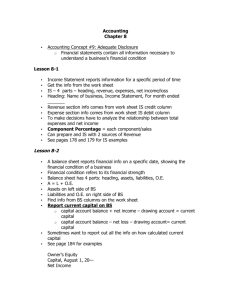

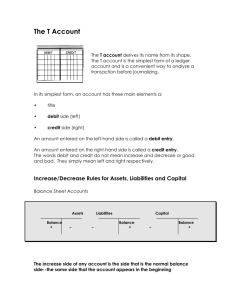

Accountancy Textbook: Higher Secondary First Year

advertisement