investing offshore

advertisement

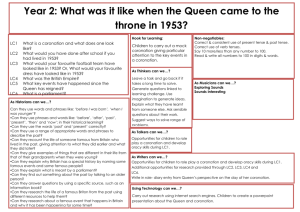

OFFSHORE INVESTING OFFSHORE Using your foreign investment allowance (externalised rands) INVESTING OFFSHORE Using your foreign investment allowance (externalised rands) The South African Reserve Bank allows each adult South African citizen to invest up to R5 million per year in foreign assets - an attractive option for investors seeking to further diversify their investment holdings. The process of investing in one of Coronation’s foreign currency denominated international funds has 4 simple steps: 1 Choose the right fund and submit your completed application form to Coronation Client Service 2 For investments greater than R1 million*, apply for tax clearance from the South African Revenue Service (SARS) 3 Contact your bank or an authorised forex broker to arrange for a transfer of funds 4 Submit your proof of payment and Tax Clearance Certificate to Coronation Client Service *In December 2011 the South African Reserve Bank anounced that investors wishing to externalise rands no longer need to obtain a tax clearance certificate from SARS on the first R1 million in any given year. Please note that the clearance-free allowance applies to forex transactions for a variety of reasons, including overseas travel, study and gifts. STEP 1 Choose the right fund and complete the Coronation application form Coronation offers a range of foreign currency denominated international funds that are available directly from us or through selected offshore platforms offered by Alexander Forbes, Allan Gray, Glacier by Sanlam, Investec, Old Mutual and RMBI/Momentum. Matching your needs to the right fund is vitally important, so if you are unsure as to which fund is right for you, speak to your financial advisor or contact Coronation Client Service on 0800 86 96 42 and one of our consultants will gladly provide you with further details on the various fund options. Once you’ve made your fund/s decision, visit our website and click on Invest Now. Alternatively you can download and complete the Application Form or request that one of our client service consultants email or post the form to you. If you are not an existing Coronation investor, you will need to include the following FICA documentation with your application form: • • • A copy of your South African identification document (ID) bearing ID number and photograph Proof of residential address less than three months old (e.g. utility bill or telephone account) Proof of SA income tax number if applicable (e.g. SARS issued document bearing name and tax number) Completed forms and supporting documentation should then be faxed to us on (021) 680 2181 or emailed to OffshoreInvestments@coronation.co.za. PAGE 1 | INVESTing offshore MARCH 2014 Steps 2 and 3 as explained below can be completed by you, or you can make use of an independent foreign exchange provider who will facilitate the process of obtaining tax clearance and the transfer of funds. These providers can assist you with the following: • • • • • • Assistance in completing the required exchange control and tax clearance forms Applying for tax clearance on your behalf (within 1-2 days) Preferential foreign exchange rates Zero transfer and administration fees Forward cover on exchange rates Applying for an offshore allowance in excess of the current R5 million allowance Coronation has identified three independent foreign exchange providers. Should you wish to make use of their services, please see their contact details below. Peregrine FX Patricia Rossouw 012 348 2337 / 082 499 0537 patricia@peregrinefx.co.za www.peregrinefx.co.za Exchange 4 Free Matthew Lawson 011 453 7818/082 391 5494 matt@exchange4free.com www.exchange4free.co.za Private Client FX Eike Feltz 086 002 2007/079 276 4503 eike@privateclientfx.co.za www.currencyinternational.co.za STEP 2 APPLY FOR TAX CLEARANCE Tax clearance from SARS is required prior to investing amounts greater than R1 million in any foreign currency denominated international fund. To do this, simply download and complete the Tax Clearance Certificate (i.r.o. Foreign Investment Allowance for Individuals) (FIA 001) available on the SARS website at www.sars.gov.za, or request the certificate from Coronation Client Service. You will be required to submit the following documents together with your completed Tax Clearance Certificate at your nearest SARS office: • • • A statement of your assets and liabilities A copy of your bank statement indicating availability of funds (SARS will only grant clearance on the amount that is available in your bank account) A certified copy of your South African ID Approval time depends on your specific SARS office and your tax status, but typically takes between two and four weeks. The Tax Clearance Certificate is valid for a period of 12 months from date of issue. PAGE 2 | INVESTING OFFSHORE MARCH 2014 STEP 3 Transfer of funds Once you’ve obtained tax clearance, you need to visit your bank to arrange for a transfer of funds into the Coronation bank account. This entails the completion of the following two forms available at your bank: 1) 2) Application for an overseas bank transfer of funds/outward balance of payment form (OTT form) Original MP1423 form (issued by the South African Reserve Bank Exchange Control indicating a foreign investment by a natural person resident in South