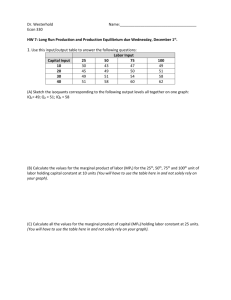

Economics: Cost Functions - Notes & Questions

advertisement

Economics 352: Intermediate Microeconomics Notes and Sample Questions Chapter 8: Cost Functions This chapter investigates the relationship between a production function and the cost of producing given quantities of output, assuming that a firm minimizes its costs of production. You should be sure to read the first two pages of the chapter. They establish the idea of economic costs and set out the basic assumptions of the chapter. The two simplifying assumptions are: 1. Firms use labor (l) and capital (k). 2. Labor and capital are hired in perfectly competitive markets, meaning that a firm can hire as much of each input as they want to without driving the price up. Also, the wage paid to labor (the price of labor) is w and the rental rate of capital (the price of capital) is v, so that total costs are: Total Costs = C = wl + vk Economic profit is the difference between a firm’s revenue and its cost. If output is sold at a constant price of p, then revenue is the product of price and quantity, pq, and profit is: Profit = π = pq – wl – vk Profit = π = pf(k,l) – wl – vk Cost Minimization Economists assume that firms minimize costs (this is consistent with profit maximization). The math behind this goes back to the Lagrangian that we used in looking at consumer decisions. In fact, a lot of producer theory is basically the same as consumer theory. Whereas a consumer sought to maximize utility given a budget constraint, a producer will minimize costs given some quantity constraint. That is, if a producer will produce a certain quantity of output, q0, they will seek to do so at the lowest possible cost. The Lagrangian for this is: Minimize wl + vk subject to f(k,l) = q0 L = wl + vk + λ(q0 – f(k,l)) Taking derivatives with respect to l, k and λ and setting these equal to zero gives us: ∂L = w − λf l = 0 ∂l ∂L = v − λf k = 0 ∂k ∂L = q 0 − f (k , l ) = 0 ∂λ Taking the ratio of the first two of these gives us: w − λf l = 0 w = λf l v − λf k = 0 v = λf k f w λf l = = l v λf k f k So, just as with the consumer’s decision we had, for two goods, x and y, the relationship that the price ratio equaled the ratio of the marginal utilities or the marginal rate of substitution: p x MU x = = MRS x , y p y MU y So with the producer’s cost minimizing input decision we have the relationship that the ratio of the costs of capital and labor is equal to the ratio of their marginal products, which is also known as the marginal rate of technical substitution (MRTS): MPl w fl = = = MRTS l,k v f k MPk We can also get the relationship that w v = =λ fl fk With the interpretation being that the marginal cost of increasing total output either by adding labor or by adding capital is equal to λ, and this is the marginal cost in, for example, dollars per unit. Diagrams and what not…. The diagram for a cost-minimizing production decision is just like the diagram for a consumer’s utility maximizing decisions. The production function gives rise to isoquants, or combinations of inputs that all produce the same quantity of output. These are like a consumer’s indifference curves. So, for example, if we had the production function q = kl , we might draw the isoquant for q=120 as: A graph showing an isoquant for the production function q=kl with q=120. And if the prices of capital and labor were v=12 and w=40, we could draw the set of all input combinations that would cost $480, an isocost line, as: A graph showing an isocost line with cost of 480, a price of capital of 12 and a price of labor of 40. Putting these two together we get either the bundle of inputs that allows 120 units of output to be produced at the lowest possible cost or the bundle of inputs that allows $480 to produce as much output as possible: A graph showing the cost minimizing point for the production function q=kl. The math underlying this, from the point of view of minimizing the cost of producing a quantity of 120, is: q = f (k , l ) = kl ∂f MPl = = fl = k ∂l ∂f = fk = l MPk = ∂k MPl w = MPk v k 40 = l 12 10 k= l 3 q = 120 → kl = 120 10 l ⋅ l = 120 3 l 2 = 36 l=6 10 10 k = l = 6 = 20 3 3 Expansion Paths Expansion paths answer the question, “How does the combination of capital and labor change as the size of a firm increases?” That is, as you move to higher and higher isoquants, how does the cost-minimizing bundle of capital and labor change, holding w and v constant? Expansion paths are shown in Figures 8.2 and 8.3 in the textbook. If an expansion path is a straight line, the relative mix of capital and labor remains constant as the quantity produced increases. So, the same proportions of capital and labor would be used. If a production function is homothetic, its expansion path will be a straight line. Both the Cobb-Douglas and CES production functions are homothetic. In some sense this means that the optimal mix of labor and capital doesn’t actually depend on the quantity of output produced. The fact that a Cobb-Douglas production function is homothetic is demonstrated by equation 8.10, which shows that the ration of capital to labor is independent of the total quantity of the good that is being produced and is simply a function of the ratio of w to v: k w α = ⋅ l v β (8.10) This is demonstrated in equation 8.15 for a CES production function. If the expansion path curls upward, getting steeper and steeper (as in Figure 8.3) then as