Materials - Stock & Option Solutions

advertisement

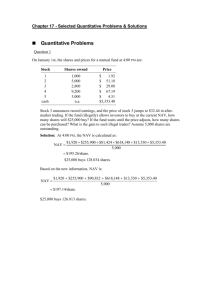

Tax Accounting & Diluted EPS: To Boldly Go Where Private Companies Have Not Gone Elizabeth Dodge, CEP, Stock & Option Solutions, Inc. Ellie Kehmeier, CPA, Steele Consulting, LLC Kevin Hassan, CPA, PricewaterhouseCoopers, LLP July 25th, 2012 Agenda Tax Accounting – – General Concepts of Tax Accounting Under ASC 718 (formerly FAS 123R) Complications Diluted EPS – – – – – 2 Earnings Per Share – ASC Topic 260 (formerly FAS 128) Common Stock / Potential Common Stock Treasury Stock Method – Explained Treasury Stock Method – An Example Other Considerations & Complications TAX ACCOUNTING 3 Common Acronyms and Terms ISO = Incentive Stock Option (IRC sec. 421) NQSO or NSO or NQO = Nonqualified Stock Option, Nonstatutory option or “nonqual” (sec. 83) RS or RSA = Restricted Stock or Restricted Stock Award (sec. 83) RSU = Restricted Stock Unit FMV = Fair Market Value (stock price) Bargain Element or Spread = Difference between purchase price and FMV, usually computed as of date of exercise. Also known as intrinsic value Fair Value = Expense per Share 4 Common Tax Accounting Lingo under ASC 718 ASC = Accounting Standards Codification (ASC 718 = FAS 123R) APIC = Additional Paid-in-Capital; part of equity Tranche = portion of award that vests at any given time Cliff vesting = typically means entire grant vests at same time Graded vesting = tranches within grant vest over time. – Typical option = 25% “cliff vesting” at end of one year, with 36 monthly tranches thereafter Tax Deficiency = “Shortfall”: amount by which expense exceeds tax deduction Excess tax benefit = “Windfall”: amount by which tax deduction exceeds expense APIC Pool = sum of excess benefits that have been realized by reducing taxes payable 5 Background ASC 718 requires that companies record compensation expense for fair value of equity awards issued; generally over the vesting period – e.g., Stock options, RSAs, RSUs, etc. Tax rules only allow a tax deduction on company’s tax return when and if there is a tax event – – – – Exercise of NSOs Disqualifying disposition of ISOs and qualified ESPPs Release of RSAs Delivery of RSU shares Thus, in most cases, timing AND amount of book expense and tax deductions differs And therein lies the complexity!! 6 General Concepts ASC 718/FAS 123R – 7 Requires that: • Record expected tax benefit (i.e., deferred tax asset or DTA) as expense is booked, based on cumulative book expense • Reverse and reconcile DTA at time of tax deduction (or lack thereof) • Excess tax benefits (aka windfalls) be recognized as an addition to paid-in capital (APIC Pool) when they reduce taxes payable, NOT as a reduction in income tax expense • Tax deficiencies (aka shortfalls) be recognized as income tax expense – Unless there are excess tax benefits in the APIC Pool General Concepts Translation – – – 8 Deferred Tax Asset (that you booked as expense was recognized) does not equal Actual Tax Deduction If excess = increase to APIC (but only when tax benefit reduces taxes payable) If shortfall/deficiency = • Reduction to APIC Pool (if sufficient) or • Potential tax expense (if APIC Pool not available to offset) • But not for ISOs General Concepts – Deferred Tax Asset (cont’d) Example of journal entries for expense and DTA (both booked over “requisite service period”): - Book expense for NQO = $10,000 - Vests annually over 4 years, straight-line accrual ($10,000 / 4 years = $2,500 expense per year) - 40% statutory tax rate for country Debits/credits for each year of service period: Debit: Compensation Expense 2,500 Credit: Additional Paid-in Capital Debit: Deferred Tax Asset 1,000 Credit: Deferred Tax Benefit (reduces Income Tax Expense on I/S) Notes: 9 2,500 1,000 - Book expense reduced by estimated forfeiture rate until shares vest - APIC in this entry is NOT the APIC Pool Non-Qualified Option - Excess Example NQO granted for 1,000 shares, exercise price = $30 ASC 718 book Expense = $10 per share (total = $10,000) Deferred tax asset = 40% x $10,000 = $4,000 once vested Shares exercised when market value = $42 – – Tax Deduction = 1,000 shares