AA_Feb2008_Eye on Electronics

advertisement

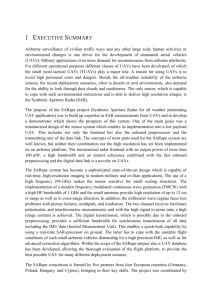

SAR for UAVs: The next big thing Airborne synthetic aperture radars (SARs) process radar returns as if they were collected by an antenna several hundred meters long. The “synthetic” antenna aperture is created by the movement of the aircraft itself (which is why aerostats do not make good SAR platforms) and allows a “parallax view” of the ground similar to a stereoscopic optical image. Typically, two primary modes are used by SARs. The first, search or “spot” mode, provides very high-resolution 3D radar data for ground mapping and target location, detection, and identification. The second, ground moving target indicator (GMTI) mode, does just that—indicates objects that have been displaced even slightly during the long radar scan. Subsequent scans indicate further movement details. SARs were developed during the Cold War for their ability to provide ground reconnaissance through clouds and weather—unlike visual, infrared, and even hyperspectral sensors—and for GMTI. Northrop Grumman’s AN/APY-3 radar for the Joint Surveillance Target Attack Radar System (JSTARS) aircraft was designed to detect and track masses of Soviet tanks advancing across an overcast Europe. Today, despite the shift in geography and opponents, SARs continue to be perhaps the most capable airborne reconnaissance technology. Because of bad weather, two-thirds of NATO air-to-surface missions over Kosovo in 1999 were not completed, having encountered more than 50% cloud cover more than 70% of the time. SARs cut through clouds and smoke and can provide reconnaissance and targeting data in any weather, unlike visible light and infrared electrooptical systems. For the Dept. of Homeland Security and antiterrorism, any sensor that 22 AEROSPACE AMERICA/FEBRUARY 2008 cannot provide 24-hr surveillance is useless against individuals who can simply wait to move or attack until weather or darkness shields them. The JSTARS legacy: Manned systems Though missing out on the Cold War, preproduction versions of JSTARS served with great success in the 1990-1991 gulf war over Iraq, and at least seven production aircraft served in Operation Iraqi Freedom in 2003. Although considered a legacy program now, the last of 19 platforms was only delivered in March 2005, and a six-year, $532-million contract for upgrade and support was awarded to Northrop Grumman in November 2005. In 2007, with the Air Force’s follow-on E-10A SAR/GMTI Multi-Sensor Command and Control Aircraft (MC2A) finally canceled, it looked as if JSTARS would get even more technology transfers, and perhaps complete next-generation systems such as the MP-RTIP radar. JSTARS will remain the world’s most important manned SAR program for the next decade or more, though funding may not be huge because of constrained budgets and other priorities. Our forecast here is conservative, allowing for continued APY-3 service through the next decade; if MP-RTIP is retrofitted, it would likely be after this. Following quickly in MC2A’s footsteps (or stumbles), the world’s other major widebody jet SAR program, NATO’s AGS (Alliance Ground Surveillance), collapsed in late November after years of underfunding and bickering. In July 2007, the Netherlands was no longer earmarking funds for AGS; according to defense minister Eimart van Midelkoop, “We’ve stopped funding AGS as we’re awaiting the outcome of international discussions about this program.” Then, in November 2007, faced with developing its own manned radar (AGS was to be heavily based on the MC2A’s MP-RTIP), NATO dropped the manned aircraft component of AGS, planning instead simply to buy Global Hawks with the MP-RTIP radar. With this, AGS essentially dissolved as a European program. The other major next-generation manned SAR program, the U.K.’s Raytheon-developed ASTOR (Airborne Stand-Off Radar), was still struggling to reach service in late 2007. In June 2007, the first ASTOR aircraft was delivered to the RAF, having exceeded its planned schedule by seven months. The in-service date