Ideal Financial Solutions, Inc.

advertisement

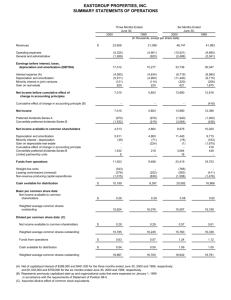

UNAUDITED, CONSOLIDATED FINANCIAL STATEMENTS The Nine Months Ended September 30, 2009, The Years Ended December 31, 2008 and 2007 IDEAL FINANCIAL SOLUTIONS, INC. INDEX TO CONSOLIDATED FINANCIAL STATEMENTS These statements have not been audited Page Balance Sheets — September 30, 2009, December 31, 2008 and 2007 F-2 Statements of Income for the Nine Months Ended September 30, 2009, The Years Ended December 31, 2008 and 2007 F-3 Statements of Shareholders’ Equity for the Years Ended December 31, 2007 and 2008 and Nine Months Ended September 30, 2009 F-4 Statements of Cash Flows for the Nine Months Ended September 30, 2009, The Years Ended December 31, 2008 and 2007 F-5 Notes to Unaudited, Consolidated Financial Statements F-6 IDEAL FINANCIAL SOLUTIONS, INC. UNAUDITED, CONSOLIDATED BALANCE SHEETS F-2 The accompanying notes are an integral part of these financial statements. IDEAL FINANCIAL SOLUTIONS, INC. UNAUDITED, CONSOLIDATED STATEMENTS OF OPERATIONS F-3 The accompanying notes are an integral part of these financial statements. IDEAL FINANCIAL SOLUTIONS, INC. UNAUDITED, CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT F-4 The accompanying notes are an integral part of these financial statements. IDEAL FINANCIAL SOLUTIONS, INC. UNAUDITED, CONSOLIDATED STATEMENTS OF CASH FLOWS F-5 The accompanying notes are an integral part of these financial statements. IDEAL FINANCIAL SOLUTIONS, INC. NOTES TO UNAUDITED, CONSLIDATED FINANCIAL STATEMENTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2009 AND THE YEARS ENDED DECEMBER 31, 2008 AND 2007 NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Unaudited Financial Statements – These financial statements have not been audited, reviewed or compiled by independent auditors. These statements have been prepared internally and have omitted certain disclosures required by generally accepted accounting principles in the United States of America and are subject to adjustment and additional disclosures pending an independent audit. Organization and Nature of Operations – Ideal Financial Solutions, Inc. (“Ideal” or the “Company”) was incorporated in the State of Nevada on April 2, 2002 and was a development stage company through September 2004. The Company acquired the majority of the common stock of Jaguar Gaming Corp, incorporated in February 1993, in September 2004 and emerged from the development stage. The Company provides the education, support and automated online tools to create additional cash resources, rapidly eliminate all non-asset-building debt and build financial independence for individuals through a continuity or subscription-based software solution. Accounting Principles – The financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America. Principles of Consolidation – The financial statements include the accounts of Ideal and its subsidiaries. Intercompany transactions and balances have been eliminated. Equity investments in which the Company exercises significant influence, but does not control and is not the primary beneficiary, are accounted for using the equity method. Use of Estimates – Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. Examples include estimates of cash reserves, returns and refunds, and stock-based compensation forfeiture rates; when technological feasibility is achieved for our services; the potential outcome of future tax consequences of events that have been recognized in our financial statements or tax returns. Actual results and outcomes may differ from management’s estimates and assumptions. Cash Reserves – The Company records cash reserves for money held in merchant accounts, resulting from credit card transactions, and pending satisfactory completion of an agreed-upon period of time. Property, Equipment, and Depreciation – Property and equipment are recorded at cost. Maintenance, repairs, and minor replacements are charged to expense as incurred. When depreciable assets are retired, sold, or otherwise disposed of, the cost and related accumulated depreciation are removed from the accounts and the resulting gain or loss is reflected in earnings. F-6 IDEAL FINANCIAL SOLUTIONS, INC. NOTES TO UNAUDITED, CONSLIDATED FINANCIAL STATEMENTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2009 AND THE YEARS ENDED DECEMBER 31, 2008 AND 2007 Impairment of Long-Lived Assets – The Company reviews its long-lived assets for impairment when events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. The Company evaluates, at each balance sheet date, whether events and circumstances