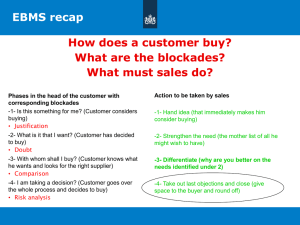

Chapter 1: Business-to-Business markets and marketing

advertisement