for the first aircraft was originally slated for 2005, with two of five aircraft delivered; but in mid-2007 this had slipped to a still-optimistic “end of 2007,” The first ASTOR aircraft was delivered to the RAF in June 2007. with the ability to deploy operationally by late 2008. Aircraft number five is expected this year, with delays due to “parts shortages.” The first overseas deployment to Texas of the tactical ground station (TGS) occurred in September 2007. But ASTOR is a half-generation of technology older than MP-RTIP and a much smaller system. It will mount an interleaved (but not concurrent) SAR/GMTI dual-mode radar with an active electronically scanned array, based upon Raytheon’s ASARS-2 (U-2) and HISAR (Global Hawk), aboard a Bombardier Global Express business jet. Much data processing and analysis will be carried out on the ground by the TGS. This will save airborne volume and allow use of a more economical and efficient business jet platform rather than a widebody such as the JSTARS Boeing 707. In essence, ASTOR is a final development of earlier systems. One last major manned SAR now in production, developed as a classified (or at least hidden) program, is Raytheon’s AN/APS-149(V) littoral surveillance radar system, which has been seen mounted on Navy P-3C aircraft. Its ventral “canoe” antenna, and reported capabilities, are equivalent to those of Northrop Grumman’s AN/APY-3 JSTARS radar. Seven radars had been delivered by mid-2007, with 16 Orions in the Block Modification Upgrade Program (BMUP) reportedly capable of carrying the radar. It is presumed that, like Raytheon’s similarly antennaed ASTOR, the APS-149 provides a SAR mode with GMTI. However, it may also have an inverse synthetic aperture radar (ISAR) mode, like Raytheon’s AN/APS-137(V) in service on P-3Cs and under development for the Boeing 737-based P-8A Multimission Maritime Aircraft (MMA). The existence of the APS-149 came as something of a surprise, but not a shock. Navy P-3C Orions have increasingly been used for overland surveillance, and their APS-137 ISAR is not really the best radar for this task (which raises ques- JSTARS will remain the world’s most important manned SAR program for the next 10 years. tions about the new APS-137 being developed for the MMA). We suspect the Navy may buy a full 16 radars for its BMUP Orions, making the APS-149, suddenly, quite a major program. We must congratulate the Navy on its efficient (if secret) procurement. The Navy is not known for actually getting new systems in the field (A-12, P-7, ASPJ, DD(X), ATIRCM, J-UCAS, and so on), and they seem to have done an end run to provide a very Air Force-JSTARS-like capability. Sixteen SAR/GMTI P-3Cs will provide a huge all-weather ISR (intelligence, surveillance, and reconnaissance) capability. The future: UAVs But aside from the surprise APS-149, maritime patrol ISARs, and continuing upgrade and support of manned systems, the future is all UAVs. The first generation of manned systems resulted in major programs such as JSTARS. But the few firstgeneration UAV SARs in service today, on the first generation of endurance UAVs, are legacy programs from before the UAV spending explosion. Primary among these are Raytheon’s Global Hawk HISAR and Northrop Grumman’s Predator TESAR (Tactical Endurance SAR). HISAR will continue in production in upgraded form, while TESAR has already been removed from service and is being replaced by the General Atomics Lynx SAR on the Predator B. From this very low level, the next generation of UAV SARs will see huge funding growth. UAV SAR development funding has already risen drastically in the past few years. Initially, most of the increase was due to the large MP-RTIP radar for future Global Hawks. But today many smaller SAR development programs, including upgraded non-MP-RTIP radars for Global Hawk, are funding a broader and more robust increase. Programs entering production soon include a larger HISAR for the enlarged USAF RQ-4B Global Hawk, Lynx and Lynx II for Predator B, Warrior ER/MP and Fire Scout, and the Telephonics RDR 