adms3530_-_lecture_7_-_ca

advertisement

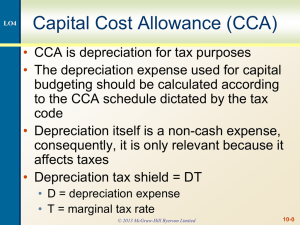

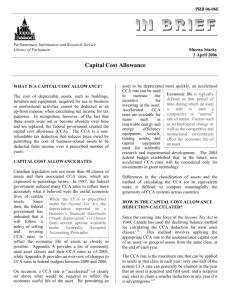

Finance ADMS 3530 - Winter 2012 – Professor Lois King Lecture 7 – Capital Budgeting I – Feb 14 7.1 Identifying Relevant Cash Flows There are 9 basic rules for identifying relevant cash flows for DCF analysis: o Rule 1: discount cash flows, not accounting profits. Recognize expenses and revenues as they occur, not later when they show up for accounting purposes. You have to be especially careful to ignore non-cash items such as depreciation and accruals. o Rule 2: discount incremental cash flows. Incremental cash flows = cash flows with the projects – cash flows without the project. o Rule 3: include all indirect effects. Bad indirect effect a new product damages sales of the firm’s existing product. Good indirect effect the additional parts and maintenance revenues that the sale of a new engine would provide to an aircraft manufacturer. o Rule 4: forget sunk costs All historical costs are sunk costs and will remain the same whether the project is accepted or rejected. Therefore, they should not be included in a project’s cash flows. o Rule 5: include opportunity costs Opportunity costs are benefits or cash flows foregone as the result of going ahead with a project. Example: the market value (not cost base) of land that is owned by a company, who is evaluating whether or not to build a new plant, should be included in the DCF analysis. o Rule 6: include the investment in net working capital Net working capital = short-term assets – short-term liabilities. Short-term assets include cash, accounts receivables and inventories. Short-term liabilities include notes payable and accounts payable. Investments (or increases) in net working capital (e.g. if inventories are being increased), are just like investments in plant and equipment, result in cash outflows. o Rule 7: be aware of allocated overhead costs You should include only extra overhead expenses that result from a project. o Rule 8: discount nominal cash flows by the nominal interest rate If using ‘real’ cash flows, discount by the real interest rate. o Rule 9: separate investment and financing decisions. First assess a project as if it were all-equity financed. Do not include any interest or debt payments incurred as a result of project financing. 7.2 Basic Steps in DCF analysis Step 1 – Identify all relevant project cash flows. Step 2 – Separate the cash flows into 4 main categories: o Plant & equipment. o Net working capital. o Cash flow from operations. Method 1: CFop = revenues – cash expenses – taxes paid Method 2: CFop = net profit (after tax) + depreciation Method 3: CFop = (revenues – cash expenses) * (1 – t) + (depr. * t) o Salvage value. Step 3 – Determine the cost of capital. Step 4 – Discount all relevant cash flows. Step 5 – Find NPV and if NPV > 0 then proceed with the project. Note on deprecation: o Recall from module 7.1 We do not include depreciation in our project cash flows (as it is a noncash item). We need to add it back to our cash flow number if we are trying to calculate our cash flows from accounting income (where it has been deducted). However because we are allowed to use deprecation (or CCA) to reduce our taxes payable, depreciation savings do affect cash flow and we do have to incorporate this tax savings which is called the CCA tax shield. 7.3 Review of Depreciation & CCA Depreciation o A non-cash expense that reduces the value of an asset as a result of wear and tear, age or obsolescence. o Reflects the declining value of their assets over time. CCA – Capital Cost Allowance o A specific type of depreciation expense that the CRA allows when businesses calculate taxable income (and hence their tax returns). o There are over 30 categories or CCA asset classes. Note o Although CCA itself is a non-cash charge, it does affect cash flow to the extent that it reduces taxes paid those tax savings must be included in the capital budgeting decision. o This tax savings is also called the CCA tax shield or depreciation tax shield. There are two main methods of calculating CCA and accounting depreciation: o Straight-line depreciation Assumes the asset will lose an equal amount of value each year. (Except for the half-year rule, which we will discuss shortly). = [Purchase price – salvage value] / est. useful life of the asset. It is essentially an annuity series – in that the same dollar amount of depreciation is expensed each year. Used for leasehold improvements, patents and a few other assets classes. o Declining balance depreciation Used for most asset classes. The same percentage is applied to the un-depreciated asset value. = the class % rate x the declining asset balance amount. Note: you will be told in the problem whether you have to use declining balance or straight-line depreciation. Other CCA terms: o Half-Year Rule In an asset’s first year of purchase, only one-half of the purchase cost can be used to calculate CCA (regardless of what part of the year the asset was purchased). This rule was designed to stop companies from purchasing assets in December and then expensing CCA for the whole year. A company is entitled to CCA as long as it owns at least one asset in the asset class. The value of the CCA tax shield in any one year: o = CCA amount [x] tax rate. 7.4 Present Value of CCA Tax Shields So far we have calculated: CCA tax shield for a single year but most projects we will last many years. o We will have a tax shield or tax saving for every year of the project. o And we have to discount these tax shields. o So we need to calculate the present value of all the CCA tax shields over the project’s life, or the PVCCATS (present value of the CCA tax shields). Recall from module 7.3 – 2 main methods of calculating depreciation: o Straight-line o Declining balance. Calculating PVCCATS: o Straight-line depreciation is easy finding the PV of an annuity. o Declining balance depreciation – much more complicated. 7.5 Putting it all Together – A DCF Example The cash flows can be broken down into 4 categories: o Plant & equipment o Network capital o Cash flow from operations o Salvage value 7.6 Summary Financial managers evaluate potential projects for a firm. In unit 6, we learned that NPV is the single best rule to use when evaluating projects, as a company will maximize shareholder wealth by accepting all projects that have a positive NPV. In this unit, we learned to identify which cash flows (whether they are cash inflows or outflows) belong in project analysis. Identify the cash flows [+] discounting them for NPV calcs. o = discounted cash flow (or DCF) analysis. o = Capital budgeting. DCF analysis o Only include incremental cash flows (not accounting profits) in the numerator and also how to include working capital, salvage and CCA tax shields into our analysis. o CCA does make the analysis more complicated especially if declining balance method applies. o If you are having trouble with this unit, try to attend one of the Help sessions or final exam review sessions. o In the next unit, we will expand on project analysis by trying to figure out how sensitive the project NPV is if our estimates of the cash flows vary.