x $12 gain per share = $12,000 Actual Tax Benefit = $12,000 x 40% = $4,800 Actual Deferred Tax Benefit Tax Asset $4,800 $4,000 10 Result Excess = $800 (Increase to APIC Pool) Non-Qualified Option - Deficiency Example NQ granted for 1,000 shares, exercise price = $30 Expense = $10 per share (total = $10,000) Deferred tax asset = 40% x $10,000 = $4,000 once vested Shares exercised when market value = $36 – – Tax Deduction = 1,000 shares x $6 gain per share = $6,000 Actual Tax Benefit = $6,000 x 40% = $2,400 Actual Deferred Tax Benefit Tax Asset $2,400 $4,000 11 Result Deficiency = $1,600 (Either Reduce APIC Pool, or Increase Tax Expense) Non-Qualified Option – Cancel/Expiration Example Same facts as deficiency example Larger deficiency because NO tax benefit Vested shares expire unexercised – – Tax Deduction = $0 Actual Tax Benefit = $0 Actual Deferred Tax Benefit Tax Asset $0 $4,000 12 Result Deficiency = $4,000 (Either Reduce APIC Pool or Increase Tax Expense) Statutory Option (ISO/ESPP) Treatment Under ASC 718, companies not allowed to anticipate a future tax deduction for ISOs, qualified ESPPs – i.e., cannot record a DTA for ISOs, qualified ESPPs Tax benefit can only be recorded in income statement if / when there is a tax deduction – – 13 i.e., only if there is a disqualifying disposition (DD) Tax benefit recorded in income statement limited to LESSER of actual tax benefit or expected amount based on book expense • i.e., tax benefit in P&L limited to same amount as for NQs, but may be less if actual tax deduction is less than book expense ISO Disqualifying Disposition - Excess Example If actual tax benefit > estimated tax benefit (i.e., benefit based on book expense), excess increases APIC Pool & estimated tax benefit reduces tax expense, but only if DD – If actual > estimated • • – Excess tax benefit to APIC (when realized) Estimated tax benefit reduces tax expense at DD Example • • Actual: $4,800 > estimated $4,000 $800 = APIC AND $4,000 reduction to income tax expense Actual Estimated Tax Benefit Tax Benefit Result $4,800 $4,000 Excess = $800 (Increase to APIC AND $4,000 reduction to Tax Expense) 14 ISO Disqualifying Disposition – “Deficiency” Example No DTA booked, so no “real” deficiency If actual tax benefit <= “estimated tax benefit”, no additional paid-in capital and actual tax benefit reduces tax expense – If actual < estimated • • – APIC = $0 Actual tax benefit reduces tax expense Example • Actual $3,000 < estimated $4,000 (but estimate not recorded as a DTA) • $0 = APIC AND $3,000 reduction to tax expense Actual “Estimated” Tax Benefit Tax Benefit Result $3,000 $4,000 “Deficiency” = $1,000 ($0 APIC AND $3,000 Reduction to Tax Expense) 15 ISO – Cancel/Expiration Example Same initial facts as deficiency example Vested shares expire unexercised; NO tax benefit No tax accounting impact, since no DTA would have been recorded for ISOs – – Tax Deduction = $0 Actual Tax Benefit = $0 Actual Tax Benefit $0 16 Deferred Tax Asset $0 Result No entry Tax Accounting for Restricted Stock and RSUs Book expense based on FMV of the stock on grant date – Same under ASC 718/FAS 123R, and old APB 25 Tax accounting similar to NQs: • • • Recognize tax benefit and record DTA for book expense Reverse DTA as award becomes deductible for tax Excess benefit to APIC pool; shortfall to APIC or tax expense (if no APIC pool) Note: Since tax event is typically vest date, windfalls and shortfalls arise sooner with RSA/RSUs than with options – DTAs for underwater options don’t get written off until options expire 17 Forfeitures v. Cancellation of Vested Awards Forfeitures – – When award forfeited, book expense previously recorded reversed, along with DTA previously recorded Typically, Co records net book expense (i.e., current period expense netted with any forfeiture adjustments), so current period DTA set up takes into account forfeiture adjustment Cancellations/Expirations of vested options – – 18 When vested option cancelled or expires (eg. If an underwater option expires) book expense not reversed However, DTA must be reversed (no actual tax benefit) and shortfall will increase tax expense, unless: • APIC pool