have occurred which indicate possible impairment. The Company uses an estimate of future undiscounted net cash flows from the related asset or group of assets over their remaining life in measuring whether the assets are recoverable. As of December 31, 2008, the Company does not consider any of its long-lived assets to be impaired. Unearned Revenue– The Company collects subscriptions to the online software services on a monthly basis. Income Taxes – The Company has elected to be taxed under the provisions of Subchapter S of the Internal Revenue Code. Under those provisions, the Company does not pay federal or state corporate income taxes on its taxable income. Instead, the shareholders are liable for individual federal and state income taxes on their respective share of the Company's taxable income in the period earned and are not taxed separately on dividends distributed. Advertising costs – Advertising costs are expensed as incurred. Research and Development – Research and development expenses include third-party development and programming costs. Such costs related to software development are included in research and development expense until the point that technological feasibility is reached, which for our software products, is generally shortly before the service is made available to the public. Once technological feasibility is reached, such costs are capitalized and amortized to cost of revenue over the estimated lives of the products. NOTE 2 – CASH RESERVES Online subscription-based services require the use of credit card merchant accounts, which create a cash reserve. The reserve is a portion of the monthly revenue from a merchant's card processing transactions that credit card processing companies may request to hold in an escrow account as an insurance against possible loss from chargebacks and other sources. Upon satisfactory completion of a predetermined period, reserves are returned to the merchant. The Company records these amounts when the final amount has been determined. The Company partners with other online service providers who participate in revenue share agreements. Therefore a cash reserve payable is recorded when the amount has been determined. NOTE 3 – PROPERTY AND EQUIPMENT Depreciation is calculated by using the straight-line method based on the following useful lives: F-6 IDEAL FINANCIAL SOLUTIONS, INC. NOTES TO UNAUDITED, CONSLIDATED FINANCIAL STATEMENTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2009 AND THE YEARS ENDED DECEMBER 31, 2008 AND 2007 Depreciation expense for the nine months ended September 30, 2009 and the years ended December 31, 2008 and 2007 was $3,177, $9,817 and $8,137, respectively. NOTE 4 – STOCKHOLDERS’ EQUITY In July of 2007 the Company issued 576,100,000 shares of common stock for consulting services valued at $115,220. In March 2009, the Company issued 600,000,000 shares of common stock to officers of the Company valued at $60,000 in payment for accrued salary. In June 2009, the Company issued 173,397,735 shares of common stock to consultants for services valued at $190,738. In August 2009, the Company purchased 27,050,000 shares of common stock as treasury stock for $75,000. NOTE 5 – WARRANTS AND OPTIONS Warrants without an expiration date were issued in 2004 to purchase a certain amount of shares of common stock are outstanding and are carried at the fair market value at time of issuance of $4,000. NOTE 6 – MARKETING AGREEMENTS The Company engages third party marketing companies to provide subscription leads. The majority of these contracts require a revenue share payment after the subscription has been received and earned. The revenue share liability is reflected in cash reserves as a reduction in the net value as mentioned in Note 2. There are no additional commitments or liabilities under the terms of these agreements. NOTE 7 – COMMITMENTS AND CONTINGENCIES Employment agreement – In July 2003, the Company entered into an employment agreement with its President and CEO. The agreement has no defined termination date and provides for an annual base compensation with annual reviews and adjustments. Litigation – The Company is not subject to any claims or suits at this time. However, the Company understands that such claims may arise in the ordinary course of business. NOTE 8 – SUBSEQUENT EVENTS There have been no actions performed by or for the Company since September 30, 2009 that would have a material effect on the financial position or results of Ideal.

![Accounts - GFPL [ 18 May 2015 ]](http://s3.studylib.net/store/data/007190112_1-146eb980362ee79364105ad70cf6aa55-300x300.png)