JOURNAL

DATE

(d)

DESCRIPTION

26

GENERAL JOURNAL

REF

DEBIT

CREDIT

DATE

Work in process

(f)

Manufacturing overhead

DESCRIPTION

REF

DEBIT

CREDIT

Manufacturing overhead

Accumulated depreciation

Materials inventory

Prepaid insurance

Property taxes payable

(e)

Work in process

Manufacturing overhead

(g)

Manufacturing wages

Work in process

Manufacturing overhead

($9,350 Direct labor x 160%)

Copyright (c) 2009 Prentice Hall. All rights reserved.

27

(h)

DESCRIPTION

REF

DEBIT

CREDIT

Manufacturing overhead

Finished goods

Work in process

(i)

28

Adjusting UnderUnder- or Overallocated

Manufacturing Overhead

GENERAL JOURNAL

DATE

Copyright (c) 2009 Prentice Hall. All rights reserved.

Actual costs

Accounts receivable

If actual costs

are greater,

overhead is

underallocated

Sales revenue

Cost of goods sold

Finished goods

Copyright (c) 2009 Prentice Hall. All rights reserved.

29

Applied to jobs

If amount

applied to jobs

is greater,

overhead is

overallocated

Copyright (c) 2009 Prentice Hall. All rights reserved.

30

The underallocated or overallocated overhead

amount is closed to Cost of goods sold

GENERAL JOURNAL

DATE

DESCRIPTION

DEBIT

CREDIT

Cost of goods sold

Calculate unit costs for a service company

Manufacturing overhead

GENERAL JOURNAL

DATE

DESCRIPTION

DEBIT

CREDIT

Manufacturing overhead

Cost of goods sold

Copyright (c) 2009 Prentice Hall. All rights reserved.

31

Have no inventory

Managers need to know the cost of jobs to set

prices

Cost of Job X

Often service companies largest cost is labor

Employees keep track of time spent on each client

or job

$1,000

Standard markup of 40%

Sale price of Job X

400

Employee’s annual salary

$1,400

Hourly rate to

the employer

Copyright (c) 2009 Prentice Hall. All rights reserved.

Hourly direct

labor costs

2,000 work hours per

year

33

Copyright (c) 2009 Prentice Hall. All rights reserved.

Predetermined

indirect cost

allocation rate

Direct labor costs

34

Expected indirect costs

Expected direct labor hours

Direct labor hours

Office rent

Support staff

Utilities

$2,150,000

Total

$260,000

850,000

350,000

$1,460,000

$1,460,000

$?

14,000 hours

$104.29

Copyright (c) 2009 Prentice Hall. All rights reserved.

35

14,000 hours

Copyright (c) 2009 Prentice Hall. All rights reserved.

36

Hourly direct

labor costs

$153.57

$257.86

Predetermined

indirect cost

allocation rate

Service

cost per

hour

$104.29

$257.86

260 hours

$67,044

Copyright (c) 2009 Prentice Hall. All rights reserved.

155%

$67,044

Round to

$104,000

$103,918

37

Copyright (c) 2009 Prentice Hall. All rights reserved.

38

Used by companies who manufacture large

quantities of similar products

Building blocks

◦ Conversion costs

◦ Equivalent units

Process Costing: Weighted-average method

Copyright (c) 2009 Prentice Hall. All rights reserved.

Materials

inventory

Manufacturing

wages

Job 92

Job 91

Work in

Job

90

Process

Materials

inventory

Work in process,

Mixing Dept

Finished

goods

Manufacturing

wages

Work in process,

Molding Dept

Finished

goods

Cost of

goods

sold

Manufacturing

overhead

Work in process,

Packaging Dept

Cost of

goods

sold

Manufacturing

overhead

Copyright (c) 2009 Prentice Hall. All rights reserved.

41

Copyright (c) 2009 Prentice Hall. All rights reserved.

42

40

Department 1

Physical

units

Beginning inventory

Production started

0

Dollars

Physical

units

$

0 Transferred out

40,000

50,000

Direct materials

$140,000

Conversion costs

Direct labor

20,000

Manufacturing overhead

Total to account for

48,000

50,000

$208,000

Ending inventory-25%

complete

Copyright (c) 2009 Prentice Hall. All rights reserved.

10,000

43

Copyright (c) 2009 Prentice Hall. All rights reserved.

Department 1

Step 1

Step 2: Equivalent units

Flow of

Direct materials

Conversion

physical units

costs

Flow of production

Department 1

Units to be accounted for:

Beginning work in process

0

Started in production

50,000

Total physical units to account for

50,000

Direct

materials

Ending WIP units

are 25% complete

as to conversion

costs

Beginning work in process

Units accounted for:

Completed and transferred out

40,000

Ending work in process

10,000

Total physical units accounted for

50,000

Equivalent units

40,000

40,000

10,000

2,500

50,000

42,500

Copyright (c) 2009 Prentice Hall. All rights reserved.

Department 1

Direct materials Conversion costs

Completed and transferred out

Conversion costs

Conversion

costs

0

0

Costs added

$140,000

$68,000

Divide by equivalent units

÷ 50,000

÷ 42,500

$2.80

$1.60

Cost per equivalent unit

45

Copyright (c) 2009 Prentice Hall. All rights reserved.

46

Total

[40,000 units x (2.80 + 1.60)]

$176,000

GENERAL JOURNAL

DATE

DESCRIPTION

DEBIT

Work in process – Dept. 2

Ending work in process

Direct materials

44

(10,000 x 2.80)

$28,000

(2,500 x 1.60)

Total cost of ending inventory

Work in process – Dept. 1

CREDIT

176,000

176,000

4,000

32,000

Total costs accounted for

$208,000

Copyright (c) 2009 Prentice Hall. All rights reserved.

47

Copyright (c) 2009 Prentice Hall. All rights reserved.

48

Work in process - Dept. 1

Work in process – Dept. 1

Direct

materials

140,000

Direct labor

20,000

Manufacturing

overhead

48,000

Endin

g WIP

176,000

Completed

and

transferred

out

32,000

Copyright (c) 2009 Prentice Hall. All rights reserved.

49