is sufficient to absorb shortfall, or.. • Valuation allowance offsetting DTA (i.e., no net deficiency), or.. • ISO (remember – no DTA booked for ISOs) Loss Companies with Valuation Allowances Valuation allowance recorded as offset to DTA if future tax benefit is too uncertain – – – – Very common for companies with a history of losses Eliminates recognition of tax benefit on income statement If full valuation allowance, then there is no net DTA • And no net deficiency! Need for valuation allowance based solely on expectation of sufficient future taxable income • 19 For example, don’t record valuation allowance just because stock price declines, even if options are deeply under water APIC Pool Basics APIC Pool represents excess tax benefits that can offset future tax benefit deficiencies – – – – – 20 Excess benefits must be “realized”, meaning that deductions have to actually reduce taxes payable Companies must track APIC pool separately from G/L APIC account • Some companies use sub-account in G/L for APIC Pool • APIC Pool can sometimes exceed APIC balance recorded in G/L Exclude awards outside ASC 718’s scope (e.g., ESOPs) APIC pool includes employee and non-employee awards & all jurisdictions included in consolidated financial statements APIC pool can never be negative Realization of Excess Tax Benefits A source of incredible complexity – tax geeks only Credit to APIC for excess tax benefits postponed until “realized” • • E.g., if excess benefits merely increase a net operating loss (NOL), APIC Pool not increased until NOL used to offset taxable income – ASC 718-740-25-10 (formerly SFAS 123R, Footnote 82) Tracked off balance sheet – aka “footnote 82 memo account” Two policy choices for how & when excess benefits are realized: • • • 21 Tax law ordering (Follow the tax law) Excess benefits last (a.k.a. with and without approach) Accounting policy decision; should be applied consistently and should be disclosed if has significant impact Realization of Excess Tax Benefits (cont.) Know your policy and make sure you follow it! Especially important if you have a valuation allowance (VA) – Under “excess benefits last” approach, you use current and prior year attributes (NOL, credit carryforwards) that are not from excess benefits prior to current and prior year excess benefits – This minimizes tax expense while company has a VA – However, it delays “realization” of excess benefits, meaning company isn’t building up an APIC pool such that shortfalls increase tax expense once VA is gone 22 Other Deferred Tax Accounting Complexities Not a complete list! – – – – – – – 23 Reclassification of gross excess benefits to financing cash flow Complexities with multinationals & grants to overseas employees Awards assumed in M&A transactions Modification accounting: option repricings, exchanges Impact of Section 162(m) Pre-adoption grants (prior to 2006) Expense under APB 25 DILUTED EPS Earnings Per Share Calculating earnings per share – – 25 Basic EPS • Does not include potential common shares • Net Earnings divided by Common Stock Diluted EPS • Includes common shares & other potential common shares (warrants, convertible debt, employee equity awards, etc.) • Net Earnings divided by Common Stock and potential common shares • Treasury Stock Method • If-Converted method • Contingently issuable shares Earnings Per Share Basic Earnings Per Share (“EPS”) = – Net Earnings1 / Common Stock Measurement of company’s success – – Higher Earnings = Higher EPS Higher EPS = greater return on investment Example: – – – Net Earnings: $100,000,000 Common Stock: 50,000,000 EPS: $100,000,000 / 50,000,000 shares = $2.00 1 Earnings 26 attributable to common shareholders Earnings Per Share Shareholder Shares Company Shares Plan Reserve Grant Outstanding Awards Potential Common Shares 27 Option/SAR RSU RSA ESPP Exercise Release Vest Purchase Common Stock Earnings Per Share To calculate basic & diluted EPS, determine: – – – Net earnings Common stock issued and outstanding Potential common shares Diluted EPS = – Net Earnings / (Common Stock + Potential Common Shares) Unissued Stock Employee Equity Grants Warrants Convertible Debt, etc. 28 