DEPRECIATION AND INCOME TAX General Depreciation Methods:

advertisement

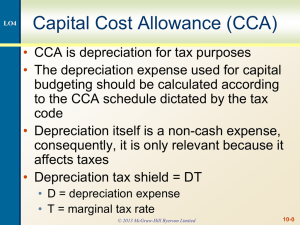

Dr. Hassan, Y. – 91.380 1 DEPRECIATION AND INCOME TAX General • Depreciation is a decrease in worth • Production equipment gradually becomes less valuable though wear • Instead of charging the full purchase price of a new asset as a one-time expense, the outlay is spread over the life of the asset • Depreciation charges are not actual cash flows • True decrease in market value may not correspond to allowable deductions Purpose of Depreciation Accounting: • Recover capital invested in production assets • Calculate realistic cost of production • Calculate realistic operating expenses Causes of Declining Value: • Physical Depreciation • Functional Depreciation • Technological Depreciation • Depletion of resources • Monetary Depreciation Canadian Vocabulary of Depreciation Accounting: • According to Revenue Canada, corporations and individuals engaged in professional activities can claim depreciation on assets that are used in earning income • Business calculate depreciation for reporting the state of finances to their shareholders and for submitting income tax to Revenue Canada • Businesses are allowed to deduct part of the capital cost of specified depreciable property from income earned during the year • This depreciation deduction is called “capital cost allowance (CCA)” • CCA is applied to the undepreciated capital cost (UCC) • The PW of the sum of tax savings due to CCA is called CCA Tax Shield Depreciation Methods: • Symbols used: P = purchase price of asset Dr. Hassan, Y. – 91.380 2 S = salvage value N = useful life of asset n = number of years of use DC = annual charge for depreciation BV = book value on accounting records BV Straight line method: DC = P P −S = constant N BV (n ) = P − n (P − S ) N S Example: P = $7,000 N = 5 years S = $1,000 BV(3) = ? n = 3 years 0 N Declining Balance Method: BV(n) = P * (1 – Depreciation rate)n DC(n) = BV(n–1) * (Depreciation rate) Example: For the previous example (P = $7,000, S = $1,000, n = 3, N = 5) find the book value after 3 years given a depreciation rate of 40% • Another form for the declining balance method is: DC(n ) = • R [BV (n − 1)] N R may be determined by the analyst based on a positive salvage value as: 1/N S R = 1− P • If R > 1, the declining balance method will produced higher depreciation charge than the straight-line (SL) in the first year • The depreciation charge will decrease every year as the book value of the previous year decreases • A more common approach for the depreciation rate is to be independent of the salvage value • The double-declining-balance (DDB) method results when the depreciation rate = 2/N • An accelerated depreciation can be achieved by switching from DDB to SL in the late years of the asset’s life Dr. Hassan, Y. – 91.380 3 Example: An asset has P = $7,000, S = 0, and N = 5. Determine an accelerated depreciation schedule in which BV(5)=0 Capital Cost Allowance (CAA): • Used to calculate tax-deductible depreciation expenses for income tax purposes • Based on straight line and declining-balance methods • Various rates determined by government for various classes of assets (Tables 9.2 and 9.3) • CCA rates are different from rates used for accounting purposes: UCC(m) ≠ BV(m) UCC(m) = undepreciated capital cost at end of year m BV(m) = book value at end of year m • CAA rates are applied to the undepreciated capital cost (UCC) of all assets in a certain class Available for Use Rule • An individual or business cannot claim the depreciation expense until the property is ready for use Half-Year Rule • Modification in the Canadian tax regulations • Effective on November 12, 1981 • Objective is to prevent individuals or businesses who could purchase a property before their year-end from receiving a full year depreciation expense • Regardless of when the asset was put in service, the corporation gets only one-half of the normally allowable depreciation Example: Purchase price of equipment = $700 million, CCA rate = 20%. Find the depreciation for years 1 to 3 and book value at the end of year 3. UCC Calculations: • Property is assigned the proper class number • UCC at beginning of year is entered • Add capital cost of new assets purchased during the year • Make the necessary adjustments that increase or decrease the total capital cost • Subtract proceeds from assets disposed of during the year (≥ 0). If the business disposed of property for more than its capital cost, use the capital cost only and the excess is treated as capital gain • Apply CCA rate to calculate allowable CCA for tax purposes 4 • Subtract CCA from UCC(1) to calculate UCC(2) for next year Example: A small engineering consulting office is planning to purchase a new computer workstation for computer-aided design. The cost of the workstation is $6,800. This equipment is Class 10 CCA (declining balance CCA rate = 30%). The company already has $20,000 in