Lifting the boundaries on investing offshore By

advertisement

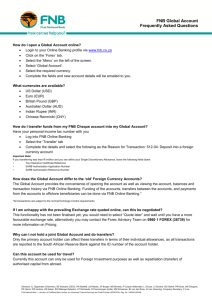

Lifting the boundaries on investing offshore By Chantal Robertson The days leading up to the annual budget announcement are always full of speculation as to what impact it will have on the market. This year was no different, and there were varying views on whether or not we would be seeing any changes on the regulatory side. Alas, there were few references to Exchange Control related issues, although the Minister of Finance did refer to proposals for simplifying and modernising procedures for cross-border investments, in and out of South Africa. It is therefore likely that we will continue to see further relaxation during the course of this year. Notwithstanding the above, it is fair to say that individuals have received the benefit of some significant changes over recent years. An excellent example of this is the ability to invest offshore. Most people are aware of the annual individual foreign investment allowance of R4m, which is applicable to South African residents over the age of eighteen. The requirements for transferring funds in terms of this allowance include a tax clearance certificate, a copy of the individual’s green bar-coded identity document, and a completed and signed Exchange Control Form MP1423. In December last year, the SA Reserve Bank announced that the annual single discretionary allowance, currently R1m, may also be used for investment purposes without the need for a tax clearance certificate. This is a significant change as it makes investing offshore much simpler for smaller amounts. It is important to note however that in addition to foreign investment, this overall allowance covers a number of other individual forex needs including travel, gifts, study allowance, etc., so use it carefully! SA residents over the age of 18 are eligible for this allowance. A word of caution is that SA residents working abroad are only eligible for this allowance in the first calendar year, so they need to make sure that their foreign earnings cover their lifestyle in London or New York! If this is not the case, they may use the R4m foreign investment allowance subject to the tax clearance process mentioned above. Whilst most people are aware of the above principles, what is not generally known is that individuals have the ability to acquire foreign investments in addition to the above allowances. The process requires a formal application to the SA Reserve Bank, and effectively allows an individual to hold a portfolio of shares offshore. The limit on this dispensation is broad and we have assisted clients in obtaining the necessary regulatory approval for amounts of R100m and larger. Similar principles are applied for the purchase of offshore property, i.e. the acquisition is subject to SA Reserve Bank approval and the quantum falls outside of the individual discretionary (R1m) and foreign investment allowance (R4m). If you have been thinking of buying an old farm house in the scenic French countryside, or a villa in Spain or Tuscany, it is now possible! The authorities granted by the SA Reserve Bank in respect of the above investments are subject to certain conditions, but we encourage you to discuss this exciting opportunity with your Relationship or Wealth Manager. We can help guide you through the full process, starting with the detail required for the application and then culminating in the transfer of the funds offshore!