Africa) In order to complete these forms, you will need to have the following documents and details: • Coronation’s bank account details (available in section F of the Application Form or from Coronation Client Service) • Your original SARS Tax Clearance Certificate • Your South African ID (and Power of Attorney, if applicable) STEP 4 Submit your final documentation to Coronation Once you’ve arranged for the transfer of funds, kindly send Coronation Client Service the following documentation and we will process your application: • • Proof of payment A copy of your Tax Clearance Certificate Frequently Asked Questions Coronation has prepared a set of frequently asked questions and answers with the objective of providing you with a general overview of the basic exchange control and tax consequences of investing in one of our foreign currency denominated international funds. If you are in any way uncertain, we recommend that you obtain appropriate independent advice prior to making such an investment. For further assistance, please contact Coronation Client Service on 0800 86 96 42 or by email at OffshoreInvestments@coronation.co.za PAGE 3 | INVESTing offshore MARCH 2014 FREQUENTLY ASKED QUESTIONS Investing Offshore If you are a South African permanent resident, you can utilise your individual offshore allowance of R5 million per year by investing in a foreign currency denominated unit trust fund. For investments greater than R1 million, you will need to apply for tax clearance from the South African Revenue Service (SARS) and complete the required exchange control form with an authorised dealer bank. Depending on your need, Coronation offers a focused range of foreign currency denominated international funds, providing access to both developed and emerging markets in a pure equity or multi-asset portfolio. Immigrants* and non-residents are also able to invest in Coronation’s range of foreign currency denominated international funds, but are not subject to the individual offshore allowance regulations. The following questions and answers have been prepared to assist you in understanding the requirements and process involved and also to provide you with a general overview of the basic exchange control and tax consequences of such an investment. Please note that this summary is not intended to constitute a comprehensive guide to the exchange control considerations and tax treatment of your foreign investment. If you are in any way uncertain, we recommend that you obtain appropriate independent advice prior to making an investment. Who qualifies for the ANNUAL R5 million foreign investment allowance? A foreign investment allowance is currently available for natural persons who are: • • taxpayers in good standing; and over the age of 18 years. Each individual may invest an amount of up to R5 million per annum offshore. Natural persons are regarded as South African residents if they are domiciled or registered in South Africa (for example if they were born in South Africa and lived in the country all their life) or foreign nationals who have taken up permanent residency in South Africa and have been living in the country for more than five years. South African residents are subject to exchange control restrictions and can therefore only invest in offshore assets such as foreign unit trusts within certain restrictions set by the South African Reserve Bank (SARB). Who does not qualify for the foreign investment allowance? • Legal entities • Trusts • Partnerships • Foundations • Clubs • Natural persons under the age of 18 years • Natural persons who are NOT taxpayers in good standing * Immigrants are subject to exchange control regulations after five years of residency, subject to certain concessions. PAGE 4 | INVESTing offshore: FREQUENTLY ASKED QUESTIONS MARCH 2014 Do I need a SARS Tax Clearance Certificate? it depends. Investors wishing to externalise rands no longer need to obtain a tax clearance certificate from SARS on the first R1 million in any given year. The clearance-free allowance however applies to forex transactions for a variety of reasons (not only investment), including overseas travel, study and gifts. Investors can still take an additional R4 million per annum offshore subject to obtaining a tax clearance certificate. A tax clearance certificate is valid for a period of 12 months. Should the certificate expire unutilised or partially utilised, you will need to apply for a new certificate. How long will it take to get a SARS ‘Tax Clearance Certificate’? This depends on your specific SARS office and your tax status. In some instances you will be able to obtain a certificate in less than a week, but it may take longer. Please ask your local SARS office as to the expected time frame when applying. What is the maximum amount I can transfer offshore? You can transfer a maximum of R5 million per annum from South Africa, without specific SARB approval. You may, however, be able to invest more than the annual R5 million if you have other ‘legal’ funds offshore, for example: • growth/income on previously transferred funds where such income was retained abroad • income earned abroad from a foreign employer after 1 July 1997 and either retained abroad or remitted to South Africa • foreign inheritances • own foreign capital introduced into South Africa on or after 1 July 1997 • funds for which amnesty was granted