Common Stock Common Stock – – – 29 Weighted for length of time during reporting period stock was issued and outstanding Common stock issued and outstanding for entire period is weighted at 100% Common stock issued during period is weighted at proportionately smaller percentage Common Stock – Weighting > Weighted for length of time stock was issued and outstanding - Common stock issued and outstanding for entire period weighted at 100% - Common stock issued during period weighted at proportionately smaller percentage July 1 Aug 4 Exercise > Example: - Reporting period is 92 days (July 1 to Sept 30) - 1,000 shares exercised on August 4 - Shares issued for 58 days (Aug 4 to Sept 30) - Shares not issued for entire period so are weighted at less than 100% - Shares are weighted at 63% (58 days / 92 days) - 1,000 shares exercised = 630 shares included as common stock Sept 30 Potential Common Shares – Weighting > Potential common shares / Potential Equivalents - Weight equity for length of time grants are outstanding - Determine shares that would be issued and outstanding after exercise / release/ vest / purchase of the weighted grants July 1 Aug 4 Sept 30 Grant1 Grant 2 > Example: Grant 1 - Reporting period is 92 days (July 1 to Sept 30) - Grant 1 outstanding for entire period and is included at 100% > Example: Grant 2 - Grant 2 is exercised on Aug 4 - Grant 2 is outstanding for 34 days (July 1 to Aug 3) - Grant 2 weighted at 37% (34 days / 92 days) Treasury Stock Method – Explained ASC 260-10-45-28A and 28B – – – – 32 All options and nonvested shares assumed issued or exercised at beginning of period (or time of grant if later) All “underwater” options excluded from Treasury Stock Method (ASC 260-10-45-25) All proceeds from hypothetical “exercise” assumed to repurchase stock on open market at Average Market Value during period • “Buyback Shares” • Three components of “exercise proceeds” (more later) Shares “issued” minus “buyback shares” = incremental shares for diluted EPS calculation Treasury Stock Method – Assumed Proceeds ASC 260-10-45-29 – – – 33 Exercise price of options (restricted stock is $0), plus Weighted average unrecognized compensation cost during the period, plus Excess tax benefits or minus certain tax benefit deficiencies • But ignore this for ISOs/ Qualified ESPPs since you can’t anticipate any tax deduction • Also, probably ignore both excess tax benefits and deficiencies if company has valuation allowance (more later) Treasury Stock Method Steps in 5 Easy (?) Steps – An Example 1. Exclude underwater options 2. Weight shares for time outstanding during period (WSO) – Can be complex if transactions occurred during period 3. Calculate exercise proceeds & “buyback shares” – – – – A. Exercise price: (Exercise Price * WSO) B. Tax benefit: ((((MV-Price) – Fair Value) * Tax Rate) * WSO) C. Avg unamortized expense: (((Beg. Unamortized Expense + Ending Unamortized Expense) / 2) * (WSO / Total Shares)) D. Sum 3 components/Avg Market Value = total “buyback shares” 4. If buyback shares > WSO (anti-dilutive), exclude grant 5. Weighted shares minus buyback shares = dilutive shares to include in diluted EPS calc in addition to common stock 34 Treasury Stock Method Effect of forfeitures on diluted EPS – – Options forfeited during reporting period weighted for portion of period they were outstanding Based on actual forfeitures not estimated forfeitures ASC 260-10-45-1: – 35 “Diluted EPS shall be based on the actual number of options or shares granted and not yet forfeited, unless doing so would be anti-dilutive.” Treasury Stock Method - Summary Calculation of Potential Common Shares Calculation: Weighted Shares Outstanding Less: - Exercise Price Buyback Shares - Tax Benefit Buyback Shares (only for grants with expected tax deduction – i.e., ignore ISOs/ qualified ESPPs) - Avg Unamortized Expense Buyback Shares -----------------------------------------------------------------------------= Total Buyback Shares = Dilutive Shares (if negative, exclude grant from calculation) Calculation should be performed grant-by-grant 36 Treasury Stock Method – Underwater Options Calculation of Buyback Shares – – 37 