1700 maritime radar for Coast Guard Bell Eagle Eye UAVs. Programs in development include the Navy’s Broad Area Maritime Surveillance UAV (possibly with an ISAR). MP-RTIP development for Global Hawk continues unabated, despite cancellations of manned platforms. Fifteen USAF Block 40 Global Hawks with MPRTIP are currently planned, with the first production MP-RTIP radar around 2010 and fielding planned from FY11 to FY15 (which we expect will slide right a couple of years). NATO also plans to buy at least a few Global Hawks with MP-RTIP, with the first systems likely delivered by the middle of the next decade. Predators B and A, along with their cousins, the Army’s Warrior ER/MP and I-Gnat, are now receiving a next-generation replacement for the earlier Northrop Grumman TESAR—General Atomics’ Lynx and Lynx II. Lynx is probably the best of the new generation of small SARs, and though unit cost is well below MPRTIP, General Atomics will gain funding through sheer numbers produced. The Army has also chosen Lynx II for its Future Combat System (FCS) Class IV Fire Scout UAV, and the U.K. and the Dept. of Homeland Security are customers. In June 2007, the Iraqi air force contracted to buy as many as two dozen Lynx IIs for Beechcraft King Air 350ER ISR aircraft. Now, with multiple U.S. orders, General Atomics is also earning RDT&E funding for technology development, including the Dual Beam Lynx program, to enhance the capabilities of Lynx to track slow-moving vehicles more accurately. The program modifies a Lynx I radar to create two beams with different phase centers. It also uses space time adaptive processing to detect moving targets in the AEROSPACE AMERICA/FEBRUARY 2008 23 ter UAV. Designated the RDR1700CG, it will develop unique new abilities for UAVs, enabling Eagle Eye to avoid other aircraft in civilian airspace while providing maritime surveillance, weather avoidance, and search and rescue capabilities. But delays and problems have dogged both Deepwater and Eagle Eye. Eagle Eye was The MP-RTIP was flown on the Proteus UAV in preparation for chosen as the Coast Guard’s its installation on Global Hawk. vertical-takeoff UAV back main beam clutter. The goals include when Northrop Grumman’s Fire Scout demonstrating improvement in minimal was having teething troubles. But now detectable velocity, improving geolocaFire Scout is ready for full-rate production accuracy, and achieving a low manution and Eagle Eye is mired in delays. The facturing cost. Coast Guard has said they are sticking In May 2007, the Air Force Research with Bell, but Northrop Grumman is still Laboratory also awarded General Atomics trying to convert them to Fire Scout and a contract for the SPI3D (standoff preciLynx II. sion identification in 3D) program, to deOne more important SAR for tactical velop high-resolution 3D imaging sysUAVs (TUAVs) is Syracuse Research’s tems. The company can now draw on Forester ultra-high-frequency foliage pengovernment RDT&E money rather than etrating SAR, for the Army’s FCS A160 funding its own technology developments Hummingbird UAV. In September 2006, as it has in the past. defense appropriations conferees wanted Another new small UAV SAR is Teleto cut $12 million or more from Forester phonics’ RDR-1700, being developed for development, but a Pentagon appeal the Coast Guard’s Bell Eagle Eye Deepwastated that the ability to sense through fo- Market growth: UAVs take over The UAV SAR market will grow much faster than the manned SAR market. In fact, it will grow much faster than perhaps any defense electronics market. Although endurance UAVs will remain relatively small platforms with light payloads (only 3,000 lb for the USAF’s enlarged Global Hawk), growing funding will go toward a nearly universal fit of small SARS on endurance and tactical UAVs. Improved technology eventually will provide smaller UAV SARs with capabilities equivalent to the large 1980s-design JSTARS system, though without an onboard C4I capability. The UAV SAR market will exceed the manned SAR market in funding for the first time in FY11 and never look