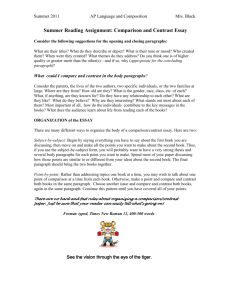

Flowchart Diagram of SAS No. 99

advertisement

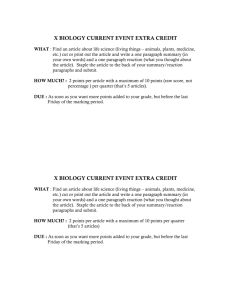

Flowchart Diagram of SAS No. 99 Professional skepticism à Fraud is a legal concept. Auditor do not make legal determination of whether fraud has occurred. There are two types of fraud: ■ Misappropriation of assets. ■ Fraudulent financial reporting. Management is responsible for designing and implementing programs and controls to present, defer and detect fraud. (paragraphs 2-6, 8-12) Consideration of other information for example, client acceptance (paragraphs 3-4) Brainstorming (paragraphs 14-18) Inquires—internal, external (paragraphs 19-27) Incentive/pressure Basic concepts Fraud triangle (pargraph 2) Rationalization Opportunity Analytical procedures (paragraphs 28-30) Fraud risk factors (paragraph 31-33) Appendix with examples of fraud risk factors (paragraph 84) Specific analytical procedures related to revenue recognition (paragraph 29) Mandatory risk procedures Overall risk assessment (paragraphs 35-37, 40) Risk of management override (paragraph 42) Specifically identified fraud risks (paragraphs 38-39) Presumption that revenue recognition is fraud risk (paragraph 41) Review and/or testing of entity programs and controls ■ Broad programs and controls ■ Specific controls . . (paragraph 43-45) Mandatory review of accounting estimates for biases (paragraph 63) Overall audit responses (paragraphs 46-50) Specific responses to management override risk (paragraphs 57-67) Other specific responses (paragraphs 51-53, 55-56) Specific revenue recognition procedures (paragraph 54) Audit documentation (paragraphs 83-84) Mind-set that fraud is a possibility, regardless of past experiences ß Professional skepticism (paragraph 13) Responsibilities and functions of the independent auditor. The auditor has a responsibility to plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether caused by error or fraud (SAS No. 99 (paragraph 1)). Mandatory risk decisions Evidence procedures Be alert to conditions or events that may arise during audit and conduct final fraud analysis (paragraphs 68-74) Misstatement or material irregularities? For the full text of SAS no. 99, “Consideration of Fraud in a Financial Statement Audit.” see Official Releases, Jan.03, page 105, or order from www.cpa2biz.com. Information on the SAS also is available at www.aicpa.org. No Audit opinions Yes Response to misstatements? (paragraphs 75-78) Communications about misstatements? (paragraphs 79-82) Final decisions