Could be “dilutive” even if not “in-the-money” because of impact of tax benefit deficiency; however, Resource Group concluded options not “in-themoney” should be excluded from EPS. Example • Proceeds = $20 x 200,000 shares = $4,000,000 • Buyback shares = Proceeds / Avg MV – $4,000,000 / $15 = 266,667 shares • Buyback shares (266,667) exceed weighted option shares outstanding (200,000) • Anti-dilutive and excluded from the calculation Other Grant Types Restricted Stock/Units – Same calculation as options, but with $0 exercise price ESPP – – – Calculations similar as for options For qualified ESPP - No tax benefit calculation (no DTA booked) Practice/guidance for ESPP varies ISOs – – 38 No tax benefit calculation (no DTA booked) Same as other options otherwise Other Considerations In-the-money Grants can be Anti-dilutive Valuation Allowance and Tax Benefit Calculation Reduction of Assumed Proceeds for Tax Benefit Deficiency – – If sufficient APIC pool, include deficiency If insufficient APIC pool, do not consider Performance shares – Performance/market conditions Two Class Method for Participating Securities Potential Changes to EPS 39 Other Considerations: In-the-Money Grants can be Anti-Dilutive When buyback shares exceed weighted shares outstanding, transaction would increase (rather than decrease) EPS – must be excluded Comparison of buyback shares to weighted shares outstanding must be done on grant-by-grant basis More common early in life of grant – – Higher unamortized expense Shares only outstanding for a portion of reporting period Example: – – – – 40 NQ for 1,000 shares granted 9/15/11, Vesting over 4 years Grant Date Market Value = $10, Price = $10 Expense per Share = $7, Avg Market Value during period = $12 Reporting Period from 7/1/12 to 9/30/12 Other Considerations: Valuation Allowance and Tax Benefit Calculation Excess Tax Benefits increase assumed proceeds, but only if expected to be realized • • Company with Valuation Allowance (VA) offsetting DTAs does not expect to realize future tax deductions Thus, companies with a VA should probably exclude excess benefits from assumed proceeds Shortfalls reduce assumed proceeds, but if company has a VA, then no net shortfall • 41 Thus, companies with VA should probably exclude shortfalls as well as excess benefits Other Considerations: Reduction of Assumed Proceeds for Tax Benefit Deficiency When expense per share exceeds “hypothetical gain” at exercise – – – 42 Tax Benefit Buyback Shares can be negative A “reduction to assumed proceeds” if sufficient APIC Pool to offset Text from Topic 260: • “Paragraph 718-740-35-5 states that the amount deductible on an employer’s tax return may be less than the cumulative compensation cost recognized for financial reporting purposes. If the deferred tax asset related to that resulting difference would be deducted from additional paid-in capital (or its equivalent) pursuant to that paragraph assuming exercise of the options, that amount shall be treated as a reduction of assumed proceeds.” [emphasis added] Performance/Market Awards When performance shares would be issuable, if end of EPS reporting were the end of contingency period, then those performance shares are included as outstanding for diluted EPS Prior to the goal being met, these shares will be excluded from diluted EPS The percentage of shares to be included in EPS will not necessarily line up with the number of shares expensed Can create significant volatility in diluted EPS 43 Performance/Market Awards Two Steps: – – 44 1. Performance condition already met at end of reporting period? • No = exclude all shares 2. Yes = include # of shares “vesting” based on performance target met as of end of the period – Impact all amounts by “expected to payout” ratio Contact Information Elizabeth Dodge, CEP Vice President, Product Management Bus: (408) 754-4609 Mobile: (650) 773-2142 E-mail: edodge@sos-team.com www.sos-team.com Kevin Hassan, CPA Managing Director Bus: (203) 539-4049 Email: kevin.hassan@us.pwc.com www.pwc.com Ellie Kehmeier, CPA Bus: (408) 221-2002 Email: ellie.kehmeier@steeleconsultingllc.com www.steeleconsultingllc.com 45 Thank You Sponsors…