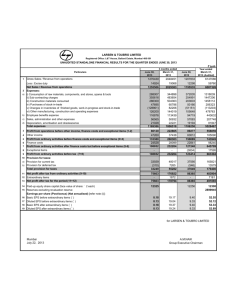

Consolidated financial statements for the year ended

advertisement