a firm expands, production becomes more capital intensive. As a side note, the increasingly intensive use of capital will make the labor that this firm employs very productive. That is, the average productivity of labor will be very high. If the expansion path curls downward, getting flatter and flatter, then as a firm expands production will become more and more labor intensive. Cost Functions Cost functions assume that a firm is cost minimizing, that is that it will produce any quantity of output at the lowest possible cost. A cost function expresses a firm’s total cost as a function of the cost of labor, w, the cost of capital, v, and the total quantity of output to be produced, q: C = C(v, w, q) A cost function is increasing (or at least non-decreasing) in all of these arguments. That is, as v, w or q increase, the cost of production will not fall and will probably rise. Average cost is defined as: AC(v, w , q ) = C(v, w , q ) q Marginal cost, or the additional cost incurred to produce an additional unit, is defined as: MC(v, w , q ) = ∂C(v, w , q ) ∂q Marginal cost is the partial derivative of total cost with respect to quantity. It is also the slope of the total cost function: A graph showing an upward sloping total cost curve and showing that the slope of the total cost curve is the marginal cost. For example, if C = 50 + wvq2, then the average and marginal cost functions would be: AC = C 50 = + wvq q q MC = ∂C = 2 wvq ∂q Some Graphical Analysis of Particular Cases Here are some specific cases of cost functions and what the associated average and marginal cost curves look like. To simplify matters, we’ll assume that w and v are held constant, so all that will be varying is the quantity produced, q. First, the curves as they are usually drawn involve a firm operating with some fixed costs and increasing marginal cost. Total cost starts out positive (total cost is equal to fixed cost at a quantity of zero) and rises at an increasing rate. The average cost curve is Ushaped because average fixed costs start out very high and fall as output rises. Marginal cost intersects average cost at the minimum average cost. Two graphs, the first showing an upward sloping total cost curve and the second showing a marginal cost and an average cost curve, with the marginal cost curve crossing the average cost curve at its minimum. As an example, consider the cost function C(q) = 420 + 2q + q2. You should be able to plot out the total cost, average cost and marginal cost functions to confirm that they look like the curves shown above. Second, this could be drawn with no fixed costs and constant marginal cost. This would be the case, for example, if there were no fixed costs and the cost of production were constant at $5 per unit. Then both the marginal cost and the average cost would be constant. This is shown below. A graph showing an upward sloping, linear total cost curve and the associated horizontal marginal cost and average cost curves. As an example of this type of cost function, consider C(q) = 5q. The marginal cost function is just MC(q)=5 and the average cost function is AC(q)=5. Deriving Cost Functions from Production Functions If you start out with a production function, you can derive the related cost function. That is, if you start with q = f(k,l) you can derive C = C(v,w,q). The steps in this process are to first solve the production function for optimal quantities of l and k, to get l*(v,w,q) and k*(v,w,q) and then to input these functions into the total cost function C = wl + vk to get, finally: C = w ⋅ l * ( v, w , q) + v ⋅ k * ( v, w , q) = C( v, w , q ) So that costs, C, are expressed as a function of v, w and q. The book (Example 8.2) shows the results of this for the fixed proportions production function, q = min(ak, bl), and for the CES production function. The CES solution is apparently a lot of fun. We’ll go through a Cobb-Douglas example with real numbers here. The book has the general result, which is a bit complex, but all particular numerical examples of the CobbDouglas production function will satisfy the general result presented in the book. Imagine the Cobb-Douglas production function q = f(k,l) = k0.3l0.6. Incidentally, this production function is homogenous of degree 0.9 and, thus, demonstrates decreasing returns to scale. As a result, the marginal cost of production should be rising. This production function, being a Cobb-Douglas production function, is also homothetic, meaning that if we solve for the ratio of optimal inputs, l*/k*, this term should not depend on the quantity produced. Anyhow, to derive the associated cost function, we first need to solve for optimal quantities of the inputs, k and l, as functions of w, v and q. We can do this either through a Langrangian or through simply equating the ratio of the marginal products with the ratio of the input prices. Let’s try the latter of these. ∂q = 0.6k 0.3 l −0.4 ∂l ∂q MPk = = 0.3k −0.7 l 0.6 ∂k MPl = MPl 0.6k 0.3 l −0.4 2k w = = = MPk 0.3k −0.7 l 0.6 l v l= 2kv lw ,k = w 2v q = k 0.3 l 0.6 2kv q=k w qw 0.6 0.9 k = 0.6 0.6 2 v 0.6 0.3 qw 0.6 k* = 0.6 0.6 2 v k 0.9 2 0.6 v 0.6 = w 0.6 1 0.9 0.3 l 0.9 w 0.3 lw q = l 0.6 = 0.3 0.3 2 v 2v 0.3 0.3 q⋅2 v l 0.9 = w 0.3 1 q ⋅ 2 0.3 v 0.3 0.9 l* = 0.3 w Plugging these functions for k* and l* into the definition of total costs gives us: C(v, w , q ) = w ⋅ l * + v ⋅ k * 1 q ⋅ 2 0.3 v 0.3 0.9 qw 0.6 0.6 0.6 + ⋅ v C(v, w , q ) = w ⋅ 0.3 w 2 v 1 2 1 2 − 1 1 2 C(v, w , q ) = q 0.9 2 3 v 3 w 3 + 2 3 v 3 w 3 1 0.9 1 1 2 2 − 1 C(v, w , q ) = q 0.9 v 3 w 3 2 3 + 2 3 It’s not pretty, but it does give the cost function. You should prove for yourself that the marginal cost function is increasing in q. That is, if you calculate the marginal cost function by taking the derivative of this cost function with respect to q and then take the derivative of the marginal cost function with respect to ∂MC q, , you should get a positive value. This means that marginal costs are increasing. ∂q Further, to show that this production function is homothetic, you can note that the formula for the optimal ratio of capital to labor, k*/l*, does not contain the quantity of output, q. Properties of Cost Functions The book lists four properties of cost functions. 