Japan, Chicago Join on Derivatives Effort - WSJ.com

Page 1 of 2

September 3, 2008

Japan, Chicago Join on Derivatives Effort

By SERENA NG and AYAI TOMISAWA

September 3, 2008; Page C3

Chicago and Osaka, Japan, are teaming up to dream up ways of trading

derivatives.

Wednesday, Chicago Mercantile Exchange parent CME Group Inc. plans to sign

an agreement with the Osaka Securities Exchange to develop products and

services that could give their customers greater access to global markets.

DOW JONES REPRINTS

This copy is for your personal,

non-commercial use only. To order

presentation-ready copies for

distribution to your colleagues,

clients or customers, use the Order

Reprints tool at the bottom of any

article or visit:

www.djreprints.com.

• See a sample reprint in PDF

format.

• Order a reprint of this article now.

The pact with Japan's largest derivatives exchange comes as CME, the world's largest futures exchange by trading

volume and market capitalization, seeks to broaden its global presence.

Investors are looking for trading opportunities across asset classes and national borders, and exchanges around the

world are linking up in an effort to make such investments more seamless.

CME last month completed its $8.2 billion acquisition of Nymex Holdings Inc., parent of the New York Mercantile

Exchange. The deal gave CME, which also owns the Chicago Board of Trade, a 98% share of listed futures trading in

the U.S.

The group has also been expanding abroad, mainly through ventures and technology-sharing arrangements with

exchanges in Asia and elsewhere.

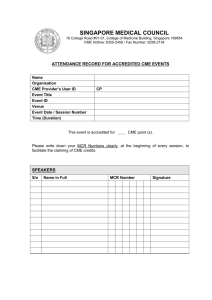

CME and OSE have listed futures contracts on Japan's Nikkei Stock Average through

licensing agreements. The exchanges' different trading hours effectively allow investors

to trade these contracts round the clock. CME Chief Executive Craig Donohue said the

two companies will seek offerings that will benefit their customers.

OSE President Michio Yoneda said he hopes more foreign investors will soon be able to

access OSE's products more directly.

The OSE is trying to increase trading amid growing pressure among smaller Japanese

securities exchanges to consolidate.

In 2007, the volume of listed futures and options traded at OSE topped 100 million

contracts for the first time, and was nearly 80% higher than a year earlier. OSE's volumes

this year are close to 2007 levels. CME has benefited from rising trading activity, but

some investors fear the credit crunch may lead banks and hedge funds to cut back on their

derivative trades.

Write to Serena Ng at serena.ng@wsj.com1 and Ayai Tomisawa at ayai.tomisawa@dowjones.com2

URL for this article:

http://online.wsj.com/article/SB122038396718391905.html

Hyperlinks in this Article:

(1) mailto:serena.ng@wsj.com

http://online.wsj.com/article_print/SB122038396718391905.html

9/3/2008

Japan, Chicago Join on Derivatives Effort - WSJ.com

Page 2 of 2

(2) mailto:ayai.tomisawa@dowjones.com

Copyright 2008 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our

Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please contact Dow Jones

Reprints at 1-800-843-0008 or visit www.djreprints.com.

RELATED ARTICLES FROM ACROSS THE WEB

Related Articles from WSJ.com

•

•

•

•

TSE Sees Little Fallout In Asia Media Delisting Aug. 23, 2008

Nasdaq OMX Takes a Rest After String of Mergers Aug. 20, 2008

CME Wins Backing For Nymex Purchase Aug. 19, 2008

SEC Approves BATS Exchange Aug. 18, 2008

Related Web News

• CME Aug volume down 32% amid continued credit woes Sep. 03, 2008 marketwatch.com

• CME Group Announces Labor Day Holiday Hours Aug. 22, 2008 news.aol.com

More related content

Powered by Sphere

http://online.wsj.com/article_print/SB122038396718391905.html

9/3/2008