in terms of the Exchange Control Amnesty and Amendment of Taxation Laws Act, 2003 (Act No. 12 of 2003), unless amnesty was granted on the basis that the funds had to be repatriated to South Africa • other amounts if specific approval has been obtained from the SARB Can I use other offshore assets to invest in the Coronation FOREIGN CURRENcy denominated international funds? Yes, if these assets are, or originate from, previous foreign capital allowance transfers, or from the sources referred to above. No, if the assets represent funds held offshore in contravention of the exchange control policies. Do I have to transfer the full amount at once? No, you can transfer in tranches, provided your Tax Clearance Certificate has not expired. Please ensure that you retain your original certificate if the full R5 million is not utilised in a single transaction. If you intend using the same bank or forex broker for future transfers, you may request them to keep a copy of your Tax Clearance Certificate on your behalf. Is this an annual limit? YES Can I borrow funds offshore? Yes, provided there is no recourse to South Africa (e.g. guarantees or surety to an overseas lender from South African sources). PAGE 5 | INVESTing offshore: FREQUENTLY ASKED QUESTIONS MARCH 2014 Can I borrow funds from another South African resident? Yes, provided this is not viewed as a scheme of arrangement to bypass exchange control restrictions. It is generally permissible to borrow funds from another family member (such as a parent or spouse) or even a family trust. If you have any doubts about a particular loan, please obtain an opinion from your banker or financial advisor. How problematic is an accidental breach of the ANNUAL R5 million limit? The SARB maintains a database of all transfers made by all individuals via all banks since the implementation of this allowance in 1996. You, the applicant (not Coronation, SARS, your bankers, advisors or SARB) are however ultimately responsible for not exceeding the limit. You may be fined between 20% and 40% of the excess transfer amount if you inadvertently exceed the limit. This penalty range, however, only applies if you approach the SARB’s Financial Surveillance Department (FSD) first. Otherwise, the full amount in excess of the limit could be confiscated. If you are uncertain regarding a proposed transfer resulting in a breach of your R5 million limit, carefully check your records. A last resort is to apply to the FSD to check your records. Does Capital Gains Tax (CGT) rather than Income Tax apply to the gain realised on the sale of a foreign collective investment scheme (CIS)? The short answer is that as long as you are a long-term investor, virtually always yes. The disposal of units could attract either income tax (at a maximum marginal rate of 40%) or CGT (at a maximum effective rate of 13.3%). If the units were held as capital assets, the gain (i.e. the difference between your proceeds and the base cost of the units disposed of) should be subject to CGT. If the units were held for speculative purposes, the proceeds on disposal will be subject to income tax. To determine whether the units were held as capital assets or trading stock, the intention of the seller is taken into account, and the period of ownership. Section 9C of the Income Tax Act No 58 of 1962 contains a ‘safe harbour’ provision in terms whereof the gains from the sale of qualifying shares will be treated as capital in nature, if the owner held such shares for a period of at least three years. However, the units in a foreign CIS do not qualify for such protection and it will therefore be necessary to apply the ‘normal rules’ relating to the intention of the seller as well as the period of ownership, to determine whether the proceeds will be subject to income tax or CGT. A disposal of units is defined for tax purposes to include both a redemption instruction given to Coronation and a sale to a third party. A disposal can also take place in a number of other instances, for example: • • a deemed disposal in the event of the death of the unit holder; or a transfer between spouses, including a transfer in the event of the death of the unit holder or in terms of a divorce order. PAGE 6 | INVESTing offshore: FREQUENTLY ASKED QUESTIONS MARCH 2014 What are the tax consequences of a disposal, assuming that the units are held as capital assets? • In the case of the disposal (or deemed disposal) of units, the difference between the proceeds (or deemed proceeds) on disposal and the seller’s base cost* in the units, will be subject to CGT. • Where the units are transferred between spouses, there will be no capital gain on the transfer, but the transferee spouse will effectively step into the shoes of the transferor spouse; with the result that the gain will be subject to CGT only at the time when the transferee spouse disposes of the units. Such roll-over relief will not apply where the transferee spouse is nonresident for tax purposes; • On the death of the unit holder, the deceased will be deemed to have disposed of the units at market value, i.e. CGT will be triggered in such case. This rule does not apply where the units are bequeathed to the deceased’s spouse, in which case the roll-over relief referred to above applies. What are the tax implications of income distributions on a foreign collective investment scheme (CIS)? Note