1. Homogeneous of degree one in input prices That is, if the costs of all inputs double, then the cost of any level of output will double. An implication of this is that if all input prices and all output prices increase by the same percentage (a so-called neutral inflation) then the firms input and output decisions won’t change. Technically, this can be written as C(tv,tw,q) = t C(v,w,q). 2. Non-decreasing in q, v and w If the quantity produced increases, or if the costs of capital or labor increase, production won’t become less expensive. This should be pretty clear. 3. Cost functions are concave in input prices This is illustrated in Figure 8.6. The straight line illustrates how costs would change if the firm didn’t substitute capital for labor as the cost of labor rose. The curved (concave) line shows how costs change if the firm substitutes from labor to capital as the cost of labor rises. Put somewhat simply, if firms can substitute between inputs, their costs will be less than or equal to what they would be if they couldn’t substitute between inputs. An implication of this is that any law requiring firms to produce output using a certain combination of inputs will probably result in those firms having higher than necessary costs. This implies that the total value of the resources they use in production will be higher than necessary. 4. Average and marginal cost functions are homogeneous of degree one in input costs. This is a fairly straightforward implication of characteristic 1. above. Input Substitution Don’t worry about this too much. The two important things to remember are: 1. Firms can and will substitute one input for another as inputs become relatively more or less expensive. So, if labor costs are currently 60% of a firm’s costs and there is the potential for labor costs to double, this does not mean that a firm’s costs will rise by 60% as they will likely substitute capital for labor in the production process. 2. The degree to which a firm may substitute one input for another varies from firm to firm and from time to time. Some industries have great potential for the substitution of one input for another while others, by their nature, do not. The assembly of automobiles or digging of holes offers great opportunities for substitution of inputs while surgery or massage, for the most part, do not. Shifts in production functions, shifts in cost curves, and technical progress Various things may shift cost functions over time. While changes in input costs won’t change cost functions because they’re included in the cost function, other things might. The best and most important example of a force that will shift a cost function is technical progress, or the process through which people learn to make goods using fewer and fewer inputs. This progress may be illustrated through changed in the production function or through changes in the cost function. One way to model technical change is to describe it as a function of time, t, basically taking the assumption that technical change is a disembodied process that occurs at some exogenous rate. While this isn’t a reasonable real-world story, it might be a good and simple analytical model. In terms of a production function, the factor A(t) might represent a multiplier that shows how much more output the same quantity of input can produce at time t versus some initial time period, perhaps called period 0. To put this in terms of a production function, we might say that the production function at time t is given by: q t = A( t )k α lβ If A(0)=1.0 and A(10)=1.5, this suggests that as time moves from period 0 to period 1, technology improves so that the same set of inputs can produce 50% more output. To put this in terms of the cost function (which is what the book does) we might state this as: C t (v, w , q ) = C 0 (v, w , q ) A( t ) Where C0(v,w,q) is the cost function at time zero. If, as above, A(0)=1.0 and A(10)=1.5, then costs would have fallen by 33% over this time period, a statement equivalent to saying that productivity rose by 50%. To think about the structure of the process behind A(t), you might imagine that some neutral (that is, not favoring one input or another) technical progress occurs at some rate of i% annually. This is the process described in the latter part of Example 8.3 where the assumed rate of technical progress is 3% and the related production and cost functions are: q t = A( t )k 0.5 l 0.5 = e 0.03t k 0.5 l 0.5 C t (v, w , q ) = C 0 (v, w , q ) e 0.03t = 2qv 0.5 w 0.5 e 0.03t The term e0.03t is an expression for the continuous rate of change at 3% over time. The number e is the irrational number from