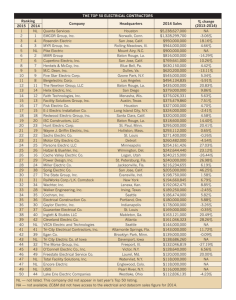

Kevin was recently featured in The Magazine of

advertisement