that the Coronation foreign currency denominated international funds are currently structured as roll-up funds. This means that any investment income earned in the portfolio is reinvested in the fund for future capital growth. As a result, there is no investment income earned or distributed by Coronation’s foreign CIS. A foreign CIS is treated as a foreign company under the Income Tax Act. Dividends (or distributions) paid by foreign companies are subject to income tax in the hands of South African resident unit holders. Can gains on my investment be deemed to be foreign dividends for tax purposes? NO. The definition of ‘foreign dividend’, as amended in the 2011 Taxation Laws Amendment Act (TLAA), which took effect from 1 January 2011, includes any amount that is paid by a foreign company in respect of a share in that foreign company, where that amount is treated as a dividend or similar payment by that foreign company. The definition clearly states that it excludes any amount so paid that constitutes a redemption of a participatory interest in a foreign CIS. Any proceeds received from the redemption of a foreign CIS are therefore not treated as a ‘foreign dividend’ and will be subject to CGT or income tax (if held for trading purposes). What are the estate duty implications? Foreign investments are included as property in your estate and are therefore subject to estate duty. asset identification methods for determining the base cost of identical assets such as unit trusts exist, namely weighted average cost, specific identification *andThree first in first out. Coronation has adopted the weighted average cost methodology which, in essence, involves keeping running totals of the number of units bought and sold in a particular fund. Coronation will disclose the following information to you to allow you to calculate your tax liability: number of units disposed, cost of those units disposed, proceeds on disposal of those units; and gain derived from, or loss incurred in respect of the disposal of those units. Unit holders who do not wish to use the weighted average cost method to determine capital gains on the disposal of their units are not bound by the return provided by Coronation. However, they will have to keep the necessary records to support the alternative they select. PAGE 7 | INVESTing offshore: FREQUENTLY ASKED QUESTIONS MARCH 2014 Should I have a foreign will and appoint a foreign executor? Not necessarily. In most instances a foreign will would not be required and a resident’s South African will would apply to his/her worldwide assets. However, should you own significant and complex foreign assets it is recommended that you consult an attorney in the relevant foreign jurisdiction for legal advice and assistance. How do I redeem or repatriate my offshore investment? The policies allowing individual SA residents to transfer funds offshore and to retain certain assets offshore also allows for the holding of foreign bank accounts and currency denominated accounts with your local SA banker. If you wish to redeem an offshore investment, Coronation can transfer the redemption proceeds to another offshore destination via a third party (offshore anti-money laundering legislation permitting), transfer the proceeds to an offshore bank account in the name of the investor, or transfer the proceeds to a currency account in South Africa (FICA & other legislation permitting). March 2014 Disclaimer All information and opinions provided are of a general nature and are not intended to address the circumstances of any particular individual or entity. As a result thereof, there may be limitations as to the appropriateness of any information given. The information set out above is a basic summary of the relevant principles and it is imperative that any proposed investor obtains detailed advice, in the context of his/her specific circumstances, prior to making an investment. It is therefore recommended that the client first obtain the appropriate legal, tax, investment or other professional advice and formulate an appropriate investment strategy that would suit the risk profile of the client prior to acting upon information. Coronation is not acting and does not purport to act in any way as an advisor or in a fiduciary capacity. Coronation endeavours to provide accurate and timely information but we make no representation or warranty, express or implied, with respect to the correctness, accuracy or completeness of the information and opinions. The information set out herein is based on enacted legislation at the time of publication, but it should be noted that the legislation and practices referred to are subject to change from time to time. Coronation does not undertake to update, modify or amend the information on a frequent basis or to advise any person if such information subsequently becomes inaccurate. Investors are therefore urged to ensure that they obtain independent, updated advice on an ongoing basis. Any representation or opinion is provided for information purposes only. Coronation Fund Managers Limited & its subsidiaries will not be held liable or responsible for any direct or consequential loss or damage suffered by any party as a result of that party acting on or failing to act on the basis of the information provided in this document. PAGE 8 | INVESTing offshore: FREQUENTLY ASKED QUESTIONS MARCH 2014