natural logarithms that is approximately equal to 2.71828 and for which the natural log is 1. That is, ln e = 1. So, holding inputs constant, output could increase by 3% annually. Holding output constant, costs could fall by 3% annually. Getting Input Demand Functions from Cost Functions – Shephard’s Lemma If you have cost functions based on cost-minimizing or profit maximizing behavior that are of the form: C=C(v,w,q) Then Shephard’s lemma says that the quantity of an input demanded can be expressed as the partial derivative of the cost function (based on cost minimizing behavior) with respect to the input price. In terms of the function above this is: k c (v, w , q ) = ∂C ∂v l c (v, w , q ) = ∂C ∂w The underlying assumption is that the firm is minimizing its costs. The demand functions are contingent (as indicated by the superscript “c”) on the quantity of output produced. You should be sure you can work through this calculation for the Cobb-Douglas cost function as given in Example 8.4 Short Run and Long Run Stuff From the point of view of one firm, the distinction between the short run and the long run is that at least one input (usually capital) is fixed in the short run, but all inputs are variable in the long run. In the real world, the time horizon to the long run really depends on the nature of the business. A company that operates espresso carts can probably get more carts up and running in less than a month. A auto company, on the other hand, may require several years to build a new plant and get it up and running. For purposes of our analysis here, in the short run, capital is fixed at some level, which the book calls k1, and short run costs are: SC = vk1 + wl In the short run, the firm is constrained in its choice of capital and can only vary its output by varying the amount of labor it hires. As a result, a firm won’t, in general. Be minimizing the cost of producing the quantity of output that it is producing. This is shown in Figure 8.7 where the firm is constrained to have capital of level k1. In this figure, if they produce q0 or q2, they will produce at a cost higher than the minimum possible cost for those quantities. Only q1 is consistent with cost minimization with capital level k1. Marginal cost, in the short run, is the marginal cost of additional output that is produced through the hiring of additional labor. The book gives this as: SMC = ∆Cost ∂SC = ∆Output ∂q (8.54) Another way to think about short run marginal cost is that it is equal to the wage paid to an extra unit of labor divided by the additional output that labor provides: SMC = ∆Cost wage = ∆Output MPlabor Short Run and Long Run Cost Curves Here are some fairly simple diagrams of the relationship between short run and long run average cost curves. First, a short run average and marginal cost curve, holding capital constant and altering only the labor input to change output, would look like this: A graph showing that the marginal cost curves intersects the short run average cost curve at the minimum of the short run average cost curve. Note that average cost is U-shaped and the marginal cost curve intersects the average cost curve at minimum average cost. Second, you could diagram two short run average cost curves, each associated with a different quantity of capital, on the same graph: Two short run average cost curves, based on different levels of capital, with minima at different quantities. SRAC1 is associated with a lower level of capital and has a minimum at a lower quantity. SRAC2 is associated with a higher level of capital and has a minimum at a higher quantity. Now, we could draw several short run average cost curves on the same graph. Again, each would be associated with a different level of capital. To point out a typo, the curves should be labeled “SRAC” and not “SRAS”, which is a bit of a slip back to teaching macroeconomics for me.1 1 This is, in fact, an economics joke. If you thought it was funny, you may consider yourself an economist with a decent sense of humor. A series of four short run average cost curves. Finally, the long run average cost curve is a smooth curve that runs along the bottom of all of these average cost curves, sort of like it was a hammock in which all of the SRAS curves were resting on a nice summer day. The art work is a bit imperfect, but the following diagram (a simplified version of the book’s Figure 8.9) should give you sense of this. A series of four short run average cost curves and a U-shaped long run average cost curve that runs along the bottom of the short run curves and is tangent to each of them. The long run average cost curve is the average cost curve that is relevant if all inputs can be altered. This will allow any particular quantity of output to be produced at the lowest average cost possible for that quantity. Practice Problems 1. For the production function q = k0.2l0.3, use a Lagrangian to solve for the costminimizing input bundle to produce 100 units of output if v=10 and w=15. What is the marginal cost of production at the solution you find? 2. a. b. c. Draw an expansion path in which both capital and labor are normal inputs labor is an inferior input capital is an inferior input Find the average and marginal cost functions for each of the following cost functions. v w 3. C( v, w , q ) = q + a b 1 γ α γ 4. C( v, w , q) = q Bv w 5. C(q) = 49 + 5q + 3q2 β γ Do the following questions from the textbook: 8.3, 8.5, 8.9a, 8.10a