Class 10 depreciable property at the beginning of the year. Find the maximum CCA for this firm’s Class 10 depreciable property for this year. Tax Concepts: Types of Taxes: 1. Property Taxes: - Charged by local governments on land, buildings, machinery, equipment, and inventory - Function of the appraised asset value and tax rate - Not a significant factor in engineering economics studies 2. Excise Taxes - Imposed on the production of certain products such as alcohol and tobacco - Rarely affect economic comparisons 3. Income Taxes: - Levied on individuals and corporations at higher rates for higher income - They have significant influence on acceptability of various proposals Changing Taxes: • Government fiscal policy vs. inflation • Methods for altering government receipts - Changing tax rates - Changing CCA requirements - Allowing tax credits Corporate Income Tax: • Taxable income = gross income – expenses – interest on debit – CCA • Income tax = taxable income * effective tax rate • Effective income tax rate = federal tax rate + provincial rate Interest: - Interest paid: deductible - Interest received: taxable Dr. Hassan, Y. – 91.380 5 Small businesses: - Much lower effective tax rates Capital gain/ losses: - Assets can appreciate or depreciate - Capital gain is taxable - Capital loss is deductible Corporate Loss Carryback / Forward: - Non capital losses can be carried back to the previous 3 years and/or forwarded to the next 7 years After Tax Economic Comparisons: • A tabular approach for modifying the before-tax cash flow to show the effect of tax • Assume tax paid at the end of each year Example: end of UCC year account CCA @ 30% Income Tax 50% (P/F, 10%, n) PW of tax credit 0 1000 1 700 300 150 0.9091 136 2 490 210 105 0.8264 87 3 343 147 73 0.7513 55 4 240 103 52 0.6830 36 5 168 72 36 0.6209 22 6 118 50 25 0.5605 14 7 83 35 18 0.5132 9 8 58 25 13 0.4665 6 9 41 17 8 0.4241 3 10 29 12 6 0.3855 2 ∑1-10 971 486 Future years 29 14 Capital Cost Tax Factor (CCTF) • It is the after-tax present value of one dollar investment • Consider a depreciable asset (declining balance): - t = tax rate 370 Dr. Hassan, Y. – 91.380 - d = CCA rate - i = discount rate 6 CCA tax saving (n) = UCC(n–1) * d * t UCC(0) = 1 → CCA tax saving (1) = d * t UCC(1) = (1–d) → CCA tax saving (2) = (1–d) d * t UCC(2) = (1–d)2 → CCA tax saving (3) = (1–d)2 d * t . . UCC(N–1)=(1–d)N-1→ CCA tax saving (N)=(1–d)N d * t 1 1− d (1 − d ) N −1 CCA tax shield = t d + + ... + 2 (1 + i )N 1 + i (1 + i ) At N → ∞: CCA tax shield = [(t d)/(i + d)] CCTF = 1 – [(t d)/(i + d)] (No salvage value) CCTF Value for Depreciable Assets (Declining Balance) • Bought before November 13, 1981: CCTF = 1 – [(t d)/(i + d)] • Bought after November 13, 1981: - Half-year rule applies CCTF = 1 – [(t d)/(i + d)] [(1+0.5 i)/(1 + i)] CCTF Value for Depreciable Assets (Straight-Line) • According to Revenue Canada regulations, a number of assets are classified as straight-line class • If the half-year rule is not applicable: - - Depreciation pattern is: Year: 1 2 … k Depreciation: d d … d Years required for full depreciation = k = (100%)/(d%) (rounded to higher number) CCA tax shield = t d (P/A, i, k) CCTF = 1 – [t d (P/A, i, k)] • If the half-year rule is applicable: - Depreciation pattern is: Year: Depreciation: 1 2 … k d/2 d … d/2 Dr. Hassan, Y. – 91.380 - 7 Years required for full depreciation = k = (100%)/(d%) + 1 (rounded to lower number) CCA tax shield = t (0.5) d [1/(1+i) + 2/(1+i)2 + … k/(1+i)k] Disposable Tax Effect: • The selling price of the asset at the end of its service life is not necessarily dependent on the original purchasing price or the UCC • Disposable tax effect at the end of the service life can be calculated as: • S>P: • • - Capital gain tax and CCA recapture apply - Disposable tax effect = (S – P) * capital gains tax + (P – UCC) * t S < P, S > UCC: - Only CCA recapture applies - Disposable tax effect = (S – UCC) * t S < UCC: - Tax shield adjustment applies - Tax shield adjustment = (UCC – S) * (tax shield) Example: A new testing machine will be purchased at $45,000 in early 1981. The required rate of return is 12% after tax. Useful life of the machine is 5 years with no salvage value. Savings in annual maintenance = $23,000 Operating Costs = $7,300 /yr The machine is in class 8 (20% CCA rate) Effective income tax rate = 42% Example: In the previous, if the machine has a salvage value of $5,000 at the end of its life. What is PW (after tax)? Example: Let the machine in the previous example be in Class 29 (straight-line method). What is PW (After Tax) if the depreciation rate is 50% (S = 0)? Example: A company is considering the purchase of Class 8 (CCA rate = 20%) equipment in 1995 for $30,000. The revenue is estimated to be $15,000/year for 5 years. Expected salvage value is $2,500. Maintenance cost is $1,400 for the first year and is to increase by $200/year. The effective tax rate is 40% and the MARR is 10% (after tax). Find the PW of the investment.