back. WORLD MANNED SAR MARKET SHARE WORLD UAV SAR MARKET SHARE RDT&E procurement available to U.S. RDT&E procurement available to U.S. FY 2007 $millions FY 2007 $millions 100% 100% 80% 80% 60% 60% 40% 40% 20% 20% 0% 0% FY07 FY08 Raytheon 24 liage is “desperately needed” for surveillance missions in U.S. southern and central commands: “The [Defense Dept.’s] current capability is one aging test bed system on a manned aircraft that contains soon-to-be-outdated equipment with a limited anticipated lifetime.” Last May, DARPA announced it will award a contract to Boeing to test-fly the Forester radar on its A160 UAV. Tests in the U.S. will take from six to nine months. FY09 FY10 FY11 FY12 FY13 Telephonics FY14 FY15 Northrop Grumman AEROSPACE AMERICA/FEBRUARY 2008 FY16 Available FY07 FY08 FY09 FY10 FY11 FY12 FY13 Gen Atomics Nor Grumman Syr Research Other Available FY14 FY15 Raytheon FY16 Telephonics WORLD MANNED SAR FUNDING WORLD UAV SAR FUNDING RDT&E procurement available to U.S. RDT&E procurement available to U.S. FY 2007 $millions FY 2007 $millions $1,200 $1,200 1,000 1,000 800 800 600 600 400 400 200 200 0 0 MC2A MP-RTIP JSTARS APY-3 ASTOR This is happening because, while big manned SARs will always provide a capability not available elsewhere—in-the-air command and control—smaller SARs will increasingly be mounted on UAVs rather than on shorter endurance manned platforms such as the U-2 and P-3. With SARs providing all-weather, all-the-time surveillance, intelligence collection will benefit greatly from the persistence of longer UAV endurance. Thus, while big SARs like JSTARS and ASTOR will continue to garner hundreds of millions of dollars a year, the heyday of manned small SARs like Raytheon’s U-2 ASARS-2 is over. Funding will remain, especially for naval helicopter-mounted ISAR systems such as the Telephonics AN/APS-147, but funding will not grow, while small UAV SARs take off as the next important SAR market. The future for UAV SARs, at least in terms of growth, is huge. Funding will ramp up, especially for small SARs for tactical UAVs, such as Northrop Grumman’s Fire Scout and, eventually, the Army’s Shadow 200 TUAV. Ultimately, mini- and micro-UAVs may get SARs also, to enable all-weather extreme tactical surveillance. APS-149 Other GH MP-RTIP Global Hawk Other U.S. Endurance Lynx/Lynx II U.S. Tactical Avail International Wide-open UAV markets In terms of market access, the manned SAR market is already pretty much locked up for the next decade. Raytheon will continue to dominate the manned SAR market, with multiple small programs as well as ASTOR and the APS-149. Northrop Grumman will rely heavily on JSTARS funding, and Telephonics will actually earn a little more than Northrop, with production of its APS-147 and AN/ APS-143 ramping up. The UAV SAR market, on the other hand, will offer great opportunities. Several small developers already have earned big contracts—General Atomics with its Lynx and Lynx II, Telephonics with the RDR 1700, Syracuse Research with the Forester SAR, and maybe Sandia National Laboratories with its MiniSAR. Already, this is incredible. The Big Three defense electronics firms today hold less than one-third of the market, with Lockheed Martin not participating at all. Northrop Grumman and Raytheon are this big only because of MP-RTIP. In fact, we see General Atomics as the number-one UAV SAR manufacturer of the next decade. A full 50% of forecast market fund- General Atomics Lynx SAR has already earned big contracts. ing is still uncontracted and available throughout our forecast period. Clearly, Northrop and Raytheon will earn some of this, but small UAV SARs are one very rare example of a field where anything seems possible, and a small technology company could suddenly find itself a major player. Equally, the opportunity exists for nearly any established defense electronics firm to become an important player as well, either through acquisition or internal development. UAV SARs offer incredible opportunities. David L. Rockwell drockwell@tealgroup.com AEROSPACE AMERICA/FEBRUARY 2008 25